🔗 Deutsche Börse Unit Adopts Chainlink for ETP Transparency

🔗 Deutsche Börse Unit Adopts Chainlink for ETP Transparency

🏦 Deutsche Börse Goes On-Chain

Crypto Finance, a Deutsche Börse subsidiary serving institutional clients, has integrated Chainlink Proof of Reserve in production.

The integration enables direct verification of assets backing nxtAssets' physically-backed Bitcoin and Ethereum ETPs. Reserve data is orchestrated through Chainlink Runtime Environment and published on Arbitrum.

Key benefits:

- Public verification of ETP reserves on Chainlink's data feed page

- Shared transparency across issuers, custodians, and exchanges

- Real-time on-chain asset backing verification

This follows recent Chainlink adoptions by 21X (EU's first regulated on-chain exchange) and partnerships with Polymarket for prediction markets.

The move strengthens institutional trust in digital asset products through verifiable on-chain data.

Europe’s first regulated tokenized securities platform 21X: “The work that Chainlink is doing ... with the involvement of the largest financial institutions in the world ... could not be more at the forefront.” Discover how tokenization is reshaping capital markets and why

ICYMI: @SergeyNazarov joined @CoinDesk Spotlight to talk early Chainlink, his entry into crypto, the future of tokenization, his legacy, & more ↓ x.com/CoinDesk/statu…

🎥SPOTLIGHT: @Chainlink co-founder @SergeyNazarov says Bitcoin could reach $1M if global capital allocates just 5% to crypto including central banks adding reserves.SPOTLIGHT: 00:36 Is Sergey Nazarov Satoshi? 02:22 The Role of Oracles in Blockchain 06:14 Early Days of Chainlink

Chainlink has just reached a new all-time high in Total Value Secured (TVS) ✅ $100B today. Trillions next. Accelerate.

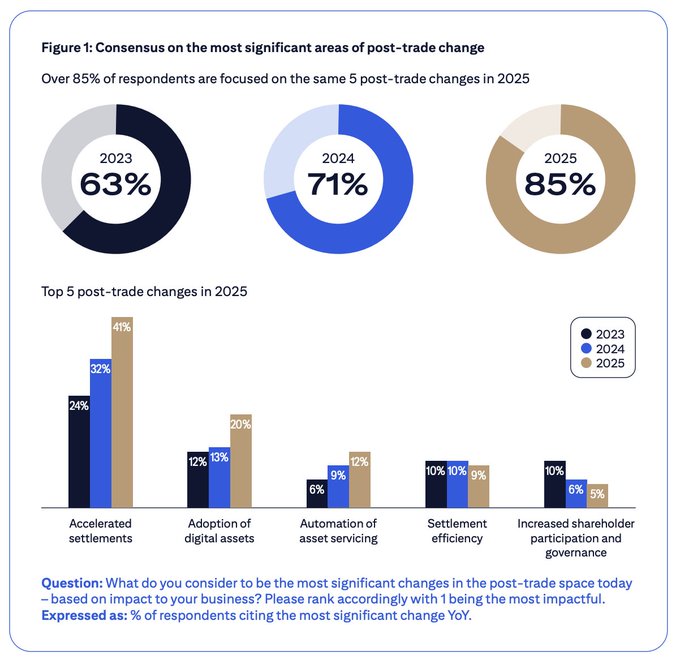

Chainlink is highlighted in @Citi’s new Securities Services Evolution 2025 report for “advancing standards enabling interoperability across public and private blockchain networks.” citibank.com/icg/docs/secur… In the report, @SergeyNazarov noted how fragmentation is one of the

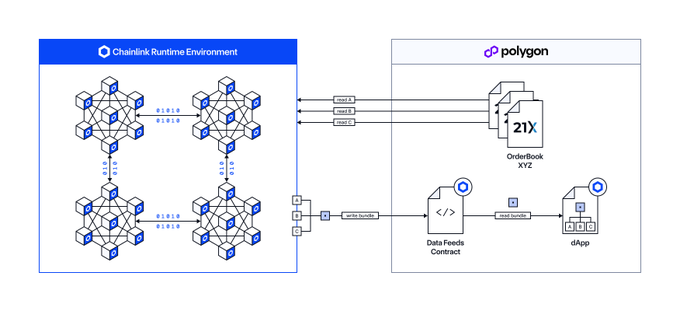

We’re excited to announce that the first EU-regulated onchain exchange for tokenized securities, 21X (@tradeon21x), has adopted the Chainlink data standard. prnewswire.com/news-releases/… Live-in-production and powered by the Chainlink Runtime Environment (CRE), Chainlink enables

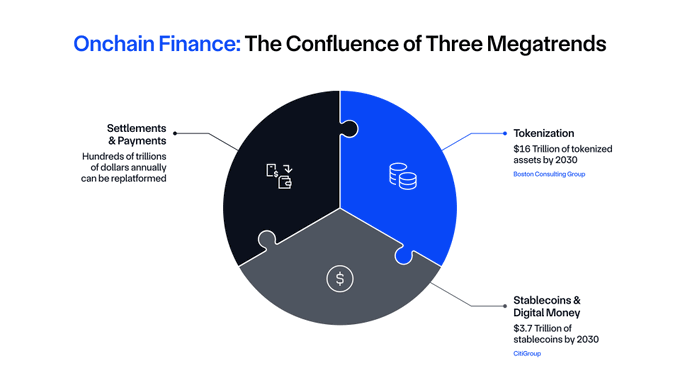

Chainlink is at the center of a $100T+ financial transformation.

Crypto Finance (@CryptoFinanceAG), a provider of professional digital asset solutions for institutional clients and part of @DeutscheBoerse, has adopted the Chainlink standard live in production. crypto-finance.com/crypto-finance… Chainlink Proof of Reserve now enables direct verification

Policy momentum, infrastructure advances, and institutional demand are all aligning. Colin Cunningham (@ctcunning), Head of Tokenization & Alliances at @chainlinklabs, explains why this is a pivotal moment for convergence in global finance. blog.chain.link/the-convergenc…

Nasdaq’s recent move to embrace tokenized stocks and exchange-traded products is part of a global transformation to move all the world’s assets onchain, with Chainlink at the center of this generational paradigm shift. Last week, Chainlink Co-Founder @SergeyNazarov met with U.S.

Today, Chainlink Co-Founder @SergeyNazarov met with U.S. SEC Chairman Paul Atkins and key policymakers at the White House to discuss how the U.S. stays at the forefront of blockchain innovation. Sergey joined @CNBC to share insights from these discussions: • Growing the U.S.

Proud to partner with @OndoFinance on its newly launched Ondo Global Markets—an initiative bringing 100+ tokenized U.S. stocks and ETFs onchain. By adopting Chainlink as its official oracle platform for trusted asset price data, Ondo is driving enhanced DeFi composability and

1/ Wall Street 2.0 is here. Ondo Global Markets is now live, providing one of the largest-ever selections of tokenized U.S. stocks & ETFs onchain with the liquidity of traditional finance, starting on @Ethereum. 100+ assets now live, with hundreds more on the way.

NEW: Today @SergeyNazarov joined @CNBCTV18News, one of the largest news outlets in India, to discuss Chainlink's groundbreaking work in Washington D.C., the tokenization of the entire global financial system, and more. Watch this can't-miss interview ↓

.@Polymarket, the leading onchain prediction markets platform, has officially partnered with Chainlink to launch new 15-minute markets featuring near-instant settlement and industry-leading security. prnewswire.com/news-releases/… Starting with asset pricing, the integration combines

Chainlink Reserve Adds 60K LINK Tokens in Latest Accumulation

**Chainlink Reserve** continues its steady growth, adding **59,968.58 LINK** tokens on October 16th. The reserve now holds a total of **523,158.77 LINK**, representing significant growth from the previous week's 463,190.18 LINK balance. **Key Details:** - Weekly accumulation of nearly 60,000 LINK tokens - Total reserve increased by approximately 60,000 LINK in one week - Funding comes from both enterprise partnerships and network usage **Purpose & Strategy:** The Chainlink Reserve supports long-term network sustainability by accumulating LINK through: - Offchain revenue from enterprise adoptions - Onchain revenue from service usage This strategic reserve mechanism helps ensure the continued growth and stability of the Chainlink Network as Web3 adoption expands. [Track reserve status](https://reserve.chain.link) | [Learn more about the reserve strategy](https://blog.chain.link/chainlink-reserve-strategic-link-reserve)

🔗 XSwap Bridges Mastercard's 3.5B Users to Onchain Economy

**XSwap connects Mastercard's massive payment network** to blockchain through Chainlink's infrastructure. The Chainlink Build member enables **3.5 billion cardholders** to access onchain swaps directly from traditional payment data. **Key features:** - Converts validated payment data into blockchain transactions - Powered entirely by Chainlink CCIP - Part of growing cross-chain ecosystem **Previous traction:** XSwap has processed $170M+ in volume across 300K+ swaps, establishing itself as a cross-chain pioneer. This integration represents a significant step toward **mainstream Web3 adoption** by bridging traditional finance with decentralized systems.

Mamo AI Agent Integrates Chainlink Price Feeds for Secure Token Markets

**Mamo**, a personal finance AI agent built on Base, has integrated **Chainlink Price Feeds** to enhance its token ecosystem. The integration provides Mamo with: - **Reliable market data** for its MAMO token - **High-quality price information** to ensure secure trading - **Tamper-proof data feeds** for accurate market operations This follows a trend of AI-focused projects adopting Chainlink's data infrastructure, with **Morpheus** recently implementing similar feeds for multiple tokens including stETH, USDC, USDT, and WBTC. The move strengthens Mamo's position in the **decentralized finance space** by providing users with dependable market data for their personal finance management needs.

Re Protocol Integrates Chainlink Proof of Reserve Across Four Major Blockchains

**Re Protocol** has integrated **Chainlink Proof of Reserve** across Arbitrum, Avalanche, Base, and Ethereum to enhance transparency in decentralized reinsurance. **Key Benefits:** - Near real-time onchain verification of collateral backing - Ensures reinsurance contracts are fully collateralized with regulated offchain capital - Increases transparency for platform users The integration allows Re Protocol to provide **automated verification** that their reinsurance contracts maintain proper collateral levels, addressing a critical trust issue in decentralized insurance markets. Chainlink Proof of Reserve has been adopted by major players like 21Shares, Coinbase, and OpenEden to verify billions in value across the onchain economy. [Read full details](https://medium.com/reprotocol/re-integrates-chainlink-proof-of-reserve-to-enhance-transparency-of-offchain-reinsurance-collateral-cb1fc441ad6f)

Deutsche Bank Partner Memento Adopts Chainlink CCIP for Cross-Chain Operations

**Memento**, an enterprise-grade digital asset management platform used by **Deutsche Bank**, has integrated Chainlink CCIP for cross-chain interoperability. The integration enables: - Institutional-grade cross-chain fund distribution - Seamless asset transfers across multiple blockchains - Enhanced security for multi-chain operations This adoption demonstrates growing institutional confidence in blockchain infrastructure solutions. Memento's choice of CCIP highlights the protocol's reliability for enterprise-level operations. The move positions traditional financial institutions to better leverage multi-chain ecosystems while maintaining security standards required for institutional use.