Convex FPIS Migration Live on Frax Finance Mainnet Fraxtal

Convex FPIS Migration Live on Frax Finance Mainnet Fraxtal

🔥 Migration Live, Rewards Await!

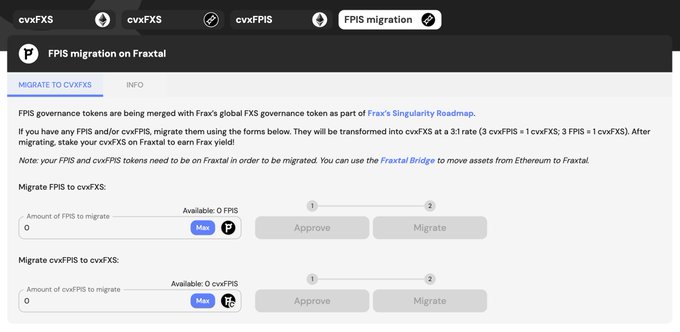

Convex Finance has announced the live migration of cvxFPIS and naked FPIS tokens to cvxFXS on the Frax Finance mainnet Fraxtal. Users can bridge their cvxFPIS or FPIS tokens using the official Frax Bridge, then deposit them into the migration contract to instantly receive cvxFXS at a 1:3 ratio. The new cvxFXS tokens can be staked for FXS rewards on Fraxtal. Convex Finance has provided a blog post with more details on the Convex for Frax integration, including the upcoming FXTL point airdrops and the cvxFPIS to FXS merger.

Convex for @fraxfinance : Road to Singularity Update. Launch of cvxFXS conversion & staking on Fraxtal, $FXTL point airdrops & cvxFPIS to FXS merger and more. Take advantage on latest & greatest of Frax with @ConvexFinance Read more at Convex blog 👇convexfinance.medium.com/cf4240d9114e

The 2nd wave of $FXTL points is coming for veFXS stakers! Holders/stakers of cvxFXS (1:1) and cvxFPIS (1:3) will be eligible for with their respective weights. A snapshot will be taken on April 17 at 11:59 UTC. Get your cvxFXS/cvxFPIS now and take part in the drop.

Lastly, to give the community additional time to stake veFXS on Fraxtal, the 2nd snapshot date for $FXTL points will be moved to 11:59 UTC on April 17th. Stay tuned for another thread going in depth on the Fraxtal portion of the new roadmap & welcome to the Singularity Era!

Convex FPIS migration is live on @fraxfinance mainnet Fraxtal! Bring your $cvxFPIS or naked $FPIS to frax.convexfinance.com/stake, convert into $cvxFXS, and stake it for $FXS rewards on Fraxtal! How? Lets walk through..

Convex Issues Security Warning Against Phishing Links

**Convex has issued a critical security alert** to its community regarding fraudulent activity on social media. **Key Points:** - Convex will **not post any links** following their official announcements - Any links appearing below their tweets claiming to be from Convex are **spam, fake, or phishing attempts** - Users are strongly advised **not to click** on any such links This warning has been repeated multiple times (December 2025, January 2026, and February 2026), indicating ongoing phishing attempts targeting the Convex community. **Stay vigilant and verify all communications directly through official Convex channels.**

🥈 DeFi Education Video Wins 3,000 CVX in Community Contest

A creator has secured second place in a community contest, earning **3,000 CVX tokens** for producing educational content about the Convex and Curve ecosystem. **Key Details:** - The winning entry is a video that combines storytelling with DeFi education - The content focuses on explaining the Convex and Curve protocols - Community members praised the work for its educational approach [Watch the winning video](https://x.com/objkt0/status/2009762349419319630) The contest appears to reward creators who make complex DeFi concepts more accessible through engaging content formats.

Convex Distributes 10,000 CVX to January Creator Collective Winners

Convex Finance announced the winners of its January Creator Collective program, distributing 10,000 CVX tokens among the top 5 content creators. **The program rewards creators who produce educational and engaging content about:** - Boosted staking yields on Convex - Governance mechanisms and voting power - Platform features and tools **Key details:** - Winners created diverse content including videos, tutorials, and educational threads - Content must be posted in Convex's Discord Creator Collective channel to be eligible - The program continues monthly with the same prize pool Convex controls 53.13% of all veCRV and manages $1.28B in TVL, offering boosted yields to users who stake through their platform.

🚨 Convex Issues Security Warning About Phishing Links

**Convex has issued a critical security alert** to its community regarding fraudulent activity on social media. **Key Points:** - Convex will **not post any links** following their official announcements - Any links appearing below their tweets claiming to be Convex are **spam, fake, or phishing attempts** - Users are strongly advised **not to click** on any such links This warning has been repeated multiple times since December 2025, indicating an ongoing phishing campaign targeting Convex users. The protocol is taking proactive measures to protect its community from potential scams. **Stay vigilant** and verify all communications directly through official Convex channels.

Convex Issues Repeated Security Warning Against Phishing Links

**Convex Finance has issued multiple security warnings** across several days, alerting users about fraudulent links appearing in their social media replies. The DeFi protocol explicitly states they **will not post any links** after their official announcements. Any links appearing below their tweets claiming to be from Convex are: - Spam attempts - Fake websites - Phishing scams This repeated warning suggests **ongoing impersonation attacks** targeting Convex users. The frequency of these alerts indicates scammers are persistently trying to exploit the protocol's community. **Stay vigilant** - only interact with official Convex channels and verify all links independently.