Since the start of 2024, the industry has experienced two significant cross-chain hacks resulting in nearly $90M in losses. To bring financial institutions onchain and scale digital assets, Chainlink emphasizes a security-first approach. Chainlink's Cross-Chain Interoperability Protocol (CCIP) has reached the highest level of cross-chain security and meets enterprise-grade requirements. The security architecture of CCIP was the deciding factor for MetaRisk Labs and Redacted Cartel in selecting Chainlink's solution for their cross-chain operations.

When @MetaRisk_Labs decided to take its flagship protocol @InsurAce_io cross-chain, selecting the right blockchain interoperability solution was vital. With ~400M dollars of coverage spanning 100+ protocols across a wide range of chains, InsurAce’s user base was already

Since the start of 2024, our industry has already experienced two significant cross-chain hacks resulting in nearly $90M in losses. While there’s been a recent surge of interest in our industry around RWA tokenization, the only way we will bring financial institutions onchain

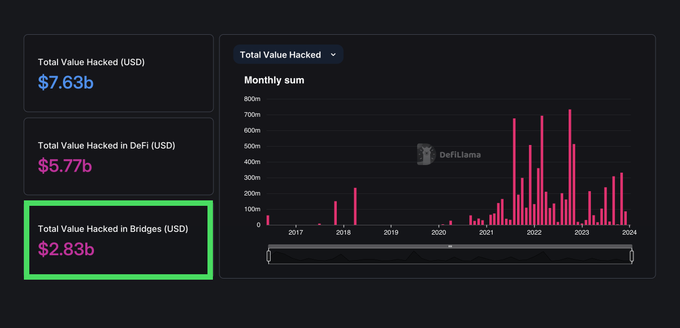

According to @DefiLlama, more than $2.8 billion in total value has been hacked due to cross-chain bridge exploits. The most recent incident took place on December 31, just before the turn of the new year. Here’s how our industry can do better in 2024🧵

.@redactedcartel is integrating #Chainlink CCIP to power cross-chain transfers of Pirex ETH across @arbitrum, #Ethereum, and @optimism. Why Redacted selected CCIP as its exclusive cross-chain solution ⬇️ mirror.xyz/0xE90c74145245…

Coinbase Wrapped Bitcoin (cbBTC) Coming to Monad Network

Monad has announced that **Coinbase Wrapped Bitcoin (cbBTC)** will be integrated into its network. This integration will bring Bitcoin liquidity to Monad's high-performance blockchain ecosystem. The move expands the utility of cbBTC beyond Ethereum and other chains where it currently operates, allowing users to leverage Bitcoin in Monad's decentralized applications. For complete details on the integration timeline and technical specifications, visit the official announcement at [Monad's blog](https://blog.monad.xyz/blog/cbbtc-to-monad). This follows Monad's recent partnership with Ankr for RPC infrastructure support, continuing the network's ecosystem expansion ahead of its mainnet launch.

Chainlink Bridges $5B+ cbBTC to Monad via CCIP

Chainlink's Cross-Chain Interoperability Protocol (CCIP) now enables cbBTC transfers to Monad DeFi. **Key Details:** - Chainlink CCIP serves as the exclusive bridging infrastructure for Coinbase Wrapped Assets - Monad users can bridge cbBTC directly from Base - Over $5 billion worth of cbBTC currently in circulation This integration expands cross-chain liquidity options for Monad's DeFi ecosystem through Coinbase's partnership with Chainlink.

🔗 Chainlink Expands Across 5 Chains with 16 New Integrations

Chainlink recorded **16 new integrations** across its standard services, spanning **5 different blockchains**: Arc, Canton Network, DogeOS Chikyu, MegaETH, and World Chain. **Key Developments:** - Canton Network adopted Chainlink's data and interoperability infrastructure, including Data Streams (with 24/5 equities coverage), SmartData (NAV & AUM), Proof of Reserve, and CCIP - CBTC became the first wrapped Bitcoin asset on Canton Network, powered by Chainlink Data Streams and Proof of Reserve - BitSafe Finance integrated Chainlink to enable advanced use cases for CBTC across Canton's $8+ trillion RWA ecosystem **New Integrations Include:** Arc, BitSafe Finance, Canton Network, DogeOS, Kairo, MegaETH, Temple, Thetanuts Finance, Unhedged, and World Chain. **Services Expanded:** - CCIP: Arc (testnet), DogeOS Chikyu (testnet), MegaETH - CRE: World Chain - Data Streams: MegaETH - Data Feeds: MegaETH Leading Canton ecosystem applications including BitSafe Finance, Kairo, Temple, Thetanuts Finance, and Unhedged have already deployed Chainlink's data standard in production.

Delphi Digital: Chainlink Becomes Standard Infrastructure for Financial Institution Tokenization

**Financial institutions are standardizing on Chainlink as their core infrastructure layer for tokenization initiatives**, according to Delphi Digital. **Key adoption areas:** - Data connectivity and feeds - Cross-chain interoperability - Orchestration services The analysis positions Chainlink as essential infrastructure for institutions entering tokenized markets, serving as the bridge between traditional financial systems and blockchain networks. This institutional standardization reflects growing confidence in Chainlink's oracle platform as the foundation for connecting real-world data and systems to blockchain-based tokenization projects.

Chainlink Reserve Continues Accumulating LINK Through Enterprise Revenue

Chainlink has announced an update to its Reserve program, which continues to accumulate LINK tokens to support the network's long-term sustainability. **How It Works** - The Reserve accumulates LINK through two revenue streams: offchain payments from enterprise clients and onchain fees from network usage - Funds are designed to support the Chainlink Network's growth over time **Recent Activity** The Reserve has shown consistent growth, with previous updates showing holdings of 1,774,215.90 LINK in late January and 1,899,670.39 LINK by early February. [Learn more about the Reserve](https://reserve.chain.link)