Curve Finance released their weekly yield and key metrics report for Week 37 of 2025.

The report highlights the best available yields across Curve's liquidity pools and provides essential performance metrics for DeFi participants.

Key areas covered:

- Top-performing yield opportunities

- Pool performance analytics

- Weekly market insights

This continues Curve's regular practice of providing transparent yield data to help users identify optimal liquidity provision strategies.

Yields, anyone? news.curve.finance/curve-best-yie…

Curve Finance Seeks Community Vote on Critical FX Pool Updates

Curve Finance is calling for community votes on **important FX pool implementation updates** that could establish the protocol as the foundation for major asset liquidity. The proposal focuses on: - Updating TwoCrypto implementations - Factory donations and yield-bearing token integration - Strengthening Curve's position in DeFi liquidity infrastructure **Key voting links:** - [DAO Proposal 1197](https://www.curve.finance/dao/ethereum/proposals/1197-ownership) - [Governance Discussion](https://gov.curve.finance/t/update-twocrypto-implementations-donations-yb-in-the-factory/10818) This update builds on previous governance actions, including gauge assignments for BOLD x fxUSD pools that received community support earlier this year. *Vote now to help shape Curve's liquidity infrastructure.*

Curve Finance Maintains Strong Yield Performance in Week 3

Curve Finance continues to demonstrate consistent yield performance in the third week of 2025, maintaining the positive trend observed since the start of the year. Key metrics: - Weekly yield reports show sustained stability - Multiple pools maintaining competitive returns - Trend continues from previous weeks' positive performance This marks the third consecutive week of notable yields in 2025, following the reporting structure implemented in December 2024. *Note*: Detailed pool-specific data available in the full report.

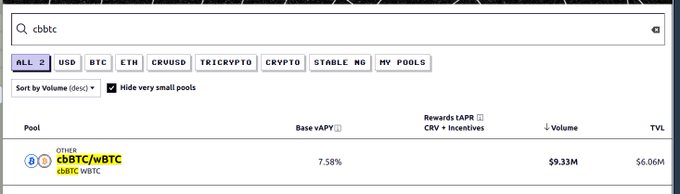

Coinbase cbBTC Swap Demand Surges

The demand for swapping Coinbase's cbBTC continues to rise, with notable metrics: - **Pool utilization** reaches 150% - **Unincentivized APR** stands at 7.6% This trend has persisted for at least two days, indicating sustained interest in cbBTC swaps. The high pool utilization suggests increased trading activity, while the attractive APR may draw more liquidity providers to the pool. Traders and investors should monitor these metrics closely, as they may impact swap costs and potential earnings from providing liquidity.

Temporary Message on Site

A brief announcement has been posted on the website, stating: - The message will only be visible for a few weeks - It will not be required after that period This temporary notice appears to be informing users about a short-term change or update. No further details about the content or purpose of the message are provided. **Action:** Check the website regularly for any updates or changes related to this temporary message.