CoW AMM Now Available on OpenCover with $1M Coverage

CoW AMM Now Available on OpenCover with $1M Coverage

🐮 CoW AMM Gets Protected

OpenCover has launched protection for CoW AMM positions with $1M in cover capacity from Nexus Mutual, available on both Ethereum and Arbitrum networks.

CoW AMM, the first MEV-capturing automated market maker, uses batch auctions to optimize LP returns and eliminate loss-versus-rebalancing issues.

Key features:

- $1M total coverage capacity

- Available on Ethereum and Arbitrum

- L2 deployment saves ~$50 in gas fees

- Streamlined cover management

Visit opencover.com/frens/244 to protect your CoW AMM positions.

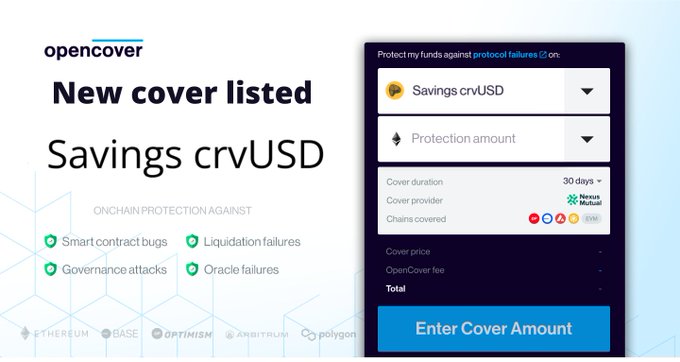

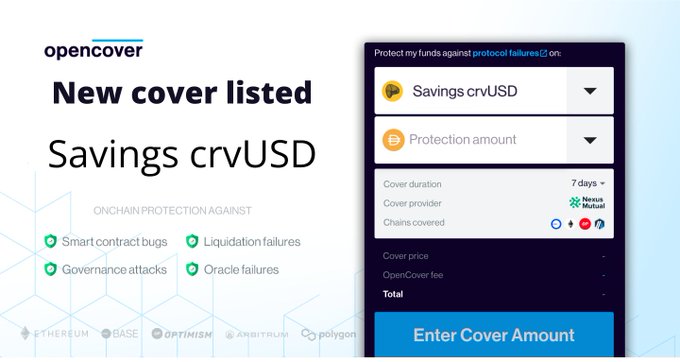

🛡️ NEW COVER LISTED 🛡️ Savings crvUSD @CurveFinance is officially available on OpenCover! We just unlocked over $1.7m in Savings crvUSD cover capacity from @NexusMutual. Cover your assets on scrvUSD and save over $50 in gas fees 🚀 👉 opencover.com/frens/241

🚀 Big news, frens! OpenCover is live on @ProductHunt today! Your onchain safety net for DeFi is here — and we’ve got a special surprise for our early supporters. 🔗 Check it out 👇

🔔 Weekly industry update 🛡️ OpenCover: 🔹 OpenCover is live on @ProductHunt. 🔒 Industry: 🔹 @NexusMutual has prepared a new dashboard for sales reports: dune.com/nexus_mutual/c…. 🔹 @NexusMutual's Protocol Pricing Parameter adjustments proposal is open for voting until Dec 6:

🛡️ NEW COVER LISTED 🛡️ Savings crvUSD @CurveFinance is officially available on OpenCover! We just unlocked over $1.7m in Savings crvUSD cover capacity from @NexusMutual. Cover your assets on scrvUSD and save over $50 in gas fees 🚀 👉 opencover.com/frens/241

🔔 Weekly industry update 🛡️ OpenCover: 🔹 Savings crvUSD @CurveFinance is officially available on OpenCover. 🔒 Industry: 🔹 @NexusMutual issued 3 new plans for its latest product, Cover: Entry Cover, Essential Cover, and Elite Cover > nexusmutual.io/blog/the-easie… 🌀 Protocols: 🔹

🔔 Weekly industry update 🛡️ OpenCover: 🔹 OpenCover is now available for cbBTC positions on Base and L1. 🚨 Hacks: 🔹 @polterfinance lost ~$12m in an #exploit. 🔹 @XTexchange was hacked for ~$1.7m. 🔒 Industry: 🔹 @NexusMutual is collecting testimonials highlighting community

OpenCover Alpha February 2026 Update

OpenCover has released its February 2026 alpha update, detailing recent developments in their onchain risk protection platform. The newsletter covers: - Latest platform improvements and features - Updates on their coverage offerings for smart contract risks - Community initiatives and engagement activities - Progress on their underwriter network OpenCover continues to focus on making portfolio protection accessible and affordable for users navigating onchain risks like smart contract exploits and oracle failures. [Read the full update](<https://open.substack.com/pub/opencover/p/opencover-alpha-february-2026?r=2chtfi&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true>)

OpenCover Launches Onchain Risk Map 2026 and CAP Protection

OpenCover released its February 2026 update, highlighting several key developments: - **Onchain Risk Map 2026**: The first comprehensive taxonomy of DeFi risk, developed with Nexus Mutual for risk professionals, protocols, and institutional users. Full report and webinar scheduled for February 11. - **CAP in-dApp Protection**: New protection feature now available within the application. - **DAF London**: Participation in decentralized finance events in London. The risk map aims to standardize how blockchain risk is understood and managed across the DeFi ecosystem, providing a structured framework for evaluating onchain vulnerabilities. [Read the full update](https://open.substack.com/pub/opencover/p/opencover-alpha-february-2026)

YO Protocol Launches Governance Token and Expands to Arbitrum

**Key Updates from Covered Yield Protocols:** - **YO Protocol** introduced its governance token $YO and expanded support to Arbitrum yield sources, starting with Revert's Lend USDC integration into yoUSD - **Cap** launched the Cap Homestead Program **Recent OpenCover Developments:** - Protocol Cover now available for [Hybra Finance](https://opencover.com/hybra) on Hyperliquid, covering protocol hacks, oracle manipulation, liquidation failures, and governance attacks at 0.46% monthly - Depeg Cover launched for Neutrl USD and Spark - Integration with Cap enables users to purchase cover directly within the Cap dApp for their positions, including Pendle YT/PT tokens

OpenCover Launches Protection for Hybra Finance Positions at 0.46% Monthly

OpenCover now offers coverage for Hybra Finance positions at a monthly rate of 0.46%. Users can protect their assets while earning yields on stablecoins within the Hyperliquid ecosystem. **Key Features:** - Monthly coverage cost: 0.46% - Earn approximately 9% on USDC/USDT0 - Protection available for Hyperliquid-ecosystem assets The service allows users to safeguard their DeFi positions while maintaining earning potential on their holdings. [Learn more about Hybra coverage](https://opencover.com/hybra)

Hybra Finance Protocol Cover Now Protects Against Hacks, Oracle Manipulation, and Governance Attacks

OpenCover has launched Protocol Cover for Hybra Finance, the public liquidity layer on Hyperliquid. **Coverage includes protection against:** - Protocol hacks - Oracle manipulation - Liquidation failures - Governance attacks Hybra Finance has processed over $3 billion in volume as a liquidity infrastructure on Hyperliquid. The Protocol Cover acts as insurance for users' positions against these specific onchain risks. This coverage is underwritten through Nexus Mutual, which has covered $6B+ in onchain risk to date.