The tokenization era is evolving. According to a new Dunes report, the next phase for real-world assets (RWAs) isn't just putting assets onchain - it's deep DeFi integration with real utility.

Centrifuge leads this transformation:

- JTRSY now serves as institutional collateral on Aave's Horizon platform

- deJAAA enables seamless cross-chain liquidity

- Both products demonstrate how RWAs can power active DeFi markets

The bigger picture: RWAs must move beyond simple tokenization to become functional collateral in DeFi protocols. This shift unlocks their full potential by creating liquid, usable assets rather than static tokens.

Centrifuge's infrastructure proves this vision works, with real institutional assets now actively participating in DeFi lending and borrowing markets.

Verifiable data is essential for building trust in tokenized assets. Our partners at @ChronicleLabs have launched the VAO Dashboard, bringing a new layer of transparency to our JTRSY tokenized treasury fund. Now, users can see exactly how asset data is sourced, verified, and

1. Chronicle has launched the Verified Asset Oracle (VAO) Dashboard, giving institutions and builders full visibility into how tokenized asset data is sourced, verified, and monitored onchain. Transparency of source data and holdings is no longer optional for tokenized RWAs 🧵

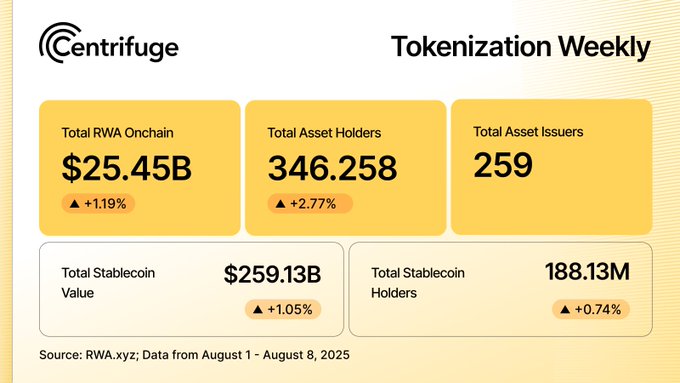

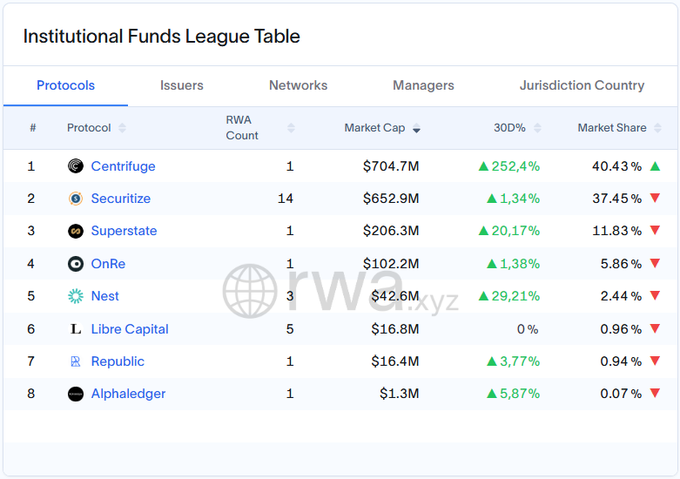

A powerful and transparent financial layer is being forged, driven by institutional adoption. The tokenized asset ecosystem continues to expand on a bedrock of high-quality assets like treasuries and credit. Explore the latest data on this fundamental shift 👇

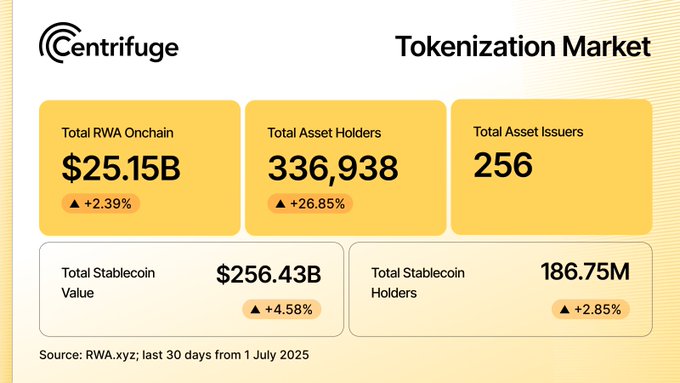

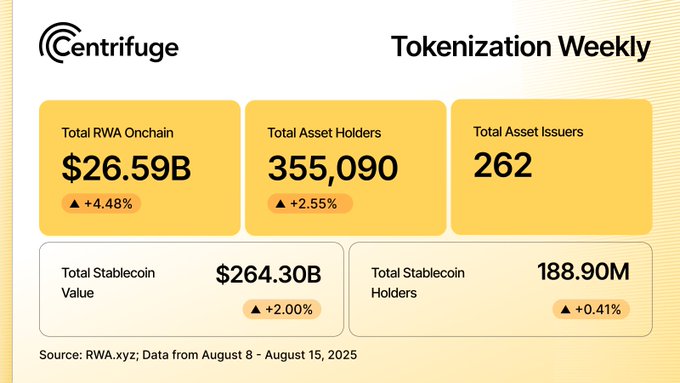

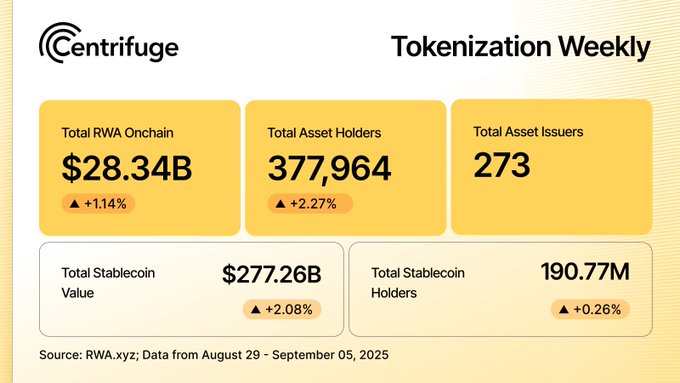

Amid the market's noise, the signal is clear: the onchain economy is growing. RWAs continue to provide a stable foundation for DeFi, with fundamental growth week after week. Here's your latest signal boost 👇

The definitive report on the state of real-world assets, launched today at the @RWASummit. Essential, data-driven insights from the teams at @Dune and @RWA_xyz for every builder in the space.

📙 RWA Report 2025 is live, co-produced by @Dune × @RWA_xyz, launched at the @rwasummit in Brooklyn. Clear theses + key trends, grounded in onchain data. Established players and emerging projects across treasuries, credit, equities, commodities & more. dune.com/rwareport2025

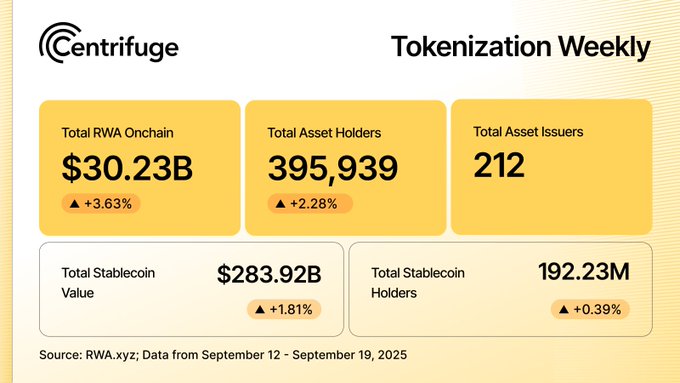

The real story of market adoption is told by the growth of the network itself. Each new asset holder and issuer onchain makes the ecosystem more resilient and decentralized. This is the foundation for a more open economy being built, week by week. Here's your weekly briefing on

With native @USDC and CCTP V2 now live on @plumenetwork, @circle strengthens the foundation for institutional RWA settlement. Institutional capital can now flow directly into tokenized funds on Plume. The first: ACRDX, the Anemoy Tokenized Apollo Diversified Credit Fund, set to

USDC and CCTP V2 are now live on @plumenetwork! Institutions, developers, and businesses can now access the world’s largest regulated stablecoin on Plume, along with seamless crosschain transfers between supported blockchains. @USDC on Plume powers key use cases: ✅ RWA

"Centrifuge plays a central role in this system, handling the full tokenization pipeline from asset onboarding to issuance. Their infrastructure enables strategies like JAAA and JTRSY to launch, scale, and operate across chains with institutional clarity and onchain

Grove expands to @avax. With a $250M target deployment into tokenized institutional credit strategies, @JHIAdvisors’ JAAA and JTRSY, Grove is laying the foundation for scalable, institutional credit onchain. What this unlocks → grove.finance/blog

First, it was tokenized treasuries. Then, CLOs. The next frontier for institutional-grade RWAs is coming to @Centrifuge. Stay tuned 👀

The future of finance is not a battle between TradFi and DeFi, but their convergence into a single, global market. This evolution requires a common language, a universal, chain-agnostic infrastructure capable of bringing any RWA onchain. That is what we are building at

"This partnership with @Centrifuge let a 90-year-old, $450B AUM global asset manager operate with the speed, transparency & security that only blockchain delivers, a proof point for finance’s re-platforming." — @NickCherney, @JHIAdvisors Read more: coindesk.com/opinion/2025/0…

RWAs are the next pillar of global finance. And @joinrepublic agrees. That's why today, Centrifuge is excited to announce a strategic investment from Republic Digital’s Opportunistic Digital Assets Fund. From pioneer to leader in tokenized finance, Centrifuge is setting the bar

The Horizon RWA market by @aave is live, with Centrifuge at launch. RWAs are no longer just tokens onchain. They’re active collateral powering real-time liquidity. For the first time, Aave users can borrow stablecoins against: 📌 Tokenized U.S. Treasuries (JTRSY) 📌 AAA-rated

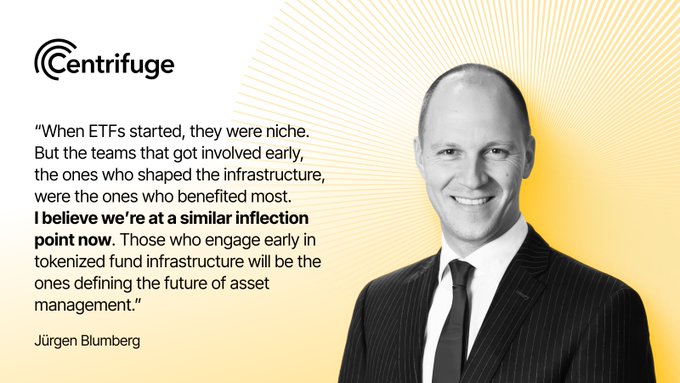

Great to join Will Beeson on the Rebank podcast! Our COO Jürgen Blumberg and CEO @itsbhaji dive deep into the evolution of Centrifuge, the drivers of RWA adoption, and how we see DeFi and TradFi converging into "just finance." Listen to the full episode to hear how tokenized

🎧 Ep 248: Scaling Tokenized Real World Assets with Centrifuge Bhaji Illuminati and Jürgen Blumberg of Centrifuge join Will Beeson, CFA Beeson to explore: ➡ The evolution of Centrifuge from esoteric assets like invoice financing to treasuries, CLOs, and beyond ➡ Why buy-side

As founders of @rwasummit, we’re proud to return to The William Vale in Brooklyn this September as Title Partner for the flagship event’s third consecutive year, where the leading minds in crypto and capital markets meet. Our CEO, @itsbhaji, will take the stage to tackle the

Real-world yield doesn't just mean treasuries. The largest pools of institutional capital are traditional assets with limited liquidity. Soon, they will be unlocked on @Centrifuge. The next generation of institutional RWAs is loading 🔄

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

The narrative has shifted. "It feels less controversial to talk about trillions onchain today than 2 years ago." — Centrifuge's co-founder, @lucasvo, on the maturation of the RWA industry, live from the @RWASummit.

Centrifuge V3 is now live on @avax, with its first major deployment on the way. @grovedotfinance is allocating up to $250M into the Janus Henderson Anemoy AAA CLO Strategy (JAAA), part of a $1B partnership with Centrifuge and @JHIAdvisors to scale institutional credit onchain.

"We have to be ready for blockchain technology growth. That also means working with best-in-class partners, like Centrifuge, who speak the Web3 language." — @NickCherney, live from the @RWASummit stage on his panel with our CEO @itsbhaji.

"The Stellar Development Foundation plus Centrifuge is... a powerful union of two organizations that really want to bring real world assets into the world of DeFi." — @AdaVaughan, Senior Director of DeFi Partnerships at Stellar. We're thrilled to partner with @StellarOrg to

A great discussion on the institutional adoption of RWAs. Our CEO, @itsbhaji, joined the latest episode of @TokenizedPod to talk about Centrifuge's pioneering role in the space since 2017, the debate on tokenized deposits, and the future of onchain finance. Check it out 👇

🚨 Ep. 46 of @TokenizedPod: Every Bank Should Tokenize Deposits @sytaylor & @cuysheffield are joined by: ➡️ @KAndrewHuang, Founder @conduitxyz ➡️ @itsbhaji, CEO @centrifuge To discuss: ⚙️ Centrifuge's role in tokenizing real world assets since 2017 🥊 Debate on tokenized

Why did a 20-year ETF veteran from Goldman Sachs & BlackRock join @centrifuge? Because as our new COO Jürgen Blumberg explains, tokenization today feels just like the early days of ETFs: A moment where a new technology challenges the entire financial system.

Goldman Sachs. BlackRock. Invesco. Jürgen Blumberg helped build the ETF market from the inside. Now he joins Centrifuge as COO, and CIO of @anemoycapital, to lead the shift from legacy structures to regulated, onchain investment products. Blumberg’s move is a signal:

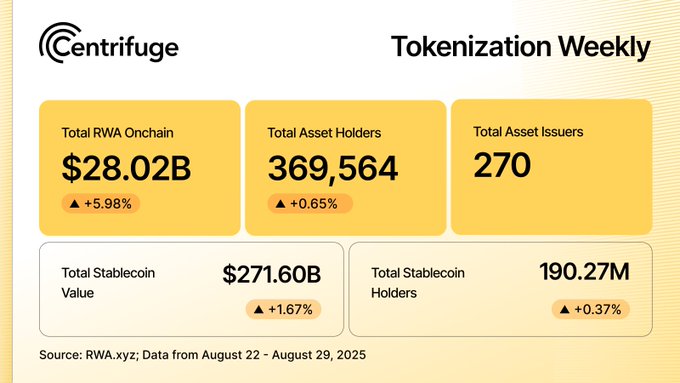

The financial system is being rewritten on new rails. From institutional credit funds moving operations onchain to tokenized treasuries becoming a core DeFi primitive, the groundwork for a more open economy is being laid. Here's your weekly briefing on the real progress in

The vision for the asset manager of the future is built on blockchain. A powerful statement from @NickCherney of @JHIAdvisors on why tokenization is a transformative force for finance and how they're bringing core strategies like JAAA and Treasuries onchain.

Centrifuge is a proud founding partner of @tokenizedvault, a global initiative setting the standard for secure and transparent digital asset management. Together, we’re raising the bar for trust and innovation in digital finance. Learn more:

"Once an asset is onchain, the most interesting question is what you can do with it," as our CEO, @itsbhaji, said on the @TokenizedPod. This is the fundamental question we answer by building open, multichain infrastructure. We create the tools, like our deRWA tokens, that

On the latest episode of Tokenized, Bhaji Illuminati (@itsbhaji), CEO of @centrifuge asks the question: “What do you do after tokenizing an asset?” Hear her thoughts below 👇 🎙️ Listen to the latest episode of Tokenized: tokenized.simplecast.com/episodes/every… 📷 Watch on YouTube:

The most powerful force in finance is compounding growth. Week after week, the onchain economy expands as more assets, holders, and issuers build a stronger, more resilient foundation. This is how a new system is built, with a relentless progress. Here's your weekly briefing👇

Most “multichain” protocols fragment liquidity. Centrifuge unifies it. In this first deep dive on Centrifuge V3, we sat down with Jeroen Offerijns (@offerijns), CTO, and Frederik Gartenmeister (@mustermeiszer2), Head of Product, to unpack the core technical unlocks: - Chain

Liquidity fragmentation ends now. Centrifuge V3 is LIVE, first launching on @ethereum, @plumenetwork, @base, @arbitrum, @avax, and @BNBCHAIN, with chain interoperability powered exclusively by @wormhole. Fund managers can manage liquidity across multiple chains from a single

Dune’s report is spot-on: the next chapter for tokenized assets is deep, onchain DeFi integration, not just tokenization, but real utility. We’re proud to be driving this future, with JTRSY now live as institutional collateral on @Aave’s Horizon and deJAAA enabling cross-chain

1/6 RWA Report 2025 — Thesis #2: Onchain capital is moving up the yield curve: from T-bills to CLOs, private credit, institutional funds & equities as investors seek higher returns. dune.com/rwareport2025

We're at a rare inflection point in finance. Our new COO, Jürgen Blumberg, saw this happen once before with the rise of ETFs. Here’s his take on why the opportunity in tokenization is just as profound, and why the time to build is now!

Traditional finance is clogged with intermediaries, adding costs and complexity. Tokenization on @centrifuge will change that. By representing RWA onchain, we aim to reduce reliance on these intermediaries, creating a more open, transparent, and efficient way to access finance.

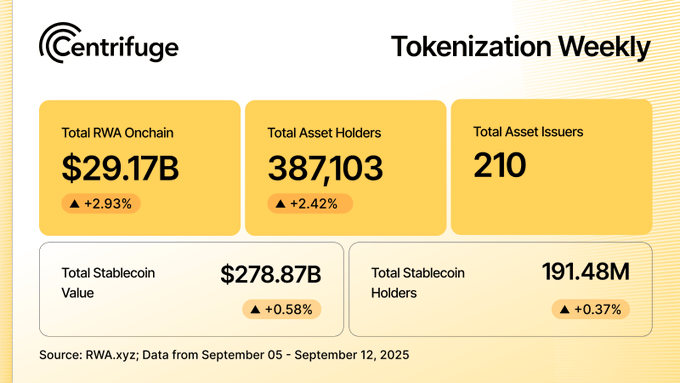

The gravity of onchain finance is growing stronger. Week by week, the pull of real-world yield and transparent infrastructure brings more assets, holders, and issuers into the ecosystem, building undeniable momentum. Here's your weekly look at the numbers 👇

Institutional trust meets DeFi composability. In Part 2 of our deep dive series, @offerijns and @mustermeiszer2 explore the "why" behind Centrifuge V3: our core design philosophy for bridging two financial worlds. Read more at: centrifuge.io/blog/centrifug…

A must-read @Dune RWA Report affirms what we’ve championed: U.S. Treasuries have defined product-market fit for tokenization, establishing a credible, liquid foundation for the next evolution in DeFi. We’re proud to see JTRSY recognized as the largest RWA collateral on @Aave's

1/9 RWA Report 2025 — Thesis #1: U.S. Treasuries proved the product–market fit for tokenization. They set the credibility + liquidity base for everything that followed. dune.com/rwareport2025

Data integrity is the bedrock of institutional trust in DeFi. @rwa_xyz has upgraded its analytics dashboard to fully support Centrifuge V3, our scalable, multi-chain protocol for asset tokenization.

Grove Labs co-founder (@0x_roo) on our partnership with @grovedotfinance & @avax: Combining our technologies "lays the foundation for a new era of scalable onchain credit markets.” Read more in @CoinDesk's article: coindesk.com/business/2025/…

Tokenized T-bills proved the rails work. They were the gateway. But the future of the onchain economy won't be financed by treasuries alone. The true institutional leap, and the solution for DeFi's collateral, is bringing diversified, yield-bearing, non-correlated assets

The onchain economy is growing, driven by the adoption of institutional-grade assets like tokenized treasuries and credit funds. This fundamental shift is building a resilient foundation for the future of finance. Here's the latest data on this progress 👇

Another week, another major milestone. The total value of onchain real-world assets has officially surpassed $30 billion, proving the steady adoption of this new financial layer. Here's the latest data on this progress 👇

deRWA are coming to @StellarOrg 🚀 Launching with: deJTRSY → short-term US Treasuries deJAAA → AAA CLO strategy Backed by a $20M investment at the start. RWA embedded in Stellar’s global financial rails.

🚀 CFG Goes Live

**Centrifuge (CFG) launches spot trading on Coinbase**, marking a significant milestone for the real-world asset protocol. The listing represents a major step forward for CFG's: - **Liquidity expansion** through one of crypto's largest exchanges - **Global reach** to Coinbase's massive user base - **Real-world asset adoption** in traditional finance Centrifuge focuses on bringing traditional assets onchain, enabling businesses to access decentralized finance through tokenized real-world collateral. The team calls this moment the **"CFG Renaissance"** - positioning the Coinbase listing as just the beginning of broader ecosystem growth and innovation in the RWA space.

Centrifuge DAO Governance Call Scheduled for October 2nd

**Centrifuge Governance Call #37** is set for **Thursday, October 2nd** at 18:00 CET / 12:00 ET. This community call offers participants the opportunity to: - Discuss active governance proposals - Debate key decisions affecting the Centrifuge DAO - Help shape the protocol's future direction The call is open to all community members and encourages active participation in the governance process. **Registration required:** [Join the call](https://gov.centrifuge.io/t/centrifuge-governance-call-37-2025-09-24/7117) Mark your calendar and contribute to Centrifuge's decentralized governance.

🏦 STBL Backs USST with Tokenized Treasuries and CLOs

**STBL** is launching a new approach to stablecoin backing by collateralizing **USST** with tokenized funds on Centrifuge. The collateral includes: - **Treasuries (deJTRSY)** - traditional government bonds - **AAA CLOs (deJAAA)** - high-grade collateralized loan obligations This structure aims to provide: - Diversified yield sources - Institutional-grade backing - Full onchain transparency The move represents a shift toward **real-world asset backing** for stablecoins, moving beyond traditional crypto collateral models.

🏦 Apollo Attracts $50M for Tokenized Credit Strategy

**Apollo secures $50M** for its tokenized credit strategy, marking a significant milestone for real-world asset (RWA) tokenization. **Key developments:** - Institutional investors are backing blockchain-based credit solutions - The move demonstrates growing confidence in **tokenized RWAs** - Apollo's strategy focuses on bringing traditional credit markets onchain **Why this matters:** - Shows institutional adoption of blockchain technology for financial products - Highlights the **efficiency and transparency** benefits of tokenized assets - Signals broader shift toward public, blockchain-based credit markets This investment represents institutional recognition that tokenized RWAs offer real-world impact and operational advantages over traditional financial instruments. [Read the full story at CoinDesk](https://www.coindesk.com/business/2025/09/16/blockchain-based-rwa-specialists-bring-usd50m-to-apollo-s-tokenized-credit-strategy)