Centrifuge Announces Pool Party for Prospective New Pool

Centrifuge Announces Pool Party for Prospective New Pool

🎉 Pool Party Incoming!

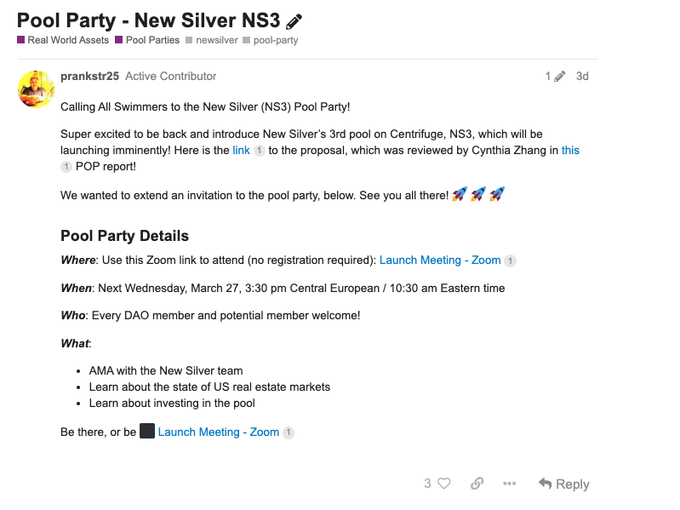

Centrifuge, a platform for on-chain finance, has announced a Pool Party event scheduled for tomorrow. Pool Parties are community calls where participants can learn about and ask questions regarding prospective new pools on the Centrifuge platform. In this particular event, @NewSilverLend will meet with the community to discuss their proposed pool, NS3. Additional information and instructions for joining the call are available on the Centrifuge forum.

Tomorrow: join a Centrifuge Pool Party 🌊 Pool Parties are calls where anyone can join to learn and ask questions about prospective new pools on Centrifuge! This time around, @NewSilverLend will meet with our community to discuss their proposed pool on Centrifuge, NS3.

Treasury Bills and Credit Products Drive Real-World Asset Adoption Onchain

**Yield-generating products are becoming the primary driver of real-world asset (RWA) adoption in onchain finance.** - Treasury bills and credit instruments are attracting significant attention from onchain allocators - Investors are actively diversifying their portfolios beyond traditional crypto-native yield sources - The shift represents a maturation of the onchain finance ecosystem This development follows the broader trend of RWA tokenization scaling across the industry, with total value locked exceeding $10 billion. Institutional players continue building infrastructure to support these traditional financial instruments onchain.

🏦 ACRDX Launches on Morpho: Apollo Credit Fund Goes Onchain

**ACRDX**, the tokenized Apollo Diversified Credit Fund, is now live on **Morpho**, expanding institutional credit access onchain. **Key Details:** - Provides tokenized exposure to Apollo Global's diversified credit strategy - Initially launched on Plume Network with $50M deployment via Grove Finance - Offers 24/7 access with real-time reporting and programmable settlement **What It Covers:** - Corporate and direct lending - Asset-backed credit strategies - Institutional-grade asset management **Technical Infrastructure:** - Built on Centrifuge's tokenization platform - Data transparency via Chronicle Labs oracles - Cross-chain capability through Wormhole This marks a significant step in bringing traditional credit markets onchain, offering risk-adjusted yield beyond crypto-native assets. The move to Morpho extends ACRDX's reach across DeFi protocols. [Read full details](http://centrifuge.io/blog/acrdx-launch-on-centrifuge)

Centrifuge V3.1 Brings Automated Onchain Accounting to Tokenized Assets

Centrifuge V3.1 introduces fully automated, onchain accounting for tokenized assets, implementing traditional double-entry bookkeeping directly on the blockchain. **Key features include:** - Transparent and auditable accounting by default - Automated NAV calculations and share pricing - Oracle updates that synchronize across multiple chains - Full visibility into pricing logic and state Builders using Centrifuge's Whitelabel solution can now deploy tokenized assets with real-time, verifiable accounting from launch. The update expands support to 10 chains through a hub-and-spoke architecture, allowing teams to launch assets on any supported chain within minutes. This infrastructure update aligns with how institutions currently operate across multiple chains, bringing traditional accounting standards to onchain finance.

Graham Jenkin Discusses Onchain Finance in All In Crypto Interview

**Graham Jenkin sits down with All In Crypto** to discuss the evolving landscape of tokenized finance and blockchain infrastructure. The interview covers: - Real-world challenges facing secure tokenized finance - Opportunities emerging in the onchain finance sector - Technical considerations for building financial infrastructure on blockchain Jenkin, known for his work in onchain finance platforms, shares insights on bridging traditional finance with blockchain technology. The conversation explores practical implementation hurdles and potential solutions for institutional adoption. [Watch the full interview](https://www.youtube.com/watch?v=Btr6WBUX-3k)

Financial Institutions Rush to Integrate DeFi Infrastructure

**Major shift in traditional finance approaches decentralized systems** Financial institutions are accelerating their integration with decentralized finance (DeFi) infrastructure. This marks a significant pivot as traditional banks and financial services recognize the efficiency and capabilities of blockchain-based financial rails. The move represents a convergence between conventional banking and decentralized protocols, suggesting that institutional adoption of DeFi technology is reaching a critical inflection point. **Key implications:** - Traditional finance embracing blockchain infrastructure - Potential for faster, more efficient financial services - Blurring lines between centralized and decentralized systems This development follows earlier predictions that DeFi would become indistinguishable from traditional finance, indicating the sector is maturing beyond its experimental phase into mainstream financial infrastructure.