Cooper Labs has received recognition for their work on the Tunnel project. The initiative has garnered support, including sponsorship for an audit, highlighting the importance of security in the space.

Key points:

- Cooper Labs praised for Tunnel project

- Audit sponsorship demonstrates commitment to security

- Project receives strong support from community

This development underscores the ongoing focus on security best practices in the web3 ecosystem.

What's next? Stay tuned for further updates on the Tunnel project and its potential impact on the industry.

Kudo to @cooper_labs on their remarkable work with Tunnel! We fully support this initiative and even sponsored the audit as a testament to our commitment. Security is paramount, and Cooper Labs has done an outstanding job!

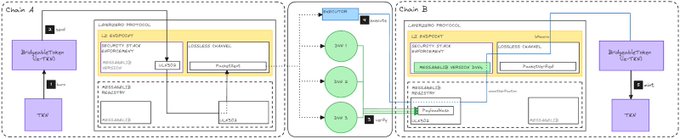

Today we're introducing Tunnel, the @ParallelMoney Bridging Module. Built with security, efficiency, modularity & extensibility in mind, it is built using @LayerZero_Core V2 infrastructure. Key Features: - Modular Security Stack: It follows the OFT standard built by LayerZero,

USDp/frxUSD Pool on Curve Offers 25%+ Weekly Yield

A **high-yield opportunity** has emerged on Curve Finance with the USDp/frxUSD liquidity pool delivering over **25% weekly returns**. This represents a significant yield farming opportunity in the DeFi space, though such high returns typically come with increased risk factors. **Key considerations:** - Weekly yield exceeding 25% - Available on Curve Finance platform - Part of ongoing high-yield pool offerings Traders should evaluate the risk-reward profile and underlying token mechanics before participating in high-yield pools.

Abu Dhabi Emerges as Major Digital Assets Hub with Four Key Events

**Abu Dhabi** is positioning itself as a significant digital assets hub with four major events taking place: - **Abu Dhabi Finance Week** - **Bitcoin MENA Conference** - **Solana Conference** - **Solana Economic Zone** The city's growing prominence in the crypto space reflects the **Middle East's increasing adoption** of digital assets and blockchain technology. These events highlight Abu Dhabi's strategic push to become a **regional crypto center**, bringing together industry leaders, developers, and investors.

Important Update for All paUSD Holders

**Critical announcement** for paUSD token holders requires immediate attention. All paUSD holders should review the latest protocol update that affects their holdings. The announcement indicates significant changes that may impact user positions or require specific actions. - Check your paUSD balance and positions - Review any required actions or migrations - Stay informed about timeline and next steps **Action required:** Visit the official channels for complete details and instructions.

Epoch 6 Fee Distribution Now Live for sPRL Token Holders

**Epoch 6 fees are now available for claiming** by sPRL holders on the Parallel Money protocol. This marks another milestone in the **Tokenomics v2.0 fee distribution system**, which has been operational since earlier this year. - Previous distributions have shown strong performance - Epoch 1 delivered 12,842 PAR tokens to sPRL holders - Historical APRs have ranged from **45% to 114%** sPRL holders can now access their allocated fees from the latest epoch through the protocol interface.

🔄 USDp Avalanche Switches to Native USDC After Stream Finance Incident

**USDp on Avalanche underwent a complete reserve asset replacement** following the xUSD situation and Stream Finance incident. **Key Changes:** - All mevUSDC (reserve asset for USDp) replaced with native USDC - USDp maintains **100% backing** with no user losses - No impact on the stablecoin's operations **Current Status:** - USDp on Avalanche remains fully collateralized - Swift response prevented any negative effects on users - Reserve transition completed successfully The proactive measure demonstrates the protocol's commitment to maintaining stability and user protection during market incidents.