Chainlink CCIP Powers Cross-Chain Transfers for Helio Protocol and Beefy Finance

Chainlink CCIP Powers Cross-Chain Transfers for Helio Protocol and Beefy Finance

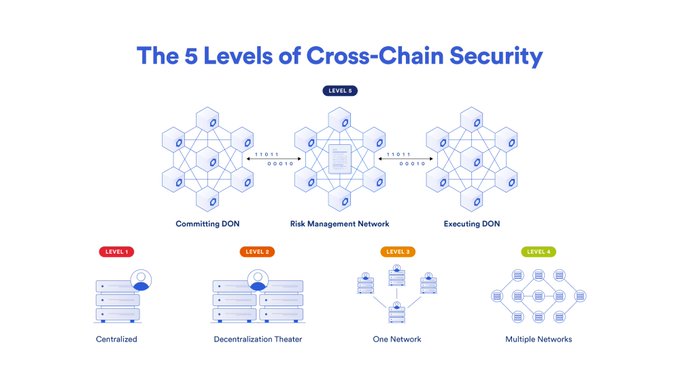

Helio Protocol is integrating Chainlink CCIP on Binance Chain and Ethereum to enable cross-chain transfers of its decentralized stablecoin. Beefy Finance chose Chainlink CCIP for its cross-chain solution, leveraging its industry-standard security and reliability. Chainlink CCIP powers cross-chain transfers for Beefy's token through a burn and mint mechanism, allowing users to securely take their BIFI tokens across different chains. CCIP offers level-5 security and a separate Risk Management Network. It enables easy expansion of cross-chain offerings while maintaining high standards of security. CCIP's architecture features multiple independent nodes and code bases, ensuring decentralized and robust cross-chain operations.

When selecting a cross-chain solution, @beefyfinance’s goal was to maintain the highest degree of decentralization while eliminating single points of failure. Chainlink CCIP’s industry-standard security and reliability made it the obvious choice. Why Beefy chose #CCIP👇

Chainlink #CCIP is the only cross-chain infrastructure that offers full-scale, level-5 security. Why is this unprecedented level of decentralization and risk management essential for building a cross-chain standard? A primer on the five levels of cross-chain security👇

.@Helio_Money is integrating #Chainlink CCIP on @BNBCHAIN and @ethereum to unlock cross-chain transfers of its decentralized stablecoin. Why Helio Protocol chose CCIP as its exclusive cross-chain solution ⬇️ medium.com/@Helio-HAY/hel…

CME Group Launches LINK and Micro LINK Futures Contracts

CME Group, the world's largest derivatives exchange, has announced the launch of LINK and Micro LINK futures contracts. This expansion follows CME's previous addition of XRP futures in April 2025, demonstrating continued institutional interest in cryptocurrency derivatives. The new futures products will allow institutional and retail traders to gain exposure to Chainlink's native token through regulated financial instruments. [Read the full announcement](<https://www.cmegroup.com/media-room/press-releases/2026/1/15/cme_group_to_expandcryptoderivativessuitewithlaunchofcardanochai.html>)

Swift and Chainlink Connect Tokenized Assets to Traditional Payment Systems

Swift, Chainlink, and UBS Asset Management have successfully demonstrated connecting tokenized assets to existing payment infrastructure. This milestone builds on an 8-year strategic partnership between Swift and Chainlink. The collaboration includes: - Working with 23 major financial institutions on corporate actions - Enabling traditional financial systems to interact with tokenized funds using Swift rails and ISO 20022 messages - Implementing the Chainlink Digital Transfer Agent (DTA) technical standard - Allowing banks to execute blockchain transactions through existing Swift messaging standards The project involved BNP Paribas, Intesa Sanpaolo, and Société Générale in achieving interoperability between traditional finance and blockchain systems. Read more: [Swift and Chainlink Partnership](https://blog.chain.link/the-swift-and-chainlink-partnership/)

Bitwise Co-Founder Discusses Institutional Adoption in Digital Asset Markets

Bitwise Co-Founder Hong Kim addresses the growing institutional presence in digital asset markets and the challenges of scaling to meet mainstream demand. **Key Points:** - Institutional investors are increasingly entering the crypto space - Focus on infrastructure needed to scale digital asset markets - Discussion centers on meeting the demands of traditional finance players The conversation highlights the ongoing maturation of the crypto industry as it adapts to serve institutional clients with more sophisticated needs and expectations.

Sergey Nazarov Outlines Chainlink's Path to Trillion-Dollar Tokenization

Chainlink co-founder Sergey Nazarov shared his vision for the protocol's growth in 2026, focusing on three key areas: - **Scaling tokenization** to reach trillions in value - **Accelerating adoption** across the blockchain ecosystem - **Advancing the industry** to its next phase of development Chainlink previously enabled DeFi to grow beyond $200 billion and is now positioning itself to power the next wave of onchain finance at a much larger scale.

Bitwise Highlights Chainlink's Role as Critical Infrastructure for Prediction Markets

**Bitwise emphasized Chainlink's essential role in prediction markets during a Bloomberg appearance.** The asset management firm highlighted how Chainlink serves as critical infrastructure enabling prediction markets to function reliably on blockchain networks. **Key points:** - Chainlink provides the data connectivity layer that prediction markets depend on - The infrastructure connects real-world information to blockchain-based prediction platforms - This validation from a major asset manager underscores Chainlink's growing importance in DeFi applications Prediction markets require accurate, tamper-proof data feeds to settle outcomes fairly. Chainlink's oracle network addresses this need by securely bridging off-chain data with on-chain smart contracts. The recognition from Bitwise on a mainstream financial platform like Bloomberg signals increasing institutional awareness of blockchain infrastructure providers.