DAOs add LUSD to their treasury; LUSD dipping below peg offers buying opportunities

DAOs add LUSD to their treasury; LUSD dipping below peg offers buying opportunities

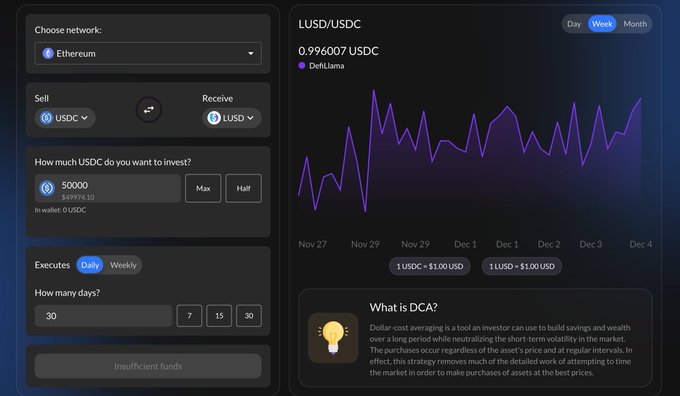

Multiple DAOs have added LUSD to their treasury, recognizing its value. Due to redemptions, LUSD has been slightly below its peg, creating buying opportunities. Users can take advantage by setting up limit orders on 1inch or using Mean.fi for dollar-cost averaging. Additionally, Aave is a good platform for borrowing against LUSD.

Many DAOs have come to the same conclusion, and added $LUSD to their treasury. Due to redemptions, LUSD has been dipping slightly below peg, offering great buying opportunities. Acquiring it that way also makes you immune to redemptions. One way users are taking advantage of

The @LiquityProtocol LUSD redemptions might seem bad for metrics and not great for trove holders' UX, but it is definitely a major benefit to LUSD holders who never have to worry about their stablecoin holdings dropping below 99c on the dollar There are trade offs to all designs

Liquity V2 Maintains Lowest ETH Borrow Rates on Mainnet at 3.6%

**Liquity V2 continues to offer the most competitive ETH borrowing rates on Ethereum Mainnet:** - Current borrow rate: **~3.6%** - 365-day average: **~2.54%** - Approximately **2% cheaper** than major competitors (4.5-5.6%) **Key Features:** - Fixed interest rates that users control - Option to set your own rates or delegate to rate managers - Consistently lowest borrowing costs over extended periods Users maintain full control over their borrowing costs through Liquity's unique rate-setting mechanism, making it an attractive option for ETH-backed loans on Mainnet. [Learn more about Liquity V2](https://www.liquity.org/frontend-v2)

🪂 Enosys Airdrop Now Live for BOLD Liquidity Providers

The first portion of the Enosys airdrop is now claimable for Liquity V2 users. The program distributes 52.5 APS tokens initially, with 10+ additional airdrops planned throughout the year. **Key Details:** - 40-week incentive program totaling 412.5 APS (~$850k value) - Adds approximately 3% APR on top of existing yields - Split 50/50 between retroactive rewards and ongoing activity - Weekly distribution of 9 APS (~$18k) to active participants **Current Yields for BOLD LPs:** - 8.5% on Uniswap - 7.5% on Yearn yBOLD - 6.5% on Curve Finance APS tokens can be staked in [Enosys Governance](https://gov.enosys.global/) to earn protocol fees or used for liquidity provision on [Enosys DEX v3](https://v3.dex.enosys.global/liquidity). Claims are available on the [Enosys Protocol frontend](https://loans.enosys.global/incentives) on Flare Network. Users can bridge to Flare via [Stargate Finance](https://stargate.finance/). *Continue providing liquidity with BOLD to remain eligible for upcoming airdrops.*

Liquity V2 Ecosystem Dashboard Now Live on Dune Analytics

Liquity has launched a comprehensive ecosystem dashboard on Dune Analytics, providing users with a centralized view of eligible venues within the Liquity V2 ecosystem. **Key Features:** - Access to real-time data on Liquity V2 ecosystem participants - Transparent tracking of eligible venues and protocols - Complements the existing BOLD yield dashboard launched in December **What This Means:** The dashboard builds on Liquity's commitment to transparency, following the December release of their BOLD yield tracking tool that monitors 15+ venues for earning yield on BOLD stablecoin. Users can now monitor both ecosystem participation and yield opportunities through dedicated Dune dashboards. [View Liquity V2 Ecosystem Dashboard](https://dune.com/liquity/liquity-v2-ecosystem)

🎁 Enosys Airdrop Goes Live Tomorrow for Liquity V2 Users

The **Enosys airdrop** becomes claimable on **January 21, 2026** for Liquity V2 users on Ethereum Mainnet. **Key Details:** - 40-week incentive program split 50/50 between retroactive rewards for existing users and ongoing activity - Adds approximately **3% APR** on top of existing yields - Claims available through the Enosys frontend starting tomorrow - **10+ additional airdrops** planned throughout 2026 **Current Earning Opportunities:** - 8.5% APR liquidity providing on [Uniswap](https://uniswap.org) - 7.5% APR on [Yearn Finance](https://yearn.fi) yBOLD - 6.5% APR liquidity providing on [Curve Finance](https://curve.fi) Users maintaining active liquidity positions on Ethereum will continue capturing rewards from the extended airdrop series. Full details: [Liquity Blog Post](https://www.liquity.org/blog/enosys-airdrop-for-liquity-v2-users)

Liquity Launches Dual Reward Program with $108k Retro Claims and Weekly Incentives

Liquity has introduced a two-part reward distribution system for its community: **Retroactive Rewards (1.375% allocation)** - One-time claim of 52.5 APS (~$108k) available for users on the [Liquity leaderboard](https://dune.com/liquity/v2-leaderboard) - Eligible users will continue receiving 3.85 APS weekly (~$8k/week) on a pro-rata basis **Ongoing Incentives (1.375% allocation)** - Fresh rewards for Mainnet Liquity activity beginning January 21 - Distribution rate: 5.15 APS per week (~$11k/week) - Same leaderboard criteria apply, including: - Liquidity provision on Stability Pools - LP positions on Curve - LP positions on Uniswap The program rewards both historical participation and encourages continued engagement with the protocol's liquidity infrastructure.