Connext Offering Incentives to Migrate to Layer 2 Solutions

Connext Offering Incentives to Migrate to Layer 2 Solutions

🤑 Profit Opportunity: Connext Incentives

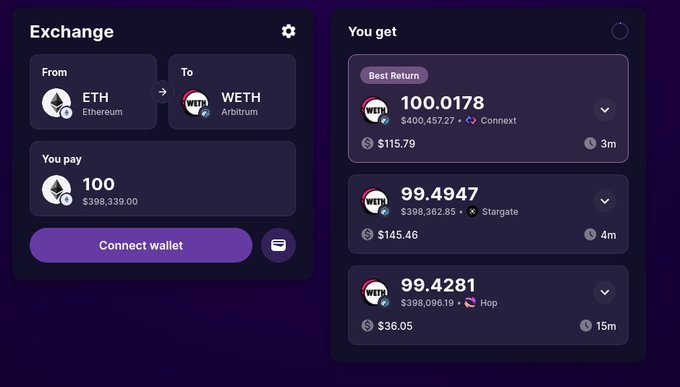

Connext, a developer solution providing advanced bridge aggregation with DEX connectivity, is currently incentivizing users to bridge from the Ethereum mainnet to Layer 2 solutions. The company is offering positive arbitrage opportunities for those who utilize their Jumper platform to bridge to Layer 2 networks. This move aims to alleviate congestion on the Ethereum mainnet and promote the adoption of scalable Layer 2 solutions.

At this point @Connext is practically paying you to jump to L2s from Ethereum mainnet in size 🔥 Don't believe me? Just look at the quotes! Bridge to L2s via Connext on Jumper and benefit from the positive arbitrage opportunities. Happy blob day friends! .oO

Connext is giving fantastic positive slippage on @arbitrum and @modenetwork. For txs >5 ETH, we're the cheapest option for escaping high L1 gas fees. (Note: @JumperExchange quotes positive slippage only when transferring to WETH, but you'd receive same pricing for ETH too)

Large Crypto Swaps Surge on Jumper Exchange Platform

**Whale Activity Increases on Jumper** Large cryptocurrency swaps over $100,000 now represent a growing share of Jumper's monthly trading volume: - **January 2025**: 29% of volume - **January 2026**: 41% of volume This represents a **12 percentage point increase** in high-value transactions over the past year. **Key Trends:** - Monthly whale volume (large trades) has grown 5x year-over-year - Mid-sized swaps ($10k-$100k) increased approximately 2.6x - Platform positioning itself for institutional and high-net-worth traders Jumper, a bridge aggregation platform with DEX connectivity, is seeing increased adoption among traders executing larger transactions.

Jumper Enables Direct Cross-Chain Deposits into Morpho Vaults

Jumper has integrated Morpho vault deposits through its platform, allowing users to deposit from any blockchain directly into Morpho vaults in a single transaction. **Key Features:** - Cross-chain deposits powered by LiFi Protocol Composer - One-transaction process eliminates multiple steps - Part of Jumper's broader DeFi earning platform **Platform Context:** Jumper Earn aggregates yield opportunities across 15 DeFi protocols including Aave, Lido, Euler, and others. The platform offers filtering by chain, protocol, pool type, and deposit asset. The integration builds on Jumper's recent Portfolio feature, which provides unified asset management across chains with plans for rebalancing and yield claiming capabilities. Learn more: [jumper.exchange/earn](http://jumper.exchange/earn)

Flow Blockchain Integration Expands Jumper's Cross-Chain Capabilities

**Flow blockchain is now integrated with Jumper**, enabling seamless asset swaps into Flow's consumer DeFi ecosystem. - Users can swap assets from any supported chain directly into Flow - Integration follows Jumper's recent additions of Monad and Hemi networks - Flow positions itself as the **home for consumer DeFi** applications This expansion continues Jumper's growth trajectory after processing **$2.05 billion in November volume** and adding multiple new blockchain integrations.

🌉 Bitcoin DeFi Bridge Opens

**Jumper integrates Hemi network**, enabling seamless Bitcoin DeFi access. - Users can now **swap BTC directly into Hemi** through Jumper's platform - Access to **Bitcoin-native yield opportunities** and liquidity markets - **Rate markets** now available for BTC holders Hemi positions itself as the **chain powering Bitcoin DeFi**, offering new ways to put Bitcoin to work beyond simple holding. The integration expands **cross-chain accessibility** for Bitcoin users seeking DeFi participation.

🚀 Jumper Hits $2.14B Volume Record

**Jumper Exchange achieved a new all-time high** with $2.14B in trading volume during September. **Key developments include:** - Integration with @0xoogabooga and @HyperFlow_fun DEX platforms - Launch of official onboarding platform for @Plasma - Significant volume growth from August's $1.6B The bridge aggregation platform continues expanding its **DEX connectivity** and user onboarding capabilities. [Read full breakdown](https://jumper.exchange/learn/jumper-update-september)