CoinGecko Joins Global Markets Alliance

CoinGecko Joins Global Markets Alliance

🦎 Gecko Enters the Alliance

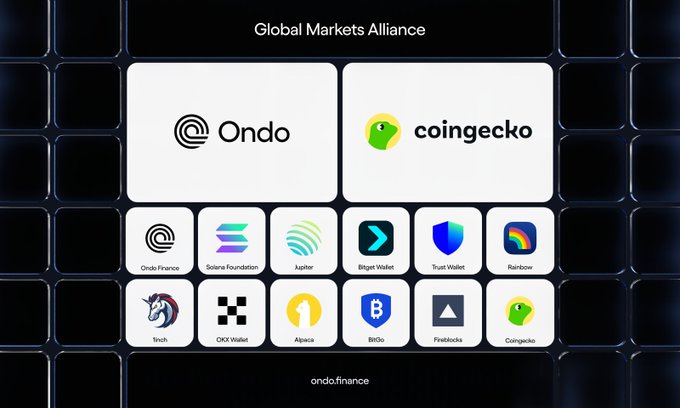

CoinGecko, the leading independent crypto data aggregator, has joined the Global Markets Alliance, bringing its GeckoTerminal DEX tracking platform into the fold.

Key points:

- CoinGecko provides real-time crypto market data to millions of users

- GeckoTerminal offers DEX tracking and price charting capabilities

- The Alliance continues to expand with industry leaders focused on tokenized assets

Another key player joins the Global Markets Alliance. @CoinGecko, the world’s largest independent crypto data aggregator, joins the Alliance, bringing with it @GeckoTerminal, its real-time DEX tracker and price charting tool.

Ondo Finance Acquires Strangelove Labs, Strengthens RWA Platform Development

Ondo Finance has acquired Strangelove Labs to enhance its real-world asset (RWA) platform development. The acquisition brings significant engineering expertise and blockchain infrastructure capabilities. Key points: - Former Strangelove CEO Jack Zampolin joins as VP of Product - Strangelove team brings experience in interoperability protocols and SDK frameworks - Acquisition positions Ondo as full-stack tokenized asset platform with omnichain capabilities This move follows Ondo's recent announcement of Ondo Chain, a purpose-built blockchain for institutional RWAs that addresses key challenges in the space including DeFi compatibility, cross-chain liquidity, and regulatory compliance. [Read full announcement](https://blog.ondo.finance/ondo-finance-acquires-strangelove/)

Global Financial System Accelerates Tokenization with Major Institutional Moves

Major financial institutions are rapidly advancing tokenization initiatives across multiple regions: - HSBC launches MENA's first digitally native bond via Orion platform with First Abu Dhabi Bank - BBVA Spain introduces crypto trading and custody for retail customers (BTC & ETH) - SIX Digital Exchange and Pictet complete corporate bond tokenization pilot - German NRW Bank issues €100M digital bond on Polygon blockchain These developments signal increasing institutional adoption of blockchain technology in traditional finance. Each initiative demonstrates practical applications for improving efficiency and accessibility in financial markets. [Read HSBC announcement](https://www.about.hsbc.ae/news-and-media/adx-partners-with-hsbc-and-fab-to-launch-menas-first-digital-bond)

Squads Protocol Joins Global Markets Alliance

**Squads Protocol**, known for securing over $600M in on-chain assets through Solana's leading multisig solution, has joined the Global Markets Alliance. The protocol specializes in: - Building stablecoin-first finance products - Developing APIs for individuals and businesses - Providing smart account infrastructure This integration follows their successful partnership with Solana, where they implemented Cash Management with enterprise-grade security. *The alliance aims to accelerate mainstream adoption of tokenized assets through enhanced infrastructure.*

Tokenized Stocks and ETFs Coming to Ethereum

Traditional financial instruments are preparing to enter the Ethereum ecosystem. Multiple sources indicate that tokenized stocks and ETFs will be available on Ethereum as early as 2025. Key developments: - Regulatory frameworks being established for on-chain securities - Infrastructure providers building compliant trading platforms - Traditional finance firms exploring blockchain integration This marks a significant step toward bridging traditional finance with decentralized networks. Implementation will require careful consideration of regulatory requirements and technical standards. *Note: Timeline subject to regulatory approval and technical readiness.*

Global Financial Markets Embrace Blockchain Integration

Traditional financial markets are steadily moving towards blockchain integration, marking a significant shift in how assets are traded and managed. - Major financial institutions are adopting blockchain technology for various operations - US Treasury markets show early signs of tokenization efforts - Infrastructure development continues for onchain financial systems This transition represents a methodical evolution rather than a sudden transformation. Traditional finance and blockchain technology are finding practical convergence points, particularly in asset tokenization and settlement systems. *Key developments are expected throughout 2024-2025*