Centrifuge Q3 2024 Highlights: Partnerships, Launches, and Recognition

Centrifuge Q3 2024 Highlights: Partnerships, Launches, and Recognition

🚀 Q3 Recap: Guess What?

Centrifuge had a productive Q3 2024, marked by key initiatives and partnerships:

- Submitted a proposal to Sky Ecosystem's Spark Tokenization Grand Prix with Anemoy Capital and JHI Advisors

- Launched the first institutional-grade RWA lending market on Base with Morpho Labs

- Ranked top 10 in tokenized treasuries by RWA.xyz

- Formed the Treasury Advisory Group (TAG) to boost the Centrifuge DAO

- Team bonding in Croatia

The company's efforts were recognized with features in Financial Times, CNBC, Moody's Ratings, and CoinDesk.

For more details: Read the full recap on Centrifuge's Mirror page.

We're thrilled to support Janus Henderson as they take over the management of @anemoycapital's Liquid Treasury Fund. “I think this is as disruptive, probably more disruptive, than ETFs. There is a significant probability that decentralised blockchain technology does to ETFs what

Centrifuge is widely recognized for our work in Private Credit, having financed $650M in assets since our launch in 2017. Over the past year, we’ve expanded our focus to support @anemoycapital in bringing Tokenized Treasuries to the onchain community. Today, we’re proud to see

Now tracking $LTF from Centrifuge on @RWA_xyz! As an early RWA protocol, Centrifuge brings a familiar name to tokenized Treasuries. Its Liquid Treasury Fund is an onchain fund actively-managed by @anemoycapital available on Ethereum, Base, Celo, and more. Investment returns are

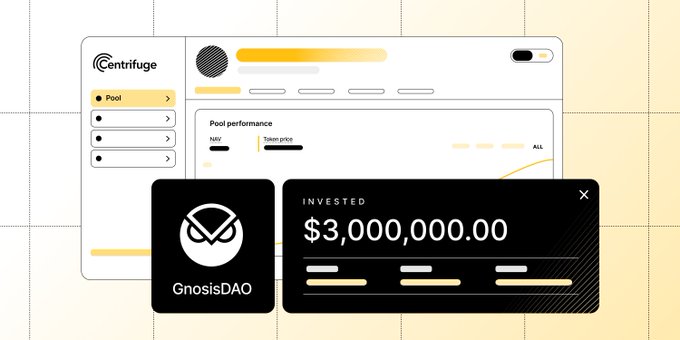

The latest DAO to allocate to RWAs: @GnosisDAO $3M in @anemoycapital Tokenized Treasuries through Centrifuge Prime. This is a key step in growing the GnosisDAO treasury through RWA yields. Why Centrifuge: • Diversified yield sources uncorrelated to crypto volatility •

Centrifuge is partnering with @ChronicleLabs to enhance transparency for @anemoycapital's Liquid Treasury Fund (LTF) Key highlights: • Real-time price updates via Chronicle's decentralized RWA Oracle • Full portfolio visibility, including cash movements and offchain holdings

Q3 Highlights As we reflect on a productive summer, we are pleased to share key initiatives and partnerships that marked the quarter: • Submitted a proposal to @SkyEcosystem's Spark Tokenization Grand Prix with @anemoycapital and @JHIAdvisors • Launched the first

Centrifuge Among 14% of DeFi Protocols Actually Generating Revenue

**Only 14% of DeFi protocols generate consistent revenue** - and Centrifuge is among them. The real-world asset protocol generates **protocol revenue monthly from actual activity**, not just token emissions or speculative trading. This positions Centrifuge in a rare category of DeFi protocols with sustainable business models. Previously, the protocol introduced a 0.4% fee on loans, with estimates projecting $4M in annual treasury revenue. The distinction matters: most DeFi protocols rely on token incentives rather than genuine revenue from services, raising questions about long-term sustainability across the sector.

DIMO Featured in Automotive News Coverage

**DIMO gains mainstream attention** as Automotive News covers the project's approach to vehicle data management. The coverage highlights how DIMO addresses automakers' challenges with big data collection and utilization. This marks significant recognition for the decentralized vehicle network in traditional automotive media. **Key developments:** - Traditional automotive publication features web3 mobility project - Focus on practical data management solutions - Bridges gap between legacy auto industry and blockchain technology The article demonstrates growing interest from established automotive sectors in decentralized infrastructure for vehicle data.

Centrifuge V3.1 Completes Final Security Review After Six-Month Audit Process

Centrifuge has completed the final security audit for its V3.1 upgrade, marking the end of a comprehensive review process that began in August 2025. **Key developments:** - BurraSec delivered their third and final security report - The platform underwent continuous scrutiny from multiple security firms including Cantina and Sherlock - A $250,000 security contest concluded with hundreds of researchers examining the codebase - Sherlock's top auditor, IAm0x52, participated in the review process The project emphasized security as an ongoing practice rather than a one-time milestone. A bug bounty program remains active with a maximum reward of $250,000 for V3.1. All identified issues have been addressed, with reports now publicly available from Sherlock and Blackthorn.

Centrifuge Launches Public Quarterly Updates

Centrifuge is introducing **public quarterly updates** starting today, offering transparency into their operations and future plans. **What's Covered:** - Strategic direction and protocol health metrics - Product roadmap and development priorities - Live Q&A sessions with the community The initiative reflects Centrifuge's commitment to open communication with stakeholders. Participants can join the sessions to ask questions directly and get real-time answers from the team. [Register for the quarterly update](https://luma.com/f7tkx8yu)

🏛️ Onchain Equity Goes From Synthetic to Real

**Tokenized equity has fundamentally changed.** Previously, it meant synthetic exposure—price tracking without ownership. Now, the share register itself exists onchain with full shareholder rights. **What changed:** - SEC-registered transfer agents can maintain authoritative shareholder records onchain - Smart contracts enable real-time settlement and automated transfers - Companies can issue actual shares on blockchain with complete legal rights **Why it matters:** Crypto-native companies previously relied on tokens to bootstrap communities, but lacked enforceable investor rights and clear paths to institutional capital. Onchain equity solves this by providing one unified cap table accessible to both contributors and institutions. [@caesar_data](https://twitter.com/caesar_data) became the first crypto-native company to issue real equity onchain through Centrifuge's SEC-registered infrastructure—no parallel systems, no fragmentation.