Chainlink Enables Global Asset Tokenization

Chainlink Enables Global Asset Tokenization

🔗 Wall Street Goes Crypto

Chainlink continues expansion with strategic partnerships and integrations across major platforms:

- Partnership with BX Digital & BX Swiss (Stuttgart Exchange Group) to bring securities pricing data onchain

- Integration with World Chain (Worldcoin) for cross-chain interoperability

- Multiple L2 adoptions including Sonic Labs (formerly Fantom) and BOB network

- GMX_SOL implementing Chainlink Data Streams for DeFi derivatives

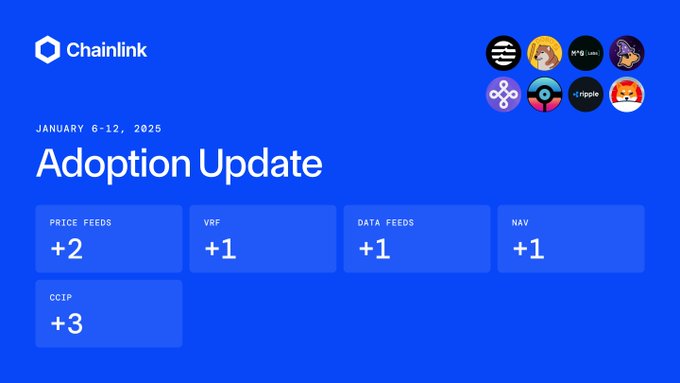

Recent metrics show:

- 14 new integrations across 7 services and 8 chains

- Growing adoption in banking and capital markets

- Expanding support for staking solutions via partnerships with Lido Finance

The platform aims to facilitate global asset tokenization through secure cross-chain infrastructure and reliable data feeds.

⬡ Chainlink Adoption Update ⬡ There were 8 integrations of the Chainlink standard across 5 services and 7 different chains: @Aptos, @arbitrum, @avax, @base, @ethereum, @plumenetwork, and @ShibariumNet. New integrations include Aptos, @Dobo_community, @m0labs, @Mage_Labs,

The Chainlink standard supports the development of feature-rich applications with highly secure, sub-second market data. Integrate the SCR/USD Data Streams feed on @base to build efficient DeFi markets around @Scroll_ZKP's token: data.chain.link/streams/scr-usd

New assets supported by the Chainlink standard for low-latency market data ↓ FXS - @fraxfinance LPT - @Livepeer ORDER - @OrderlyNetwork POLYX - @PolymeshNetwork SCR - @Scroll_ZKP TOKEN - @tokenfi TURBO - @TurboToadToken View more: data.chain.link/streams

.@Ripple has adopted the Chainlink standard to access highly secure & reliable pricing data around the recently launched Ripple USD (RLUSD) stablecoin. Learn how Chainlink Price Feeds are set to accelerate the adoption of RLUSD across the DeFi ecosystem:

.@Ripple x @Chainlink: $RLUSD has adopted the Chainlink standard for verifiable data to fuel DeFi adoption with real-time, secure pricing data. The future of stablecoins is here: ripple.com/ripple-press/r…

Chainlink Convergence Hackathon Opens Registration with Major Sponsors

The Chainlink Convergence hackathon is now accepting registrations, with sponsorship from Worldcoin, Tenderly, and thirdweb. The event focuses on building CRE-powered solutions for onchain finance. Developers can compete for prizes while creating applications that connect real-world data and systems to blockchain networks. **Key Details:** - Open to all builders and developers - Focus on Cross-Chain Interoperability Protocol (CCIP) solutions - Prizes available for winning projects - Registration: [chain.link/hackathon](https://chain.link/hackathon/?utm_medium=social&utm_source=twitter&utm_campaign=convergence-hackathon) The hackathon aims to advance practical applications in decentralized finance by leveraging Chainlink's infrastructure for connecting blockchains with external data sources.

Tessera Adopts Chainlink for Real-Time Private Equity Verification on Solana

Private equity tokenization platform Tessera has integrated Chainlink as its official oracle provider. The platform now uses **Chainlink Proof of Reserve** in production to verify off-chain holdings backing its tokenized private equity assets on Solana in real time. This integration allows Tessera to provide transparent, verifiable proof that its tokenized assets are properly backed by real-world holdings. The move follows a similar adoption by Crypto Finance in September 2025, which used Chainlink to verify assets for Bitcoin and Ethereum ETPs on Arbitrum. The integration demonstrates growing institutional adoption of oracle solutions for real-world asset tokenization, particularly in the private equity sector where transparency and verification are critical for investor confidence.

Ondo Finance Launches Tokenized Stocks for DeFi Integration

Ondo Finance has announced the **live adoption of tokenized stocks in DeFi**. This development allows blockchain-based financial applications to integrate traditional equity markets through tokenized representations of stocks. **Key Points:** - Tokenized stocks are now available for DeFi protocols - Builds on Ondo's previous work tokenizing BitGo stock during its IPO - Enables DeFi platforms to offer exposure to traditional equity markets This move bridges traditional finance and decentralized finance by bringing stock market access to blockchain platforms. The integration could expand DeFi's utility beyond crypto-native assets. Full details: [Ondo Finance Blog](https://ondo.finance/blog/defi-adoption-of-ondo-tokenized-stocks-live)

Ondo Finance Integrates Chainlink Oracles for Tokenized U.S. Equities on Ethereum DeFi

**Ondo Finance has adopted Chainlink as its official data oracle** to power its regulated tokenized stocks platform. This integration enables tokenized U.S. equities like QQQon and TSLAon to be used across Ethereum DeFi applications for the first time. **Key developments:** - Chainlink provides institutional-grade, real-time market data for Ondo's tokenized assets - Chainlink Cross-Chain Interoperability Protocol (CCIP) serves as the preferred solution for financial institutions working with Ondo - Chainlink has joined the Ondo Global Market Alliance The partnership aims to bridge traditional finance liquidity with DeFi programmability, enabling tokenized stocks to be used in lending protocols, structured products, and collateralized vaults with secure, reliable pricing data.

🔗 Robinhood Chain Testnet Goes Live with Chainlink Oracle Integration

Robinhood has launched its public testnet and selected Chainlink as the official oracle platform for Robinhood Chain. **Key Details:** - Developers can now access the testnet at [robinhood.com/chain](http://robinhood.com/chain) - Chainlink will provide data feeds, interoperability solutions, and compliance infrastructure - The integration enables builders to create tokenization applications on the platform This follows Robinhood's recent Stock Tokens launch on Arbitrum One and represents the next phase in their roadmap toward migrating to their own Arbitrum-based chain.