Chainlink Adds 9 New Integrations Across 4 Blockchains

Chainlink Adds 9 New Integrations Across 4 Blockchains

🔗 Chainlink's Latest Moves

Chainlink expanded its reach this week with 9 new integrations spanning 5 services across 4 blockchain networks.

Networks involved:

- BNB Chain

- Ethereum

- Monad

- ZKsync

New protocol integrations include:

- @ampli_inc

- @HoldstationW

- @monad

- @perpltrade

- @stakedotlink

- @ThenaFi

This follows recent strong adoption momentum, with Chainlink seeing 52 integrations just two weeks prior across 15 different chains. The oracle network continues expanding its infrastructure to support cross-chain applications with reliable data feeds.

Explore the complete ecosystem at chainlinkecosystem.com

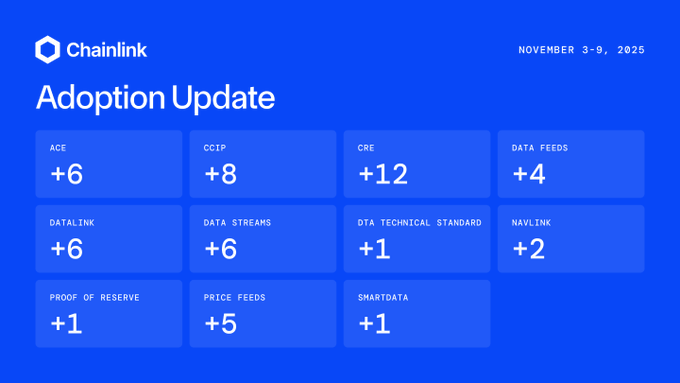

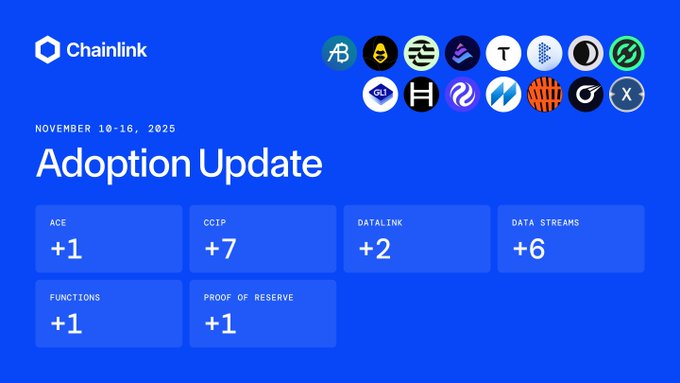

⬡ Chainlink Adoption Update ⬡ This week, there were 17 integrations of the Chainlink standard across 6 services and 11 different chains: Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Linea, MegaETH, Memento, Plasma, Solana, TAC. New integrations include @balconytech,

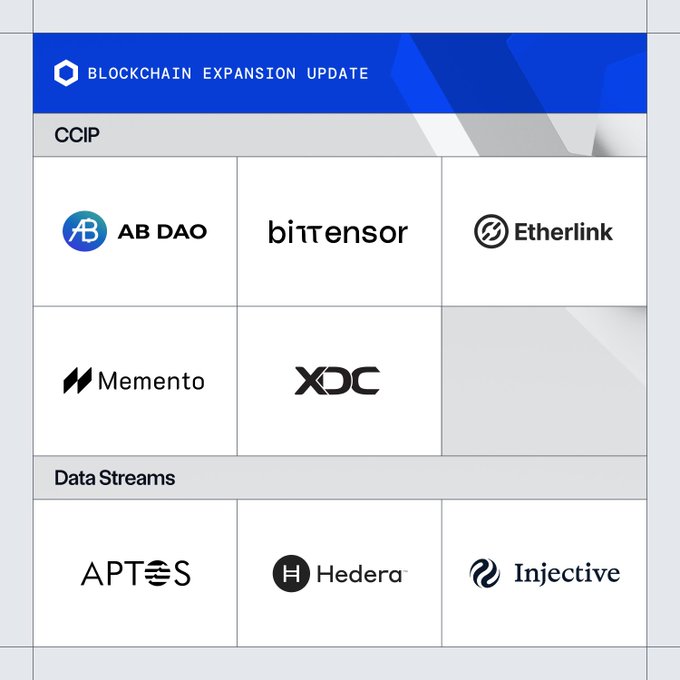

BLOCKCHAIN EXPANSION UPDATE This week, Chainlink services expanded across the following blockchains: CCIP • AB Blockchain • Bittensor • Etherlink • Memento • XDC Data Streams • Aptos • Hedera • Injective EVM

⬡ Chainlink Adoption Update ⬡ This week, there were 9 integrations of the Chainlink standard across 5 services and 4 different chains: BNB Chain, Ethereum, Monad, and ZKsync. New integrations include @ampli_inc, @HoldstationW, @monad, @perpltrade, @stakedotlink, and @ThenaFi.

⬡ Chainlink Adoption Update ⬡ This week, there were 14 integrations of the Chainlink standard across 5 services and 11 different chains: Aptos, Arbitrum, Avalanche, Base, Bitcoin, Bittensor EVM, ChaosChain, HyperEVM, Injective EVM, Solana, and Tron. New integrations include

⬡ Chainlink Adoption Update ⬡ This week, there were 52 integrations of the Chainlink standard across 11 services and 15 different chains: 0G, Aptos, Arbitrum, Avalanche, Base, BNB Chain, Ethereum, HyperCore, HyperEVM, Ink, Monad, Plasma, Ronin, Sei, and X Layer. New

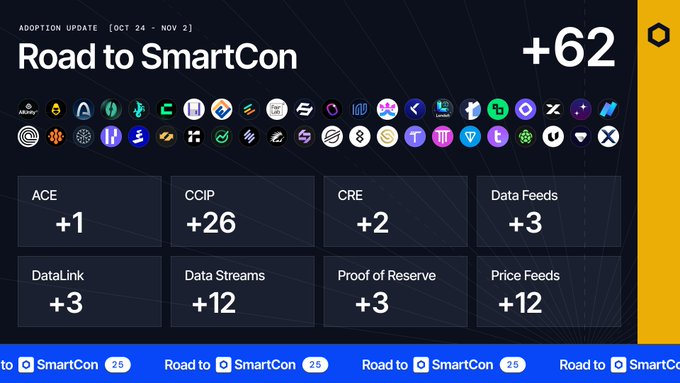

⬡ Chainlink Adoption Update ⬡ This week, there were 62 integrations of the Chainlink standard across 8 services and 24 different chains: Arbitrum, Arc, Avalanche, Base, Berachain, BNB Chain, Canton Network, Corn, Ethereum, Etherlink, Katana, Linea, Mantle, Monad, opBNB,

Chainlink CCIP, Data Streams, & Price Feeds are live on @monad mainnet from Day 1. 15+ DeFi protocols across the Monad ecosystem are already integrating Chainlink services at launch to build secure, cross-chain apps with reliable, low-latency data powered by Chainlink.

⬡ Chainlink Adoption Update ⬡ This week, there were 18 integrations of the Chainlink standard across 6 services and 15 different chains: AB Blockchain, Aptos, Arbitrum, Base, Bittensor, BNB Chain, Dusk, Ethereum, Etherlink, Hedera, Injective EVM, Mantle, Memento, Optimism, and

Coinbase Wrapped Bitcoin (cbBTC) Coming to Monad Network

Monad has announced that **Coinbase Wrapped Bitcoin (cbBTC)** will be integrated into its network. This integration will bring Bitcoin liquidity to Monad's high-performance blockchain ecosystem. The move expands the utility of cbBTC beyond Ethereum and other chains where it currently operates, allowing users to leverage Bitcoin in Monad's decentralized applications. For complete details on the integration timeline and technical specifications, visit the official announcement at [Monad's blog](https://blog.monad.xyz/blog/cbbtc-to-monad). This follows Monad's recent partnership with Ankr for RPC infrastructure support, continuing the network's ecosystem expansion ahead of its mainnet launch.

Chainlink Bridges $5B+ cbBTC to Monad via CCIP

Chainlink's Cross-Chain Interoperability Protocol (CCIP) now enables cbBTC transfers to Monad DeFi. **Key Details:** - Chainlink CCIP serves as the exclusive bridging infrastructure for Coinbase Wrapped Assets - Monad users can bridge cbBTC directly from Base - Over $5 billion worth of cbBTC currently in circulation This integration expands cross-chain liquidity options for Monad's DeFi ecosystem through Coinbase's partnership with Chainlink.

🔗 Chainlink Expands Across 5 Chains with 16 New Integrations

Chainlink recorded **16 new integrations** across its standard services, spanning **5 different blockchains**: Arc, Canton Network, DogeOS Chikyu, MegaETH, and World Chain. **Key Developments:** - Canton Network adopted Chainlink's data and interoperability infrastructure, including Data Streams (with 24/5 equities coverage), SmartData (NAV & AUM), Proof of Reserve, and CCIP - CBTC became the first wrapped Bitcoin asset on Canton Network, powered by Chainlink Data Streams and Proof of Reserve - BitSafe Finance integrated Chainlink to enable advanced use cases for CBTC across Canton's $8+ trillion RWA ecosystem **New Integrations Include:** Arc, BitSafe Finance, Canton Network, DogeOS, Kairo, MegaETH, Temple, Thetanuts Finance, Unhedged, and World Chain. **Services Expanded:** - CCIP: Arc (testnet), DogeOS Chikyu (testnet), MegaETH - CRE: World Chain - Data Streams: MegaETH - Data Feeds: MegaETH Leading Canton ecosystem applications including BitSafe Finance, Kairo, Temple, Thetanuts Finance, and Unhedged have already deployed Chainlink's data standard in production.

Delphi Digital: Chainlink Becomes Standard Infrastructure for Financial Institution Tokenization

**Financial institutions are standardizing on Chainlink as their core infrastructure layer for tokenization initiatives**, according to Delphi Digital. **Key adoption areas:** - Data connectivity and feeds - Cross-chain interoperability - Orchestration services The analysis positions Chainlink as essential infrastructure for institutions entering tokenized markets, serving as the bridge between traditional financial systems and blockchain networks. This institutional standardization reflects growing confidence in Chainlink's oracle platform as the foundation for connecting real-world data and systems to blockchain-based tokenization projects.

Chainlink Reserve Continues Accumulating LINK Through Enterprise Revenue

Chainlink has announced an update to its Reserve program, which continues to accumulate LINK tokens to support the network's long-term sustainability. **How It Works** - The Reserve accumulates LINK through two revenue streams: offchain payments from enterprise clients and onchain fees from network usage - Funds are designed to support the Chainlink Network's growth over time **Recent Activity** The Reserve has shown consistent growth, with previous updates showing holdings of 1,774,215.90 LINK in late January and 1,899,670.39 LINK by early February. [Learn more about the Reserve](https://reserve.chain.link)