BNPL Pay Opens Early Access for Bank Node Applications

BNPL Pay Opens Early Access for Bank Node Applications

🏦 Free Money for Banks?

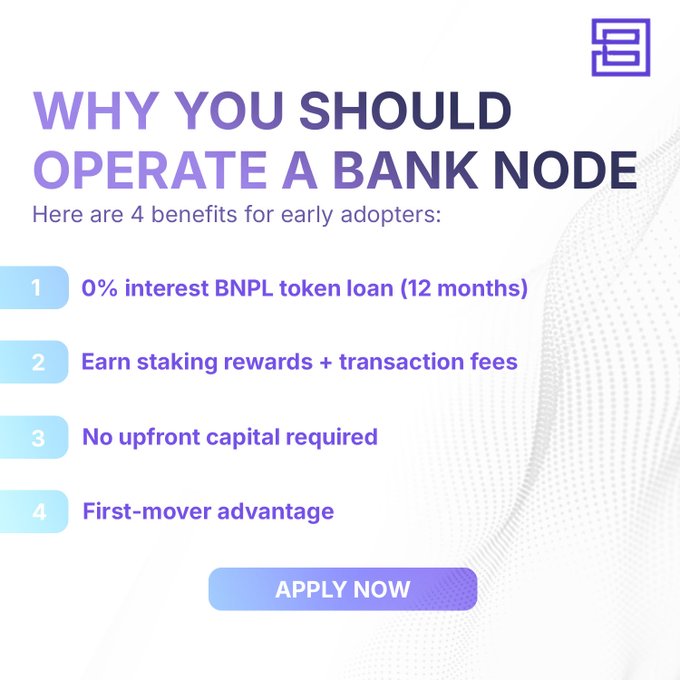

BNPL Pay has launched its Bank Node Operator Pilot Program, seeking the first five institutions to participate. Key benefits include:

- 0% interest token loans for 12 months

- No upfront capital required for node bonding

- Revenue from staking rewards and transaction fees

Qualified institutions must be regulated banks, credit unions, or licensed financial entities. The program supports use cases like retail BNPL financing, SME invoice tokenization, and cross-border trade finance.

How to Apply: Email info@bnplpay.io with:

- Institutional credentials

- Intended BNPL use case outline

Officially launching our Bank Node Operator Pilot Program! Be one of the first 5 institutions and get the following benefits: ✔️ 0% interest token loan for 12 months ✔️ Bond your node without upfront capital ✔️ Earn staking rewards + transaction fees Full details:

BNPL Pay Signs Major License Agreement with Ovanti Limited

BNPL Pay has secured a strategic partnership with Ovanti Limited (ASX: OVT), marking a significant milestone in decentralized BNPL lending. Key highlights: - AUD $2.39M funding from Ovanti - 50% revenue share from platform activities - Enhanced liquidity through stablecoin lender participation The agreement validates BNPL Pay's decentralized lending model and positions the protocol for sustainable growth in the BNPL sector. This follows their January 2025 protocol relaunch and partnership with Global Block. [Join the community](https://t.me/bnplpaychat) to stay updated.

BNPL Pay Protocol Announces Strategic Relaunch and Funding Round

BNPL Pay announces a strategic pivot to focus exclusively on Buy Now, Pay Later businesses. Key updates include: - New funding round with TradeFi partners using foundation treasury tokens - Enhanced security measures following 2022 wallet compromise - Partnership with Global Block for operational expertise - New P2P lending pools with autonomous Banking Nodes - Improved governance framework for stakeholders The protocol will launch a new website in Q1 2025 alongside several key partnership announcements. Visit bnplpay.io for more details.