DeFi protocols are strengthening Ethereum through crypto-backed stablecoins, with BOLD leading the charge.

Key developments:

- Liquity's treasury holds over 5% in crypto stables

- BOLD creates direct demand for ETH

- Multiple protocols now offer decentralized alternatives

Major players include:

- Liquity Protocol (BOLD)

- Curve Finance (crvUSD)

- Protocol FX (fxUSD)

- Aave (GHO)

- Asymmetry Finance (USDaf)

These crypto-backed stablecoins provide decentralized alternatives to traditional stables while generating utility for Ethereum's ecosystem.

Support decentralized stables and help power Ethereum's growth.

DeFi stables help support @ethereum support crypto backed stablecoins be BOLD.

Liquity treasury holds well over 5% in crypto stables. This supports our ecosystem because - BOLD brings value to @ethereum - BOLD creates demand for ETH What about your treasury? Put your bags where your chain is.

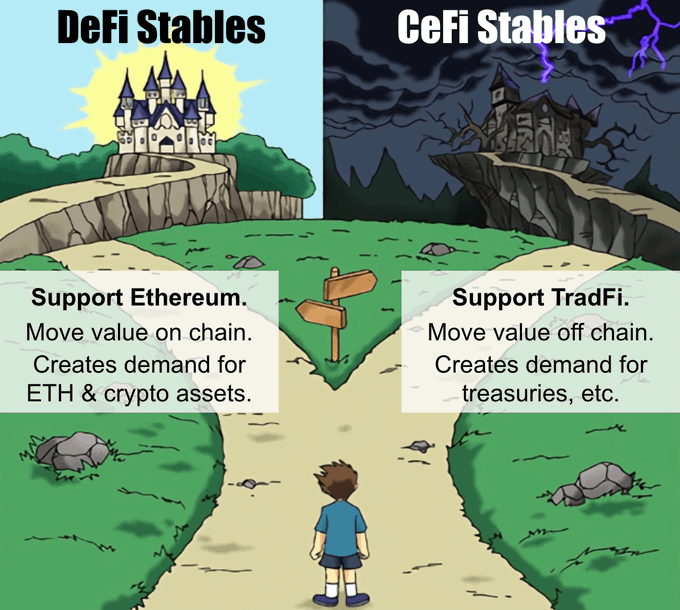

Move $15+ BILLION from TradFi onchain. All it takes is a 5% shift from CeFi>DeFi stables. CeFi stables support Wall Street. DeFi stables support Ethereum. Swapping into DeFi stables like... - $BOLD: ETH & LSTs coll - $crvUSD: BTC/ETH & crypto coll - $fxUSD: ETH & BTC coll -

🎯 Create BOLD Content

Liquity announced **October Community Rewards** for content creators. **How to participate:** - Create unique content about V2 or $BOLD - Post in their Discord - Win rewards based on quality and reach **Content ideas:** - @lagoon_finance vault features - sBOLD/yBOLD performance analysis - BOLD vs traditional stablecoins comparison - Memes (low effort welcome) Rewards focus on highlighting **Liquity V2's unique benefits** and BOLD's advantages over black-box stablecoins.

🤖 Rate Managers Slash Borrowing Costs

**Rate managers** are proving their value beyond redemption protection by maintaining ultra-low borrowing costs. **Key developments:** - rETH borrow rates adjusted from **5.50% to 0.50%** - Some users accessing rates **10x below market** - Automation through rate managers keeps costs minimal **Why rates stay low:** - BOLD token maintains peg stability - Low redemption risk environment - Automated rate management systems **Risk considerations:** - Market conditions can shift rapidly - Even average rates remain among DeFi's lowest - Rate managers provide both protection and cost optimization This demonstrates how **automated systems** can deliver dual benefits: protecting positions while maximizing cost efficiency in volatile markets.

BOLD Hits All-Time Highs as Liquity V2 Revenue Cycle Accelerates

**BOLD supply and TVL reach record levels**, driving protocol revenue higher in a self-reinforcing cycle. **Key metrics:** - 523K BOLD distributed through PIL program - $45K earned by LQTY stakers in bribes - Revenue growth fuels higher PIL rewards and bribes **The symbiotic system works:** As BOLD adoption increases, rewards grow for all participants. **For LQTY stakers:** Vote on liquidity allocation. New Uniswap v4 proposal aims to deepen liquidity pools. **For projects:** Propose initiatives to earn sustainable stablecoin rewards. **For borrowers:** Access DeFi's lowest borrowing rates. Check the [protocol dashboard](https://dune.com/liquity/protocol-incentivized-liquidity) for real-time metrics.

🏆 September Community Rewards

Liquity announced September Community Rewards for creators. **How to participate:** - Create unique content about V2 or $BOLD - Post in their Discord - Win rewards based on quality and reach The program values contributions highlighting Liquity V2's unique benefits and BOLD's advantages. Check [this week's winner](https://discord.com/channels/700620821198143498/1418719728352100493) for inspiration on successful submissions.