Chainlink Reserve Generates Hundreds of Millions in Revenue

Chainlink Reserve Generates Hundreds of Millions in Revenue

🔗 Reserve Revenue Hits New Heights

Chainlink's Reserve initiative has achieved significant revenue milestones through enterprise integrations, strategic partnerships, and onchain service usage. The Reserve acts as a strategic LINK token repository, powered by both offchain enterprise adoption revenue and onchain service fees. This development provides a clear mechanism for connecting enterprise revenue back to the Chainlink protocol system. The initiative represents a major step in Chainlink's evolution, demonstrating how enterprise adoption translates to protocol value.

"This is the clearest signal our industry has ever had that it will be the way the financial system and the world works." On @AltcoinDaily, @SergeyNazarov explains how the GENIUS Act enables the industry to go beyond cryptocurrencies and become defined by tokenized assets ↓

“The partnership marks the first time any asset on the chain — from bitcoin to stablecoins — can be purchased on-chain with traditional cards.” @Mastercard explores how its work with Chainlink is a major catalyst for the global adoption of crypto: mastercard.com/us/en/news-and…

🏗️ New Build member: @swapperfinance Swapper Finance’s participation in the Build program led to its inclusion in Chainlink's groundbreaking partnership with Mastercard, which enables 3B+ cardholders to purchase crypto directly onchain. blog.swapper.finance/swapper-financ… Swapper Finance

“We’re able to do very complex transactions across multiple chains, with multiple steps, jurisdictions, and pieces of data.” At @blockchain_rio, @SergeyNazarov joins Bruno Grossi, Head of Digital Assets at Banco Inter (@interbr), a leading financial institution serving over 34

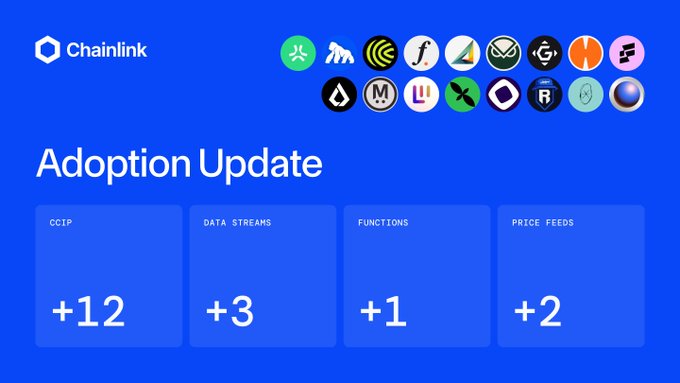

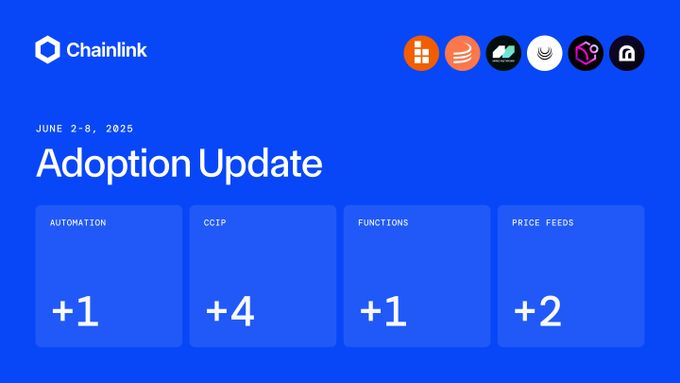

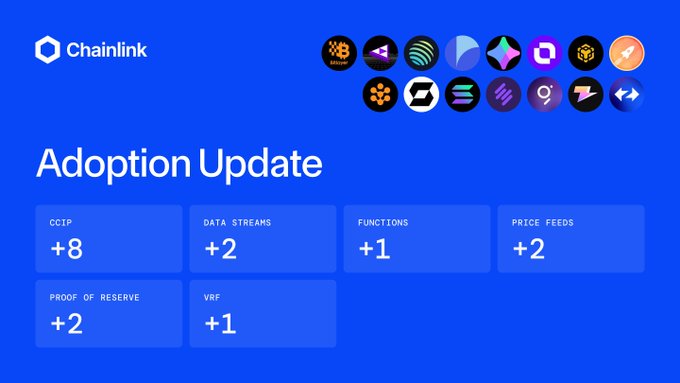

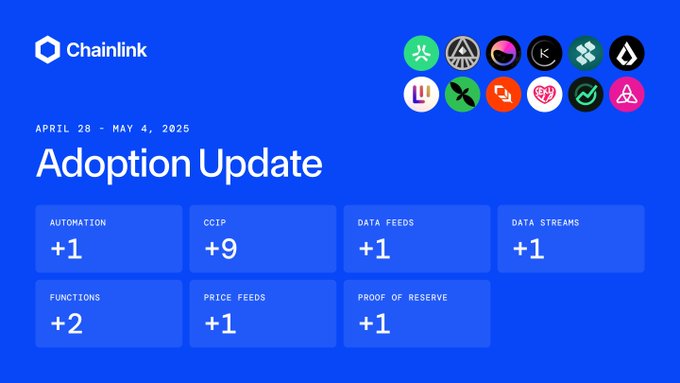

⬡ Chainlink Adoption Update ⬡ There were 18 integrations of the Chainlink standard across 4 services and 20 different chains: Abstract, ApeChain, Avalanche, Base, BNB Chain, Celo, Ethereum, Gnosis Chain, Hemi, Lisk, MegaETH, Metal L2, Mint, Monad, Optimism, Polygon, Ronin,

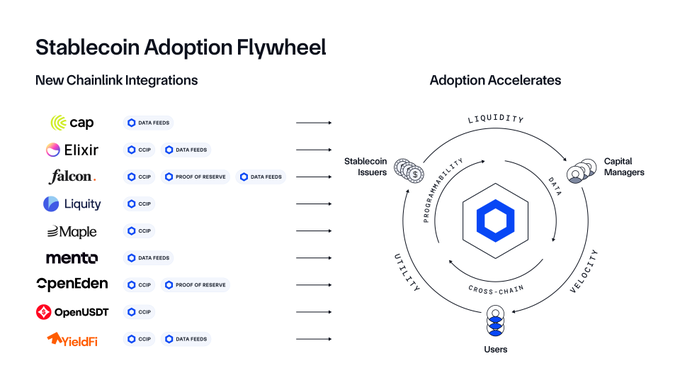

"U.S. stablecoin legislation is kicking off a stablecoin issuance boom from banks, asset managers, & tech companies." @SergeyNazarov says a stablecoin boom is underway, with Chainlink providing the key data, interoperability, and compliance required to build them at scale ↓

"This is what crypto looks like when it’s ready for the real world." @Forbes on the recent @Mastercard and Chainlink partnership ↓ forbes.com/sites/digital-…

⬡ Chainlink Adoption Update ⬡ This week, there were 12 integrations of the Chainlink standard across 6 services and 8 different chains: Gravity Alpha, Monad, Polygon, Ronin, Rootstock, Superseed, Taiko, and Zora. New integrations include @GravityChain, @monad_xyz,

“Chainlink CCID and ACE are a fundamental transformation... I call it almost next-gen 3643.” Dennis O’Connell, President of the ERC-3643 Association, explains how Chainlink’s Cross-Chain Identity and Automated Compliance Engine is transforming ERC-3643 into a dynamic RWA token

The institutional era of stablecoins has arrived. With the GENIUS Act bringing regulatory clarity, financial institutions are adopting stablecoins for payments, settlement, and liquidity. Chainlink is the only platform that can power this next evolution of finance at scale,

As leading financial institutions adopt digital assets, the need for a cash leg to settle onchain transactions has become increasingly important. Discover how Chainlink is enabling the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin ↓

⬡ Chainlink Adoption Update ⬡ There were 18 integrations of the Chainlink standard across 7 services and 10 different chains: Base, BNB Chain, Botanix, Ethereum, Katana, Metis Andromeda, Optimism, Polygon, Solana, and Soneium. New integrations include @aktionariat,

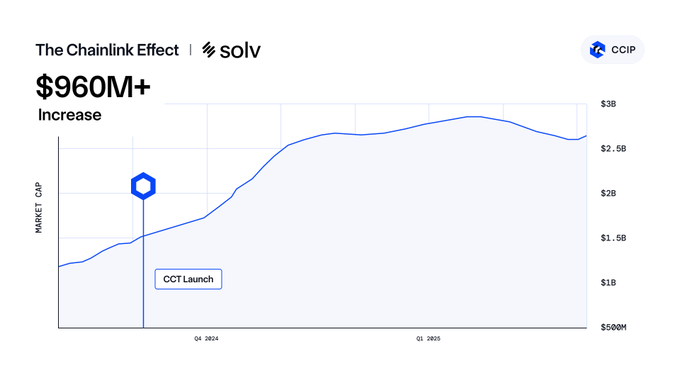

After @SolvProtocol adopted the Cross-Chain Token (CCT) standard, the Bitcoin staking protocol surged to $2.5B+ TVL—with $1.16B+ in cross-chain transfers via CCIP. Cross-chain by Chainlink → a catalyst for growth uniquely enabled by CCIP and a thriving community.

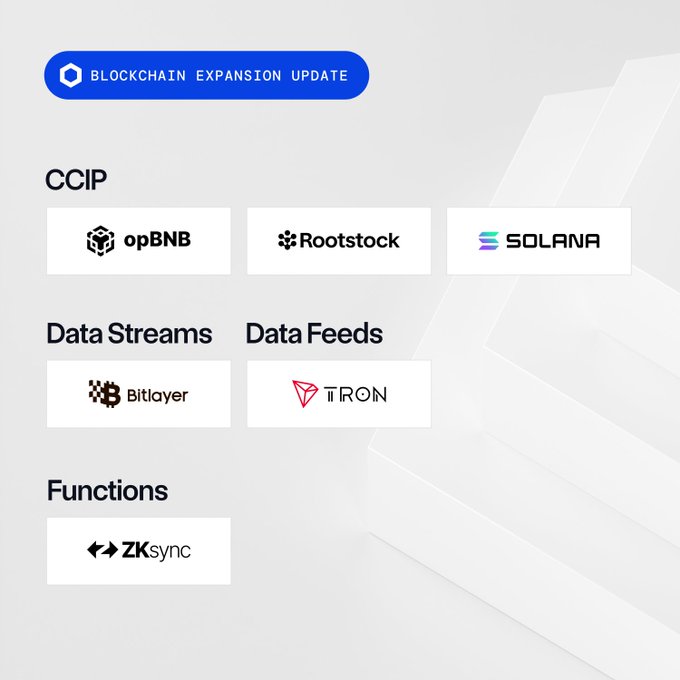

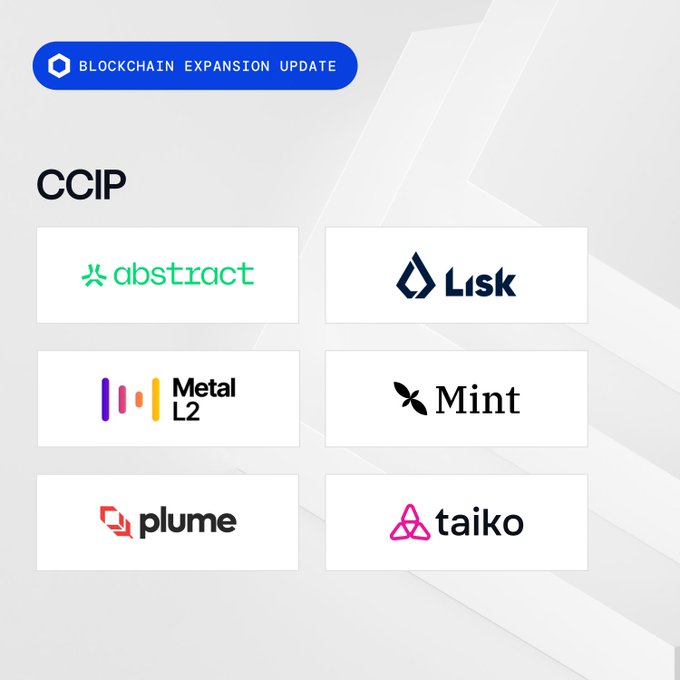

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: CCIP • opBNB • Rootstock • Solana Data Streams • Bitlayer Data Feeds • TRON Functions • ZKsync

Chainlink and @BlockchainAssn convened government and blockchain leaders in D.C. for Tokenized in America—a strategic event focused on advancing the next generation of U.S. financial innovation. How Tokenized in America is paving the path to digital asset leadership ↓

1/ Crypto Week continues this evening with a special event hosted by BA and @chainlink at The Ned in Washington. BA’s @SKMersinger opened with comments on the opportunity at hand for the U.S. to lead on digital assets.

Onchain asset manager @maplefinance ($1.9B AUM) has upgraded to Chainlink CCIP by adopting the Cross-Chain Token (CCT) standard to make $500M+ of syrupUSDC natively transferable across @Ethereum and @Solana. Users can also natively mint the yield-bearing stablecoin on Solana,

syrupUSDC is live on Solana. With DeFi use cases on day one and up to $500K in incentives. Launched in collaboration with @chainlink, @KaminoFinance, @Paxos, @jito_sol and @orca_so. Maple’s liquid yielding dollar is bringing consistent high yield to the ecosystem. Details

“The capital that can flow into Solana over CCIP will initially be the DeFi community’s capital … and then there will also be a very large category of institutional users.” Sergey Nazarov explores the impact of bringing Chainlink CCIP to @solana ↓

The Graph (@graphprotocol), a blockchain data platform that has served over 1.2 trillion requests, is adopting Chainlink CCIP and making its native token GRT a Cross-Chain Token (CCT). Users will be able to transfer the $1B+ market cap token across @arbitrum, @base, and @solana.

Misyon Bank (@MisyonBank), a pioneering financial institution in Turkey, has adopted the Chainlink standard in production to enable onchain data feeds and reserve verification for its tokenized asset platform. misyon.com/medium/Documen… With Chainlink Data Feeds and Proof of

"You need institutional-grade infrastructure and that's why we're very excited to be partnered with Chainlink." @Lombard_Finance’s Matthew Donovan explains why Chainlink's institutional-grade platform is crucial to the long-term success of BTCFi. BTCFi scales with Chainlink.

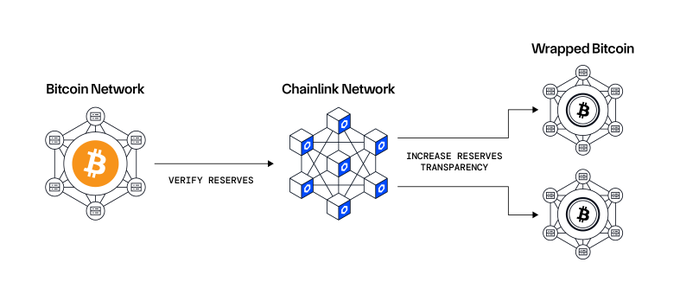

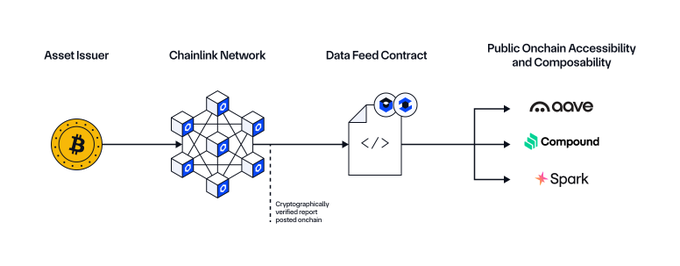

Coinbase is utilizing Chainlink Proof of Reserve to increase the transparency of $4.6B+ worth of cbBTC reserves. Proof of Reserve helps @coinbase ensure cbBTC reserves are verifiable onchain, with data published on @base & @ethereum. BTCFi scales with Chainlink.

Proof of Reserves empowers users to confidently integrate cbBTC across the DeFi ecosystem. Utilizing @chainlink Proof of Reserves on @base and @ethereum provides independent, transparent onchain verifications that cbBTC reserves are backed 1:1 by BTC.

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 4 services and 4 different chains: Base, BOB, Ethereum, and Solana. New integrations include @build_on_bob, @maplefinance, @mindnetwork_xyz, @NuraLabs, @SpaceandTimeDB, and

.@Mastercard’s EVP Raj Dhamodharan: "I found Chainlink to be an incredibly quick partner on this in terms of coming up with solutions ... The velocity and number of apps that can get on the platform will exponentially increase.”

Sergey Nazarov was featured by the White House: “The GENIUS Act is a huge step forward for stablecoins, forming the basis of on-chain payments for retail users in both highly developed and emerging markets.” Read more ⬇️

"Chainlink is pushing the types of things people in the government care about—namely infrastructure and a plan for how the digital asset economy will succeed in the U.S." @SergeyNazarov highlights Chainlink’s role in supporting pro-crypto policy development in the U.S.

USD1—an institutional-grade stablecoin from @worldlibertyfi—is officially going cross-chain with Chainlink CCIP. prnewswire.com/news-releases/… Already the fastest-growing stablecoin from zero to $2B, USD1 is now expanding into new blockchain markets to increase its utility for

USD1 just got a major upgrade. Chainlink CCIP is live – enabling secure, cross-chain transfers and bringing true interoperability to DeFi. 🦅 prnewswire.com/news-releases/…

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, BNB Chain, Ethereum, Optimism, and Sonic. New integrations include @BasedChadHQ, @coinbase, @muxprotocol, @SiloFinance,

“Right now, we are at sub 1% levels of everything that can be tokenized.” At @EthCC, @SergeyNazarov delivered a keynote speech discussing the next wave of industry growth being driven by institutional capital and tokenized RWAs. How Chainlink is unlocking this opportunity 🧵

The rapidly increasing demand for stablecoins to facilitate cross-border flows, coupled with emerging regulatory requirements, highlights the pressing need for flexible infrastructure to support stablecoins across jurisdictions. Enter Chainlink:

The U.S. has the talent & infrastructure to lead in tokenization. As well as the regulatory foundation to support leadership taking shape. The @chainlinklabs Government Affairs team explores key barriers & how public policy efforts can unlock progress ↓blog.chain.link/how-united-sta…

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Rootstock (testnet) • Superseed • Taiko • Zora Data Streams • Gravity Alpha • Polygon Data Feeds • Monad (testnet) VRF • Ronin

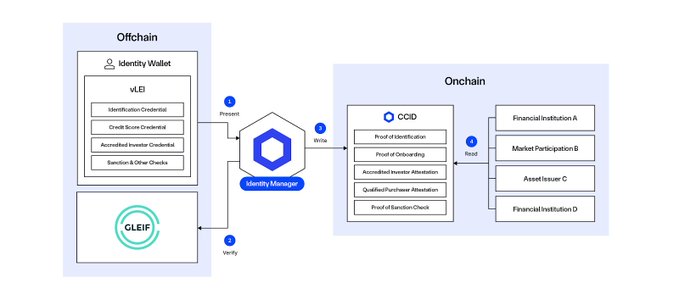

Reusable identities will completely transform both onchain and existing compliance processes. Chainlink Automated Compliance Engine (ACE) + @GLEIF's verifiable digital identity (vLEI) introduces a groundbreaking new framework for creating reusable identities and using them to

“They need data, they need identity, and they need connectivity across chains.” @SergeyNazarov joins @paulbarrontv and explains why capital markets face three key problems when moving onchain—and how Chainlink solves them.

The below report, supported by @Accenture & @RWA_xyz, examines the state of blockchain adoption in financial services. Learn why prioritizing cross-chain is a competitive advantage and how CCIP uniquely solves interoperability hurdles for institutions. pages.chain.link/hubfs/e/liquid…

Tokenized in America, a newly launched industry resource from Chainlink and @BlockchainAssn, was featured today in @politico’s Morning Money newsletter. politico.com/newsletters/mo… Highlighting the significance of launching this industry-shaping initiative, Chainlink Labs’ Head of

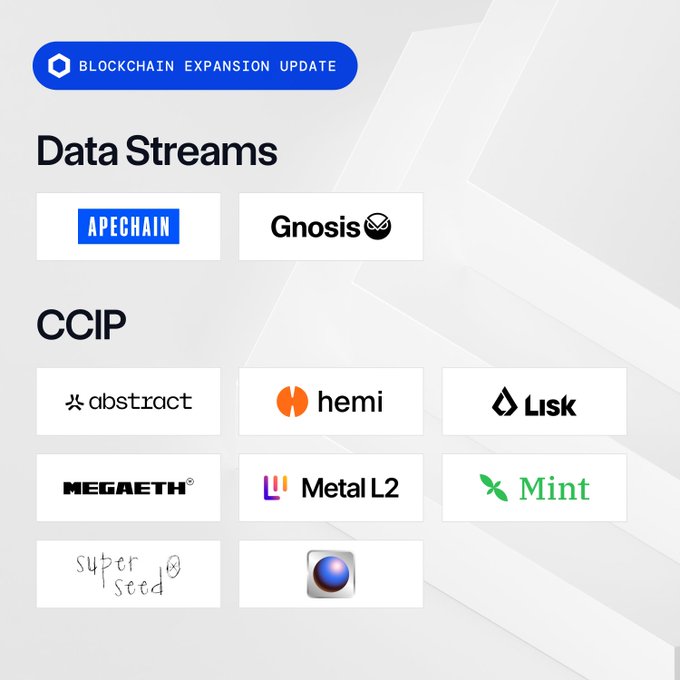

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: Data Streams • ApeChain • Gnosis Chain CCIP • Abstract (testnet) • Hemi • Lisk (testnet) • MegaETH (testnet) • Metal L2 (testnet) • Mint (testnet) • Superseed (testnet)

“Chainlink’s ACE & CCID: A Monumental Step Forward.” Find out how Chainlink ACE and CCID transform global finance in a recent report from @keystatecapital, @Cardano_CF, and @GLEIF: verifiablesmartcontract.com/vLEI%20on%20Ch… Key highlights: Chainlink Automated Compliance Engine (ACE) Chainlink

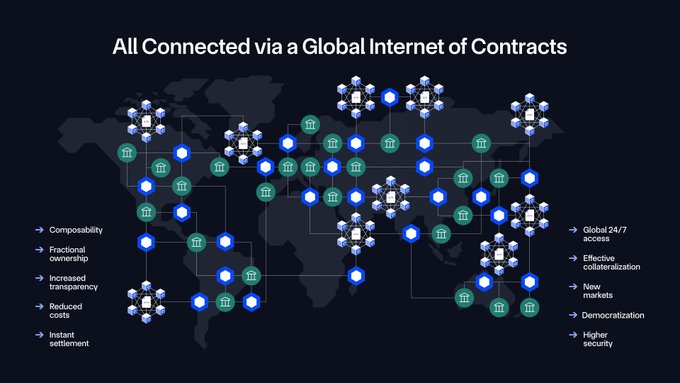

Problem: Developers must be able to quickly combine offchain data, blockchains, and legacy systems into customizable, executable workflows. Solution: The Chainlink compute standard.

Problem: Data and value must move seamlessly together across blockchains and legacy systems to maximize efficiency and liquidity. Solution: The Chainlink interoperability standard.

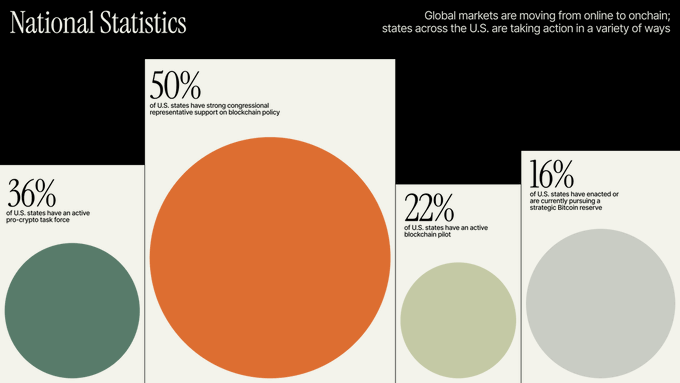

Where is blockchain policy gaining ground? Tokenized in America gives a clear view across all 50 states. Dive into the state-by-state results ↓ tokenizedinamerica.com

“In the Mastercard use case, Chainlink is at the center of coordinating the critical information about the transaction across the multiple parties involved.” @SergeyNazarov on the critical role Chainlink plays in enabling @Mastercard's network to interact with digital assets ↓

Establishing security and transparency standards is key to the success of BTCFi. Chainlink Proof of Reserve can elevate security and transparency for any wrapped Bitcoin product by delivering real-time verification of asset reserves. BTCFi scales with Chainlink.

NEW REPORT: Explore insights from @GLEIF on how standards for organizational identity and automated compliance can “increase the trust and integrity of financial markets globally.” chain.link/resources/digi… Since 2008, the introduction of global identity standards has

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, Berachain, BNB Chain, Ethereum, and TRON. New integrations include @BasisOS, @Dolomite_io, @0xfluid, @multisynq, @ThenaFi_,

The Chainlink Reserve enables offchain revenue from large enterprises adopting the Chainlink standard and onchain service usage revenue to be converted into LINK and stored in a strategic reserve. @SergeyNazarov joins @scottmelker on The Wolf of All Streets podcast to explain ⬇️

We're excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens. blog.chain.link/chainlink-rese… The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink

Chainlink & @Mastercard are connecting over 3 billion cardholders to crypto. This new post explores how Mastercard and Chainlink are enabling secure, compliant, and reliable crypto access: blog.chain.link/mastercard-and…

Chainlink TradFi Use Cases Purchasing tokenized real estate in fiat using existing offchain payment networks. Made possible by Chainlink.

Chainlink's work with @Mastercard is a "turning point in how people access digital assets".

The U.S. financial system is at a turning point. To remain the global hub of asset creation, it must offer the most attractive assets onchain. The @chainlinklabs Government Affairs team explores the need for proof of reserves & proof of composition ↓ blog.chain.link/the-need-for-p…

Hundreds of millions in revenue. Created by enterprise integrations, strategic partnerships, and onchain service usage. Fueling the growth of the Chainlink Reserve.

Chainlink CCIP is the universal adapter for blockchains. One plug. Every chain. Unified liquidity.

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: CCIP • 0G (testnet) • Botanix • Hyperliquid • Janction (testnet) • Katana Data Streams • Botanix • Celo • Katana • Metis Andromeda Data Feeds • Botanix • Katana

Kings College London (@KingsCollegeLon) published a new working paper by Dr. Rhys Bidder, Deputy Director at the Qatar Centre for Global Banking and Finance, exploring the path forward for stablecoins to fulfill their global potential. Chainlink is highlighted for its

Mastercard SVP Izzy Iliev-Wolitzer on combining @Mastercard’s network with Chainlink’s infrastructure: "When you combine these two things together, you get a very, very powerful system, where everybody feels safe.” Watch today’s talk with @SergeyNazarov at @Permissionless ↓

“It’s the first time we’ve seen a platform that can offer an on-ramp … where you can go from cash through to digital assets on a DEX.” @ZeroHashX CBO Mark Daly on how they teamed up with Chainlink & @Mastercard to unlock seamless crypto purchases for billions of cardholders ↓

⬡ Chainlink Adoption Update ⬡ There were 16 integrations of the Chainlink standard across 6 services and 16 different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync. New

BTCFi platform with over $2B TVL @SolvProtocol has adopted Chainlink CCIP across @BNBChain, @ethereum, and @solana. In addition, Solv Protocol has adopted the Cross-Chain Token (CCT) standard for SolvBTC.Jup. BTCFi scales with Chainlink.

Chainlink Build member @SpaceandTimeDB has made SXT a Cross-Chain Token (CCT), enabling it to be natively transferred across chains via Chainlink CCIP. Space and Time has also adopted Chainlink Price Feeds to support secure DeFi markets around SXT.

Build to Scale Q2 2025 saw Chainlink Build & ecosystem members continue to grow via innovation & scaling. • Build: Season Genesis launch with @SpaceandTimeDB • Blockchains: 29 integrations including @Optimism, @solana, & @trondao Ecosystem teams—Drop your updates below ↓

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 5 services and 7 different chains: ApeChain, Avalanche, Base, BNB Chain, Ethereum, Katana, and Solana. New integrations include @AITECHio, @EmGemXofficial, @IthacaProtocol,

Investment funds today share the same identity data with multiple counterparties across fragmented, siloed systems. Blockchain turns that into a single, verifiable source of truth accessible to all, significantly increasing efficiency. Learn how ↓ chain.link/resources/digi…

"Through CCID [Chainlink's Cross-Chain Identity], you make identity & credentials portable across chains ... That’s really what is critical to the scaling & adoption of DeFi." @GLEIF CEO Alexandre Kech shares identity insights at @rwasummit with @SergeyNazarov ↓

As more real-world assets get tokenized onchain, governments will compete to have their currencies used to settle transactions. @SergeyNazarov explains this emerging dynamic on @paulbarrontv and why asset issuance is key for the U.S. ↓

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • Abstract • Lisk • Metal L2 • Mint • Plume • Taiko Hekla (testnet)

Chainlink enabled DeFi to grow to over $200 billion. Now it is on the path to trillions. @SergeyNazarov on @BTCTN explains how Chainlink is powering the next wave of onchain finance ↓

DeFi didn’t 1000x by magic. Sergey Nazarov explains why it was @Chainlink that fed it the data it needed to grow from <$100M to $200B+. Without oracles, DeFi doesn’t work. @SergeyNazarov breaks it down 👇 🎥 Watch the full interview: x.com/BTCTN/status/1…

“The industry needs a common identity language—one that bridges traditional finance and digital assets.” @marketsmedia explores why onchain verifiable identity is critical to digital assets, and how @GLEIF and Chainlink are helping make it possible ↓

"Now you have over a billion retail users that can, in a compliant, reliable, and secure way, utilize blockchain assets." @SergeyNazarov on why the recent Chainlink and Mastercard partnership is a pivotal moment for the blockchain industry ↓ x.com/chainlink/stat…

Chainlink & @Mastercard are connecting over 3 billion cardholders to crypto. This new post explores how Mastercard and Chainlink are enabling secure, compliant, and reliable crypto access: blog.chain.link/mastercard-and…

“We are excited to be the infrastructure partner alongside Chainlink and Mastercard on the Swapper Finance platform”—@ZeroHashX CEO & Co-Founder @e_woodford. On the platform, Chainlink verifies and synchronizes key transaction details to enable Mastercard holders to purchase

We’re excited to announce that Chainlink and @Mastercard have partnered to enable billions of cardholders to purchase crypto directly onchain. prnewswire.com/news-releases/… Chainlink verifies and synchronizes key

⬡ Chainlink Adoption Update ⬡ There were 12 integrations of the Chainlink standard across 4 services and 11 different chains: Arbitrum, Base, BNB Chain, Ethereum, HashKey Chain, HyperEVM, Optimism, Plume, Solana, Soneium, and WEMIX3.0. New integrations include @AstarNetwork,

NEW: Direct from the White House, @SergeyNazarov joined @AltcoinDaily to discuss new opportunities the GENIUS Act unlocks for crypto and Chainlink. Watch now ↓

Epic conversation with @SergeyNazarov all about #crypto! We discuss: -- The Significance of GENIUS Act -- Crypto Entering 1997 Early Internet Era -- What's Next for #Chainlink -- CLARITY Act May Be Even Bigger? -- & MORE! 👉 WATCH FULL : youtu.be/IIf-hc_SagA

Silo, a leading lending protocol on Sonic with $506M+ TVL, is going cross-chain. @SiloFinance has adopted Chainlink CCIP and the Cross-Chain Token (CCT) standard to enable secure transfers of its SILO token across @arbitrum, @ethereum, and @SonicLabs.

The U.S. is positioned to lead in the onchain financial system—but only if it embraces blockchain innovation early. The @chainlinklabs Government Affairs team explores how the U.S. financial system can gain global market share by enabling tokenization ↓ blog.chain.link/tokenized-in-a…

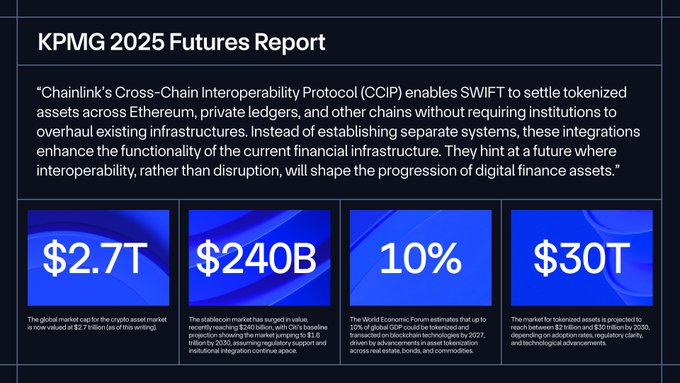

.@KPMG, a global professional services network and "Big Four" accounting firm, published its 2025 Futures Report, highlighting Chainlink's role in connecting traditional finance with decentralized protocols:

Introducing Chainlink Automated Compliance Engine (ACE)—a unified & modular standard to solve all onchain compliance problems and bring institutional capital onchain. ACE is built on the Chainlink Runtime Environment (CRE) & launched in collaboration with leading market

Chainlink is making digital identity for institutions accessible across the onchain economy. Explore the future of onchain compliance, verifiable identity, and more with @GLEIF CEO Alexandre Kech: chain.link/resources/digi…

The Chainlink Reserve provides a clear answer for how offchain revenue from enterprise adoption connects back to the Chainlink system. Offchain & onchain revenue → conversion to LINK → Chainlink Reserve @SergeyNazarov explains on @AltcoinDaily ↓

"Our industry is going through the next stage of institutional adoption." At @solana Accelerate, @SergeyNazarov joined @FintechTvGlobal to discuss the impact of asset management moving onchain, CCIP on Solana, & greater U.S. regulatory clarity. 📺 ↓ fintech.tv/unlocking-inst…

Financial innovation doesn’t just happen on Wall Street or in Silicon Valley. Every state has a role to play. Find out how all 50 states are engaging with blockchain ↓

$2B+ TVL BTCFi protocol @SolvProtocol has deepened its integration with Chainlink Proof of Reserve (PoR). PoR now provides real-time transparency into the backing of SolvBTC, xSolvBTC, and Solv's entire protocol TVL. solvprotocol.medium.com/solv-integrate…

"Financial institutions can't act without knowing who they're dealing with... and that's why identity and what you're doing with us is so important." Alexandre Kech joined @SergeyNazarov at @EthCC to discuss why institutions need Chainlink ↓

Everything you need to know about the Chainlink Reserve ↓ x.com/chainlink/stat…

We're excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens. blog.chain.link/chainlink-rese… The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink

Chainlink enables asset issuers to do more. Data Feeds supply critical pricing information so tokenized Bitcoin can be used across top DeFi lending protocols. BTCFi scales with Chainlink.

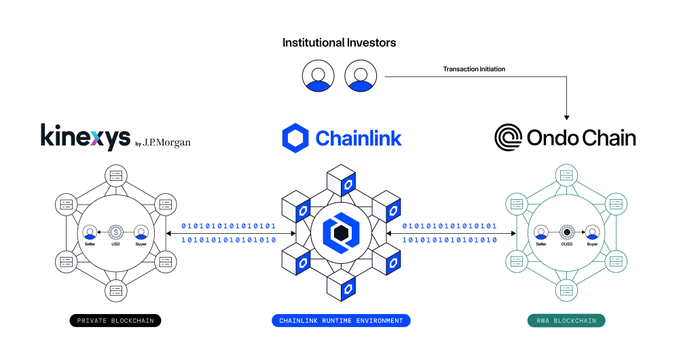

Chainlink is excited to be working with Kinexys by J.P. Morgan and Ondo on a groundbreaking way to utilize Kinexys Digital Payments to allow institutional clients to purchase Ondo’s tokenized treasuries. With $23B+ in tokenized RWAs on public chains, the need for secure

“Chainlink is absolutely critical to merging traditional finance with decentralized finance.” At @consensus2025, @worldlibertyfi Co-Founder Zak Folkman announces they’re making USD1 accessible cross-chain using CCIP and discusses how Chainlink powers the onchain economy.

Sergey Nazarov and @paulbarron recently discussed: • The impact of Chainlink CCIP going live on Solana • Why cross-chain infra is driving institutional adoption • How regulation is unlocking liquidity for tokenized assets Watch on the Paul Barron Network ↓

Rocket Pool (@Rocket_Pool), a leading liquid staking protocol with 660K+ ETH staked and $1.6B+ in TVL, now supports rETH cross-chain token transfers between @Ronin_Network and @ethereum via an integration with Chainlink CCIP. Powered by the Cross-Chain Token (CCT) standard, this

"Providers like Chainlink play an important role because interoperability is not necessarily something a single institution can achieve by itself." @Nzaltsman of Kinexys by @jpmorgan joins Chainlink’s Future Is On series to discuss the institutional adoption of blockchain

BTCFi scales with Chainlink. Zeus Network (@ZeusNetworkHQ), a permissionless multichain layer that connects Bitcoin and other leading blockchains to the Solana ecosystem, has adopted Chainlink CCIP and Proof of Reserve. CCIP enables highly secure transfers of zBTC across @base,

Solana-Native Bitcoin $zBTC is Now Interoperable Through @Chainlink Zeus Network adopts Chainlink Proof of Reserve and CCIP to enhance transparency and cross-chain compatibility for Bitcoin on Solana and other chains. What’s the impact (1/6)👇

New stablecoin issuers choose Chainlink ↓ 🪙 Cap (@capmoney_): Cap has integrated Chainlink Price Feeds to help power its decentralized institutional-backed stablecoin protocol. 🪙 Elixir (@elixir): Elixir, an institutional-focused protocol with $160M+ in TVL, upgraded to

Chainlink CCIP’s Cross-Chain Token (CCT) standard is now compatible with @Optimism’s SuperchainERC20, with its first deployment on @soneium via @AstarNetwork's token, ASTR. This upgrade of Astar Network's infrastructure shows how the CCT standard can seamlessly connect

Chainlink’s compliance framework is opening the floodgates for $100T+ of regulated assets to move onchain. @SergeyNazarov on @GLEIF’s new podcast discussing how Chainlink is making regulatory compliance a competitive advantage for the blockchain industry: gleif.org/en/newsroom/gl…

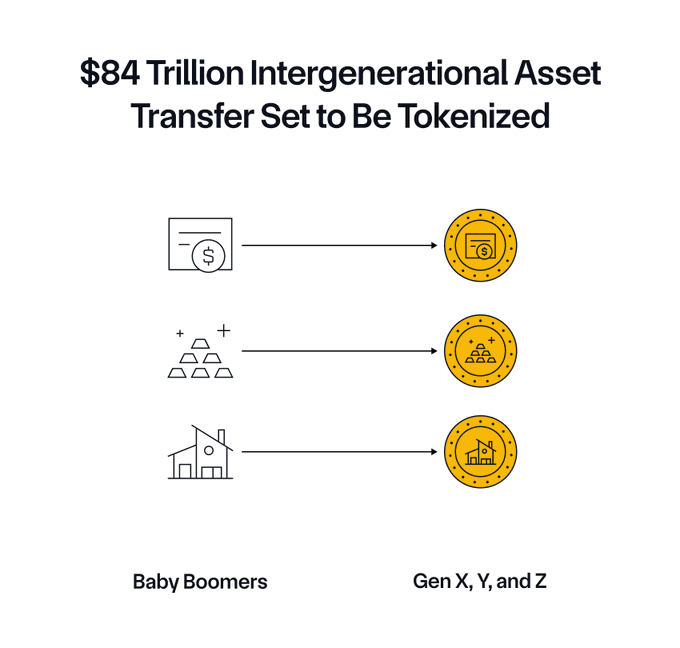

An $84 trillion wealth transfer is underway. Discover how Chainlink’s essential infrastructure for tokenized assets helps DeFi and TradFi capitalize on this generational opportunity: marketsmedia.com/fund-tokenizat…

BREAKING NEWS: The GENIUS Act is now law.

Institutional transactions onchain have many key requirements, from data & compliance to cross-chain & offchain systems integration. "There is no other system that has built even 20% of those requirements, while Chainlink has successfully now built anywhere from 70% to 90%."

We’re excited to collaborate with @GLEIF for the vLEI Hackathon alongside Swift (@swiftcommunity) to accelerate the global adoption of compliant digital assets onchain. gleif.org/en/newsroom/pr… With hundreds of trillions in value poised to move onchain, digital assets are

Following a successful community vote, @OlympusDAO has upgraded to Chainlink CCIP as its canonical cross-chain infrastructure to enable OHM transfers across @ethereum and @solana. olympusdao.medium.com/olympus-integr… Through this integration, OHM adopts the Cross-Chain Token (CCT) standard

Chainlink Total Value Secured (TVS) is experiencing significant growth, according to data from @DefiLlama. In May alone, Chainlink TVS (incl. borrows) surged by over 50% to over $65B+, driven by several major integrations, including:

“The next stage of the whole compliance industry is the automation of compliance”

"The Chainlink Reserve is now a clear answer to the question of how all of this adoption of Chainlink by enterprises of various sizes relates back to the protocol." @SergeyNazarov joined @Token_Relations' livestream to discuss the Chainlink Reserve, how it connects enterprise

States across the U.S. are charting their own path with blockchains, from task forces and legislation to exploring digital asset reserves. A breakdown of how states are engaging with blockchain today ↓ blog.chain.link/how-states-are…

“CCIP is going to be the key pathway for institutions to reliably interact with Solana.” Watch @SergeyNazarov’s presentation from @SolanaConf today to discover how Chainlink is powering internet capital markets ↓

The U.S. government is modernizing the financial system and Chainlink is at the center of it all: • @SECGov issuing recent interpretive guidance informed by Chainlink’s feedback • Stablecoin issuers adopting Chainlink following the signing of the GENIUS Act • @SergeyNazarov's

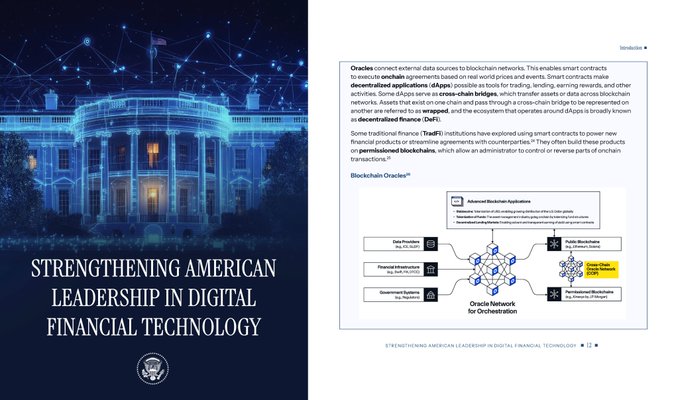

TODAY: The White House has featured oracles as a key technology in its new Digital Asset Report, highlighting how Chainlink is critical infrastructure for powering stablecoins, tokenized funds, & the onchain economy. whitehouse.gov/wp-content/upl… We and our entire industry are

For stablecoins to achieve mainstream adoption, their collateral backing must be verifiable. Find out how Chainlink Proof of Reserve increases consumer confidence in stablecoins by providing up-to-date information on their mark-to-market value. blog.chain.link/platform-for-s…

⬡ Chainlink Adoption Update ⬡ This week, there were 16 integrations of the Chainlink standard across 7 services and 15 different chains: Abstract, Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Lisk, Metal L2, Mint, Optimism, Plume, Polygon, Solana, Soneium, and Taiko Hekla.

Chainlink Wins in Q2, 2025: blog.chain.link/quarterly-revi… • Launch of the Chainlink Reserve, a strategic LINK reserve supported by offchain and onchain revenue. • Mastercard and Kinexys by J.P. Morgan leverage Chainlink to innovate onchain, such as to connect billions of existing

Problem: Data and value must move seamlessly together across blockchains and legacy systems to maximize efficiency and liquidity. Solution: The Chainlink interoperability standard.

Problem: Most onchain financial transactions cannot take place without data. Solution: The Chainlink data standard.

Chainlink Automated Compliance Engine (ACE) is solving one of the biggest barriers to institutional blockchain adoption—onchain compliance at scale. In this technical overview, learn more about the technology and use cases underpinning Chainlink ACE ↓ blog.chain.link/automated-comp…

YieldFi has upgraded to Chainlink CCIP & is using the CCT standard for yUSD—its $200M+ market cap stablecoin—across @arbitrum, @base, @ethereum, & @Optimism. In addition, @GetYieldFi has adopted Chainlink Price Feeds to support secure markets around yUSD.

YieldFi has upgraded from LayerZero to @Chainlink CCIP with yUSD now exclusively bridged via CCIP. Enabling secure, seamless cross-chain transfers! A short thread🧵👇

Tomorrow, @SergeyNazarov joins @BlackRock's Joseph Chalom in a fireside chat at Digital Assets Week New York to discuss: • The acceleration of tokenized asset adoption • How traditional finance and DeFi are converging • The future of the digital asset industry And much more.

“This is a massive unlock for the compliance industry.” @SergeyNazarov explains how the Chainlink Automated Compliance Engine creates reusable compliance credentials built on a common technical standard ↓

Chainlink and oracles are key technologies, according to the new @WhiteHouse Digital Asset Report. From kickstarting DeFi with data to now underpinning advanced apps that interact across chains and enterprise systems, Chainlink provides the critical services for onchain finance

Chainlink is powering the next wave of stablecoin growth unlocked by the GENIUS Act. Insights from @AltcoinDaily ↓

ICE Partners with Chainlink to Bring Forex and Metals Data Onchain

Intercontinental Exchange (ICE), operator of the New York Stock Exchange, is collaborating with Chainlink to provide forex and precious metals data onchain through Chainlink Data Streams. Key points: - ICE's Consolidated Feed covers 300+ global exchanges - Data includes institutional-grade FX rates and precious metals prices - Partnership aims to meet traditional capital market standards - Supports growing demand for tokenized real-world assets This follows Chainlink's recent launch of U.S. equities & ETF data streams across 37 blockchain networks, further bridging traditional finance with decentralized markets.

Chainlink Video Update - August 2025

Chainlink has released its latest video update showcasing network developments and ecosystem growth. Key highlights include: - New integrations with major DeFi protocols - Enhanced cross-chain interoperability features - Updates to the oracle network infrastructure This marks the third video update in the series, following releases in January 2025 and November 2024, demonstrating consistent progress in network development. The video provides technical insights into Chainlink's expanding role in connecting real-world data to blockchain applications. *View the complete update here* [Chainlink Video Update](link-to-video)

Chainlink Powers DREX Trade Finance and Launches Strategic Reserve

**Major Banking Integration:** - Chainlink partners with Banco Inter (34M+ customers), Microsoft, and 7COMM for Brazil's DREX initiative - Solution enables cross-border trade finance using CCIP to connect Brazil's CBDC with foreign central banks - System facilitates tokenized settlement of agricultural exports **Strategic Reserve Launch:** - New Chainlink Reserve implemented as Ethereum smart contract - Payment Abstraction system now supports both onchain and offchain payment conversion to LINK - Public analytics dashboard available at [metrics.chain.link/reserve](https://metrics.chain.link/reserve) *This development marks significant progress in institutional blockchain adoption and Chainlink's economic model.*

Chainlink Updates Institutional Tokenization Milestones

Chainlink has released an updated compilation of their major institutional tokenization partnerships and achievements. The comprehensive overview showcases collaborations with leading financial institutions: - **Key Partners**: Apex Group, Coinbase, and Maple - **Focus Area**: Real-World Asset (RWA) tokenization - **Documentation**: All milestones and announcements consolidated in one resource For detailed information, visit the [official Chainlink blog](https://blog.chain.link/chainlink-institutional-tokenization-announcements/). This update reflects Chainlink's ongoing efforts to bridge traditional finance with blockchain technology.