Comparison of Fluid with Aave, Compound, and Maker for $ETH Collateral

Comparison of Fluid with Aave, Compound, and Maker for $ETH Collateral

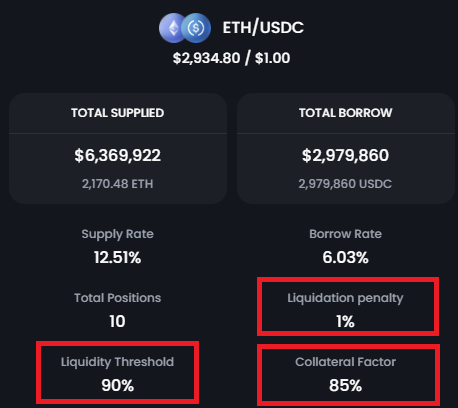

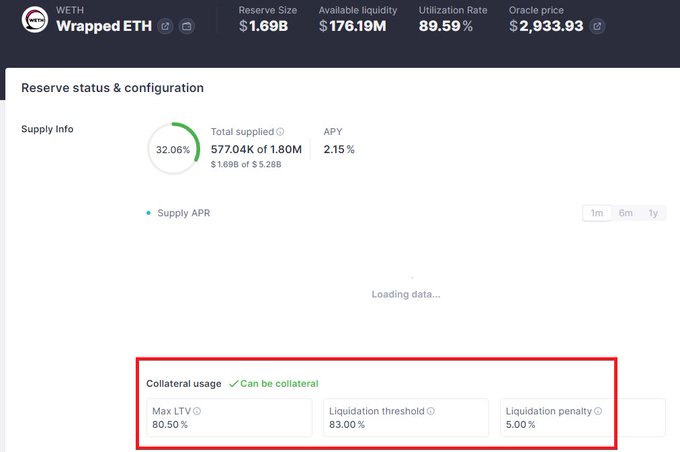

Instadapp highlights the strengths of @0xfluid in the lending space due to its superior parameters like 85% LTV, 90% Liquidation Threshold, and 1% Liquidation Penalty. In comparison, Aave, Compound, and Maker have different parameters ranging from 77% to 83% LTV, 77% to 90% Liquidation Threshold, and 5% to 13% Liquidation Penalty. Fluid stands out as it is 5-13 times more efficient than the other protocols and boasts a mere 0.1% liquidation penalty for the wstETH <> ETH pair.

One of the main reasons I am sure @0xfluid will take over the lending space is its unbeatable parameters such as Max LTV, Liquidation Threshold, and Liquidation Penalty Let's compare Fluid vs Aave/Compound/Maker for $ETH collateral Fluid: • 85% LTV • 90% Liquidation

Interesting! 🌊🌊🌊 In less than 24hr, @0xfluid has reached $11M in TVL with ~$24M in total supply & ~$13M in total borrow. Currently, users can earn +100% in APR on stable through on-going rewards. And users can earn +15% APR ETH collateral while borrowing stables against it.

Instadapp Pro Integrates Coinshift's USDL

Instadapp Pro has expanded its stablecoin offerings with the integration of Coinshift's USDL token. This addition enhances the platform's DeFi Smart Accounts capabilities: - Users can now manage USDL within their Instadapp Pro portfolios - Integration provides enhanced control over digital assets - Follows recent addition of Sky Ecosystem's USDS/sUSDS tokens The platform continues to expand its stablecoin ecosystem, strengthening its position as a comprehensive DeFi management solution. **Key Benefit**: Improved portfolio management options for DeFi users

Aave v3 Ether.fi Market Now Live on Instadapp Pro

The Aave v3 Ether.fi market on Ethereum is now available on Instadapp Pro. This new market offers users the ability to borrow against selected stablecoins with an increased Loan-to-Value (LTV) ratio. n nKey features: n- Higher LTV for borrowing against stablecoins n- 1x Eigen points rewards n- 2x Etherfi points rewards n nThis integration provides DeFi users with more borrowing options and potential rewards. Users interested in leveraging these new features can access the market through Instadapp Pro. n nAs always, users should conduct their own research and understand the risks associated with DeFi borrowing before participating.

Instadapp and 0xfluid Users: Surprise Airdrop Announced

Active users of Instadapp and @0xfluid are in for a treat! A surprise airdrop has been announced for eligible participants. n n Key points: n - Airdrop targets active users of both platforms n - Claiming process has begun n - Details on eligibility criteria not yet disclosed n n This unexpected token distribution highlights the growing trend of rewarding engaged community members in the DeFi space. While specifics remain limited, users are encouraged to check their eligibility and start the claiming process. n n As always, exercise caution when interacting with airdrops and verify all information through official channels before proceeding. n n Stay tuned for more details on this exciting development in the Instadapp and 0xfluid ecosystems.

Coinbase cbBTC Vault Launches on Instadapp Lite

Instadapp Lite has introduced a new Coinbase cbBTC vault, powered by Veda Labs. This feature allows users to deposit Bitcoin on Base or Ethereum chains to access DeFi yield strategies across the ecosystem. n nKey points: n- Deposit BTC on Base or Ethereum chains n- Tap into various DeFi yield strategies n- Earn 3x Veda points n nThis launch follows Instadapp Lite's recent addition of Aave v3 Lido Finance market support to its ETH vault. The platform continues to expand its offerings, aiming to provide users with higher APRs and long-term reliable yields. n nTo try out the new cbBTC vault and explore other yield opportunities, visit lite.instadapp.io or app.veda.tech.

Aave v3 Lido market now supported on Instadapp Lite ETH vault

Instadapp has expanded its DeFi offerings by integrating the Aave v3 Lido market into its Lite ETH vault. This update allows users to access better rates and potentially higher APR through optimized routing. Key points: - Aave v3 Lido market now supported on Instadapp Lite ETH vault - Enables routing through best market rates - Aims to provide users with higher APR - Follows recent integration of Aave v3 Lido market on Instadapp ProLeverage Users seeking long-term, reliable yields can now explore these new options on the Instadapp Lite platform.