Curve Finance Highlights High APY on Strike Finance Platform

Curve Finance Highlights High APY on Strike Finance Platform

🔥 Juicy Yields Alert!

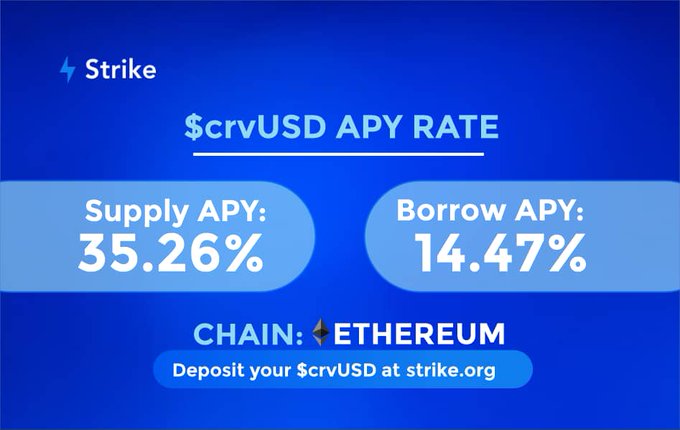

Curve Finance, a decentralized exchange liquidity pool on Ethereum, has highlighted the attractive annual percentage yields (APY) currently available on the Strike Finance lending platform. According to Curve Finance's tweet, the supply APY for crvUSD, their USD-pegged stablecoin, is 35.26% while the borrow APY is 14.47% on Strike Finance. Curve Finance encourages users to deposit their crvUSD on Strike Finance to earn passive yields.

Yho Strikers 😊 @CurveFinance crvUSD suppy APY is currently 35.26% while the borrow APY is 14.47% on @StrikeFinance. Deposit your crvUSD at : strike.org and earn passively!🔋 #StrikeFinance #ETH #DeFi #Lending #crvUSD

Curve Finance Accuses PancakeSwap of Unauthorized Code Use

Curve Finance has publicly accused PancakeSwap of copying their stableswap code without permission, claiming it violates their license terms. **Key Points:** - Curve states the code usage is illegal and historically problematic for projects that have done similar things - They're offering PancakeSwap a path forward through official licensing and collaboration - The accusation emphasizes keeping users "SAFU" (secure) through proper expertise **Context:** This contrasts with Uniswap's approach, which released their interface under an open-source GPL license specifically to encourage forking - their GitHub repo has been forked nearly 4,700 times. The situation highlights ongoing tensions around code licensing in DeFi, where the line between open-source collaboration and intellectual property protection remains contested.

Curve Finance Weekly Yields and Key Metrics - Week 10 2026

Curve Finance has released its weekly report highlighting the best yields and key performance metrics for Week 10 of 2026. The report provides insights into: - Top-performing liquidity pools and their current APYs - Key protocol metrics and performance indicators - Yield opportunities across different Curve pools This weekly update helps liquidity providers identify optimal yield strategies within the Curve ecosystem. The data reflects the current state of DeFi yields and liquidity provision opportunities. [Read the full report](https://news.curve.finance/curve-best-yields-key-metrics-week-10-2026/)

Curve Launches Unified Knowledge Hub for Users, Developers, and AI

Curve Finance has launched a comprehensive **Knowledge Hub** that consolidates all documentation and resources in one centralized location. The new platform provides: - User documentation for traders and liquidity providers - Developer documentation for builders - Integration and ecosystem information - Latest ecosystem updates The hub is designed to be accessible to everyone, including **LLMs (Large Language Models)**, making it easier for AI systems to access accurate information about Curve's protocol. This unified resource aims to streamline the learning experience for both newcomers and experienced users of the DeFi protocol, which specializes in stablecoin trading and liquidity provision. [Read more](https://news.curve.finance/curve-knowledge-hub-a-unified-home-for-curve-documentation/)

Curve Finance Releases Week 8 Yield Performance Report

Curve Finance has published its weekly yield report for Week 8 of 2026, providing an overview of the platform's best-performing liquidity pools and key performance metrics. The report continues Curve's regular practice of tracking and sharing yield opportunities across its decentralized exchange protocol. This follows the previous week's yield analysis from Week 7. **Key aspects typically covered in these reports include:** - Top-performing liquidity pools by APY - Trading volume metrics across different pools - Total value locked (TVL) changes - CRV token emissions and rewards distribution These weekly reports help liquidity providers make informed decisions about where to deploy their capital within the Curve ecosystem. Full details: [Curve Week 8 Report](https://news.curve.finance/curve-best-yields-key-metrics-week-8-2026/)

Curve Finance Releases Week 49 Yield Report and Key Metrics

**Curve Finance** has published its weekly yield report for Week 49 of 2025, continuing its regular series of performance updates. The report covers: - **Current yield opportunities** across Curve's liquidity pools - Key performance metrics for the week - Pool-specific data and analytics This marks another installment in Curve's consistent weekly reporting, following their November monthly recap and previous weekly yield updates. The platform continues to provide transparency around yield farming opportunities and protocol performance through these regular data releases. [View the full Week 49 report](https://news.curve.finance/curve-best-yields-key-metrics-week-49-2025/)