CYPH ICO goes live today at 4pm UTC for eligible xGRAIL holders with whitelist allocations.

Key Details:

- Holders of 10+ xGRAIL: $5,000 allocation

- Holders of 1-10 xGRAIL: $500 allocation

- First 24 hours exclusive to whitelisted users

Airdrop Distribution:

- 9k eligible xGRAIL holders will receive 30M xCYPH tokens (3% total supply)

- Distribution occurs after CYPH Token Generation Event next week

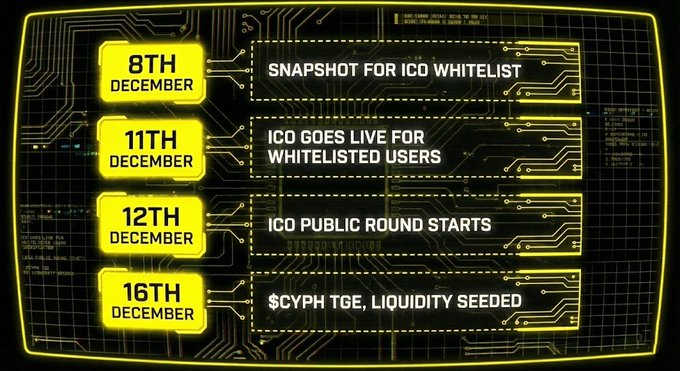

CYPH leverages Camelot's liquidity infrastructure to support Ethereum Mainnet builders. The snapshot closed December 8th for staked or non-vesting xGRAIL holders.

CYPH leverages the liquidity infra that Camelot has developed, using it as a foundation to support builders on Ethereum Mainnet. As it currently stands, 9k xGRAIL is currently eligible to receive 30,000,000 xCYPH tokens, equivalent to 3% of the total supply. /2

xGRAIL holders will receive an airdrop of xCYPH and a whitelist allocation for the ICO on 11th Dec. The snapshot will close on 8th December. To be eligible, holders must have xGRAIL that is staked or not vesting. The airdrop will be distributed after the CYPH ICO 🧵/1

The $CYPH ICO starts 11th Dec at a fixed-price valuation of $1.38m mcap. No VCs or private investors. +70% supply to the community. A token with real value accrual. Provide liquidity > earn points > secure your whitelist allocation & future airdrop. app.cyphereth.com/pools

In addition to the airdrop, eligible xGRAIL holders have a whitelist allocation for the CYPH ICO, starting at 4pm UTC today. The airdrop will be distributed to xGRAIL holders following CYPH TGE in the coming week. The Holy Grail 🏆

The $CYPH ICO starts in 24hrs. Market infrastructure for Ethereum Layer 1, owned by its users. Fixed-price ICO at a $1.4m valuation, FCFS. No private investors, this is the very first opportunity to be early. Details below 🧵/1

Holders of 10+ xGRAIL get a $5,000 whitelist allocation. Holders of >1 and <10 xGRAIL get a $500 allocation. The ICO begins next week, on December 11th, and will be open exclusively to whitelisted users for the first 24 hours. /3

Camelot DEX Reaches $24B Trading Volume Milestone in 2025

Camelot, the Arbitrum-focused decentralized exchange, achieved **$24 billion in spot trading volume** throughout 2025, marking a significant milestone for the protocol. **Key Highlights:** - The platform's Orbital Liquidity Network expanded to support **14 Arbitrum chains** - Recent 24-hour volume hit **$420 million**, setting a new all-time high - The protocol continues to focus on providing deep, sustainable liquidity for Arbitrum ecosystem builders Camelot's customizable infrastructure enables both developers and users to access adaptable liquidity solutions, moving beyond traditional DEX designs with a composability-first approach. The growth demonstrates increasing adoption of the platform's tailored liquidity mechanisms within the Arbitrum ecosystem.

Camelot Launches Enhanced APE Rewards on ApeChain

**Camelot**, the first DeFi protocol on ApeChain, announces **boosted rewards** for $APE liquidity pools. Key developments: - Enhanced incentives for APE token holders - New token launch from ApeChain's leading NFT project - Builds on previous partnership with ApeChain DAO's Banana Bill program The protocol continues expanding its presence on the **Orbit-based ApeChain**, offering tailored liquidity solutions for the ecosystem. *Ready to explore enhanced APE rewards on Camelot?*

Orbital Liquidity Network Expands on Arbitrum

The Orbital Liquidity Network continues to strengthen its position in the rollup ecosystem by providing robust liquidity infrastructure on Arbitrum. - Network maintains consistent growth trajectory - Focuses on battle-tested liquidity solutions - Supports Arbitrum's expanding ecosystem The integration represents a significant milestone in decentralized liquidity provision, offering builders and users access to reliable infrastructure for cross-chain operations. *Key features include scalable architecture and tested security measures.*

Camelot DEX Maintains Market Leadership on Arbitrum with $36B Trading Volume

Camelot continues its strong performance as Arbitrum's leading DEX: - Trading volume reaches **$36 billion** - Generated **$42 million** in fees - Offers **25% APY** through Real Yield Staking - First to implement Orbital Liquidity Network - Maintains community-first approach with no VC backing The platform shows consistent growth from October's metrics while expanding its infrastructure to support Orbit chains including ApeChain and Sanko.