Chainlink Proof of Reserve Enhances BTCFi Security Standards

Chainlink Proof of Reserve Enhances BTCFi Security Standards

🔐 BTCFi's New Guardian

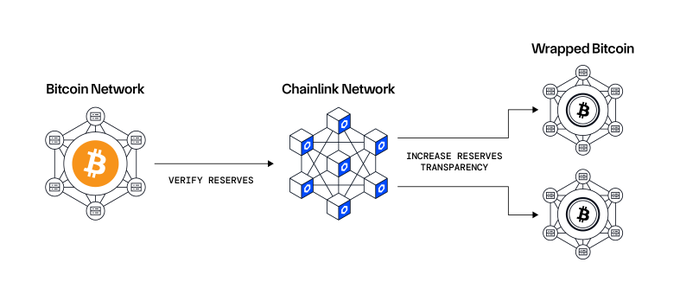

Chainlink's Proof of Reserve is emerging as a crucial tool for BTCFi security and transparency standards. The system provides real-time verification of wrapped Bitcoin product reserves.

Notable implementation includes Coinbase's integration for verifying $4.6B+ worth of cbBTC reserves across Base and Ethereum networks.

- Real-time reserve verification

- Enhanced transparency standards

- Cross-chain implementation

- Automated reserve tracking

Verification feeds available on:

Establishing security and transparency standards is key to the success of BTCFi. Chainlink Proof of Reserve can elevate security and transparency for any wrapped Bitcoin product by delivering real-time verification of asset reserves. BTCFi scales with Chainlink.

Chainlink Launches Automated Compliance Engine (ACE) for Institutional Adoption

Chainlink has launched its Automated Compliance Engine (ACE), a comprehensive framework designed to facilitate institutional adoption of blockchain technology. The system features: - Cross-Chain Identity Framework for managing investor credentials - Token Compliance Extension for integrating compliance into any token - Customizable Policy Manager for enforcing compliance rules - Identity Manager for credential management without storing sensitive data onchain - Monitoring tools for real-time compliance tracking The platform launched in partnership with Apex Group, GLEIF, and ERC3643 Association. According to Sergey Nazarov, this infrastructure could enable tokenized assets to outperform traditional financial instruments in efficiency and cost. [Learn more about ACE](https://blog.chain.link/automated-compliance-engine-technical-overview/)

Chainlink Weekly Integration Report

Chainlink reports 12 new integrations across 11 blockchain networks this week, including Arbitrum, Base, BNB Chain, Ethereum, HashKey Chain, HyperEVM, Optimism, Plume, Solana, Soneium, and WEMIX3.0. Notable integrations include: - Astar Network - Briky Capital - Euler Finance - HashKey Chain - HyperLend - OlympusDAO - Plume Network - Swapper Finance - SynFutures - Wemix Network These integrations continue to expand Chainlink's cross-chain infrastructure and oracle services across the blockchain ecosystem.

SynFutures Adopts Chainlink Data Standard on Base

SynFutures, a decentralized perpetual exchange, has integrated Chainlink's data infrastructure on the Base network. The platform, which handles over $67B in quarterly trading volume, now uses Chainlink Price Feeds to secure various markets including: - BTC - DEGEN - weETH - wstETH - XAU (Gold) The integration provides tamper-proof market data, enhancing security and reliability for traders. This marks significant growth from their earlier $20B trading volume milestone on Base.

Final Countdown: Chromion Hackathon Submission Requirements

The Chromion Hackathon submission deadline is approaching on June 29 at 11:59PM ET. Required submission components: - Publicly accessible source code - Clear project description with architecture details - 3-5 minute public demo video - README file with Chainlink integration links All submissions must include complete documentation and be publicly viewable. Ensure all components are ready before the final deadline.

Aave DAO Approves Phase 3 of Chainlink SVR Integration

The Aave DAO has unanimously approved Phase 3 of Chainlink SVR integration, expanding coverage to ~75% of Aave's total Ethereum TVS. Key updates: - SVR now covers all ETH-correlated assets and USDC - Represents ~95% of Aave's OEV-relevant TVS - Zero bad-debt accrual since launch - Successful liquidation of at-risk positions Remaining assets pending future vote due to unique mechanics. This expansion aims to eventually cover all Aave markets on Ethereum. [View proposal details](https://vote.onaave.com/proposal/?proposalId=330)