FDUSD now available on BRIDGERS

Bridgers has added support for $FDUSD, enabling users to route the stablecoin across multiple blockchain networks.

Key features:

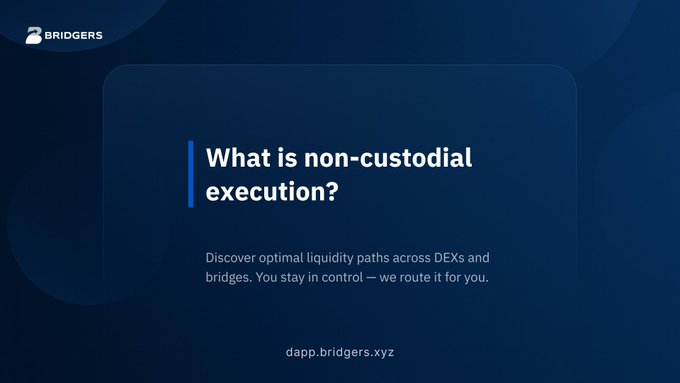

- Non-custodial execution through smart contracts

- Aggregated liquidity from multiple sources

- User-authorized transactions

- Secure cross-chain routing

This follows recent additions of other tokens including BONK, PENGU, JUP, and PUMP to the platform.

Bridgers operates as a routing protocol that finds optimal paths across DEXs and bridges while users maintain control of their assets.

🚀 UDS is live on BRIDGERS! 🚀 Route $UDS across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

#Solana is the engine for next-gen finance. Bridgers connects it to the rest of the ecosystem. Liquidity knows no borders → dapp.bridgers.xyz

Stocks. Bonds. Lending. Money markets. Foreign exchange. Commodities. Derivatives. Private equity. Venture capital. Hedge funds. Real estate investment trusts. Asset-backed securities. Municipal bonds. Treasury securities. Corporate bonds. Convertible bonds. Preferred stocks.

❌ Trading platforms hold your funds. ✅ Bridgers lets you keep them. Bridgers is a non-custodial routing layer that computes optimal liquidity paths across DEXs and bridges. You authorize. We route. ⚡ dapp.bridgers.xyz

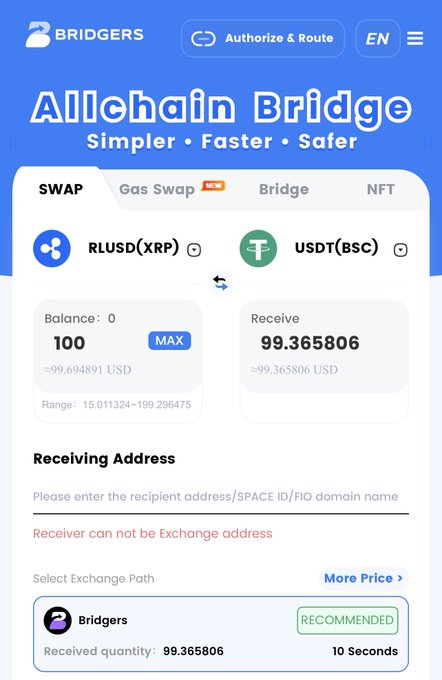

💸 $RLUSD is already flowing through chains with ease! A real world backed #stablecoin with real utility across ecosystems. Exactly what #DeFi has been waiting for! Now available on Bridgers. Authorize and Route 🔗 dapp.bridgers.xyz

🚨 New Asset Live on Bridgers 🚨 We are excited to announce that $RLUSD, @Ripple new real world asset backed #stablecoin, is now available on Bridgers Backed one to one by US dollar deposits and short term US treasuries, $RLUSD is built for transparency, compliance, and

🚀 PUMP is live on BRIDGERS! 🚀 Route $PUMP across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 BONK is live on BRIDGERS! 🚀 Route $BONK across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 @arbitrum is live on BRIDGERS! 🚀 Route $ARB across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 BTCB is live on BRIDGERS! 🚀 Route $BTCB across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

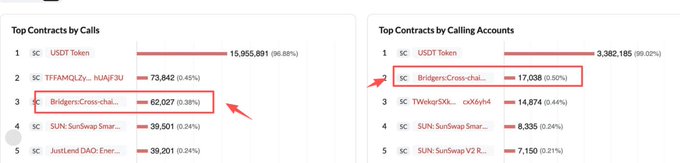

🚀 Bridgers is climbing the #TRON charts! In the past 7 days, our Cross-Chain Routing Protocol ranked: 🔥 Top 3 by Contract Calls 🔥 Top 2 by Calling Accounts This is a huge milestone showing how fast the community is adopting Bridgers. You authorize. We route. 🔗

Tweet not found

The embedded tweet could not be found…

Bridging blockchains with magic. ✨ You Authorize. We Route. 🔗dapp.bridgers.xyz

🚀 OKB is live on BRIDGERS! 🚀 Route $OKB across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

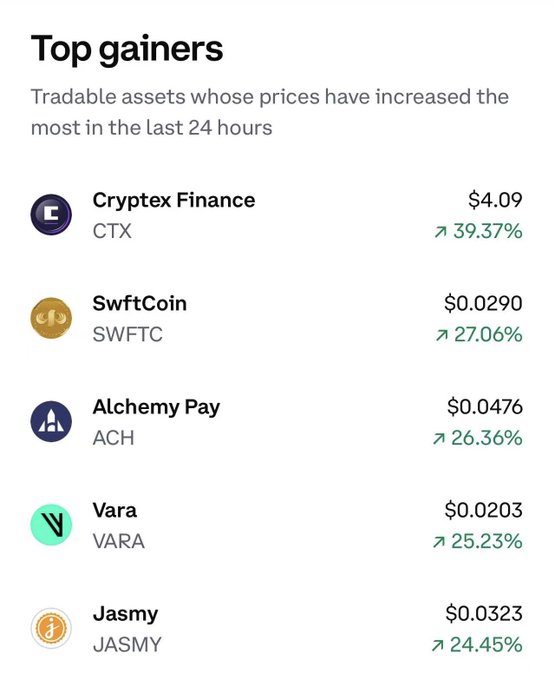

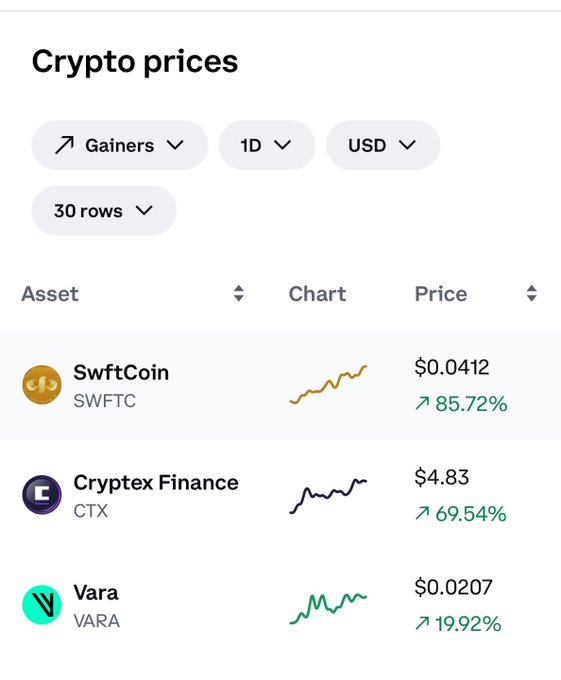

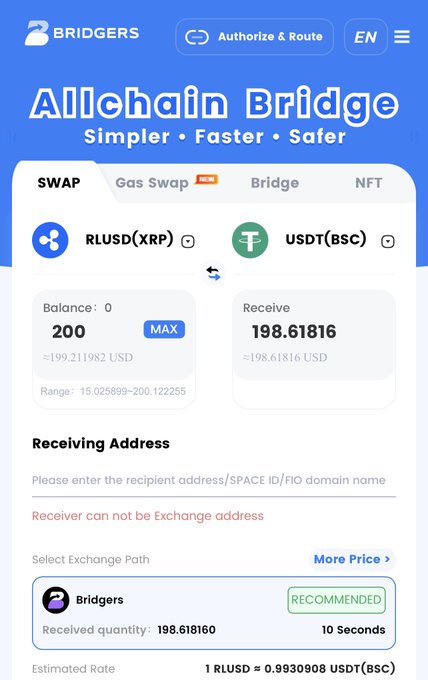

🚀 $SWFTC is the No. 2 top gainer on @Coinbase! $SWFTC is the first AI token on Coinbase, powering SWFT Blockchain and its AI-driven ecosystem, SWFTGPT—the first domain-specific LLM for crypto. 🔗 exchange.coinbase.com/trade/SWFTC-USD

With hundreds of networks out there, how many dApps do you actually open just to bridge tokens across chains?

🚀 KASPA is live on BRIDGERS! 🚀 Move your $KAS across chains with ease — non-custodial, smart contract-powered, and backed by deep liquidity. You authorize. We route. ⚡ dapp.bridgers.xyz

🚀 SWFTC Hits Top Gainer on @okx! 🚀 This remarkable growth highlights the potential of $SWFTC and SWFTGPT, the first domain-specific LLM for #crypto. 🔗 okx.com/trade-spot/swf…

Tweet not found

The embedded tweet could not be found…

$SWFTC: Redefining AI + Blockchain Integration🤖 From a 300% surge in Dec. to AI-powered swaps, $SWFTC is revolutionizing crypto with SWFTGPT. 💡 Save 50% on fees, unlock premium AI tools, & ride the future of seamless blockchain innovation. mirror.xyz/0x48D4B8625917…

Tweet not found

The embedded tweet could not be found…

🚀 CATI is live on BRIDGERS! 🚀 Route $CATI across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 USDJ (TRON) is live on BRIDGERS! 🚀 Route $USDJ across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

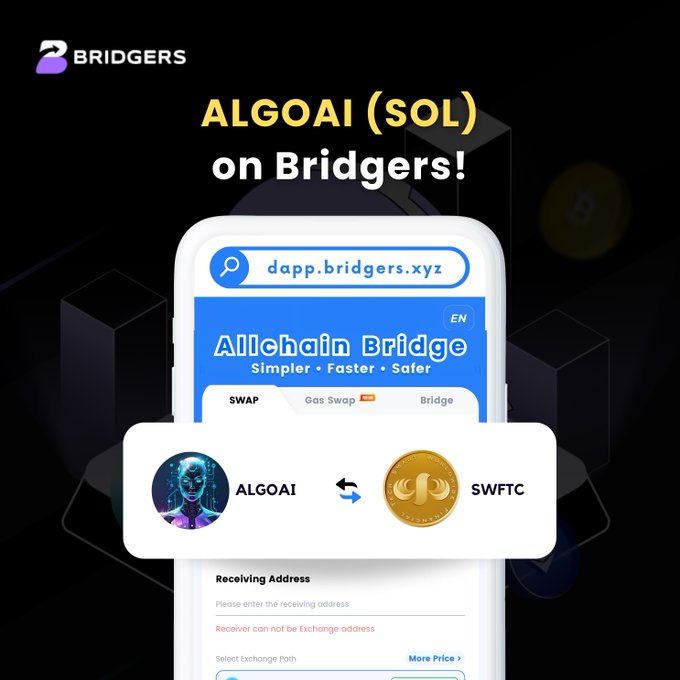

📢 Upcoming Listing Alert! We’re excited to announce that $ALGOAI from @algoritha_coin will soon be available on BRIDGERS! 🚀 Get ready to route $ALGOAI across chains with non-custodial execution, smart contract routing, and aggregated liquidity — all from your own wallet. 🔐

Bridgers computes the best path across DEXs & bridges — without ever holding your funds. ✅ Non-custodial ✅ User-authorized ✅ Smart contract powered You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 WAL is live on BRIDGERS! 🚀 Route $WAL across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 ENA is live on BRIDGERS! 🚀 Route $ENA across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 BNB is live on BRIDGERS! 🚀 Route $BNB across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚨 Ripple is making major moves The company applied for a US national bank charter to bring its stablecoin $RLUSD under federal regulation. Its subsidiary also seeks a Federal Reserve master account to enable 24/7 stablecoin issuance and redemption 📲 A big step for crypto and

Tweet not found

The embedded tweet could not be found…

🚀 @WFTtoken is live on BRIDGERS! 🚀 Route $WFTT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 @grass is live on BRIDGERS! 🚀 Route $GRASS across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 PENGU is live on BRIDGERS! 🚀 Route $PENGU across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

The explorer who chose Bridgers? They reached the vault in one click. No bridges burned. No funds lost. Powered by smart contracts. Non-custodial. Multi-chain. Bridgers isn’t just a path — it’s the way. 🔗 dapp.bridgers.xyz

🚀 WFTT is live on BRIDGERS! 🚀 Route $WFTT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 AVAX is live on BRIDGERS! 🚀 Route $AVAX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 $CFX from @Conflux_Network is live on BRIDGERS! 🚀 Route $CFX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $TSLAX is live on BRIDGERS! 🚀 Route $TSLAX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 @Uniswap is live on BRIDGERS! 🚀 Route $UNI #ERC20 & #BSC across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚨 Swapping big? Meet Bridgers, No custody. No logins. Just better output, every time! ⚡ Smarter route 💰 More value on each swap 🔐 Always stay in control You authorize. We route. 🔗 dapp.bridgers.xyz

At BRIDGERS — You authorize. We route. A smart, non-custodial execution paths powered by aggregated liquidity across chains. 🔗 dapp.bridgers.xyz

🚀 @berachain is live on BRIDGERS! 🚀 Route $BERA across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

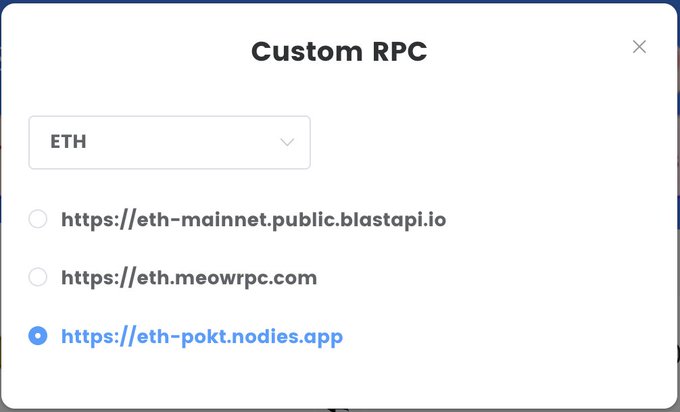

🚀 Bridgers Now Support Multiple RPCs for EVM Networks! 🔗✨ With multi-RPC support, users can now select their preferred RPC endpoint when bridging across EVM chains. 🧠 Reliability – If one RPC is down or slow, switch to another instantly. No more bottlenecks! ⚡ Speed –

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 HAEDAL is live on BRIDGERS! 🚀 Route $HAEDAL across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🔐 Not your keys, not your #crypto. When you leave your assets on centralized exchanges, you're trusting someone else with your funds. ✅ Stay in control. Swap safely. Bridgers is non-custodial, meaning you authorize — we route. 🔗 dapp.bridgers.xyz

Bridgers is not a DEX. Bridgers does not hold your funds. Bridgers does not match orders. We route your transaction securely through aggregated liquidity and smart contracts. You stay in control at every step. 🔗 dapp.bridgers.xyz

🚀 SUNDOG (TRON) is live on BRIDGERS! 🚀 Route $SUNDOG across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Authorize it. We route it. That’s BRIDGERS. No custody. No middlemen. Just on-chain execution. 🔗 dapp.bridgers.xyz

📍Bridgers HQ — where optimal execution paths are mapped. We compute the smartest cross-chain routes using aggregated liquidity from DEXs & bridges — all executed on-chain, fully authorized by you. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 NOT is live on BRIDGERS! 🚀 Route $NOT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🔍 What makes Bridgers different? ✅ Non-custodial by design ✅ Aggregated liquidity across DEXs & bridges ✅ Smart contract-powered routing ✅ User-authorized transactions You authorize. We route. 🔗 dapp.bridgers.xyz

🧠 Forget the mess — Bridgers does it all in one click. ✅ You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 HYPE is live on BRIDGERS! 🚀 Route $HYPE across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 FDUSD is live on BRIDGERS! 🚀 Route $FDUSD across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $NVDAX is live on BRIDGERS! 🚀 Route $NVDAX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Need faster way to bridge across chains? 🤔 With Bridgers, your assets don't just move — they teleport. ✅ Smart routing ✅ Non-custodial ✅ Real-time execution You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $USDC (XRP) is live on BRIDGERS! 🚀 Route $USDC (XRP) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

We’re excited to announce that @XLayerOfficial is now fully integrated on Bridgers 🎉 Users can now authorize and route transactions seamlessly across #XLAYER with top assets: 💠 $OKB 💠 $ETH 💠 $USDT This integration expands our cross-chain routing layer, giving you: ⚡

🚀 $WBTC of @unichain is live on BRIDGERS! 🚀 Route $WBTC (UNICHAIN) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $SWFTC is featured on @Coinbase Biggest Movers! $SWFTC is the first AI token on Coinbase, fueling SWFTGPT, the first domain-specific LLM for crypto. 🔗 exchange.coinbase.com/trade/SWFTC-USD

Tweet not found

The embedded tweet could not be found…

Manual bridging still leads the way—but at what cost? There’s a smoother route. 🔗 Try Bridgers: dapp.bridgers.xyz

🚀 MANA is live on BRIDGERS! 🚀 Route $MANA across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 OKB (XLAYER) is live on BRIDGERS! 🚀 Route $OKB (XLAYER) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 ETH is live on BRIDGERS! 🚀 Route $ETH across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

From the peaks of Avalanche to the towers of Ethereum, Bridgers charts the fastest path to your #crypto quest. You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 1INCH is live on BRIDGERS! 🚀 Route #1INCH across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 DOGS is live on BRIDGERS! 🚀 Move $DOGS across chains with ease — non-custodial, smart contract-powered, and backed by deep liquidity. You authorize. We route. ⚡ dapp.bridgers.xyz

🚀 @TokoCrypto is live on BRIDGERS! 🚀 Route $TKO across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 $GOOGLX is live on BRIDGERS! 🚀 Route $GOOGLX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Not all who wander swap wisely… Gas fees spike. Paths break. Assets vanish in the mist. Many explorers tried shortcuts — most never made it to the treasure. Bridgers was built to change that. You authorize. We route. dapp.bridgers.xyz

🚀 Always have Gas when you need it 🚀 Gas Swap is a simple but powerful feature that lets you convert any token into the native gas token of your target network. Whether you're moving funds across chains or trying out a new ecosystem, you’ll never get stuck waiting or

🚀 TWT is live on BRIDGERS! 🚀 Route $TWT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

What if you could get better rates with lower fees—all while staying decentralized? That’s Bridgers. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Bridgers is a non-custodial cross-chain aggregator that finds the best route for your swap — fast, secure, and on-chain. 🔗 dapp.bridgers.xyz

🚀 @Vaulta_ is live on BRIDGERS! 🚀 Route $A across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 @coin98_wallet is live on BRIDGERS! 🚀 Route #C98 across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $SWFTC is a top gainer on @Coinbase with over $200M in trading volume! $SWFTC continues to surge as the first AI token on Coinbase, powering SWFT Blockchain and SWFTGPT, the first domain-specific LLM for crypto. 🔗 exchange.coinbase.com/trade/SWFTC-USD

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

…and we’re gonna say it again 😆

Tweet not found

The embedded tweet could not be found…

🚀 CAKE is live on BRIDGERS! 🚀 Route $CAKE across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

How do you move crypto across chain? 🤔

Tweet not found

The embedded tweet could not be found…

🚀 @0xMantle is live on BRIDGERS! 🚀 Route $MNT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🔁 How Bridgers Uses Non-Custodial Execution 🔐 Bridgers doesn’t hold your assets or function as a typical exchange. It simply finds the most efficient cross-chain route while keeping you in full control of your wallet. Non custodial execution let you exchange #crypto directly

🚀 Meet @algoritha_coin – The Algorithmic Intelligence 🤖 Beyond Traditional AI: ALGORITHA fuses automation, data analysis, and personalized intelligence for real-world optimization. 🔒 Blockchain-Powered: Built for security, transparency, and autonomy—your data, your control.

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 $USDC (CFX) is live on BRIDGERS! 🚀 Route $USDC (CFX) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 @pendle_fi is live on BRIDGERS! 🚀 Route $PENDLE across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚨 New Asset Live on Bridgers 🚨 We are excited to announce that $RLUSD, @Ripple new real world asset backed #stablecoin, is now available on Bridgers Backed one to one by US dollar deposits and short term US treasuries, $RLUSD is built for transparency, compliance, and

Not all stablecoins are built the same 🧬 $RLUSD by @Ripple brings real-world utility, fully backed by $USD and short-term US Treasuries. It’s built for transparency, compliance, and trust 🔍 Now available on Bridgers ⚙️ You authorize. We route. 🔗 dapp.bridgers.xyz

We see the reports. We see the inflows. But we’re not waiting. We’re building with Bridgers so everyone can access cross-chain liquidity. 🔗 dapp.bridgers.xyz

The shift is happening: banks are investing in blockchain. ➡️$100B+ invested in blockchain companies since 2020 ➡️$700B/month in stablecoin volume ➡️$18T projected in tokenized assets by 2033 Our latest report with @CBInsights and @UKCBT_org uncovers how financial

🚀 POL is live on BRIDGERS! 🚀 Route $POL across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 USDE is live on BRIDGERS! 🚀 Route $USDE (ERC20) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Swap Bitcoin across chains without giving up control. Connect your wallet, set your slippage, and authorize the best path. Bridgers makes swapping $BTC easier, safer, and smarter. 🔐 Works with: @TokenPocket_TP, @unisat_wallet, @Ctrl_Wallet, @wallet , @iSafePal ,

🚀 SUN is live on BRIDGERS! 🚀 Route $SUN across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

For the swaps that don’t give you anxiety. For the bridges that actually work. For Bridgers. You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 USD1 is live on BRIDGERS! 🚀 Route #USD1 across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 Worldcoin is Now Live on BRIDGERS — Fully Integrated with Worldchain! 🚀 Bridge $WLD seamlessly across chains with secure, non-custodial execution, powered by smart contracts and aggregated liquidity. 🔐 With full @world_chain_ integration, BRIDGERS now supports $WLD

🚨 Upcoming Listing Alert! 🚨 We’re excited to announce that $UDS from @Undeadscom will soon be available on BRIDGERS! 🚀 Get ready to route $UDS across chains with non-custodial execution, smart contract routing, and aggregated liquidity — all from your own wallet. 🔐 Stay

Tweet not found

The embedded tweet could not be found…

🚀 TON is live on BRIDGERS! 🚀 Route $TON across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚨 Swapping big? Meet Bridgers, No custody. No logins. Just better output, every time! ⚡ Smarter route 💰 More value on each swap 🔐 Always stay in control You authorize. We route. 🔗 dapp.bridgers.xyz

📅 Bridgers Monthly Recap for July 2025 🧩 Bridgers continues to push the boundaries of cross-chain routing, accessibility, and liquidity. Here's everything we launched in July to expand asset support, onboard new networks, and enhance the overall experience for our users: 🆕

🚀 BTC is now live on BRIDGERS! 🚀 Route $BTC across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Swaps stay smooth when you route with Bridgers. 🔄🌉 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 BGB is live on BRIDGERS! 🚀 Route $BGB across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 ONDO is live on BRIDGERS! 🚀 Route $ONDO across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

More chains. More access. More power. With Bridgers , you’re not limited by ecosystems. You’re free to move where and when you want. You authorize. We route. 🔗 dapp.bridgers.xyz

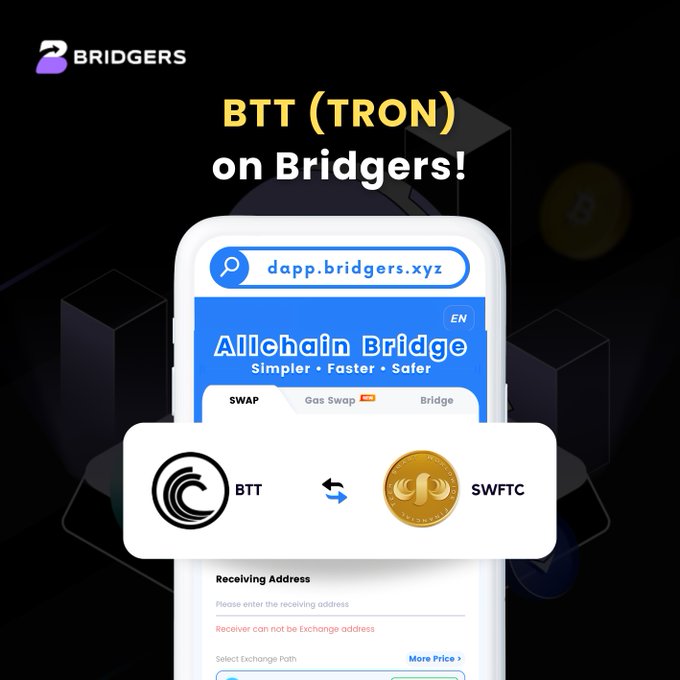

🚀 @BitTorrent is live on BRIDGERS! 🚀 Route $BTT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Bridge smarter, not harder. Let Bridgers handles the route for you. 🔗 dapp.bridgers.xyz 🛠️➡️🤖✅

Tweet not found

The embedded tweet could not be found…

🚀 @0xPolygon is live on BRIDGERS! 🚀 Route $POL across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Looking for a smarter way to move assets across chains? 🔄✨ Bridgers helps you route over 400 #crypto securely and efficiently using real time liquidity data and non custodial smart contract execution. You stay in control from start to finish, with full transparency before

Tweet not found

The embedded tweet could not be found…

Another choice for users who value trust and interoperability. @Ripple $RLUSD is available on Bridgers alongside top #stablecoins! You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 In case you missed it! @WFTtoken is live on BRIDGERS! 🚀 Route $WFTT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 JUP is live on BRIDGERS! 🚀 Route $JUP across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 ALGOAI is now live on BRIDGERS! 🚀 Route $ALGOAI across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚨 Upcoming Listing Alert! 🚨 We’re excited to announce that $YURU from @yuru_coin will soon be available on BRIDGERS!🚀 Get ready to route $YURU across chains with non-custodial execution, smart contract routing, and aggregated liquidity — all from your own wallet. 🔐 Stay

How important is speed when swapping tokens cross-chain?

🚀 $USDC @unichain is live on BRIDGERS! 🚀 Route $USDC (UNICHAIN) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

What if you could move assets across chains without giving up control of your wallet? That’s the Bridgers way. You authorize. We route. 🔗 dapp.bridgers.xyz

Two Chains. One Route. Bridgers isn’t a DEX. It’s not an exchange. It’s a non-custodial cross-chain routing protocol that lets you move from $BTC to $SOL — in one optimized path. You authorize. We route. 🔗 dapp.bridgers.xyz #Bridgers #BTC #SOL #CrossChain #Web3

💶 New listing alert: StablR Euro $EURR is now live on Bridgers 💶 $EURR by @stablreuro is a Euro-backed stablecoin pegged 1:1 to the Euro, collateralized with fiat and short-term government bonds 🇪🇺 Route $EURR across chains using Bridgers non-custodial smart contract

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 BNB on BNB Smart Chain & OpBNB is live on BRIDGERS! 🚀 Move your $BNB across chains with ease — non-custodial, smart contract-powered, and backed by deep liquidity. You authorize. We route. ⚡ dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🔀 Routing across chains is complex 🔐 Doing it securely is critical Bridgers aggregates liquidity and computes best execution paths, all while keeping your assets in YOUR control. Explore secure routing 👉 dapp.bridgers.xyz #DeFi #CrossChain #crypto #NonCustodial #Web3

Looking for a better way to move across chains? Bridgers helps you move assets with: ✅ Custom slippage control ✅ Transparent routing before you authorize ✅ Non custodial smart contract execution Try Bridgers today and experience seamless routing. 🔗 dapp.bridgers.xyz

🚀 RSR is live on BRIDGERS! 🚀 Route $RSR across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Still jumping across 3 platforms just to bridge tokens? 😩 There’s a smoother way. ✅ One click ✅ One route ✅ One dApp Bridgers makes it simple. You authorize. We route. 🔗 dapp.bridgers.xyz

We are thrilled to announce that @deepseek_ai will be integrated into SWFTGPT! 🎉🤖 This integration aims to enhance SWFTGPT's capabilities by leveraging Deepseek advanced AI technology, providing users with more accurate and efficient responses. Stay tuned for more updates as

🚀 SUSHI is live on BRIDGERS! 🚀 Route $SUSHI across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 COOKIE is live on BRIDGERS! 🚀 Route $COOKIE across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Your $BTC deserves better than random bridges. BRIDGERS gives you smart routing across chains, backed by aggregated liquidity and secured by on-chain execution You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 USDT (SUI) is live on BRIDGERS! 🚀 Route $USDT (SUI) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

Not a DEX. Not an exchange. Bridgers is a non-custodial routing protocol 🌉⚡ We don’t hold funds. Bridgers compute the optimal path across DEXs & bridges. You stay in control. 🔗 dapp.bridgers.xyz

Bridgers lets you swap 400+ #crypto assets across multiple chains. 🌐⚡ You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 CETUS (SUI) is live on BRIDGERS! 🚀 Route $CETUS (SUI) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 USDC (TRON) is live on BRIDGERS! 🚀 Route $USDC across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 $VENUS is live on BRIDGERS! 🚀 Route $VENUS (SOL) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

You authorize. We route. 🔗 dapp.bridgers.xyz

💸 New listing alert: StablR USD $USDR is now live on Bridgers 💸 $USDR by @stablrusd is a MiCAR-compliant stablecoin backed 1:1 by the US Dollar, collateralized with fiat and short-term government bonds 🇺🇸 You can route $USDR across chains using Bridgers non-custodial smart

🚀 @qubetics is live on BRIDGERS! 🚀 Route $TICS across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Looking for a better way to move #cryptocurrencies across chains? Bridgers helps you with: ✅ Custom slippage control ✅ Transparent routing before you authorize ✅ Non custodial smart contract execution Try Bridgers today and experience seamless routing. 🔗

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

🚀 ASTER is live on BRIDGERS! 🚀 Route $ASTER across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 RADX is now live on BRIDGERS! 🚀 Route $RADX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 @WinkLink_Oracle is live on BRIDGERS! 🚀 Route $WIN across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

⚠️ Moving $BTC across chains? You are probably taking more risk than you think. Most platforms hold custody, use centralized servers, or act like an exchange. Bridgers is different. It finds the best path and executes everything on-chain with your full approval. 👇 You

🚀 @RunOnFlux is live on BRIDGERS! 🚀 Route $FLUX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 HTX (TRON) is live on BRIDGERS! 🚀 Route $HTX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

We know what you’re looking for 👀 ✨ Low fees ⚡ Fast execution paths 🔒 Non-custodial control That’s exactly what Bridgers brings to you, scanning across DEXs & bridges to deliver the optimal route, while your funds stay safe in your wallet. 💙🌉 You authorize. We route.

Tweet not found

The embedded tweet could not be found…

🚀 @tusdio is live on BRIDGERS! 🚀 Route $TUSD across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Introducing SWFTGPT – powered by $SWFTC! 🚀 As the first ever AI token featured on Coinbase and the first domain-specific LLM for crypto, enjoy 50% reduced fees, AI-driven market analysis, and more. RT to spread the word! 🤖 Download SWFTGPT: 🔗 swft.pro/#Download

🚀 $PAL from @PalioAI is live on BRIDGERS! 🚀 Route $PAL across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

No more breaking your $BTC into tiny pieces 👀 Bridgers lets you swap over 1 $BTC in one go! 🐋⚡ Big moves. Bigger bridge. You authorize. We route. 🌉 dapp.bridgers.xyz

🚀 In case you missed it! USD1 is live on BRIDGERS! 🚀 Route #USD1 across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 KAITO is live on BRIDGERS! 🚀 Route $KAITO across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 $USDT (CFX) is live on BRIDGERS! 🚀 Route $USDT (CFX) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 @StellarOrg is live on BRIDGERS! 🚀 Route $XLM across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 BTT is live on BRIDGERS! 🚀 Route $BTT across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

With Bridgers, there’s no KYC. No account needed. 🔐 Non-custodial 🔄 Aggregated liquidity 🚀 Smart-routing across chains You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

Tweet not found

The embedded tweet could not be found…

gm to you fren ☀️ Bridgers + @WalletConnect = smooth cross-chain routing without giving up control Try it now → dapp.bridgers.xyz

🚀 @yuru_coin is live on BRIDGERS! 🚀 Route $YURU across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 DEEP is live on BRIDGERS! 🚀 Route $DEEP across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 USDT (XLAYER) is live on BRIDGERS! 🚀 Route $USDT (XLAYER) across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

Tweet not found

The embedded tweet could not be found…

🚀 BCH is live on BRIDGERS! 🚀 Route $BCH across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

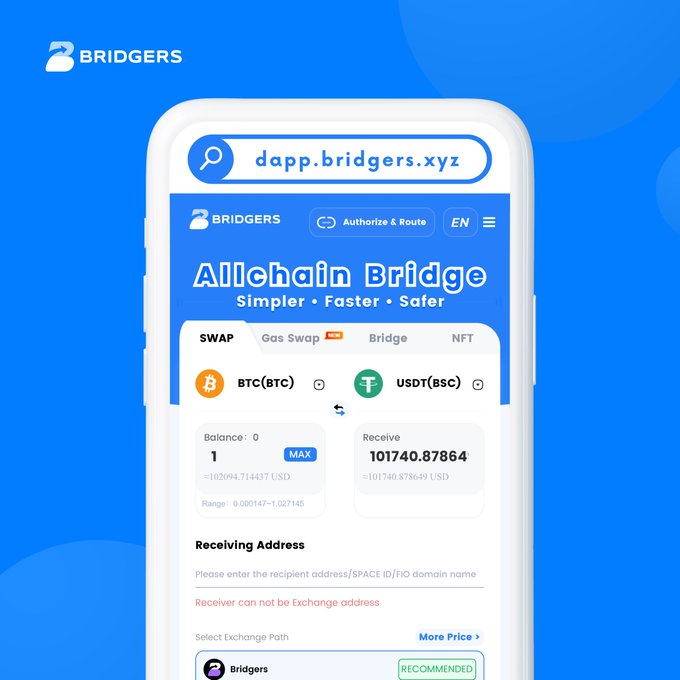

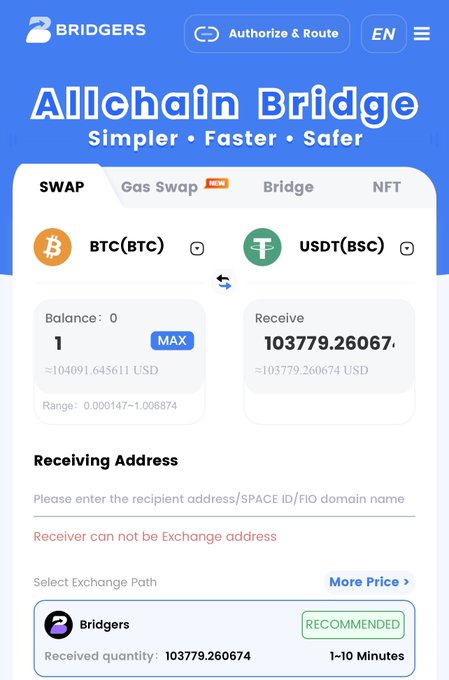

$BTC to $USDT in 1 click. No centralize exchanges. No confusion. Just you, your wallet, and Bridgers. ⚙️ 1 BTC ≈ 103,779 USDT ⏱️ 1–10 mins delivery Tap in: dapp.bridgers.xyz

🚀 $AAPLX is live on BRIDGERS! 🚀 Route $AAPLX across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🚀 @usddio is live on BRIDGERS! 🚀 Route $USDD across chains with secure, non-custodial execution powered by smart contracts and aggregated liquidity. 🔐 You authorize. We route. 🔗 dapp.bridgers.xyz

🏦 European Banking Giants Unite for MiCA-Compliant Euro Stablecoin

**Nine major European banks** including ING, UniCredit, and CaixaBank are collaborating to launch a **MiCA-regulated euro stablecoin** by the second half of 2026. The consortium will: - Seek licensing from the **Dutch central bank** - Target becoming **Europe's digital payment standard** - Enable **low-cost, near real-time cross-border payments** - Support digital asset settlement This initiative represents a significant step toward **institutional adoption** of stablecoins in Europe, leveraging the new MiCA regulatory framework to create a compliant digital euro solution. The project positions these traditional financial institutions at the forefront of Europe's **digital currency evolution**.

☀️ Another Sunny Day

The web3 community continues its daily ritual with another cheerful "gm gm" greeting accompanied by a sunny emoji. This consistent pattern of morning salutations reflects the ongoing optimism and community spirit that characterizes the space. The simple yet meaningful tradition of sharing good morning messages has become a staple of web3 culture, fostering connection and positivity among community members across different time zones and projects.

Fnality Raises $136M Series C to Build Central Bank-Backed Payment Rails for Tokenized Assets

**UK fintech Fnality secured $136M in Series C funding** led by major financial institutions including Bank of America, Citi, and WisdomTree. The company is developing **real-time payment infrastructure** backed by central banks specifically designed for tokenized assets. Their Fnality Payment System (FnPS) is already operational. **Key highlights:** - Major banking giants leading the investment round - Focus on central bank-backed payment rails - Live payment system already processing transactions - Targeting the growing tokenized asset market This funding positions Fnality to expand its **institutional-grade payment infrastructure** as traditional finance increasingly adopts digital assets and tokenization.

Deutsche Bank: Bitcoin Could Become Reserve Asset by 2030

**Deutsche Bank** released a report suggesting Bitcoin could gain recognition as a **reserve asset by 2030**, potentially joining gold as a hedge against inflation and geopolitical risks. The report highlights ongoing **diversification trends** in global reserves: - US dollar currently holds **57% of global reserves** - Central banks seeking alternatives amid economic uncertainty - Bitcoin positioned as potential store of value This shift could represent a significant milestone for cryptocurrency adoption at the institutional level, as traditional financial institutions increasingly view Bitcoin as a legitimate asset class for portfolio diversification.