CRV rewards are now available on crvUSD pools on both Curve and ConvexFinance on Polygon.

crvUSD pools have CRV rewards on @0xPolygon, both on Curve and @ConvexFinance

🚨 Security Alert: Eywa/CrossCurve Users Urged to Review Pool Positions

Following a security incident at eywa.fi (CrossCurve), users are advised to review and consider removing votes from Eywa-related pools. **Key Points:** - Security incident affects CrossCurve platform - Users with allocated votes in Eywa pools should reassess positions - Platform encourages vigilant, risk-aware decisions with third-party projects The platform, which enables deep on-chain liquidity through bonding curves, had previously promoted its voting mechanism where veEYWA holders earn rewards and control liquidity distribution. The incident marks a shift from recent promotional activity highlighting 51M+ locked EYWA and $16.2M TVL.

Curve Finance Week 5 Yields and Key Metrics Report

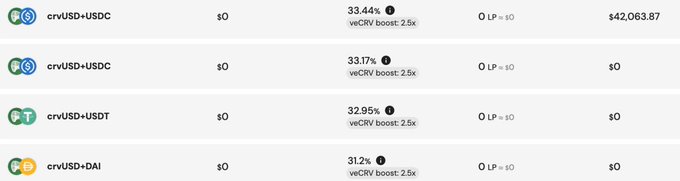

Curve Finance has released its weekly yields and key metrics report for Week 5 of 2026. The platform continues its regular cadence of providing transparency around liquidity pool performance and returns. This weekly update follows similar reports from previous weeks, maintaining consistency in tracking DeFi yields. **Key Points:** - Weekly yield data now available for liquidity providers - Metrics cover various Curve pools and their performance - Part of ongoing series tracking DeFi returns For detailed yield information and pool-specific metrics, view the full report: [Week 5 2026 Yields](https://news.curve.finance/curve-best-yields-key-metrics-week-5-2026/) This data helps liquidity providers make informed decisions about capital allocation across Curve's ecosystem of stablecoin and crypto asset pools.

Curve Finance Releases Week 49 Yield Report and Key Metrics

**Curve Finance** has published its weekly yield report for Week 49 of 2025, continuing its regular series of performance updates. The report covers: - **Current yield opportunities** across Curve's liquidity pools - Key performance metrics for the week - Pool-specific data and analytics This marks another installment in Curve's consistent weekly reporting, following their November monthly recap and previous weekly yield updates. The platform continues to provide transparency around yield farming opportunities and protocol performance through these regular data releases. [View the full Week 49 report](https://news.curve.finance/curve-best-yields-key-metrics-week-49-2025/)

🔄 Curve Launches First Foreign Exchange Pool with CHF/USD Trading

**Curve Finance introduces foreign exchange trading** with its first pilot CHF/USD liquidity pool on Ethereum. The pool combines: - **$ZCHF** from Frankencoin - **crvUSD** for the USD side - **CRV emissions** offering up to 100% APR **FXSwap algorithm powers the pool**, designed specifically for efficient trading of low-volatility assets like foreign currencies. This marks Curve's expansion into **on-chain foreign exchange markets**, targeting deep liquidity for currency pairs beyond traditional crypto assets. [Access the CHF/USD pool](https://www.curve.finance/dex/ethereum/pools/factory-twocrypto-276/deposit)

Curve Finance Reports Strong Yields in Week 40 Performance Update

Curve Finance released its weekly performance report for Week 40 of 2025, highlighting **strong yield opportunities** across its liquidity pools. The DeFi protocol continues its regular updates on key metrics and best-performing pools, providing users with data-driven insights for yield farming strategies. - Weekly yield tracking helps users identify optimal liquidity provision opportunities - Performance metrics guide investment decisions across Curve's ecosystem - Regular reporting maintains transparency in the protocol's operations This marks another consistent week of yield reporting from Curve Finance, following similar positive updates in previous weeks. The protocol's focus on **advanced bonding curves** continues to generate competitive returns for liquidity providers. [View full yield report](https://news.curve.finance/curve-best-yields-key-metrics-week-40-2025/)