CoW Swap Offers Surplus-Capturing Limit Orders

CoW Swap Offers Surplus-Capturing Limit Orders

💰 Profit Boost on CoW Swap

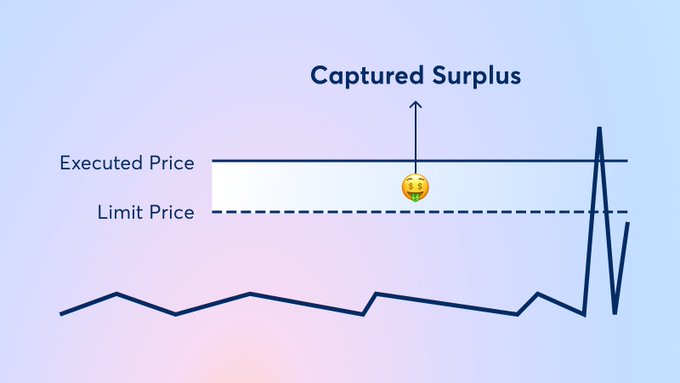

CoW Swap, a decentralized exchange protocol, has implemented a unique feature called surplus-capturing limit orders. When a price spike occurs, CoW Swap provides users with the more favorable rate, unlike other exchanges that would fill the order at the limit price. A recent example showcased a user who was willing to sell ANGLE tokens for $0.085 each but received $0.091 per token due to a price spike, resulting in an additional $2,000 in profit. This feature aims to benefit users by sharing the surplus gains, which other exchanges typically keep for themselves.

Limit orders on CoW Swap are surplus-capturing. In other words, when a price spikes, we give you the more-favorable rate (unlike other exchanges).

CoW DAO Launches on New Chain and Reports Strong Revenue in January 2026

CoW DAO kicked off 2026 with significant developments in January: - **Chain expansion**: The protocol launched on a new blockchain network - **Revenue growth**: Posted strong protocol revenue numbers for the month - **Performance**: The DAO demonstrated momentum heading into the new year The organization has published a [detailed January recap](https://cow.fi/learn/cow-dao-monthly-recap-january-2026) covering all developments from the month. CoW Protocol specializes in finding optimal trade prices across multiple exchanges and aggregators while providing MEV protection for users.

DAO Secures 2026 Foundation with Renewed Grants Programs

The DAO has voted to renew its core funding programs for 2026, ensuring continued support for builders and contributors. **Key Approvals:** - **CIP-82**: Grants Program renewed - **CIP-83**: Team Grants renewed with enhanced accountability measures The renewed Team Grants now include **stricter, performance-linked milestones**, introducing more rigorous oversight for funded projects. These governance decisions establish the operational framework for the year ahead, with builders and contributors now confirmed for 2026.

CoW DAO Value Distribution RFP Proposals Under Review

CoW DAO's Request for Proposals (RFP) for designing a **Value Distribution Mechanism** has closed submissions and entered the review phase. **What's Being Decided:** - How protocol profits are captured - Management of treasury funds - Distribution mechanisms to token holders The RFP aims to establish a sustainable framework for CoW Protocol's economic model, defining the path forward for value accrual to the community. Proposals are currently being evaluated by the DAO. [Read the full RFP details](https://forum.cow.fi/t/rfp-cow-value-distribution-mechanism/3328)

CoW Protocol Expands: First Aggregator on Plasma Network with New Integrations

CoW Protocol has become the **first aggregator on Plasma Network**, enabling gasless stablecoin swaps on the platform. The protocol also launched three new integrations: - **HeyElsaAI**: Integration with AI agents - **Ondo Finance**: Support for institutional assets - **TokenPocket**: Mobile wallet integration These additions expand CoW Protocol's reach across different user segments, from AI-powered trading to institutional investors and mobile users. The Plasma Network integration builds on the stablecoin-native chain that launched in September 2025 with USDT at its core.

COW Token Achieves Net Negative Emissions in 2025

**Protocol Economics Performance** COW token demonstrated strong fundamentals throughout 2025: - **Net buy pressure**: 4.7M COW tokens (0.5% of total supply) - **Buyback dominance**: Exceeded emissions in 11 out of 12 months - **Total activity**: 37.6M COW bought back versus 32.9M emitted The protocol successfully maintained sustainable tokenomics, with buybacks consistently outpacing emissions. This marks continued progress since the Treasury Team began executing buybacks in April 2024 under [CIP-38](https://forum.cow.fi/t/cow-token-buyback-an-update-on-1-year-of-execution/3168).