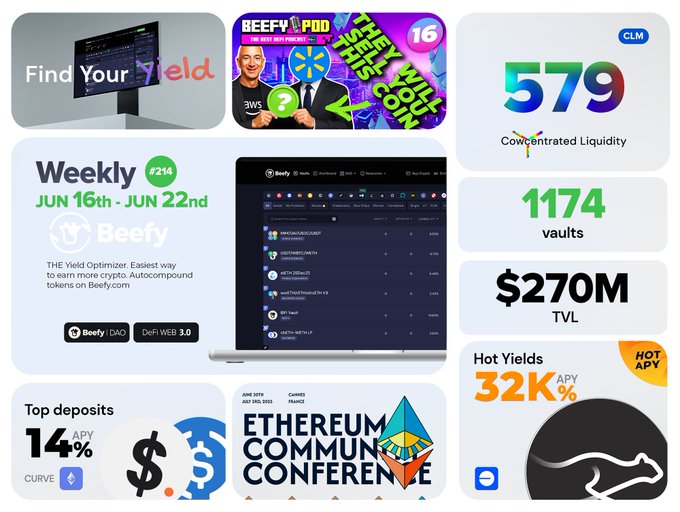

Beefy made several key announcements this week:

- Stealth launched BeefyDrip merchandise store at beefygear.creator-spring.com

- Attending Sonic BBQ Event in New York City

- Deployed 14 new yield optimization strategies

- Released BeefyPod Episode 16

- ChainPatrol security service renewal vote ongoing

- EthCC Paris conference participation confirmed

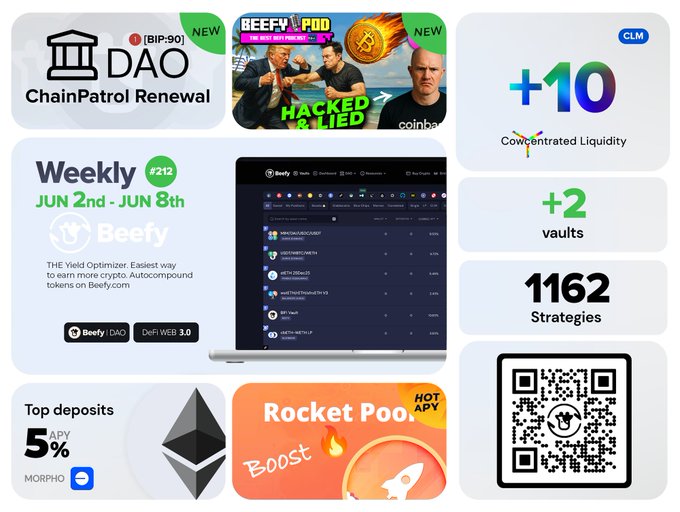

Previous week highlights:

- Rocket Pool ETH (rETH) boost feature added

- Womfi quests integration

- Assets under management exceeds $250M

Beefy Weekly Highlights #214 • #BeefyVote: ChainPatrol Renewal 🗳️ • BeefyPod Episode 16 is out 📻 • EthCC Incoming 🇫🇷 • See you in NY for BBQ🗽

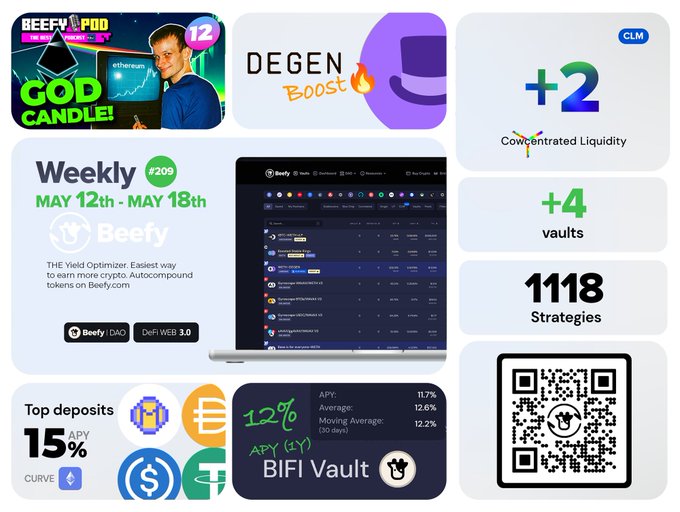

Beefy Weekly Highlights #209 • New Beefy POD is live youtube 👈 • Over $250M assets under management 💰 • 6 new yield strategies! 🛠️

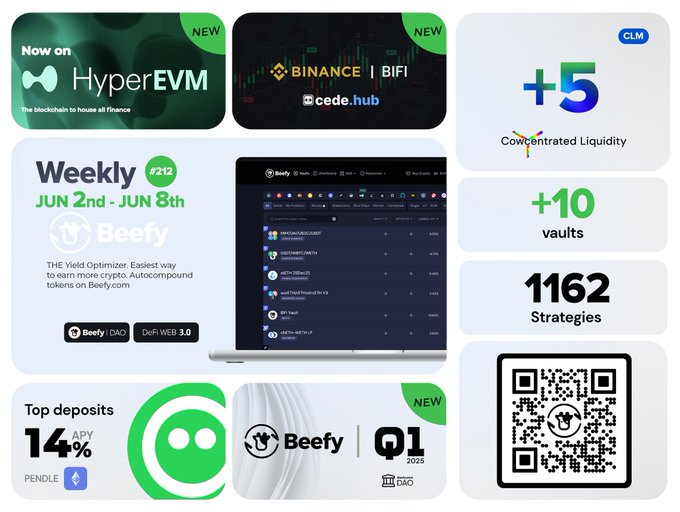

Beefy Weekly Highlights #212 • BIFI Trading Campaign is LIVE 🔥 • Now on HyperEVM ⛓️ • Beefy Q1 2025 Quarterly report released! 📈 • 15 new yield strategies! 🛠️

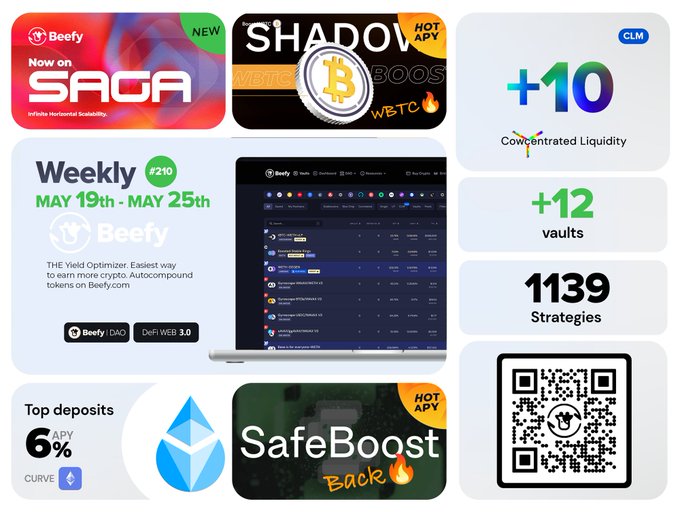

Beefy Weekly Highlights #210 • Now on @Sagaxyz__ 🥳 • @ShadowOnSonic Bitcoin boost 🚀 • Safe Boost is back 🔥 • 22 new yield strategies! 🛠️

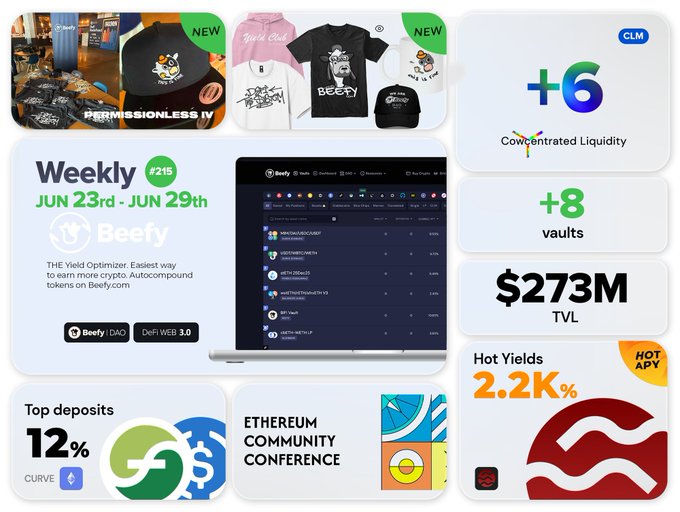

Beefy Weekly Highlights #215 • Beefy at Sonic BBQ Event NYC🗽 • Stealth launch @BeefyDrip 👕 beefygear.creator-spring.com • 14 new yield strategies! 🛠️

Aave's GHO Stablecoin Expands DeFi Presence with New Liquidity Pools

Aave's GHO stablecoin has surpassed $150M in circulation and is expanding its DeFi footprint through new Balancer liquidity pools. Key developments: - New Tri-StablePool pairs GHO with USDC and USDT on Ethereum mainnet - GyroStable concentrated liquidity pool launched on Arbitrum - Users can access waGHO, a yield-bearing version of GHO - Multiple reward opportunities include swap fees, BAL, AURA, and ARB tokens The expansion introduces innovative yield generation methods through liquidity provision, while maintaining GHO's core function as a USD-pegged, multi-collateral backed stablecoin.

Euler Finance Interest Rate Update

Euler Finance reports historically low borrowing rates, particularly for major assets: - WBTC-Euler Prime: 0.00% - WETH-Euler Prime: 0.03% - USDC-Euler Yield: 5.90% These exceptionally low rates are currently supported by rEUL incentives. Users can access these rates through Euler Prime and Euler Yield platforms. [Access the borrowing platform](https://app.euler.finance/borrow?asset=USDC&sorting=borrowApy-asc&network=ethereum)

Beefy DAO Votes on New Profit Distribution Model

Beefy Finance has initiated a crucial governance vote on profit distribution mechanisms. The protocol also expanded its yield offerings with 23 new strategies. Key updates: - Community voting on profit distribution model - Integration of beS (Beefy Escrowed Sonic) rewards system - Users can now earn both yield and points through beS - 23 new yield strategies deployed across networks This follows recent developments including RWA integration and BIFI-USDT liquidity mining campaign extensions from previous weeks. **Action Required**: Community members should participate in the governance vote to help shape Beefy's financial future.

40% APY USDC Vault Launches on Silo/Sonic

**Key Updates from Beefy Finance:** - New USDC vault offering 40% APY through Silo/Sonic partnership - mooBIFI expansion continues with strong performance - Convention participation budget approved for 2025 - @ShadowOnSonic joins Beefy team - eUSD/USDC pair leads deposit volume - 11 new yield strategies added to platform *Notable developments include high-yield USDC opportunities and strategic team growth. Platform continues focus on sustainable yield optimization across multiple chains.*