Chainlink Facilitates Cross-Chain Interoperability for Tokenized Assets

Chainlink Facilitates Cross-Chain Interoperability for Tokenized Assets

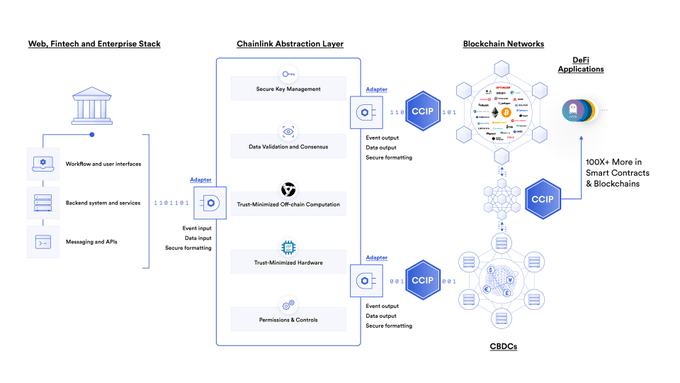

Chainlink provides the necessary tools for tokenized assets to gain liquidity by enabling cross-chain interoperability, verifying offchain reserves, providing mark-to-market valuations, and offering identity verification. Traditional financial institutions require data, compute, and cross-chain capabilities to adopt blockchain and tokenized assets, with Chainlink being the sole platform offering these features. The industry emphasizes the importance of cross-chain solutions, communication between traditional financial markets and blockchains, and the need for information networks and data sources to validate tokenized assets. Major financial institutions are already embracing tokenization, with collaborations involving Chainlink and other industry leaders in progress.

“The simplest way to enable interoperability is to use the same standards and underlying technologies across all platforms and ecosystems,” notes a recent industry report by Swiss Fintech Innovations, which references #Chainlink CCIP. Three key highlights from the report: 1.

“The industry is ready for tokenization.” At Sibos 2023, Chainlink Labs team members met with world-leading financial institutions. One insight from talking with industry leaders was that the financial system is ready for tokenization. Since the September event, there have

“ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset”—Larry Fink, CEO of @BlackRock on @CNBC.

You just issued your first tokenized asset on your own private blockchain—a good first step. However, you quickly realize that most buyers reside on other blockchains. Your tokenized asset will have low liquidity—unless it is cross-chain interoperable. Furthermore: • Buyers

Traditional financial institutions need data, compute, and cross-chain capabilities to adopt blockchains and tokenized #RWAs at scale. Only the Chainlink platform provides all three. blog.chain.link/tokenization-f…

🏦 Major Banks Join Chainlink's Web3 Infrastructure Push

**Chainlink announces massive institutional adoption** with over 50 major financial institutions integrating its blockchain infrastructure. **Key participants include:** - Payment networks: Swift, Mastercard - Major banks: UBS, J.P. Morgan, Citi, BNP Paribas - Asset managers: Fidelity, Franklin Templeton, Wellington Management - Market infrastructure: Euroclear, Clearstream, ICE - Central banks: Hong Kong, Singapore, Brazil monetary authorities The integration spans **traditional banking and capital markets**, connecting established financial systems to blockchain networks. This represents one of the largest institutional Web3 adoption announcements to date. **Regional coverage** extends across North America, Europe, Asia-Pacific, and Latin America, indicating global financial infrastructure transformation. Chainlink's oracle network enables these institutions to **securely connect** existing systems with blockchain applications, maintaining regulatory compliance while accessing Web3 capabilities.

Chainlink Defines Four Essential Requirements for Tokenized Assets

**Chainlink outlines four critical requirements** for tokenized assets to reach their full potential: - **Data-rich**: Assets must access key real-world information - **Compliant**: Meet regulatory and legal standards - **Interoperable**: Move securely across different blockchains - **Privacy-preserving**: Maintain data protection while staying updated cross-chain The message emphasizes that simply issuing tokenized assets isn't sufficient. **True utility requires comprehensive infrastructure** that connects blockchain systems to real-world data and enables seamless cross-chain functionality. This positioning reinforces Chainlink's role as essential infrastructure for the tokenized asset ecosystem, providing the connectivity needed between traditional systems and blockchain networks.

Chainlink Powers Major Financial Transformation Through Institutional Tokenization Platform

**Chainlink emerges as the central infrastructure** powering what's being called the largest financial transformation in decades through institutional tokenization. The oracle platform is enabling traditional financial institutions to tokenize securities and assets, with Europe's first regulated tokenized securities platform 21X highlighting Chainlink's critical role. **Key developments:** - Major financial institutions worldwide are integrating Chainlink's oracle technology - Platform connects traditional financial data and systems to blockchain networks - Enables advanced decentralized applications that bridge Web3 and traditional finance 21X CEO Max Heinzle emphasized that Chainlink's work with the world's largest financial institutions "could not be more at the forefront" of reshaping capital markets. The transformation represents a significant shift toward blockchain-based financial infrastructure, with Chainlink serving as the bridge between legacy systems and decentralized networks.

Major Financial Institutions Partner with Chainlink for Blockchain Integration

**Major financial institutions are partnering with Chainlink** to explore blockchain technology's role in transforming the global financial system. Seven of the world's largest financial institutions have joined Chainlink's #TheFutureIsOn series to discuss: - How blockchain tech is reshaping finance - Institutional adoption strategies - Real-world blockchain applications This collaboration signals **growing institutional interest** in blockchain infrastructure and decentralized oracle networks. [More insights available](https://on.chain.link/)

Banks Issue Stablecoins as Wall Street Tokenizes Assets

**Major financial institutions are accelerating their blockchain adoption** across multiple fronts: - **Banks are launching stablecoins** to compete in the digital currency space - **Wall Street firms are tokenizing traditional assets** like stocks, bonds, and real estate - **Government agencies in Washington D.C.** are developing regulatory frameworks for digital assets - **Capital markets infrastructure** is being rebuilt to support blockchain-based trading **Enterprise adoption is driving demand** for interoperable blockchain solutions that can connect traditional finance with decentralized systems. This represents a **fundamental shift** in how financial services operate, with established institutions embracing the technology they once viewed skeptically.