During a cross-chain development project, Curve engineer Roman encountered significant challenges that highlight the ongoing complexity of multi-chain implementations.

Key findings:

- Discovered critical infrastructure bug affecting major DeFi protocols

- Security vulnerability impacted Aave, Frax, and StakeDAO

- Bug discovery helped protect protocols from potential exploits

The incident underscores the growing importance of thorough testing in cross-chain development, as DeFi continues shifting from single-chain to modular execution layers.

Multichaining is still tough! This is a review of cross-chain work by our engineer Roman. While porting, he accidentally discovered a bug in commonly used infrastructure, inadvertently helping protocols like Aave, Frax and StakeDAO to stay safe news.curve.finance/curve-block-or…

Curve Weekly Yield Report - Week 27 2025

**Key Yield Metrics for Curve Finance - Week 27** - Top performing pool: tricrypto2 with 8.2% APY - Stable pools averaging 4.1% APY, down 0.3% from last week - New USDC/USDT pool launched with initial 5.5% APY - Total Value Locked (TVL) increased by 2.1% to $4.2B Notable changes: - ETH/stETH spread narrowed to 0.02% - CRV rewards multiplier adjusted to 2.5x - Gas optimization reduced trading fees by 12% *Visit [Curve Analytics Dashboard](https://analytics.curve.fi) for detailed metrics*

Curve Finance Releases June 2025 Monthly Recap

Curve Finance has published their June 2025 monthly activity report. The comprehensive overview details: - Protocol performance metrics - New pool deployments - Governance decisions - Technical upgrades The report is available on the official Curve news portal: [Curve Monthly Recap - June 2025](https://news.curve.finance/curve-monthly-recap-june-2025/) *Want to stay updated?* Subscribe to Curve's monthly newsletter for regular protocol insights.

Curve Finance Maintains Strong Yield Performance in Week 3

Curve Finance continues to demonstrate consistent yield performance in the third week of 2025, maintaining the positive trend observed since the start of the year. Key metrics: - Weekly yield reports show sustained stability - Multiple pools maintaining competitive returns - Trend continues from previous weeks' positive performance This marks the third consecutive week of notable yields in 2025, following the reporting structure implemented in December 2024. *Note*: Detailed pool-specific data available in the full report.

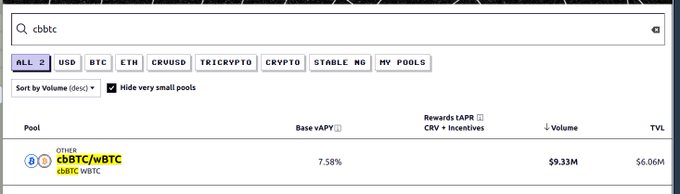

Coinbase cbBTC Swap Demand Surges

The demand for swapping Coinbase's cbBTC continues to rise, with notable metrics: - **Pool utilization** reaches 150% - **Unincentivized APR** stands at 7.6% This trend has persisted for at least two days, indicating sustained interest in cbBTC swaps. The high pool utilization suggests increased trading activity, while the attractive APR may draw more liquidity providers to the pool. Traders and investors should monitor these metrics closely, as they may impact swap costs and potential earnings from providing liquidity.

Temporary Message on Site

A brief announcement has been posted on the website, stating: - The message will only be visible for a few weeks - It will not be required after that period This temporary notice appears to be informing users about a short-term change or update. No further details about the content or purpose of the message are provided. **Action:** Check the website regularly for any updates or changes related to this temporary message.