Datamine Gems Unveils Collect All Gems Feature

Datamine Gems Unveils Collect All Gems Feature

🎮 One Click To Rule Them All

Datamine Network has launched a new 'Collect all gems' feature for its GameFi platform. The update allows users to claim rewards from multiple addresses in a single transaction, significantly reducing gas fees and improving efficiency.

The feature works through an upgraded Public Market V2 smart contract that enables atomic batch burning and optimized reward distribution. Each gem represents a public market address with unminted token balance.

Key benefits:

- Single-click collection of multiple rewards

- Reduced transaction costs

- Increased monetary velocity

- Enhanced user experience

The update aims to strengthen the Datamine ecosystem by making participation more rewarding while maintaining decentralization.

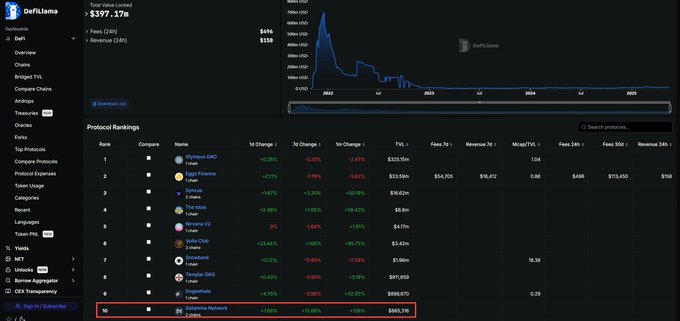

🔥Datamine Network is now in the 10th place on @DefiLlama for Reserve Currency category with over $885,000 in TVL! #DeFi on #Etehreum is growing rapidly and we're happy to see our 2021 ecosystem grow! Liquidity is flowing back into $ETH and unique audited #tokenomics like our

We've just supercharged #DatamineGems! 🔥 Introducing the "Collect all gems" button – a revolutionary atomic collection feature. Now you can claim ALL your rewards from multiple addresses in a SINGLE transaction! 🤯 Read more: medium.com/@dataminenetwo… ✅ Save on gas fees ✅

🚀 Introducing Datamine Market! 🚀 Imagine a button that turns $100 into $105 instantly! 🤯 Click, earn crypto & help validators access their yield NOW. We're revolutionizing #DeFi by decentralizing "Time-in-Market". Learn more: dataminenetwork.medium.com/datamine-marke… #DatamineNetwork

🚀 BIG NEWS! Datamine Gems is NOW LIVE for ArbiFLUX on @Arbitrum! 💎✨ Dive into @dataminenetwork's revolutionary #GameFi experience. Click gems, earn #ArbiFLUX instantly through our decentralized "Time-in-Market" system! The ultimate game of speed & efficiency has arrived.

Is inflation eroding your crypto's value? 📉 After 5 years of development, #Lockquidity ( $LOCK ) offers a new approach! 🔥 Learn how its permanent liquidity & unique burn-to-LP mechanism are designed to combat inflation & deliver real value retention.

DAM Token Shows Unusual Market Dynamics with Low Liquidity

The $DAM token is displaying unusual on-chain metrics that challenge typical market expectations. **Key Metrics:** - Market cap: ~$1,000,000 - Liquidity: ~$26,000 - Whale holdings: ~30% of supply - Supply locked: 78% (minting $FLUX) **Notable Finding:** LP fees (1%) are currently outperforming the 3% staking APY, suggesting active trading despite limited liquidity. The combination of low liquidity and high demand creates significant volatility opportunities for traders. This situation particularly affects $FLUX and $LOCK token holders. [Watch full breakdown](https://youtu.be/1AYtKF6Xg4Q)

Single Bot Dominates Datamine Ecosystem Game Rewards

**On-chain data reveals a single bot is capturing nearly 100% of rewards** in Datamine Network's ecosystem game, exposing a challenge for the community to address. **Key metrics from 5 years of DeFi operations:** - $FLUX inflation currently at 40% - $49,000 in decentralized liquidity split across the ecosystem - Holding LP tokens for $LOCK may outperform holding the token directly due to 1% swap fees **Recent achievements:** - $LOCK inflation dropped from 700% to 100% in one year through automated on-chain mechanisms - 96% of $LOCK supply locked in liquidity pools, with only 4% circulating - Over $100k in Ethereum-backed liquidity The data is publicly available for verification. [Watch the breakdown](https://youtu.be/4Y6f96iuxI4)

DeFi Project Tackles 5 Years of Technical Debt Using AI Assistance

A DeFi project successfully migrated 89 unit tests to Hardhat v3 and addressed years of smart contract technical debt using AI assistance during recent market volatility. **Key developments:** - Completed major technical upgrade while ETH dropped 30% - AI tools helped accelerate development process significantly - Migrated entire test suite to new framework **Technical focus:** - Doubling down on ERC777 token standard for $FLUX and $LOCK - ERC777 enables single-transaction hooks unavailable in standard ERC20 - Allows for immutable decentralization with zero admin keys **Project stability:** - Maintains over $100,000 in ETH-backed liquidity - Focus on long-term building despite market conditions - [Technical update video](https://youtu.be/bTmzBa9iNNw) available The project emphasizes building for the decade rather than short-term market movements.

Datamine Network Completes Hardhat v3 Migration While Defending ERC777 Token Standard

**Datamine Network** successfully migrated their smart contract testing suite to **Hardhat v3**, requiring upgrades to Node.js 22, ESM modules, and ESLint v9 flat config. Despite industry abandonment, they're **defending ERC777** over ERC20 for its superior user experience: - **Single-transaction interactions** via hooks (tokensToSend/tokensReceived) - **No approve-then-transfer** friction - users send tokens directly to contracts - Powers their **Lockquidity mechanism** where users lock DAM tokens to mint FLUX in one action **Key challenges solved:** - Built custom Hardhat plugin for ERC1820 Registry deployment - Implemented rigorous **re-entrancy attack testing** to prove security - Used proper mutexes and checks-effects-interactions patterns **Why ERC777 was abandoned:** OpenZeppelin removed support due to complexity and re-entrancy risks. However, Datamine argues the industry gave up too quickly on a powerful standard. The migration resulted in a **faster, cleaner, future-proof codebase** while maintaining advanced token functionality that ERC20 cannot match. [Learn more about Datamine Network](https://datamine.network/)

Datamine Network Introduces Yield Function - Money That Generates Its Own Returns

**The Problem: Money Is Static** Traditional money fails as a store of value due to inflation. A $100 basket of goods from 2000 now costs $192, with current inflation at 3.0% annually. This forces people into risky yield-seeking through banks, stocks, or protocols. **The Solution: Built-in Yield Function** Datamine Network introduces the **Yield Function** - a fourth monetary function that transforms static assets into perpetual generators of future supply. **How It Works:** - Open market generates new token supply over time - Users can "burn" existing tokens (irreversible conversion) - Burning grants permanent proportional share of all future tokens **Key Features:** - Mathematical certainty built into code - No third-party risk - Transparent, decentralized yield market - 95% of LOCK value locked in permanent ETH-backed liquidity After 5 years of development, this system demonstrates how money can evolve to generate yield itself, eliminating dependence on banks or brokers. [Explore the ecosystem](https://datamine.network)