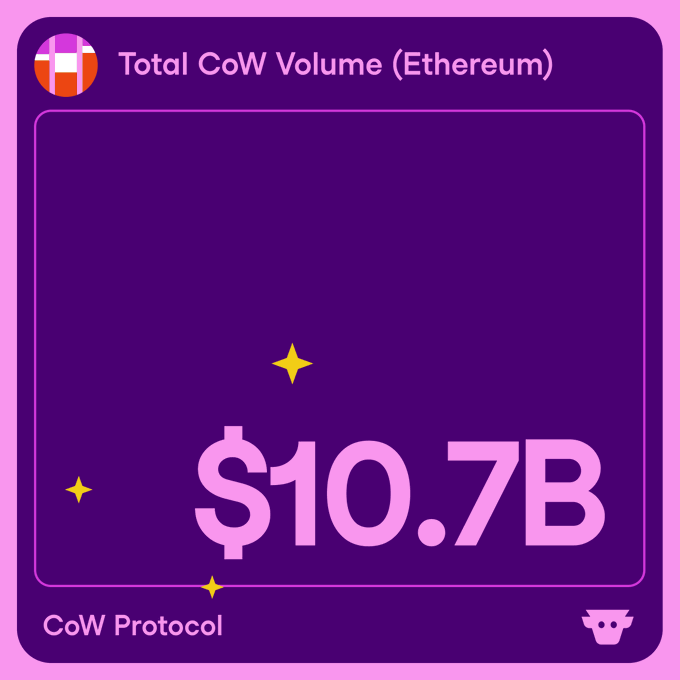

CoW Protocol Hits Third Consecutive Month Above $10B Trading Volume

CoW Protocol Hits Third Consecutive Month Above $10B Trading Volume

🐄 Third $10B Month

CoW Protocol achieves milestone performance with over $10 billion in trading volume on Ethereum mainnet for the third consecutive month.

This sustained performance demonstrates:

- Consistent high-volume trading activity

- Strong community and partner engagement

- Growing adoption of MEV-protected trading

The protocol continues to deliver competitive pricing by aggregating liquidity across multiple exchanges while protecting users from MEV attacks.

Ready to trade with better prices and MEV protection?

Another month, another set of big numbers. 🤯 This is the 3rd month in a row CoW Protocol has recorded more than $10 billion in volume on mainnet. 💪 A mega thank moooooo to our community members, partners and swappers. 🐮

🔗 CoW Swap Expands to 8 Blockchains

**CoW Swap now supports 8 blockchains** with the same MEV protection and gasless trading experience. **Supported networks:** - Ethereum - Gnosis - BNB Chain - Lens - Avalanche - Polygon - Arbitrum - Base **Key features remain consistent** across all chains: - MEV-protected trades through batch auctions - Gasless swaps (solvers pay gas fees) - Solver competition for best prices - Cross-chain liquidity sourcing The expansion builds on CoW Swap's recent BNB Chain launch, which eliminated the need for native tokens as gas and provided advanced order types like limit and TWAP orders. **More chains are planned** according to the announcement, suggesting continued multi-chain expansion. Trade across networks with consistent protection at [swap.cow.fi](https://swap.cow.fi/#/1/swap/WETH/0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48)

CoW Swap Overtakes Uniswap and 1inch in Trading Volume

**CoW Swap has emerged as the volume leader** in the competitive DEX landscape, surpassing established players like Uniswap and 1inch. The platform's success stems from its **structural advantage**: solver competition that consistently delivers optimal pricing for users. **Key advantages:** - More decentralized solver network (top solver holds only 25% vs competitors' 80-90%) - Superior performance for large trades above 100 ETH - Average daily volume of ~$200m vs $60m (1inch Fusion) and $30m (UniswapX) Research analyzing 6 months of trading data confirms that **solver-based DEXes outperform traditional alternatives** through optimized routing and off-chain liquidity access for both major and long-tail assets.

CoW Swap Powers Limit Orders on Aave

**CoW Swap integration with Aave is now live**, bringing limit order functionality to the world's largest decentralized lending platform. - Users can now place limit orders directly through Aave's swap feature - Currently supported on **Arbitrum network** with additional networks planned - Integration aims to streamline trading experience for Aave users The partnership combines Aave's lending infrastructure with CoW Swap's trading capabilities, allowing users to set specific price targets for their trades while using the platform's lending services.

CoW AMM Users Safe from Balancer v2 Exploit

**Balancer v2 pools hit by exploit** - security teams investigating with high priority. **CoW AMM users remain protected** - isolated implementation keeps funds secure despite using Balancer technology. - CoW Protocol's version operates independently from affected pools - Engineering teams monitoring situation closely - Users warned against phishing attempts exploiting the news Balancer advised users to avoid suspicious links as scammers may capitalize on the incident.