Crypto Now Valid Asset for US Mortgages

Crypto Now Valid Asset for US Mortgages

🏠 Crypto Buys Houses Now

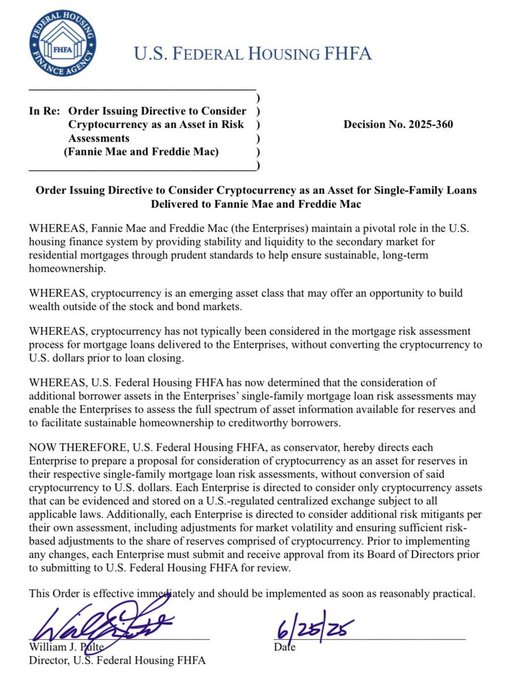

The Federal Housing Finance Agency (FHFA) has mandated Fannie Mae and Freddie Mac to include cryptocurrency holdings in single-family mortgage risk assessments.

Key points:

- Cryptocurrency now counts as a valid reserve asset for mortgage applications

- Policy applies to government-backed mortgage providers

- Change is effective immediately

This marks a significant shift in traditional finance's acceptance of digital assets. Fannie Mae and Freddie Mac, which provide crucial liquidity to the US housing market, will now evaluate crypto holdings alongside traditional assets when assessing mortgage applications.

ICYMI: Crypto will now be considered in US mortgage evaluations

🇺🇸 Just in: FHFA orders Fannie Mae & Freddie Mac to consider crypto as a reserve asset for single-family mortgage risk assessments, effective immediately. Fannie & Freddie are US gov't-backed firms that: - Buy mortgages from lenders - Provide liquidity to the housing market

Kraken Launches New Global Payment App Krak

Kraken has introduced Krak, a new payments application offering: - Free cross-border transactions - Yield earning opportunities up to 10% - Upcoming credit card integration The app enables instant international transfers with minimal fees while allowing users to earn rewards on their deposits. This marks Kraken's entry into the consumer payments space, expanding beyond their traditional cryptocurrency exchange services.

Bitcoin as Corporate Treasury: Beyond Basic Holdings

**Key Points on Bitcoin Corporate Treasury Adoption:** - Companies are increasingly considering Bitcoin for treasury holdings as traditional monetary policies shift - Core benefits include inflation hedging, censorship resistance, and proven institutional adoption track record **Beyond Basic Treasury Holdings:** - Payment rail integration reduces dependency on traditional financial intermediaries - DeFi tool development and tokenized asset opportunities - Strategic partnerships with Bitcoin ecosystem players (miners, custodians, exchanges) *Companies limiting themselves to treasury holdings capture only basic hedge benefits, while those building ecosystem integration unlock greater value potential.*

Nine Investment Firms Await Solana ETF Approvals

Nine major investment firms have filed applications for Solana ETFs, signaling growing institutional interest in the blockchain platform: - Traditional finance giants: Franklin Templeton, Fidelity, VanEck - Crypto-focused firms: Bitwise, Grayscale, 21Shares - Additional players: Canary Capital, Coinshares, Invesco Galaxy This development follows recent Delaware filings by Invesco and Galaxy Digital. The potential approval of these ETFs could expand institutional access to Solana's ecosystem through regulated investment vehicles.

Crossmint and Visa Partner to Enable AI-Powered Purchases

Crossmint has formed a strategic partnership with Visa to introduce agentic commerce capabilities. This collaboration enables AI agents to make secure purchases on behalf of users. - AI agents can now execute autonomous transactions - Integration ensures secure and seamless payment processing - Builds on earlier developments from Story Protocol's IP trading framework This development represents a significant step toward AI-integrated financial services, potentially transforming how we conduct digital transactions. [Learn more about Crossmint](https://crossmint.com)