Chainlink Proof of Reserve: Enhancing Transparency in Crypto Markets

Chainlink Proof of Reserve: Enhancing Transparency in Crypto Markets

🔗 Chainlink's game-changing move

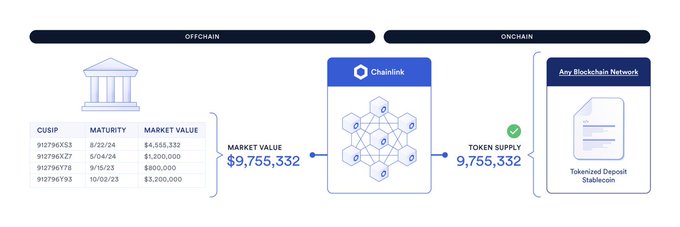

Chainlink's Proof of Reserve (PoR) is making waves in the crypto market by introducing end-to-end transparency for offchain and cross-chain reserves. Key features include:

- Unmatched security and verifiability

- Near real-time data aggregation

- Blockchain-agnostic design

- Synchronization of offchain assets and onchain liabilities

PoR is gaining traction:

- Bedrock DeFi integrated PoR after a $2M security exploit

- ARK Invest and 21Shares use PoR for their Bitcoin and Ethereum ETFs

- 21co integrated PoR for its wrapped Bitcoin product on Ethereum and Solana

Benefits for crypto ETF issuers:

1. Programmability 2. Decentralization 3. Transparency

PoR is crucial in connecting offchain and onchain markets, potentially solving financial market fragmentation.

#Chainlink Proof of Reserve accelerates stablecoin adoption in capital markets via three distinct components: • Secure, near real-time data aggregation • Blockchain-agnostic design • Synchronization of offchain assets and onchain liabilities blog.chain.link/chainlink-proo…

The approval of spot Bitcoin and Ethereum ETFs this year highlights the need for crypto ETF issuers to bring reserves data onchain in a secure & reliable manner. How #Chainlink Proof of Reserve (PoR) supports the transparency and adoption of crypto ETFs 🧵

Following @Bedrock_DeFi’s $2M security exploit today, the restaking protocol is integrating #Chainlink Proof of Reserve (PoR). Chainlink’s industry-standard PoR will help secure Bedrock’s minting function to mitigate future security exploits. mirror.xyz/0xF3c0C25090ae…

🪙 Chainlink Targets $35 Trillion Gold Market Through Tokenization Infrastructure

Chainlink is positioning its platform to enable tokenization of the world's largest physical store of value: gold, valued at approximately $35 trillion. **Key Infrastructure Components:** - Reliable data feeds - Cross-chain interoperability - Compliance frameworks - Privacy features The platform argues that while gold represents Earth's largest physical store of value, most of it remains economically idle. Tokenization could unlock this value, but requires robust technical infrastructure. Chainlink's recent developments support this vision: - Launch of 24/5 U.S. Equities Streams for the $80 trillion equities market - Chainlink Runtime Environment (CRE) for institutional-grade smart contracts - Privacy standard enabling confidential transactions - Integration with 8+ platforms including BitMEX and Orderly Network The announcement comes as tokenized gold currently represents only $1.4 billion of the total market, suggesting significant growth potential for blockchain-based gold products.

Bitwise CIO Names Chainlink Among Crypto's Mount Rushmore

Matt Hougan, Chief Investment Officer at Bitwise Invest, has publicly stated that Chainlink belongs on the "Mount Rushmore of crypto assets." This endorsement from a major institutional investment firm highlights Chainlink's position as one of the most significant projects in the cryptocurrency space, alongside Bitcoin and Ethereum. **Key Points:** - Bitwise CIO recognizes Chainlink as a foundational crypto asset - Statement reinforces Chainlink's role in connecting blockchains to real-world data - Institutional validation continues to grow for oracle infrastructure The comparison to Mount Rushmore suggests Hougan views Chainlink as one of the essential, enduring pillars of the crypto ecosystem.

🔗 Chainlink Reserve Grows

The Chainlink Reserve accumulated 99,103.22 LINK tokens on January 29, 2026, bringing its total holdings to **1,774,215.90 LINK**. The reserve supports the long-term growth and sustainability of the Chainlink Network by: - Accumulating LINK from offchain revenue generated by large enterprise adoption - Collecting onchain revenue from network service usage This represents continued growth in the reserve's holdings, which have increased from 973,752.70 LINK in December 2025. [Learn more about the Chainlink Reserve](https://reserve.chain.link)

Banks Turn to Blockchain to Fix Coordination Problems

Modern banking faces significant coordination challenges that create costly inefficiencies across the financial system. Blockchain technology is proving to be a more effective execution and coordination layer for financial institutions. **Key improvements blockchain brings to banking:** - Streamlined payment processing - Faster settlement times - Enhanced compliance mechanisms - Reduced operational friction Real-world adoption is already underway as banks recognize blockchain's potential to address longstanding infrastructure limitations. The technology offers a practical solution to coordination problems that have plagued traditional banking systems, particularly in cross-border transactions where inefficiencies are most pronounced. This shift represents a pragmatic evolution in financial infrastructure rather than a revolutionary overhaul, with institutions gradually integrating blockchain capabilities into existing operations. [Read the full analysis](https://blog.chain.link/banks-and-blockchain/)

OKX's X Layer Highlights Chainlink Integration for Infrastructure Security

**X Layer**, the Layer 2 solution from cryptocurrency exchange OKX, has publicly emphasized its partnership with Chainlink as a cornerstone of its security infrastructure. In a recent statement, X Layer representatives noted that working with Chainlink enables them to confidently claim highly secure infrastructure. This endorsement underscores the growing importance of reliable oracle networks in Layer 2 scaling solutions. **Key Points:** - X Layer integrates Chainlink to enhance infrastructure security - The partnership reflects broader industry recognition of oracle reliability - Secure data feeds remain critical for L2 ecosystem development The statement aligns with Chainlink's positioning as essential infrastructure for blockchain applications requiring off-chain data connectivity.