Datamine Network Launches Core Metrics for Lockquidity Tokens

Datamine Network Launches Core Metrics for Lockquidity Tokens

🔥 Four Tokens One Mission

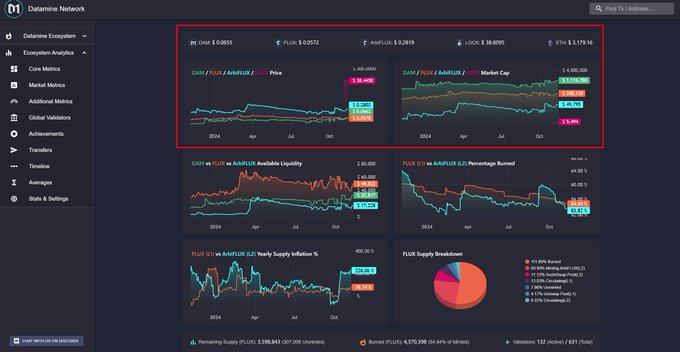

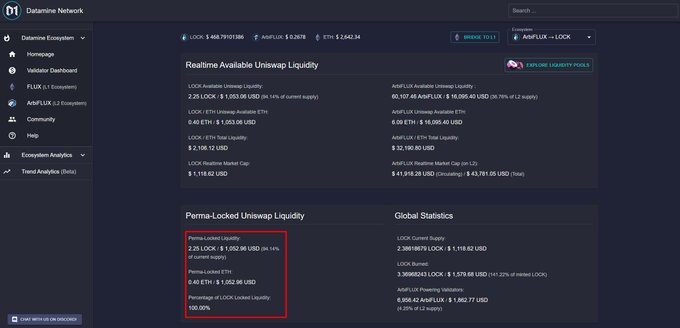

Datamine Network has launched four core metrics for their new Lockquidity tokens on Arbitrum L2. The ecosystem now features four interconnected tokens:

- $DAM: Fixed-supply token on Ethereum L1

- $FLUX: Generated by staking $DAM

- ArbiFLUX: Generated by staking $FLUX on Arbitrum

- $LOCK: Generated by staking ArbiFLUX

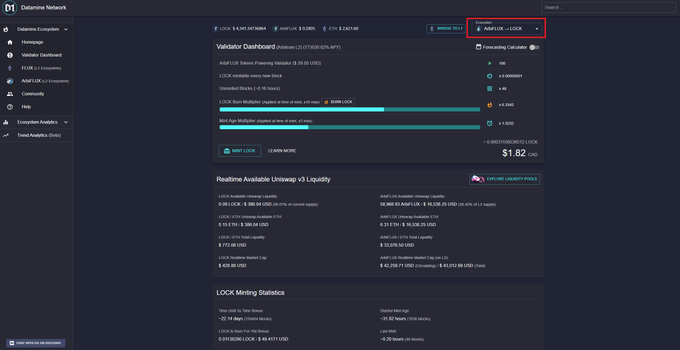

Key features include permanent Uniswap liquidity pools and >100% burn capability through liquidity recycling. The system has already secured over $9,000 in locked Ethereum liquidity since launch.

Track the entire ecosystem across both Ethereum L1 and L2 Arbitrum networks through their real-time dashboard.

🔥Now live: 4 powerful core metrics for our new #Lockquidity tokens Lockquidity is our first #Arbitrum #L2 tokens that features permanent @Uniswap liquidity pool and ability to have >100% burn with "liquidity recycling" Our unique #DeFi ecosystem features 4 unique tokens, each

🔥It is here! Datamine Network Realtime #Decentralized dashboard 2.0! Now featuring 3 exciting ecosystems in one realtime place. Swiftly change to - $DAM → $FLUX - #FLUX (L2) → #ArbiFLUX (L2) - ArbiFLUX(#L2) → #Lockquidity $LOCK (L2) Simply the most polished #UX in all of

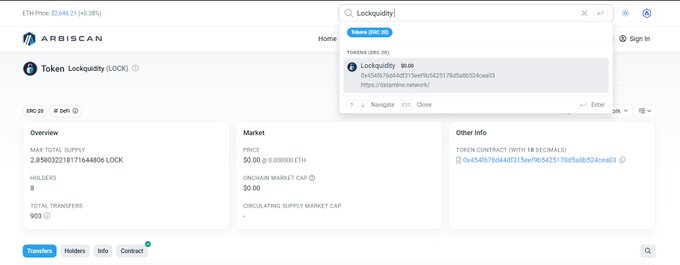

🔥#Lockquidity $LOCK is now listed on Arbiscan! You can now search for Lockquidity on Arbiscan and navigate directly to our #smartcontract! Lockquidity is a unique #DeFi ecosystem on #Arbitrum #L2 that permanently locks-in liquidity in a #Uniswap pool. Stake your $LOCK tokens

🔒Introducing Lockquidity Token ( $LOCK ) — Datamine Network Arbitrum L2 scaling for permanent liquidity TLDR: Lock-in #ArbiFLUX to mint $LOCK. Instead of burning LOCK it’s now added as permanent liquidity to the #Uniswap V2 pool. dataminenetwork.medium.com/introducing-lo…

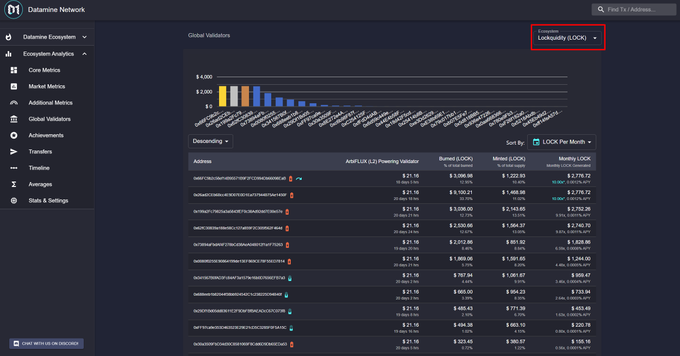

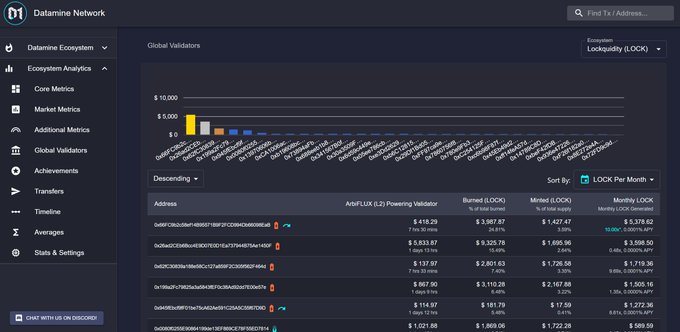

🔥Datamine #Lockquidity $LOCK ecosystem analytics dashboard is finally live! Featuring: - In-depth Validator analytics. See who is minting, burning and buying/selling to @Uniswap - #DeFi Achievements - Detailed ledgers for full transparency - 11 daily charts for complete

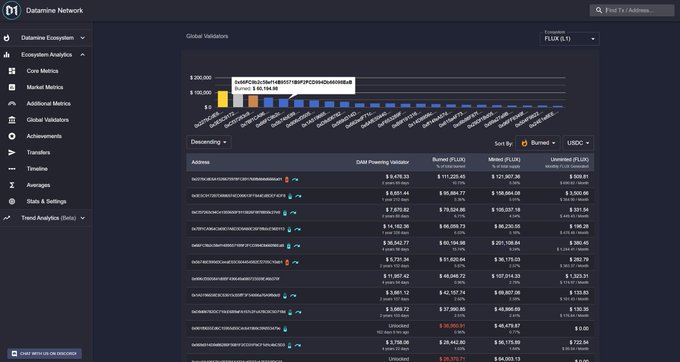

🔥The next update to Datamine Network features a brand new global validators distribution chart! Now you can quickly see leading validators for all the metrics and see who is leading! Over $1,700,000 in $FLUX has now been destroyed over the past 4 years to control inflation.

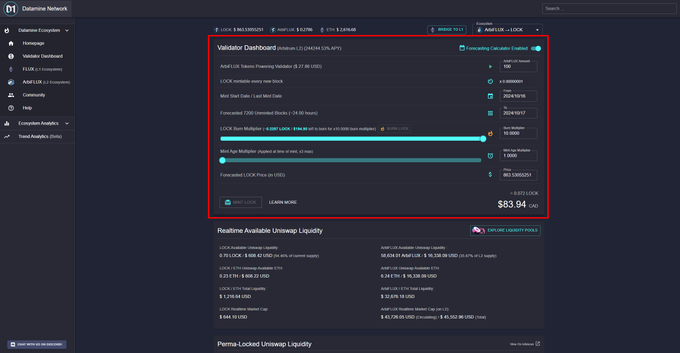

🔥Check out our new forecasting calculator for #Lockquidity $LOCK Now you can forecast the #LOCK that you can mint over certain durations. You can adjust all the #tokenomics, duration and even the predicted price. #DeFi forecasting tools like these are essential for all of our

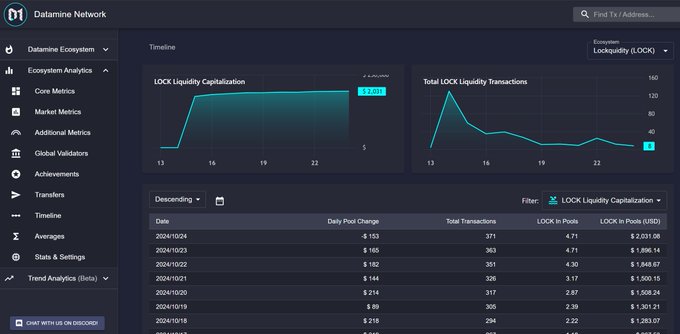

🔥Just 10 days after launch #Lockquidity $LOCK has reached $2,000 in locked liquidity! Validators in our unique #DeFi ecosystem compete to increase their staking APY and have burned over 150% of the supply to control the market inflation! If you're a fan of #masternodes and

🔥It's been a crazy day for #Lockquidity $LOCK #DeFi ecosystem. Today we've broken through $9000 in locked #Ethereum liquidity way ahead of schedule. That's +$8000 in locked liquidity in just 11 days! Lockquidity takes #staking & #masternode rewards into next generation of

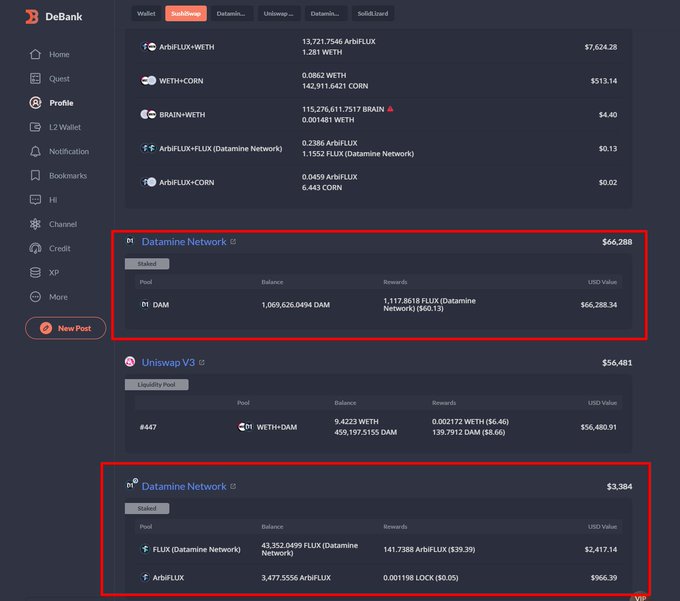

🤝We're excited to announce Datamine Staking is now supported by @DeBankDeFi This includes $DAM + $FLUX ecosystem and @arbitrum #L2 #ArbiFLUX staking! This includes our new #Lockquidity $LOCK token! Track Datamine staking directly in your DeBank!👀 datamine-crypto.github.io/realtime-decen…

DAM Token Shows Unusual Market Dynamics with Low Liquidity

The $DAM token is displaying unusual on-chain metrics that challenge typical market expectations. **Key Metrics:** - Market cap: ~$1,000,000 - Liquidity: ~$26,000 - Whale holdings: ~30% of supply - Supply locked: 78% (minting $FLUX) **Notable Finding:** LP fees (1%) are currently outperforming the 3% staking APY, suggesting active trading despite limited liquidity. The combination of low liquidity and high demand creates significant volatility opportunities for traders. This situation particularly affects $FLUX and $LOCK token holders. [Watch full breakdown](https://youtu.be/1AYtKF6Xg4Q)

Single Bot Dominates Datamine Ecosystem Game Rewards

**On-chain data reveals a single bot is capturing nearly 100% of rewards** in Datamine Network's ecosystem game, exposing a challenge for the community to address. **Key metrics from 5 years of DeFi operations:** - $FLUX inflation currently at 40% - $49,000 in decentralized liquidity split across the ecosystem - Holding LP tokens for $LOCK may outperform holding the token directly due to 1% swap fees **Recent achievements:** - $LOCK inflation dropped from 700% to 100% in one year through automated on-chain mechanisms - 96% of $LOCK supply locked in liquidity pools, with only 4% circulating - Over $100k in Ethereum-backed liquidity The data is publicly available for verification. [Watch the breakdown](https://youtu.be/4Y6f96iuxI4)

DeFi Project Tackles 5 Years of Technical Debt Using AI Assistance

A DeFi project successfully migrated 89 unit tests to Hardhat v3 and addressed years of smart contract technical debt using AI assistance during recent market volatility. **Key developments:** - Completed major technical upgrade while ETH dropped 30% - AI tools helped accelerate development process significantly - Migrated entire test suite to new framework **Technical focus:** - Doubling down on ERC777 token standard for $FLUX and $LOCK - ERC777 enables single-transaction hooks unavailable in standard ERC20 - Allows for immutable decentralization with zero admin keys **Project stability:** - Maintains over $100,000 in ETH-backed liquidity - Focus on long-term building despite market conditions - [Technical update video](https://youtu.be/bTmzBa9iNNw) available The project emphasizes building for the decade rather than short-term market movements.

Datamine Network Completes Hardhat v3 Migration While Defending ERC777 Token Standard

**Datamine Network** successfully migrated their smart contract testing suite to **Hardhat v3**, requiring upgrades to Node.js 22, ESM modules, and ESLint v9 flat config. Despite industry abandonment, they're **defending ERC777** over ERC20 for its superior user experience: - **Single-transaction interactions** via hooks (tokensToSend/tokensReceived) - **No approve-then-transfer** friction - users send tokens directly to contracts - Powers their **Lockquidity mechanism** where users lock DAM tokens to mint FLUX in one action **Key challenges solved:** - Built custom Hardhat plugin for ERC1820 Registry deployment - Implemented rigorous **re-entrancy attack testing** to prove security - Used proper mutexes and checks-effects-interactions patterns **Why ERC777 was abandoned:** OpenZeppelin removed support due to complexity and re-entrancy risks. However, Datamine argues the industry gave up too quickly on a powerful standard. The migration resulted in a **faster, cleaner, future-proof codebase** while maintaining advanced token functionality that ERC20 cannot match. [Learn more about Datamine Network](https://datamine.network/)

Datamine Network Introduces Yield Function - Money That Generates Its Own Returns

**The Problem: Money Is Static** Traditional money fails as a store of value due to inflation. A $100 basket of goods from 2000 now costs $192, with current inflation at 3.0% annually. This forces people into risky yield-seeking through banks, stocks, or protocols. **The Solution: Built-in Yield Function** Datamine Network introduces the **Yield Function** - a fourth monetary function that transforms static assets into perpetual generators of future supply. **How It Works:** - Open market generates new token supply over time - Users can "burn" existing tokens (irreversible conversion) - Burning grants permanent proportional share of all future tokens **Key Features:** - Mathematical certainty built into code - No third-party risk - Transparent, decentralized yield market - 95% of LOCK value locked in permanent ETH-backed liquidity After 5 years of development, this system demonstrates how money can evolve to generate yield itself, eliminating dependence on banks or brokers. [Explore the ecosystem](https://datamine.network)