Bored Ape Owner Secures $12,470 USDC Loan Through Cyan Protocol

Bored Ape Owner Secures $12,470 USDC Loan Through Cyan Protocol

💰 Ape puts itself to work

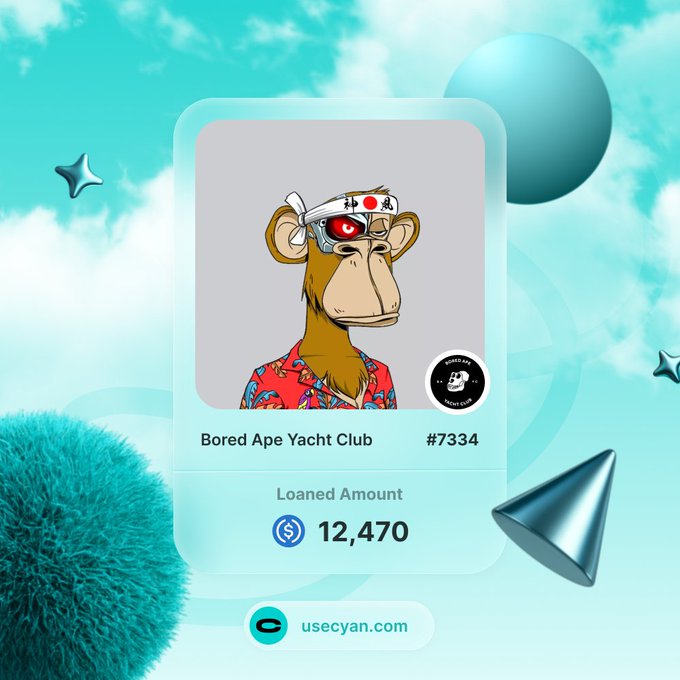

A Bored Ape Yacht Club NFT holder used their #7334 Ape as collateral to secure a $12,470 USDC loan through Cyan's lending protocol.

This represents a slight increase from the previous week's largest loan of $11,474 USDC against Ape #2600.

Key highlights:

- Cyan enables NFT owners to unlock liquidity from their digital assets

- Users can generate income from their NFT holdings rather than simply holding them

- The protocol provides financing options specifically designed for the NFT market

The trend shows consistent demand for NFT-backed lending, with Bored Ape holders actively leveraging their assets for capital access.

Largest Loan of the Week! 💰 A $12,470 USDC loan was secured against @BoredApeYC #7334 last week. Cyan users don’t just hold their Apes, they put them to work.

Largest Loan of the Week! 💰 A $11,474 USDC loan was secured against @BoredApeYC #2600 last week. Cyan users don’t just hold their Apes, they put them to work.

BAYC Holder Secures $5,956 Loan Through Cyan Protocol

A Bored Ape Yacht Club NFT holder has taken out a **$5,956 USDC loan** against BAYC #2931 through the Cyan protocol. This marks another instance of the same holder utilizing Cyan's lending services to **optimize capital efficiency** while maintaining ownership of their NFT. The loan demonstrates continued adoption of NFT-backed financing, allowing collectors to access liquidity without selling their digital assets. Cyan enables users to leverage their NFTs as collateral for loans, providing an alternative to traditional selling when capital is needed.

Cyan Provides Alternative Access Link for Ethereal Platform

Cyan has shared an alternative access link for users experiencing connectivity issues with their Ethereal platform at https://ethereal.usecyan.com/. This follows a pattern of the protocol providing backup access methods, similar to previous instances where alternative links were made available for their services. The move ensures continuous access to Cyan's Buy Now, Pay Later services for NFT purchases and re-collateralized NFT loans.

Cyan Launches NFT Rewards Program with First Lil Pudgy Claim

Cyan protocol recorded its first user claiming rewards against their Lil Pudgy NFT. The platform treats NFTs as balance sheet assets that holders can unlock liquidity from while maintaining ownership. **Key Details:** - Users can earn rewards by using the protocol at [ethereal.usecyan.com](http://ethereal.usecyan.com) - The platform enables NFT holders to access liquidity while retaining airdrops and whitelists - Cyan is seeking community input on which NFT collections to reward next The protocol offers Buy Now, Pay Later services and re-collateralized loans for NFT holders.

Mutant Ape Yacht Club Returns to BNPL Spotlight

Two Mutant Ape Yacht Club NFTs have recently utilized financing options: - **MAYC #21210** was purchased through a Buy Now, Pay Later arrangement - **MAYC #7969** holder secured a loan for 1,077 USDC The collection, which hasn't been as prominent in recent deal flow, is showing renewed activity in the NFT financing space. Both transactions demonstrate continued demand for flexible payment options in the NFT market, even for established collections like Mutant Ape Yacht Club.

🦍 BAYC Owner Unlocks 2.32 ETH

**Bored Ape #3180** was used as collateral for a **2.32 ETH loan** on Cyan this week. The move demonstrates how NFT holders can **unlock capital efficiency** rather than keeping valuable assets idle. Cyan's lending platform allows users to: - Use NFTs as loan collateral - Access liquidity without selling - Maintain ownership of digital assets This follows similar activity, with **BAYC #7896** securing a $31,500 loan earlier this month on the same platform.