CoW Swap has expanded its multi-chain presence, now supporting 8 major blockchains including Ethereum, Gnosis, BNB Chain, Lens, Avalanche, Polygon, Arbitrum, and Base.

The platform maintains its core features across all chains:

- Gasless trading - no native tokens required

- MEV protection through batch auctions

- Solver competition for optimal pricing

- Cross-chain functionality without bridge complexity

The team hints at additional surprises in development, suggesting further chain integrations are planned.

This expansion allows users to access CoW Swap's protected trading experience across DeFi's most popular ecosystems while maintaining consistent security and cost benefits.

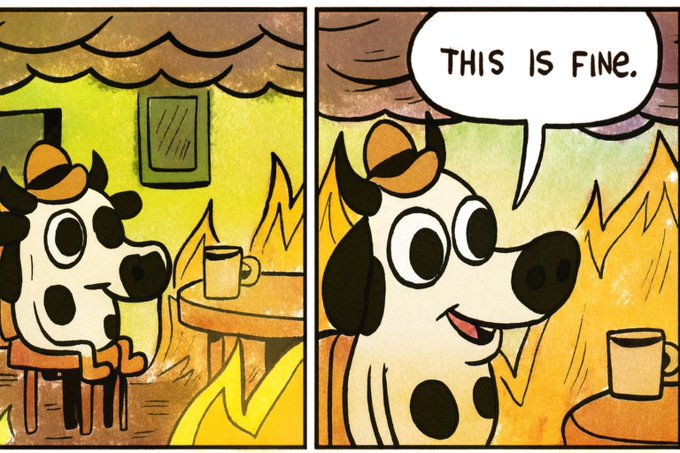

Bridging? mid. Gas tokens? annoying. Slippage? hurts. Just use CoW Swap - one click, no gas, no MEV tears 🐮💅 Cross-chain finally feels smooooth af. cow.fi/learn/cow-dao-… 👆

More chains, more freedom. Same bulletproof protection. 🔐 CoW Swap is live on: • Ethereum • Gnosis • BNB • Lens • Avalanche • Polygon • Arbitrum • Base (+ a few surprises cooking 👀) Gasless, MEV-shielded, solver-powered swaps - wherever you roam. 🐮✨

BNB traders, meet your new favorite DEX. 🐮 CoW Swap just landed on @BNBChain - no gas, no MEV, no nonsense. Smarter swaps start here 👇 swap.cow.fi/#/56/swap/WBNB… 🐮

More chains. More choice. Same protection. 🔐 CoW Swap now routes trades across: - Ethereum - Gnosis - BNB - Lens - Avalanche - Polygon - Arbitrum - Base - More to come? 🤫 MEV-protected, gasless, solver-powered swaps - wherever you trade. 🐮 swap.cow.fi/#/1/swap/WETH/… 👆

Flash crash? More like flash cash. 💸 CoW Protocol solvers compete to find the best prices. And when there's a sudden price spike, even limit traders can get more than expected. Like this limit order that bagged a whopping $15,879 extra on Friday. explorer.cow.fi/orders/0x86aa2… ...

Bridges? Pain. Gas tokens? Juggle. Slippage? Ouch. Try seamless Cross-Chain swaps instead 🐮✨ → Trade across chains, gasless by default. → Best route, best price. → MEV protection baked in. Cross-chain finally feels like swapping on one chain. cow.fi/learn/cow-dao-…

BNB Chain + CoW Swap = 🧠 Smart liquidity 🛡️ MEV protection ⛽ Zero gas swaps It's the DEX upgrade BNB users didn't know they needed. Swap smarter → cow.fi/learn/cow-swap…

Bridge and swap, sounds simple right? 🤔 But the reality can be a little more tricky. 😵💫 In this week's guide, we help you navigate moving assets cross-chain, and how to do it safely and securely. 🙌 cow.fi/learn/crypto-b…

👀👀

Have you even cross-chain swapped yet bro? Swap on CoW Swap and you get: • 💸 Best-route pricing • 💨 Gasless trading • 🤑 Surplus back to you • 🔒 MEV protection baked in No bridge chaos. Just clean swaps. 👀 cow.fi/learn/cow-dao-… 👆

Did you miss it? 👀 The CoW's on @BNBCHAIN now. 🐮 Bring your trades, leave the MEV. ✨ cow.fi/learn/cow-swap… 👆

MEV went wild last night — CoW users slept peacefully. 🌙🐮 During the flash crash, MEV bots extracted millions across DEXs. CoW Protocol traders? Paid zero to MEV. Here’s how 👇

BNB Chain just got an upgrade. 📈 CoW Swap is live - bringing MEV protection, solver competition, and gasless trades to one of DeFi's biggest ecosystems. ✨ Swap smarter: cow.fi/learn/cow-swap… 👀

CoW Protocol Expands Team with Three Remote Positions

CoW Protocol is hiring for three fully remote positions: - **Research Team Lead** - **Smart Contract Engineer** - **Lead Visual Designer** All roles are remote and applications can be submitted at [cow.fi/careers](https://cow.fi/careers). CoW Protocol specializes in finding optimal trade prices across exchanges while providing MEV protection.

CoW Protocol Expands to Ink Chain with Tydro Integration

**CoW Protocol has officially launched on Ink chain**, partnering with Tydro to bring MEV-protected swaps to a new ecosystem. **Key details:** - CoW Swap now operates on Ink chain through Tydro integration - Users can access cross-exchange price optimization on this new network - The expansion follows CoW Protocol's multi-chain growth strategy This deployment extends CoW Protocol's reach beyond its existing networks, offering Ink chain users access to aggregated liquidity and protection from front-running. The integration maintains CoW's core functionality of finding optimal prices across multiple decentralized exchanges while shielding traders from maximal extractable value (MEV) attacks. The launch represents another step in CoW Protocol's mission to provide efficient, protected trading across diverse blockchain ecosystems.

🚨 CoW DAO Team Member's X Account Compromised

**CoW DAO has issued a security alert** after a team member's X (Twitter) account was compromised. **Key points:** - Ignore any unexpected messages from the compromised account - Disregard token announcements, fundraising requests, or external links - Official updates only come from verified CoW DAO channels This marks the second security incident for the organization, following a similar breach in October 2024 where unauthorized tweets promoted a fake token launch and airdrop. **Action required:** Users should verify all CoW DAO communications through official channels only and remain vigilant against potential scam attempts originating from the compromised account.

CoW Swap Launches on Linea L2 and Deepens Aave Integration

**CoW Swap is now live on Linea**, Ethereum's L2 network, bringing gasless trading and advanced order types to the platform. **Key features on Linea:** - Gasless swaps by default - no ETH needed for gas - Limit and TWAP orders - Swap & Send functionality - Upcoming Swap & Bridge feature **How it works:** CoW Protocol's solver network competes to find the best prices across DEXs while protecting users from MEV attacks. **Expanded Aave integration** also launched, powering more DeFi operations: - Collateral swaps - Repay-with-collateral transactions - Debt swapping All operations are **gas-optimized and MEV-protected**. The integration uses intent-based transactions - users specify what they want, and solvers find the optimal execution path. **Benefits include:** - Solver-routed execution for better prices - Shared liquidity across $10B+ monthly volume - Simplified user experience with fewer approvals Try CoW Swap on Linea: [swap.cow.fi](https://swap.cow.fi/#/59144/swap/WETH/0x176211869cA2b568f2A7D4EE941E073a821EE1ff) Learn more about the Aave integration: [aave.com/blog/aave-cow-swap](https://aave.com/blog/aave-cow-swap)

Study Shows CoW Swap Leads Intent-Based DEXes in Decentralization and Volume

A comprehensive 6-month trading analysis reveals CoW Swap's dominance among solver-based DEXes: - **Higher Trading Volume**: ~$200M daily vs $60M (1inch Fusion) and $30M (UniswapX) - **More Decentralized**: Top solver only controls 25% market share, with next five at ~10% each - **Better for Large Trades**: Shows best execution improvement for trades over 100 ETH The study compared CoW Swap, 1inch Fusion, and UniswapX, finding solver-based DEXes generally outperform traditional alternatives through optimized routing and off-chain liquidity access. Try CoW Swap: [swap.cow.fi](https://swap.cow.fi/#/1/swap/WETH/0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48)