Chainlink Weekly Integration Report - June 2025

Chainlink Weekly Integration Report - June 2025

🔗 8 New Chains Join Forces

Chainlink reports 8 new integrations across 6 blockchain networks this week:

- Networks: Arbitrum, Base, BNB Chain, Ethereum, Optimism, and Sonic

- Notable integrations: Coinbase, Mux Protocol, Silo Finance, and Solv Protocol

- GetYieldFi and xSwap also joined the ecosystem

This follows significant growth in May, where Chainlink's Total Value Secured (TVS) increased by 50% to $65B+, driven by major protocol adoptions including TRON and Jupiter Exchange.

Key protocols continue leveraging Chainlink for cross-chain transfers and price feeds, strengthening the network's position in DeFi infrastructure.

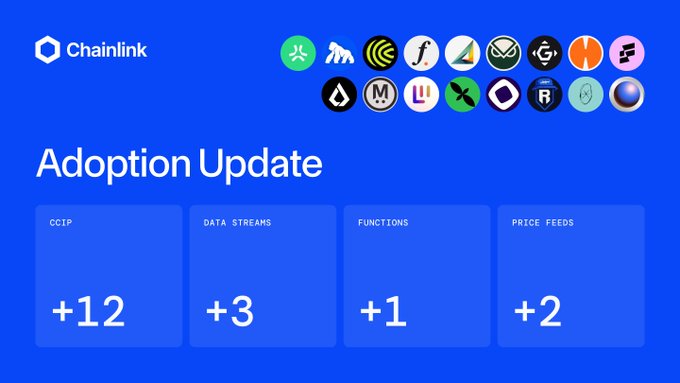

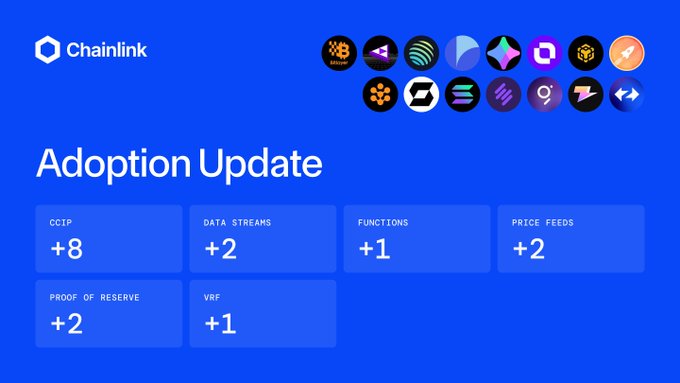

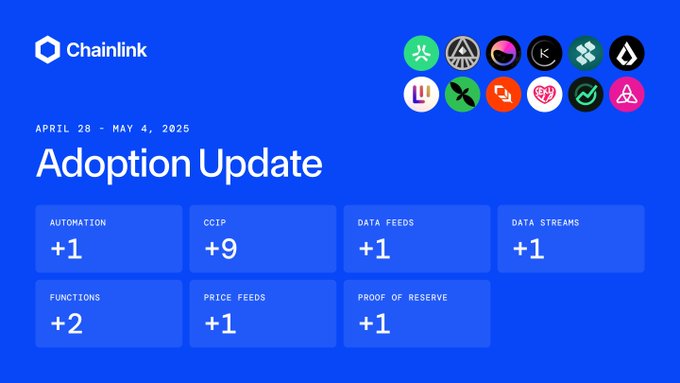

⬡ Chainlink Adoption Update ⬡ There were 18 integrations of the Chainlink standard across 4 services and 20 different chains: Abstract, ApeChain, Avalanche, Base, BNB Chain, Celo, Ethereum, Gnosis Chain, Hemi, Lisk, MegaETH, Metal L2, Mint, Monad, Optimism, Polygon, Ronin,

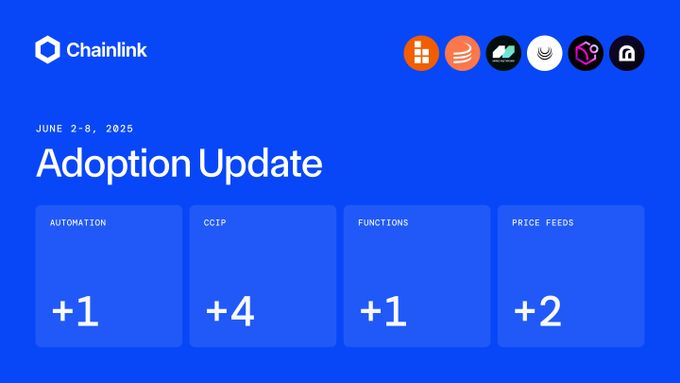

⬡ Chainlink Adoption Update ⬡ This week, there were 12 integrations of the Chainlink standard across 6 services and 8 different chains: Gravity Alpha, Monad, Polygon, Ronin, Rootstock, Superseed, Taiko, and Zora. New integrations include @GravityChain, @monad_xyz,

As leading financial institutions adopt digital assets, the need for a cash leg to settle onchain transactions has become increasingly important. Discover how Chainlink is enabling the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin ↓

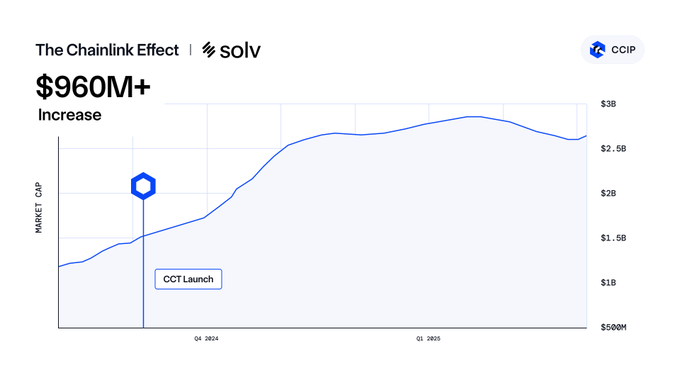

After @SolvProtocol adopted the Cross-Chain Token (CCT) standard, the Bitcoin staking protocol surged to $2.5B+ TVL—with $1.16B+ in cross-chain transfers via CCIP. Cross-chain by Chainlink → a catalyst for growth uniquely enabled by CCIP and a thriving community.

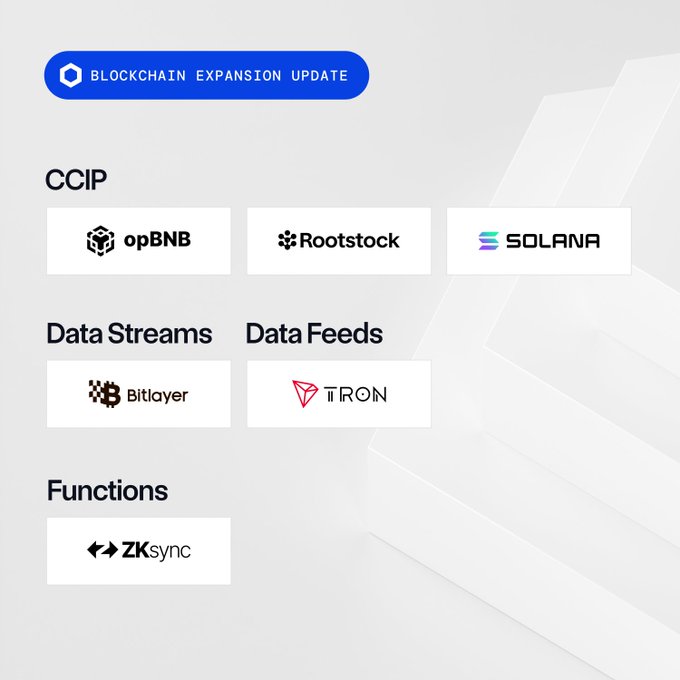

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: CCIP • opBNB • Rootstock • Solana Data Streams • Bitlayer Data Feeds • TRON Functions • ZKsync

Onchain asset manager @maplefinance ($1.9B AUM) has upgraded to Chainlink CCIP by adopting the Cross-Chain Token (CCT) standard to make $500M+ of syrupUSDC natively transferable across @Ethereum and @Solana. Users can also natively mint the yield-bearing stablecoin on Solana,

syrupUSDC is live on Solana. With DeFi use cases on day one and up to $500K in incentives. Launched in collaboration with @chainlink, @KaminoFinance, @Paxos, @jito_sol and @orca_so. Maple’s liquid yielding dollar is bringing consistent high yield to the ecosystem. Details

“The capital that can flow into Solana over CCIP will initially be the DeFi community’s capital … and then there will also be a very large category of institutional users.” Sergey Nazarov explores the impact of bringing Chainlink CCIP to @solana ↓

The Graph (@graphprotocol), a blockchain data platform that has served over 1.2 trillion requests, is adopting Chainlink CCIP and making its native token GRT a Cross-Chain Token (CCT). Users will be able to transfer the $1B+ market cap token across @arbitrum, @base, and @solana.

Coinbase is utilizing Chainlink Proof of Reserve to increase the transparency of $4.6B+ worth of cbBTC reserves. Proof of Reserve helps @coinbase ensure cbBTC reserves are verifiable onchain, with data published on @base & @ethereum. BTCFi scales with Chainlink.

Proof of Reserves empowers users to confidently integrate cbBTC across the DeFi ecosystem. Utilizing @chainlink Proof of Reserves on @base and @ethereum provides independent, transparent onchain verifications that cbBTC reserves are backed 1:1 by BTC.

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 4 services and 4 different chains: Base, BOB, Ethereum, and Solana. New integrations include @build_on_bob, @maplefinance, @mindnetwork_xyz, @NuraLabs, @SpaceandTimeDB, and

USD1—an institutional-grade stablecoin from @worldlibertyfi—is officially going cross-chain with Chainlink CCIP. prnewswire.com/news-releases/… Already the fastest-growing stablecoin from zero to $2B, USD1 is now expanding into new blockchain markets to increase its utility for

USD1 just got a major upgrade. Chainlink CCIP is live – enabling secure, cross-chain transfers and bringing true interoperability to DeFi. 🦅 prnewswire.com/news-releases/…

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, BNB Chain, Ethereum, Optimism, and Sonic. New integrations include @BasedChadHQ, @coinbase, @muxprotocol, @SiloFinance,

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Rootstock (testnet) • Superseed • Taiko • Zora Data Streams • Gravity Alpha • Polygon Data Feeds • Monad (testnet) VRF • Ronin

The below report, supported by @Accenture & @RWA_xyz, examines the state of blockchain adoption in financial services. Learn why prioritizing cross-chain is a competitive advantage and how CCIP uniquely solves interoperability hurdles for institutions. pages.chain.link/hubfs/e/liquid…

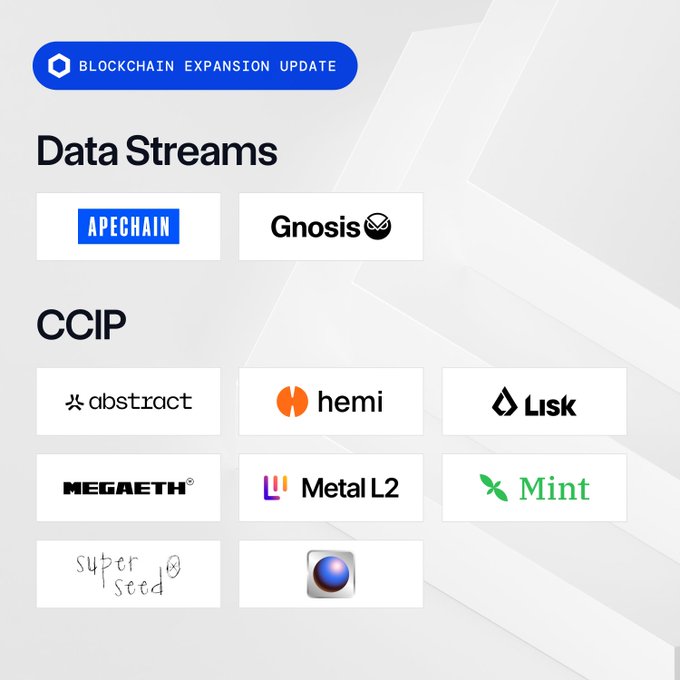

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: Data Streams • ApeChain • Gnosis Chain CCIP • Abstract (testnet) • Hemi • Lisk (testnet) • MegaETH (testnet) • Metal L2 (testnet) • Mint (testnet) • Superseed (testnet)

NEW REPORT: Explore insights from @GLEIF on how standards for organizational identity and automated compliance can “increase the trust and integrity of financial markets globally.” chain.link/resources/digi… Since 2008, the introduction of global identity standards has

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, Berachain, BNB Chain, Ethereum, and TRON. New integrations include @BasisOS, @Dolomite_io, @0xfluid, @multisynq, @ThenaFi_,

Chainlink TradFi Use Cases Purchasing tokenized real estate in fiat using existing offchain payment networks. Made possible by Chainlink.

Chainlink CCIP is the universal adapter for blockchains. One plug. Every chain. Unified liquidity.

Kings College London (@KingsCollegeLon) published a new working paper by Dr. Rhys Bidder, Deputy Director at the Qatar Centre for Global Banking and Finance, exploring the path forward for stablecoins to fulfill their global potential. Chainlink is highlighted for its

⬡ Chainlink Adoption Update ⬡ There were 16 integrations of the Chainlink standard across 6 services and 16 different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync. New

BTCFi platform with over $2B TVL @SolvProtocol has adopted Chainlink CCIP across @BNBChain, @ethereum, and @solana. In addition, Solv Protocol has adopted the Cross-Chain Token (CCT) standard for SolvBTC.Jup. BTCFi scales with Chainlink.

Chainlink Build member @SpaceandTimeDB has made SXT a Cross-Chain Token (CCT), enabling it to be natively transferred across chains via Chainlink CCIP. Space and Time has also adopted Chainlink Price Feeds to support secure DeFi markets around SXT.

Investment funds today share the same identity data with multiple counterparties across fragmented, siloed systems. Blockchain turns that into a single, verifiable source of truth accessible to all, significantly increasing efficiency. Learn how ↓ chain.link/resources/digi…

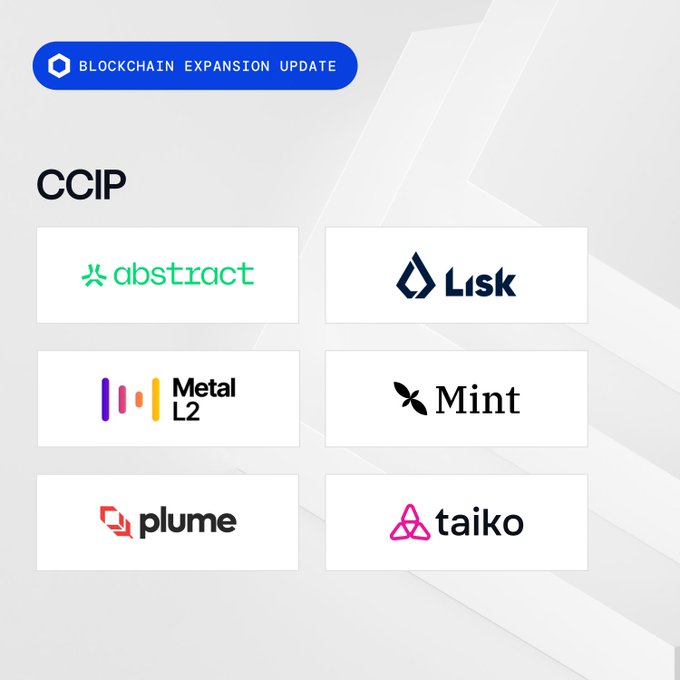

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Abstract • Lisk • Metal L2 • Mint • Plume • Taiko Hekla (testnet)

Chainlink enabled DeFi to grow to over $200 billion. Now it is on the path to trillions. @SergeyNazarov on @BTCTN explains how Chainlink is powering the next wave of onchain finance ↓

DeFi didn’t 1000x by magic. Sergey Nazarov explains why it was @Chainlink that fed it the data it needed to grow from <$100M to $200B+. Without oracles, DeFi doesn’t work. @SergeyNazarov breaks it down 👇 🎥 Watch the full interview: x.com/BTCTN/status/1…

“The industry needs a common identity language—one that bridges traditional finance and digital assets.” @marketsmedia explores why onchain verifiable identity is critical to digital assets, and how @GLEIF and Chainlink are helping make it possible ↓

Silo, a leading lending protocol on Sonic with $506M+ TVL, is going cross-chain. @SiloFinance has adopted Chainlink CCIP and the Cross-Chain Token (CCT) standard to enable secure transfers of its SILO token across @arbitrum, @ethereum, and @SonicLabs.

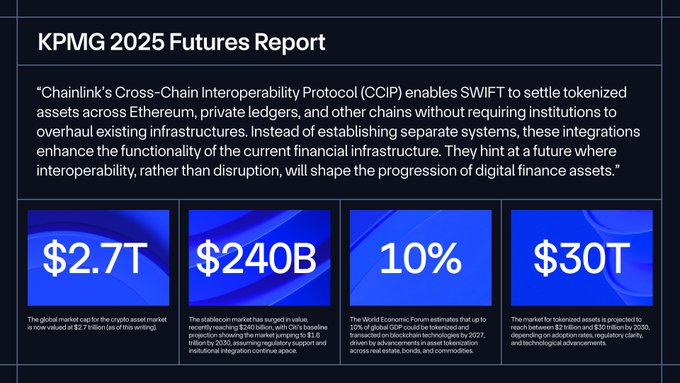

.@KPMG, a global professional services network and "Big Four" accounting firm, published its 2025 Futures Report, highlighting Chainlink's role in connecting traditional finance with decentralized protocols:

"Our industry is going through the next stage of institutional adoption." At @solana Accelerate, @SergeyNazarov joined @FintechTvGlobal to discuss the impact of asset management moving onchain, CCIP on Solana, & greater U.S. regulatory clarity. 📺 ↓ fintech.tv/unlocking-inst…

$2B+ TVL BTCFi protocol @SolvProtocol has deepened its integration with Chainlink Proof of Reserve (PoR). PoR now provides real-time transparency into the backing of SolvBTC, xSolvBTC, and Solv's entire protocol TVL. solvprotocol.medium.com/solv-integrate…

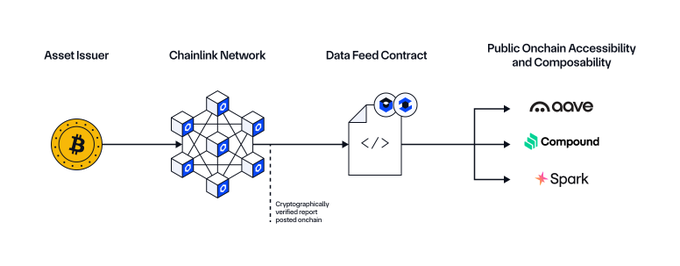

Chainlink enables asset issuers to do more. Data Feeds supply critical pricing information so tokenized Bitcoin can be used across top DeFi lending protocols. BTCFi scales with Chainlink.

“Chainlink is absolutely critical to merging traditional finance with decentralized finance.” At @consensus2025, @worldlibertyfi Co-Founder Zak Folkman announces they’re making USD1 accessible cross-chain using CCIP and discusses how Chainlink powers the onchain economy.

Sergey Nazarov and @paulbarron recently discussed: • The impact of Chainlink CCIP going live on Solana • Why cross-chain infra is driving institutional adoption • How regulation is unlocking liquidity for tokenized assets Watch on the Paul Barron Network ↓

Rocket Pool (@Rocket_Pool), a leading liquid staking protocol with 660K+ ETH staked and $1.6B+ in TVL, now supports rETH cross-chain token transfers between @Ronin_Network and @ethereum via an integration with Chainlink CCIP. Powered by the Cross-Chain Token (CCT) standard, this

BTCFi scales with Chainlink. Zeus Network (@ZeusNetworkHQ), a permissionless multichain layer that connects Bitcoin and other leading blockchains to the Solana ecosystem, has adopted Chainlink CCIP and Proof of Reserve. CCIP enables highly secure transfers of zBTC across @base,

Solana-Native Bitcoin $zBTC is Now Interoperable Through @Chainlink Zeus Network adopts Chainlink Proof of Reserve and CCIP to enhance transparency and cross-chain compatibility for Bitcoin on Solana and other chains. What’s the impact (1/6)👇

Chainlink CCIP’s Cross-Chain Token (CCT) standard is now compatible with @Optimism’s SuperchainERC20, with its first deployment on @soneium via @AstarNetwork's token, ASTR. This upgrade of Astar Network's infrastructure shows how the CCT standard can seamlessly connect

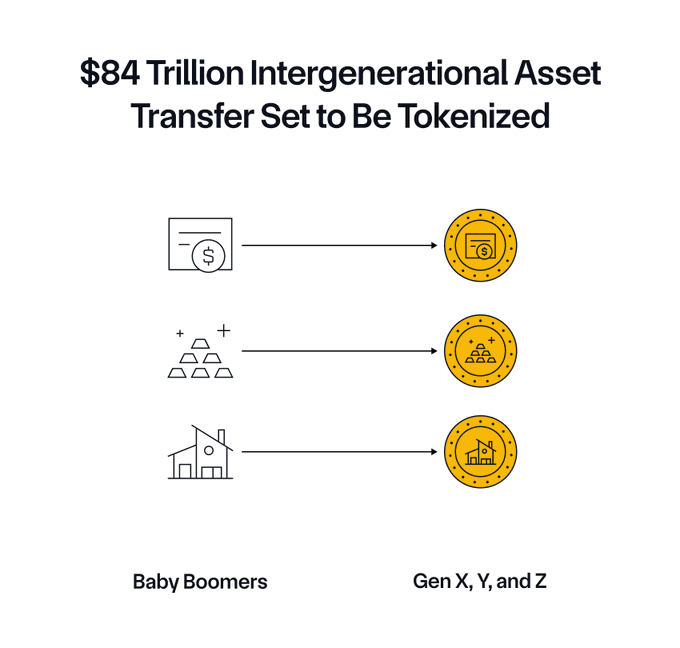

An $84 trillion wealth transfer is underway. Discover how Chainlink’s essential infrastructure for tokenized assets helps DeFi and TradFi capitalize on this generational opportunity: marketsmedia.com/fund-tokenizat…

Chainlink Total Value Secured (TVS) is experiencing significant growth, according to data from @DefiLlama. In May alone, Chainlink TVS (incl. borrows) surged by over 50% to over $65B+, driven by several major integrations, including:

“CCIP is going to be the key pathway for institutions to reliably interact with Solana.” Watch @SergeyNazarov’s presentation from @SolanaConf today to discover how Chainlink is powering internet capital markets ↓

⬡ Chainlink Adoption Update ⬡ This week, there were 16 integrations of the Chainlink standard across 7 services and 15 different chains: Abstract, Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Lisk, Metal L2, Mint, Optimism, Plume, Polygon, Solana, Soneium, and Taiko Hekla.

YieldFi has upgraded to Chainlink CCIP & is using the CCT standard for yUSD—its $200M+ market cap stablecoin—across @arbitrum, @base, @ethereum, & @Optimism. In addition, @GetYieldFi has adopted Chainlink Price Feeds to support secure markets around yUSD.

YieldFi has upgraded from LayerZero to @Chainlink CCIP with yUSD now exclusively bridged via CCIP. Enabling secure, seamless cross-chain transfers! A short thread🧵👇

Tomorrow, @SergeyNazarov joins @BlackRock's Joseph Chalom in a fireside chat at Digital Assets Week New York to discuss: • The acceleration of tokenized asset adoption • How traditional finance and DeFi are converging • The future of the digital asset industry And much more.

Chainlink, JP Morgan's Kinexys, and Ondo Finance Partner for Tokenized Asset Settlement

Chainlink has partnered with JP Morgan's Kinexys and Ondo Finance to enable institutional clients to purchase tokenized treasuries using Kinexys Digital Payments. Key developments: - Integration leverages Chainlink Runtime Environment for secure cross-chain settlement - Kinexys network has processed over $1.5T in transactions - System aims to reduce counterparty risk in digital asset transactions - Currently $23B+ in tokenized RWAs exist on public chains The collaboration demonstrates growing institutional adoption of blockchain infrastructure for traditional finance operations. Learn more: [Chainlink Blog](https://blog.chain.link/cre-dvp-kinexys-jp-morgan-ondo-finance/)

Chainlink Chromion Hackathon Office Hours Announced

Chainlink Labs is hosting expert office hours for Chromion Hackathon participants to receive direct project feedback. Two sessions are scheduled: - June 16 at 10AM ET - June 19 at 9PM ET Sessions will be held on Chainlink Discord, offering participants an opportunity to enhance their submissions with professional guidance. The Chromion Hackathon focuses on Web3, AI, and cross-chain innovation, including AI agents, asset tokenization, and cross-chain token development. *Join Discord to participate: [Chainlink Discord](https://discord.gg/chainlink)*

HyperLend Adopts Chainlink, EulerSwap Launches on Ethereum

Two major DeFi protocols have integrated Chainlink's services: - **HyperLend** ($480M+ TVL) becomes first project to implement Chainlink on HyperEVM, utilizing Data Streams for sub-second price accuracy in lending operations - **EulerFinance** ($1.8B+ TVL) launches EulerSwap on Ethereum, powered by Chainlink Price Feeds EulerSwap introduces a hybrid lending-swapping mechanism that enables: - Yield generation - Trading functionality - Collateral utilization - Enhanced AMM strategies Both integrations aim to improve price accuracy and security in DeFi operations.

Proof of Reserves Emerges as Key Solution for Market Transparency

Following the FTX fraud and Silicon Valley Bank collapse, industry experts are highlighting proof-of-reserves as a crucial tool for enhancing market oversight. Key points: - Proof-of-reserves systems provide real-time verification of assets - Policymakers can leverage this technology to prevent future financial scandals - Off-chain transaction reporting adds additional transparency layers Experts Bruce Tupper and Tyler Williams emphasize these measures as essential for rebuilding trust in trading platforms. Learn more about implementing proof-of-reserves: [Chainlink's Guide](https://blog.chain.link/proof-of-reserves-for-policymakers/)

Swift and Chainlink Bridge Traditional Finance with Blockchain Networks

Swift and Chainlink are collaborating to connect traditional financial institutions with blockchain networks, addressing growing user demand for cross-network connectivity. Key developments: - Swift's infrastructure now enables banks and financial institutions to interact with multiple blockchain networks - Integration combines Swift's established messaging protocol with blockchain capabilities - Partnership aims to bridge the gap between traditional finance and blockchain technology The collaboration demonstrates significant progress in financial infrastructure modernization, with Swift's universal language meeting blockchain innovation through Chainlink's technology. [Listen to the full discussion](https://www.globalcustodian.com/podcasts/the-future-is-on-in-conversation-with-swifts-jonathan-ehrenfeld-and-chainlinks-sergey-nazarov/)