Centrifuge V3 tackles the multichain challenge for real-world assets with a unified security architecture across 6+ blockchains.

Key innovations:

- Hub-and-spoke design: Single control layer managing Ethereum, Base, Arbitrum, Avalanche, BNB Chain, and Plume

- Unified vault architecture: ERC-7540 and ERC-4626/7540 support with real-time NAV updates

- True chain abstraction: Users get Web2 simplicity with automatic gas subsidies and retry logic

- Burn-and-mint bridging: Perfect 1:1 token parity across chains

Institutional-grade features:

- Seamless KYC/AML enforcement across all chains

- Single dashboard for pool managers

- Wormhole-powered infrastructure trusted by BlackRock

Real impact: Already securing $1B+ in tokenized assets including Janus Henderson funds (JTRSY, JAAA, SPXA).

The architecture makes six blockchains feel like one platform, enabling mainstream RWA adoption through invisible complexity.

RWAs are set to supercharge DeFi, but only with breakthrough standards. @Centrifuge led ERC-7540 to unlock async, composable RWA vaults. Next up: game-changing onchain KYC + asset tokens for a new era of permissioned DeFi. The future is here ⚒️

The multichain challenge for RWAs is real: How do you maintain security, compliance, and user experience when assets need to flow across 6+ different blockchains? Centrifuge V3 solved this with a unified security architecture that treats multiple chains as one system. Here's a

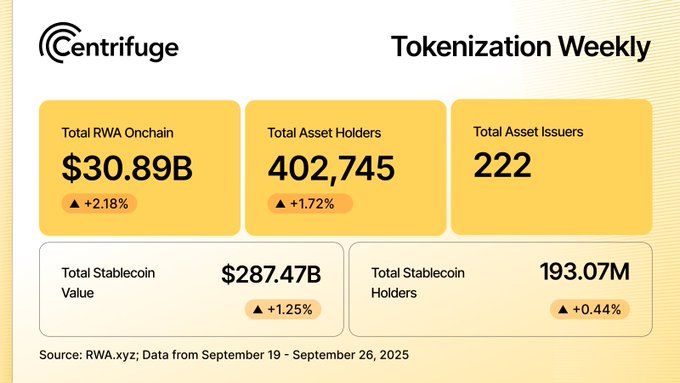

Tokenization momentum keeps building! This week, the total onchain value of real-world assets remains firmly above the $30 billion mark, while both asset holders and issuers recorded notable growth. Check out the most recent numbers on RWA 👇

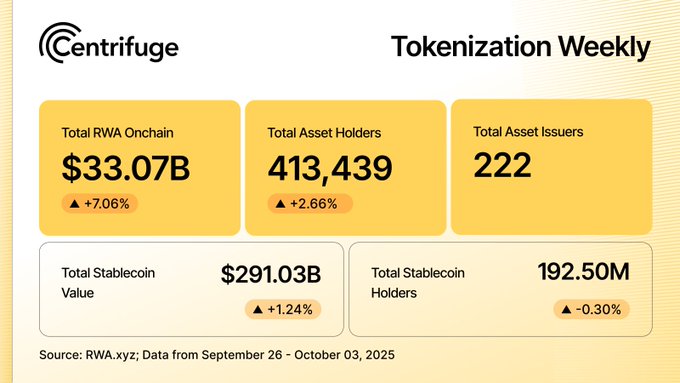

The latest snapshot of the RWA landscape is in and tokenized finance continues to set the standard! Fresh all-time highs and more users than ever, tokenization is here to stay. Take a look at the key figures fueling the movement 👇

Last week, Centrifuge has launched SPXA, the first-ever licensed S&P 500® index fund token. Powered by Coinbase’s Base network, SPXA brings the world’s premier equity index directly onchain, accessible and tradable 24/7. Let's break it down ⤵️

🚀 @OnigiriVC x Centrifuge launch RWA Bento An exclusive program for early-stage founders building real-world asset products, with $600K packages to accelerate adoption. $500K capital from Onigiri + $100K infra credits from Centrifuge.

Proud to share that @Centrifuge is a founding member of the Global RWA Alliance! Industry collaboration is key to real-world asset adoption. Looking forward to work alongside leading institutions to unlock the next chapter for tokenized assets 🔥

Introducing the Global RWA Alliance 🌐 We're bringing together leading institutions to accelerate tokenized asset adoption through shared standards, infrastructure, and regulatory engagement.

🔍 Audit Games Begin

**Centrifuge partners with Sherlock and Blackthorn** for a major smart contract audit contest starting October 20. Key highlights: - **$100K in guaranteed rewards** for security researchers - Direct path to join Blackthorn team (no leaderboard rank required) - Focus on **real-world asset (RWA) security** - Elite collaboration between top audit firms The contest aims to strengthen smart contract security for onchain finance, offering unprecedented opportunities for white hat researchers to prove their skills and potentially land positions at leading security firms.

TVVIN Launches Tokenized Gold on Centrifuge V3 Infrastructure

**TVVIN launches tokenized gold product** on Centrifuge V3's open, modular infrastructure. The platform connects tokenized assets with DeFi, bringing **institutional-grade gold onchain** efficiently and securely. **Key features:** - Built on Centrifuge's modular infrastructure - Enables institutional-scale asset tokenization - Connects traditional gold assets to DeFi ecosystem Centrifuge V3 allows institutions to **build, run, and distribute tokenized assets at scale**, supporting the broader movement of real-world assets onchain. [Read full story](https://medium.com/tvvin/tvvin-launches-tokenised-gold-on-centrifuges-open-infrastructure-1b3a0045c2f0)

🏦 Boring Yields Lead RWA Wave

**Real-world asset tokenization** is gaining momentum with a clear progression path emerging. **Current leaders:** - Tokenized U.S. Treasuries - High-quality yield funds - "Boring but compelling" products driving adoption **Next wave coming:** - Collateralized Loan Obligations (CLOs) - Private credit products Industry experts at Stellar's RWA panel outlined this roadmap, suggesting **institutional-grade assets** will follow the established pattern of starting with traditional, lower-risk products before expanding into more complex financial instruments. The progression mirrors traditional finance adoption - **simple yield products** prove the technology works before more sophisticated instruments enter the space.

🚀 Apollo Credit Fund Goes Onchain

**Major institutional breakthrough**: The Anemoy Tokenized Apollo Diversified Credit Fund launched on Centrifuge, marking a significant milestone for bringing **global, diversified real-world credit onchain**. This represents a major evolution beyond tokenized treasuries, expanding into: - Corporate direct lending - Asset-backed lending - Performing credit - Dislocated credit The fund provides **blockchain-native access** to Apollo's institutional-grade credit strategies with real-time data integration and cross-chain compatibility. **Key impact**: This launch demonstrates the next phase of RWA adoption - moving from simple tokenization to **deep DeFi integration** with active utility in decentralized markets. More DeFi integrations are planned ahead as institutional credit strategies gain onchain momentum.