Ondo Finance Partners with Chainlink for Regulated Tokenized Stocks Platform

Ondo Finance Partners with Chainlink for Regulated Tokenized Stocks Platform

🤝 Ondo Chooses Chainlink

Ondo Finance has selected Chainlink as its official oracle infrastructure for its regulated tokenized stocks platform, marking a significant partnership in institutional DeFi.

Key Partnership Details:

- Chainlink CCIP becomes the preferred interoperability solution for financial institutions working with Ondo

- Ondo adopts Chainlink data standard for accurate, reliable market data pricing

- Chainlink joins the Ondo Global Market Alliance to support regulated tokenized stocks onchain

Technical Integration:

- Each Ondo Global Markets asset receives secure, real-time data through Chainlink's institutional-grade oracle infrastructure

- Chainlink feeds capture economic and corporate action events for real-time equity pricing

- Enables composability across lending protocols, structured products, and collateralized DeFi vaults

Market Impact: This collaboration aims to build next-generation onchain capital markets by combining:

- Real-time, onchain equity access

- Trusted data and interoperability for institutional DeFi

- Traditional finance liquidity with DeFi programmability

The partnership positions both companies to work jointly with major financial institutions, leveraging Ondo's tokenization capabilities and Chainlink's oracle infrastructure to bring trillions in assets onchain.

So far through Day 3 at @Sibos 2025, Chainlink has: • Announced Phase 2 of the global corporate actions initiative with 24 of the world’s largest institutions, including Swift, DTCC, and Euroclear. • Introduced the Digital Transfer Agent (DTA) technical standard to enable fund

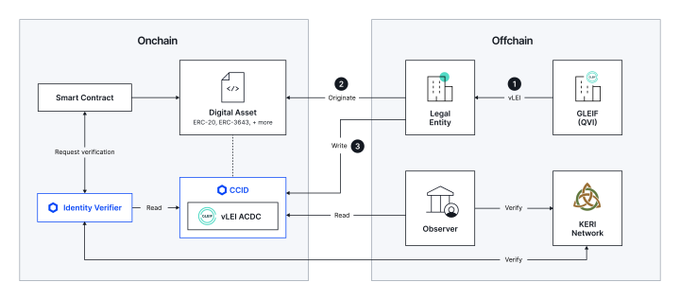

Scaling digital asset transactions relies on verifying which legal entities are involved, what they’re authorized to do, and proving it reliably across jurisdictions and blockchains. gleif.org/en/newsroom/bl… In this blog hosted by @GLEIF, Fernando Vázquez, President of Capital

"Chainlink has enabled over $24 trillion in U.S. dollars in transaction value ... that's only accelerating now with institutional adoption." @SergeyNazarov joined @theCUBE at the New York Stock Exchange to discuss how Chainlink is the infrastructure powering onchain finance ↓

"We've seen a new level of interest and commitment from financial institutions and financial market infrastructures in digital assets." At Sibos 2025, @SergeyNazarov joined @fintechf to discuss how Chainlink delivers the interoperability needed for major financial institutions

Modular, AI-driven layer-1 blockchain @0G_labs has integrated Chainlink CCIP as its canonical cross-chain infrastructure and made its $1.3B+ market cap native token 0G a Cross-Chain Token (CCT), enabling it to be natively transferable across chains via CCIP. 0G has also adopted

The Chainlink platform is being leveraged in @EmGemXofficial's framework for enabling tokenized emeralds onchain. Proof of Reserve is providing transparency into the collateralization of GEMx tokens, while CCIP enables them to be transferred across chains. GEMx's full report ↓

RWA Report: What if the rarest gemstones could move on chain like stablecoins? Our new report with @Chainlink, @Fireblocks, @ZodiaCustody, and @HackenClub shows how this vision becomes a reality. GEMx built a framework that brings physical emerald portfolios, stored in secure

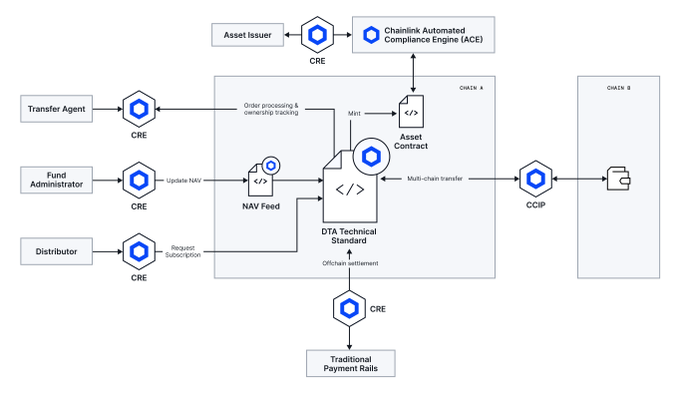

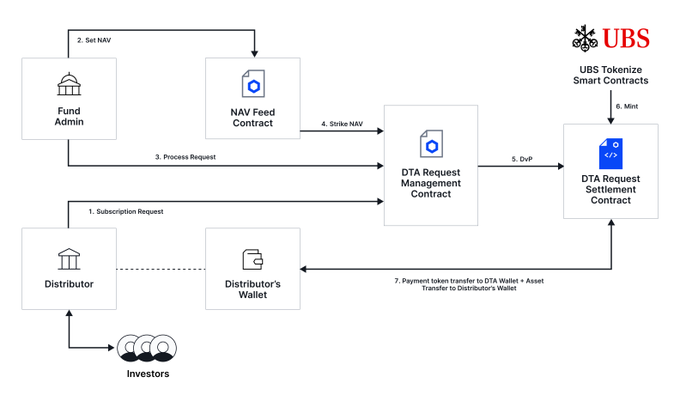

Architecture underpinning the future of fund management: ⬡ DTA technical standard ⬡ CCIP ⬡ ACE ⬡ NAVLink ⬡ CRE 5+ standards. 1 unified platform. Seamless orchestration.

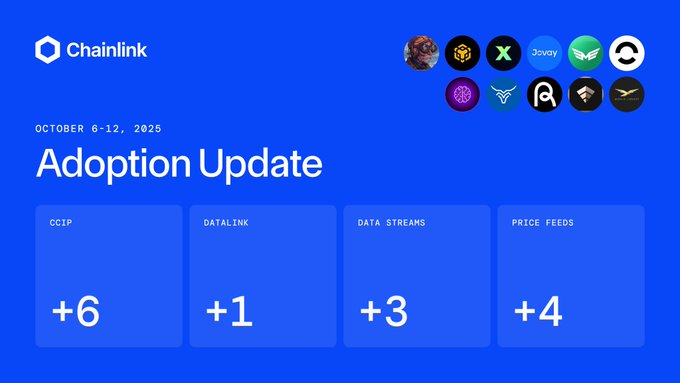

⬡ Chainlink Adoption Update ⬡ This week, there were 14 integrations of the Chainlink standard across 4 services and 11 different chains: Aptos, Arbitrum, Base, BNB Chain, Ethereum, Jovay, Plasma, Plume, Polygon, Sei, and Solana. New integrations include @AirlinezGame,

Chainlink Data Streams is officially live on @SeiNetwork as the preferred oracle infrastructure for the Sei ecosystem. blog.sei.io/chainlink-data… With Data Streams, Sei’s $1.2B TVL ecosystem gains access to institutional-grade, ultra-low-latency data—including U.S. government

At The Chainlink Forum in NYC, Sergey Nazarov and Swift's Tom Zschach discuss accelerating digital asset adoption with shared standards ↓

Watch Swift’s Chief Innovation Officer @TomZschach and @SergeyNazarov at The Chainlink Forum in NYC, where they discussed the importance of interoperability in capital markets, Swift and Chainlink’s long-standing collaboration to build the critical infrastructure for enabling

As a landmark moment for the global financial system and blockchain industry alike, Swift announced at Sibos 2025 it is launching a new blockchain-based ledger: swift.com/news-events/pr… We congratulate our partner Swift and the broader Swift community on adopting blockchains and

Chainlink had big news at Sibos. See everything here ↓ blog.chain.link/sibos-2025-rec…

Identity solutions are critical for institutions to move onchain. At Sibos 2025, @SergeyNazarov highlights how @GLEIF and Chainlink are adapting existing identity sources, like GLEIF’s LEI, to be compatible with onchain systems, enabling financial institutions to meet identity

Watch Swift’s Chief Innovation Officer @TomZschach and @SergeyNazarov at The Chainlink Forum in NYC, where they discussed the importance of interoperability in capital markets, Swift and Chainlink’s long-standing collaboration to build the critical infrastructure for enabling

Plasma (@plasma), a high-performance layer-1 blockchain purpose-built for stablecoins, with over $5.5B in stablecoin supply just one week after launch, is joining Chainlink Scale to enable Plasma developers to build next-gen stablecoin applications. prnewswire.com/news-releases/… With

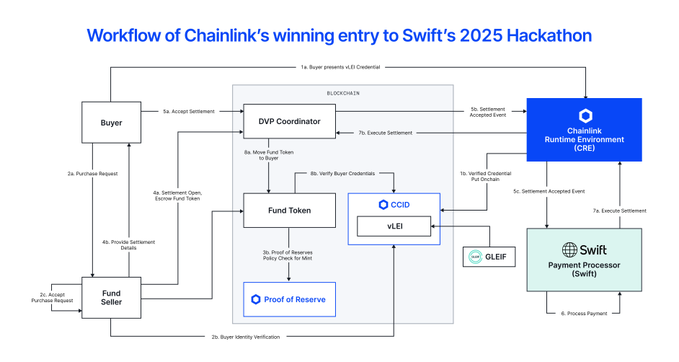

We’re excited to announce that Chainlink has been selected as the winner of the Swift (@swiftcommunity) Hackathon 2025 Business Challenge. blog.chain.link/chainlink-wins… A record-breaking 104 entrants made this Hackathon Swift’s largest yet, with premier financial institutions like

🏅 Congratulations to the winners of the 2025 Swift Hackathon, @chainlink and @DeutscheBank! Chainlink secured the Business Challenge title with a solution that combines its automated compliance standard with the trusted verifiable Legal Entity Identifier (vLEI) framework to

Universally trusted credentials that are reusable across blockchains and existing systems are critical to the mass adoption of digital assets. “Instant onboarding and secure, efficient compliance—all in one atomic transaction.” Chainlink Labs' Ryan Lovell joined @Sibos TV to

Chainlink is just Data Feeds.*

BNB Chain (@BNBCHAIN), one of the world’s largest blockchain ecosystems, backed by an active, global community of developers and users, has adopted the @chainlink data standard to make official U.S. Department of Commerce data available onchain. Sourced from the Bureau of

⬡ Chainlink Adoption Update ⬡ This week, there were 15 integrations of the Chainlink standard across 6 services and 9 different chains: Arbitrum, Avalanche, Base, Ethereum, Kaia, Monad, Polygon, Solana, and Taiko. New integrations include @AethirCloud, @avantprotocol,

Chainlink Wins in Q3, 2025: blog.chain.link/quarterly-revi… • Partnered with the U.S. Department of Commerce to bring government macroeconomic data onchain for the first time. • Adopted by leading financial institutions for a variety of tokenized finance use cases, including Swift,

Deutsche Börse Group is bringing its real-time, multi-asset class market data to blockchains using Chainlink's newly launched DataLink 🧵⬇️

We’re excited to announce that Deutsche Börse Market Data + Services has formed a strategic partnership with Chainlink to publish its market data onchain for the first time. prnewswire.com/news-releases/… Real-time data from the largest exchanges in Europe, Deutsche Börse Group’s

⬡ Chainlink Adoption Update ⬡ This week, there were 20 integrations of the Chainlink standard across 6 services and 8 different chains: 0G, Arbitrum, BNB Chain, Canton Network, Ethereum, Plasma, Solana, and World Chain. New integrations include @0G_labs, @aave, @blupryntco,

Chainlink Data Streams is officially live on MegaETH as a first-of-its-kind, native real-time oracle solution integrated directly within its execution environment to power next-generation DeFi markets. megaeth.com/blog-news/mega… @megaeth_labs is leveraging Data Streams to build

Introducing Native, Real-Time Data Streams. Built in collaboration with @chainlink. A first-of-its kind integration combining the security of traditional onchain oracles with the immediacy of streaming data.

Data. Interoperability. Compliance. Privacy. Orchestration. Legacy System Integration. @SergeyNazarov explains how Chainlink has evolved into an all-in-one oracle platform for orchestrating enterprise smart contracts across different chains, systems, and data.

THE CHAINLINK ENDGAME The updated Chainlink vision is here. What started as a data solution is now an extensive platform of essential services for integrating the world into the onchain economy ⬇️ blog.chain.link/chainlink-orac… What TCP/IP did for the Internet and the Java Runtime

THE CHAINLINK ENDGAME The updated Chainlink vision is here. What started as a data solution is now an extensive platform of essential services for integrating the world into the onchain economy ⬇️ blog.chain.link/chainlink-orac… What TCP/IP did for the Internet and the Java Runtime

We’re excited to announce a strategic partnership between Chainlink and SBI Group one of Japan’s largest financial conglomerates with the USD equivalent of over $200 billion in total assets. prnewswire.com/news-releases/… SBI Group and Chainlink will focus on powering several

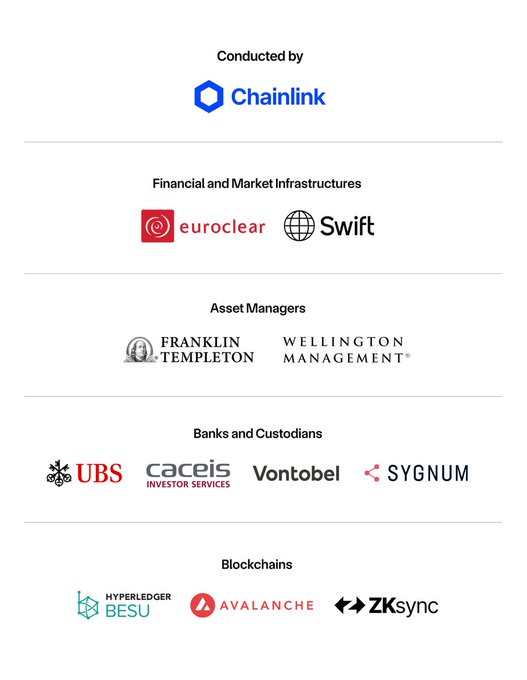

Expanding scope, expanding impact. More to come. Phase 1 (2024): Chainlink, Euroclear, Swift, UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel, and Sygnum Bank. Phase 2 (2025): Chainlink, Swift, DTCC, Euroclear, SIX, TMX, CEVALDOM, Grupo BMV, ADDX, Orbix

Regulated digital asset platform @ChintaiNetwork & Chainlink have collaborated to empower institutions to originate compliant & secure assets onchain. Chintai has also adopted the Chainlink interoperability standard, making CHEX a Cross-Chain Token (CCT), enabling it to be

"This is the year of digital assets." On Global Custodian, @SergeyNazarov and Kelli West, Head of Securities at Swift, discuss the increased excitement around digital assets at this year's Sibos ↓

Chainlink has hit a new all-time high in Total Value Secured (TVS), reaching $93+ billion across hundreds of DeFi protocols. Chainlink: The standard for onchain finance.

• Swift: Processes a volume of transactions equivalent to the world's Gross Domestic Product (GDP) approximately every three days. • DTCC: Clears up to $3.7 quadrillion in transactions per year as the primary central clearing and settlement infrastructure for U.S. securities.

We are excited to announce a major industry milestone in a global corporate actions initiative led by Chainlink in collaboration with 24 of the world’s largest financial organizations, including Swift (@swiftcommunity), DTCC (@The_DTCC), and Euroclear (@EuroclearGroup).

Layer 2 @JovayNetwork is adopting Chainlink CCIP as its canonical cross-chain infrastructure live from day one. Jovay also adopted Chainlink Data Streams, enabling its ecosystem developers to build institutional-grade tokenized asset markets powered by highly secure, low-latency

After joining industry leaders at the @federalreserve, today @SergeyNazarov met back-to-back with key Senate Democrats and Republicans on Capitol Hill to advance U.S. market structure legislation for digital assets. Across the meetings, Sergey’s message was consistent:

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 4 services and 6 different chains: Aptos, Base, Bitlayer, Ethereum, Polygon, and Sei. New integrations include @AicroStrategy, @Aptos, @BitlayerLabs, @Polymarket, @SeiNetwork,

Chainlink’s industry initiative with DTCC, Swift, and 22 leading financial organizations enables the creation of unified golden records for corporate action events across both blockchain networks and global financial infrastructure. All powered by the Chainlink platform.

NEW: @SergeyNazarov on stage with Kinexys by @jpmorgan’s Nelli Zaltsman & @OndoFinance’s Ian De Bode at @SALTConference. Full discussion below ↓

Chainlink will be at @Sibos 2025. Connect with @chainlinklabs at Stand I016 & attend speaking sessions with Chainlink leaders on: • The Future of Digital Assets in the Capital Markets | Chainlink, DTCC • Going from POCs to Production: Unlocking the Full Potential of Tokenized

Think of a global company ID system like a digital passport for businesses. Now through a partnership between Chainlink and @GLEIF, one of the largest and most trusted global databases for company IDs with more than 3 million total LEI records is coming to blockchains.

✅ Seamless fiat & digital asset settlement ✅ Real-time subscription & redemptions ✅ Transparent, auditable records ✅ Programmable compliance The Chainlink Digital Transfer Agent (DTA) technical standard establishes a global framework for the future of tokenized funds.

Today, @SergeyNazarov spoke at the Payments Innovation Conference hosted by the @federalreserve, discussing how TradFi is connecting to the DeFi ecosystem. Watch the full video with Sergey and key industry leaders from @BNYGlobal, @FireblocksHQ, and @Lead_Bank ↓

See what leaders from Chainlink, DTCC, Euroclear, and Wellington Management are saying about Chainlink's major industry initiative to solve the $58 billion annual corporate actions problem ↓

Fernando Vazquez, President of Capital Markets at Chainlink Labs, joined J.P. Morgan and State Street on @globalcustodian's day-two @Sibos panel to explore: • Modernizing financial infrastructure via blockchain technology • Building cross-system connectivity for tokenized

“Regulators are saying 'I want tokenization to be able to happen in the U.S.’” @SergeyNazarov shares key takeaways from his meeting with SEC Chairman Paul Atkins on @TheStreet, including how Chainlink is working with regulators to accelerate adoption ↓

EXCLUSIVE: SEC now sees crypto as a source of economic progress, says @chainlink co-founder @SergeyNazarov. Interview by @alpGasimov thestreet.com/crypto/policy/…

Chainlink will be at @token2049 in Singapore. Connect with the @chainlinklabs team, hear from Chainlink Labs CBO @EidJohann, and explore the convergence of TradFi and DeFi with industry leaders during exclusive meetups and networking sessions. Register now ↓

Chainlink was highlighted in a new research report by KernelDAO (@kernel_dao) in collaboration with the Ethereum Foundation (@Ethereumfndn) Enterprise. Chainlink provides the institutional-grade infra that stablecoins require to meet the security, auditability, interoperability,

The internet made everything on demand, from information to money. The next challenge: liquidity and credit. Global payments move $220T+ annually, yet trillions sit idle in pre-funded accounts. Stablecoins solved speed, not liquidity. Introducing Kred: The Internet of Credit.

Chainlink Data Streams is now live on @taikoxyz as its official oracle infrastructure to supercharge its DeFi ecosystem. Taiko Alethia is a based rollup, where Ethereum L1 validators handle sequencing to ensure decentralization & censorship-resistance. taiko.mirror.xyz/s45LBZf_0OwIRc…

“Now you have reliable offchain systems, and you have reliable onchain systems, and they are working together through this great partnership.” On @Sibos TV, @SergeyNazarov discussed how Chainlink’s partnership with Swift is powering the next phase of institutional adoption and

Intercontinental Exchange, a leading market infrastructure whose markets cleared a record 1.2 billion futures & options contracts in the first half of 2025, is bringing high-quality FX and precious metals data onchain through Chainlink. It's just one example of how the largest

We’re excited to announce that Intercontinental Exchange (@ICE_Markets) and Chainlink are collaborating to allow Chainlink to now bring high-quality derived forex and precious metals data onchain. prnewswire.com/news-releases/… ICE is a global financial powerhouse that operates

"The Chainlink Reserve is able to happen because there's now a positive environment towards crypto companies doing more innovative things." @SergeyNazarov joined @AltcoinDaily and explained what unlocked the launch of the Chainlink Reserve ↓

Leading line of tokenized stocks and ETFs, @xStocksFi, is expanding its adoption of Chainlink CCIP and Proof of Reserve across BNB Chain, Ethereum, Solana, and more. Via the Chainlink data and interoperability standards, @BackedFi’s xStocks enhances reserve transparency and

Today, @SergeyNazarov was featured on @Visa’s Tokenized podcast: • Chainlink’s work with Intercontinental Exchange (ICE) • How policy changes are driving institutional adoption • How Chainlink is unlocking cross-border transactions for ANZ and Fidelity International And much

🚨 Ep. 44 of @TokenizedPod: Stablecoin Chains - The Future of Payments? @sytaylor & @cuysheffield are joined by: ➡️ @SergeyNazarov, CEO @chainlink To discuss: ⛓️ Chainlink's role as an Oracle platform for smart contracts 💸 Programmable money and the advantages of smart

"Tens of trillions of dollars in liquidity merged into a single global Internet of Contracts." @SergeyNazarov explains how the Chainlink set of standards reduces transaction complexity by up to 90%, making it critical to enabling the flow of institutional capital into DeFi ↓

Restaking protocol with $1.6+ billion in TVL, @kernel_dao, has selected Chainlink as its official oracle provider for data and interoperability. KernalDAO is integrating the Cross-Chain Token (CCT) standard for Kred and its newly launched KUSD stablecoin, making the tokens

Now publishing financial data to the onchain economy via DataLink: Xetra—One of the largest trading platforms in Europe, with €230.8 billion in trading volume last year. Eurex—One of the world's largest derivatives exchanges, with 2.08 billion traded contracts in

The @federalreserve's Payments Innovation Conference is hosting @SergeyNazarov and key financial leaders from @BNYglobal, @FireblocksHQ, and @Lead_Bank to discuss how traditional finance and digital assets are converging. Full agenda: federalreserve.gov/conferences/pa…

The Chainlink data standard now supports XPL, the native token for the newly launched high-performance layer-1 blockchain, @PlasmaFDN. Start integrating the XPL/USD Data Stream to build highly secure, efficient DeFi markets for Plasma’s token across 40+ chains.

LIVE ON DAY ONE: Chainlink CCIP, Data Streams, and Data Feeds are now live on @PlasmaFDN, a high-performance layer-1 blockchain purpose-built for stablecoins. Chainlink everything.

BLOCKCHAIN EXPANSION UPDATE Recently, Chainlink services expanded across the following blockchains: CCIP • 0G • Aptos • Etherlink • Kaia • Plasma • TAC Data Streams • 0G • Jovay • Plasma • Sei • Taiko Data Feeds • Plasma

Following the major announcement with Chainlink and Intercontinental Exchange (@ICE_Markets), @SergeyNazarov joined @FintechTvGlobal on the floor of the New York Stock Exchange. Watch to find out what's next for global finance ↓

7 major announcements from Sibos 2025: 1. Chainlink, Swift, DTCC, Euroclear, & 21 institutions advance industry initiative to solve the $58B corporate actions problem. 2. Chainlink launches landmark solution for managing digital asset workflows from existing financial systems

We’re excited to share that Chainlink is now the industry’s first data and interoperability oracle platform to achieve ISO 27001 & SOC 2 compliance. This is a major step toward unlocking in-production use cases with the world’s largest financial institutions & governments.

We’re excited to announce that Deutsche Börse Market Data + Services has formed a strategic partnership with Chainlink to publish its market data onchain for the first time. prnewswire.com/news-releases/… Real-time data from the largest exchanges in Europe, Deutsche Börse Group’s

⬡ Chainlink Adoption Update ⬡ This week, there were 8 integrations of the Chainlink standard across 6 services and 4 different chains: Arbitrum, Base, Ethereum, and Polygon. New integrations include @aave, @AlloyX_Limited, @BasisOS, @DemetherDeFi, and @orange_web3. Explore

Cross-chain interoperability is about more than just data. It's about transferring data, value, or both at the same time across any blockchain. This unifies all onchain and offchain systems into one global economy. And that's just one pillar of the overall Chainlink stack.

Onchain standards + Existing standards/systems = The foundation of next-generation digital assets @SergeyNazarov explains at @Sibos 2025 how Chainlink is the global set of onchain standards for data, compliance, privacy, interoperability, and existing system connectivity ↓

⬡ Chainlink Adoption Update ⬡ This week, there were 10 integrations of the Chainlink standard across 5 services and 8 different chains: Aptos, Arbitrum, Avalanche, Base, Berachain, BNB Chain, Ethereum, and Solana. New integrations include @aave, @bitgetglobal, @EchoProtocol_,

⬡ Chainlink Adoption Update ⬡ There were 12 integrations of the Chainlink standard across 6 services and 10 different chains: Arbitrum, Avalanche, Base, BOB, Botanix, HyperCore, HyperEVM, Solana, Sonic, and World Chain. New integrations include @build_on_bob, @ChintaiNetwork,

"The whole global financial system … will be tokenized." @SergeyNazarov joined @coinbureau to discuss: • His recent meetings on Capitol Hill & market-structure legislation • How stablecoins & tokenization are reshaping global finance • Chainlink's work with the U.S.

🎙️NEW INTERVIEW🎙️ @nicrypto sat down with @chainlink co-founder @SergeyNazarov to reveal how tokenization takes everything on-chain. RWAs, stablecoins, gov data… #Chainlink leads the way. Watch now!👇 youtu.be/OGzUxM53E3E

At Sibos 2025, @SergeyNazarov explains how: ✅ Successful use of blockchain-based records to service digital assets... ➡️ Will prove the value of adopting these unified golden records in existing capital markets.

.@OndoFinance has selected Chainlink as the official oracle infrastructure powering its regulated tokenized stocks platform, establishing CCIP as the preferred interoperability solution for financial institutions collaborating with Ondo. prnewswire.com/news-releases/… In addition,

DataLink is now live across 40+ blockchains, giving over 2,400 protocols and institutions in the Chainlink ecosystem access to the high-quality market data that underpins traditional finance. blog.chain.link/introducing-da… With Deutsche Börse Market Data + Services as a launch

⬡ Chainlink Adoption Update ⬡ This week, there were 7 integrations of the Chainlink standard across 5 services and 6 different chains: Arbitrum, Base, BNB Chain, BOB, Ethereum, and Solana. New integrations include @Dexlab_official, @Flexperpetuals, @PublicAI_, @RiverdotInc,

"DataLink is the solution that allows institutional data providers to provide data to all the DeFi protocols and institutional use cases, with the security and reliability of the Chainlink standards' technology."

Chainlink 🤝 ISO 27001 compliance. Certification of Chainlink oracle services further validate them as enterprise-grade infrastructure suitable for real-world, in-production use cases with the largest financial institutions.

"The ability of trying to find a solution is really exciting ... we have been trying for decades to try to find a way to consolidate data, to automate the data... Blockchain, smart contracts, oracles have given us a better shot than we’ve ever had."—Nadine Chakar, Global Head of

“It’s inevitably going to become how everything works, and then there won't be a choice.” @SergeyNazarov joins @davidlin_TV to discuss why tokenization is reshaping global financial systems and how Chainlink is defining the standards powering this transformation ↓

LIVE ON DAY ONE: Chainlink CCIP, Data Streams, and Data Feeds are now live on @PlasmaFDN, a high-performance layer-1 blockchain purpose-built for stablecoins. Chainlink everything.

The new global financial system is here.

Chainlink Rewards Season 1 Launches November 11 with Nine Build Projects

Chainlink launches **Rewards Season 1** on November 11, introducing a new community engagement program for LINK stakers. **How it works:** - Eligible LINK stakers receive **Cubes** (non-transferable points) - Cubes can be allocated to preferred Build projects - Token rewards are claimed based on proportional Cube allocation **Key Timeline:** - **Nov 3:** Snapshot taken for Cube balances - **Nov 11-Dec 9:** Allocation period (Cubes expire after) - **Dec 16:** Claim period begins **Nine participating projects** include Dolomite, SpaceandTime, Brickken, Folks Finance, and others across AI, DeFi, gaming, and NFT verticals. The program builds on Season Genesis success, offering LINK stakers more choice in selecting rewards from Build program projects. **Security reminder:** Only use [rewards.chain.link](http://rewards.chain.link) - beware of phishing attempts.

🌉 Central Banks Bridge Continents

**Chainlink connects Brazil and Hong Kong central banks** in groundbreaking cross-border trade settlement. The Central Bank of Brazil and Hong Kong Monetary Authority completed the first automated workflow linking blockchain-based title registry with cross-chain payments. **Key participants:** - Standard Chartered ($800B+ assets) - Banco Inter (40M+ users) - Global Shipping Business Network - 7COMm technology provider **Technical breakthrough:** - Chainlink Runtime Environment enabled interoperability between Drex platform and Hong Kong Ensemble Network - CCIP synchronized contract execution across different networks - Automated electronic Bill of Lading transfers The solution enables conditional payments across digital currencies and tokenized reserves, translating messages into required formats like ISO 20022. *This marks a new standard for global trade settlement*, connecting previously isolated financial systems through a single automated workflow.

FTSE Russell Partners with Chainlink to Bring $18T+ Worth of Global Market Indices Onchain

**FTSE Russell**, a leading global index provider with over **$18 trillion in assets under management**, has partnered with Chainlink to publish major market indices onchain for the first time. The collaboration brings seven key indices to **40+ blockchains** via DataLink: - **Russell 1000, 2000, and 3000 indices** (covering 98% of investable U.S. equity market) - **FTSE 100 Index** (top UK companies) - **WMR FX benchmarks** (global currency rates) - **FTSE Digital Asset indices** (institutional-grade crypto benchmarks) **Key Impact:** This integration provides financial institutions access to the same trusted data they use in traditional markets, now available onchain. The move accelerates institutional adoption by eliminating infrastructure barriers. **DataLink** leverages Chainlink's proven oracle network to help institutions distribute data across blockchains while maintaining full control. The service already secures $100B+ in production value. This follows Deutsche Börse's recent partnership with Chainlink, signaling growing institutional interest in bringing traditional financial data onchain.

🔗 Cross-Chain Chaos

**Chainlink Build member xswap_link launched a token creation platform (TCP)** powered by Chainlink CCIP, enabling seamless cross-chain token creation on Base. The platform leverages **Chainlink's Cross-Chain Interoperability Protocol (CCIP)** as the interoperability standard, allowing developers to create tokens that work across multiple blockchain networks. This builds on xswap's previous integration of CCIP across seven major networks: - Arbitrum - Avalanche - Base - BNB Chain - Ethereum - Optimism - Polygon **Key benefits include:** - Secure cross-chain token transfers - Unified token creation experience - Multi-chain compatibility from launch The TCP represents another step toward **true blockchain interoperability**, making it easier for developers to build tokens that aren't confined to a single network.

Chainlink Integration Surge: 62 New Adopters Across 24 Blockchains

**Chainlink sees major adoption spike** with 62 new integrations this week, up from just 17 the previous week. **Key highlights:** - Expanded across **24 different blockchains** including Ethereum, Solana, Arbitrum, and Base - Notable new adopters include Euler Finance, Ondo Finance, Stellar, and TON blockchain - Services span **8 categories** from DeFi protocols to AI networks **Major protocols joining:** - @eulerfinance - lending protocol - @OndoFinance - institutional DeFi - @StellarOrg - payment network - @ton_blockchain - Telegram's blockchain The integration surge represents a **264% increase** from the prior week, signaling accelerating institutional adoption of Chainlink's oracle infrastructure. [Explore complete ecosystem](https://www.chainlinkecosystem.com/)