Datamine Network Announces New Decentralized CPI Feature for LOCK Token

Datamine Network Announces New Decentralized CPI Feature for LOCK Token

🔥 CPI Gets a DeFi Makeover

Datamine Network is introducing a Decentralized Consumer Price Index (CPI) for their LOCK token, marking a significant development in their DeFi ecosystem. The new feature will track price metrics differently from existing FLUX and ArbiFLUX tokens.

Key updates:

- LOCK token has reached $50,000 in permanent locked liquidity

- Achieved in 2 months what took other tokens 3-4 years

- Operating on Arbitrum L2 for improved scaling

- New CPI tracking system incoming

The rapid growth demonstrates increasing adoption of Layer 2 solutions on Ethereum, with Datamine's Lockquidity system providing permanent, decentralized liquidity solutions.

🔥Next update to Datamine Network features a new Decentralized Consumer Price Index for our new #Lockquidity $LOCK token. The new #tokenomics for #LOCK token will produce very interesting CPI chart which will be different from the $FLUX and #ArbiFLUX chart. Be sure to follow

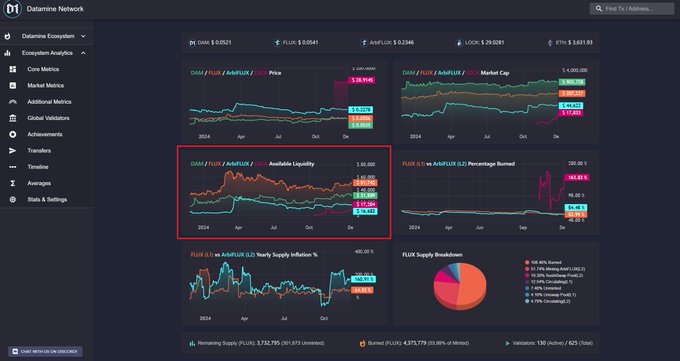

🔥#DeFi on #Ethereum is absolutely on fire! Datamine #Lockquidity $LOCK token just saw an explosive liquidity jump beating our 3 year old token in just 2 month! That's right, it took us just 2 months to get to same liquidity that took #ArbiFLUX 3 years to build... Our unique

🔥We're seeing unbelievable growth in #Lockquidity $LOCK token liquidity. In just 1 month we've beaten both $DAM and #ArbiFLUX liquidity which took over 4 years to gather. Datamine Lockquidity is a solution for permanent, decentralized liquidity while featuring all of the same

DAM Token Shows Unusual Market Dynamics with Low Liquidity

The $DAM token is displaying unusual on-chain metrics that challenge typical market expectations. **Key Metrics:** - Market cap: ~$1,000,000 - Liquidity: ~$26,000 - Whale holdings: ~30% of supply - Supply locked: 78% (minting $FLUX) **Notable Finding:** LP fees (1%) are currently outperforming the 3% staking APY, suggesting active trading despite limited liquidity. The combination of low liquidity and high demand creates significant volatility opportunities for traders. This situation particularly affects $FLUX and $LOCK token holders. [Watch full breakdown](https://youtu.be/1AYtKF6Xg4Q)

Single Bot Dominates Datamine Ecosystem Game Rewards

**On-chain data reveals a single bot is capturing nearly 100% of rewards** in Datamine Network's ecosystem game, exposing a challenge for the community to address. **Key metrics from 5 years of DeFi operations:** - $FLUX inflation currently at 40% - $49,000 in decentralized liquidity split across the ecosystem - Holding LP tokens for $LOCK may outperform holding the token directly due to 1% swap fees **Recent achievements:** - $LOCK inflation dropped from 700% to 100% in one year through automated on-chain mechanisms - 96% of $LOCK supply locked in liquidity pools, with only 4% circulating - Over $100k in Ethereum-backed liquidity The data is publicly available for verification. [Watch the breakdown](https://youtu.be/4Y6f96iuxI4)

DeFi Project Tackles 5 Years of Technical Debt Using AI Assistance

A DeFi project successfully migrated 89 unit tests to Hardhat v3 and addressed years of smart contract technical debt using AI assistance during recent market volatility. **Key developments:** - Completed major technical upgrade while ETH dropped 30% - AI tools helped accelerate development process significantly - Migrated entire test suite to new framework **Technical focus:** - Doubling down on ERC777 token standard for $FLUX and $LOCK - ERC777 enables single-transaction hooks unavailable in standard ERC20 - Allows for immutable decentralization with zero admin keys **Project stability:** - Maintains over $100,000 in ETH-backed liquidity - Focus on long-term building despite market conditions - [Technical update video](https://youtu.be/bTmzBa9iNNw) available The project emphasizes building for the decade rather than short-term market movements.

Datamine Network Completes Hardhat v3 Migration While Defending ERC777 Token Standard

**Datamine Network** successfully migrated their smart contract testing suite to **Hardhat v3**, requiring upgrades to Node.js 22, ESM modules, and ESLint v9 flat config. Despite industry abandonment, they're **defending ERC777** over ERC20 for its superior user experience: - **Single-transaction interactions** via hooks (tokensToSend/tokensReceived) - **No approve-then-transfer** friction - users send tokens directly to contracts - Powers their **Lockquidity mechanism** where users lock DAM tokens to mint FLUX in one action **Key challenges solved:** - Built custom Hardhat plugin for ERC1820 Registry deployment - Implemented rigorous **re-entrancy attack testing** to prove security - Used proper mutexes and checks-effects-interactions patterns **Why ERC777 was abandoned:** OpenZeppelin removed support due to complexity and re-entrancy risks. However, Datamine argues the industry gave up too quickly on a powerful standard. The migration resulted in a **faster, cleaner, future-proof codebase** while maintaining advanced token functionality that ERC20 cannot match. [Learn more about Datamine Network](https://datamine.network/)

Datamine Network Introduces Yield Function - Money That Generates Its Own Returns

**The Problem: Money Is Static** Traditional money fails as a store of value due to inflation. A $100 basket of goods from 2000 now costs $192, with current inflation at 3.0% annually. This forces people into risky yield-seeking through banks, stocks, or protocols. **The Solution: Built-in Yield Function** Datamine Network introduces the **Yield Function** - a fourth monetary function that transforms static assets into perpetual generators of future supply. **How It Works:** - Open market generates new token supply over time - Users can "burn" existing tokens (irreversible conversion) - Burning grants permanent proportional share of all future tokens **Key Features:** - Mathematical certainty built into code - No third-party risk - Transparent, decentralized yield market - 95% of LOCK value locked in permanent ETH-backed liquidity After 5 years of development, this system demonstrates how money can evolve to generate yield itself, eliminating dependence on banks or brokers. [Explore the ecosystem](https://datamine.network)