Bitcoin Shows Early Bottom Signals After Extreme Market Deleveraging

Bitcoin Shows Early Bottom Signals After Extreme Market Deleveraging

🔄 Bitcoin Bottom Signals

Bitcoin may be forming a stabilisation phase after experiencing extreme market conditions, according to Bitfinex Alpha analysis.

Key market indicators suggest potential relief bounce:

- Extreme deleveraging has cleared excess positions

- Short-term holders showing capitulation signals

- Early signs of seller exhaustion emerging

This follows Bitcoin's significant correction from recent highs, with the market experiencing one of its most meaningful drawdowns of the cycle. The combination of these factors historically creates conditions for local bottoms.

Previous context shows pattern:

- BTC triggered strong early-bottom signals after sharp drawdown

- Market saw classic stabilisation ingredients align

- Four straight weekly declines - first time in over 500 days

While volatility remains elevated, the current setup mirrors previous cyclical bottom formations. The question remains whether this marks the start of recovery or if more downside pressure continues.

Analysts note this consolidation phase, rather than full capitulation, could provide the foundation for the next market move as demand conditions potentially improve.

Crypto liquidations in the last two days have topped $2.8 billion, Bitcoin slipped below $100k, and there are now reduced expectations of a December rate cut are in the air. Why? Our research team has dug into what’s happening. Let’s dive into it! Time for a thread 🧵

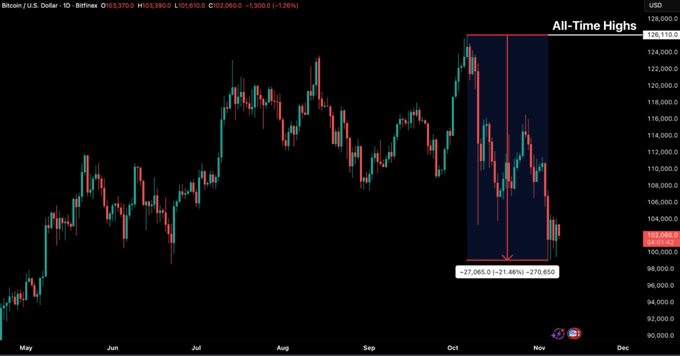

Bitcoin declined by over 21% from its October all-time high last week, briefly dipping below the psychological $100,000 level to $99,045. Rather than signalling a sell-off, this move points to the formation of a new consolidation base.

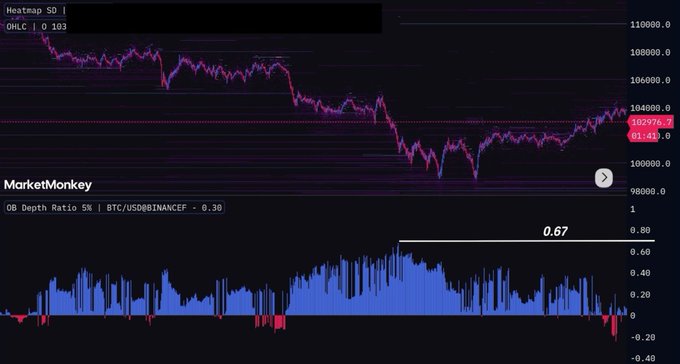

Markets are consolidating and optimism is gradually returning. ⚡️ After October’s $19B liquidation, BTC is still trading above the 0.85 supply quantile cost basis, where 15% of circulating supply would be in loss. More ⬇️

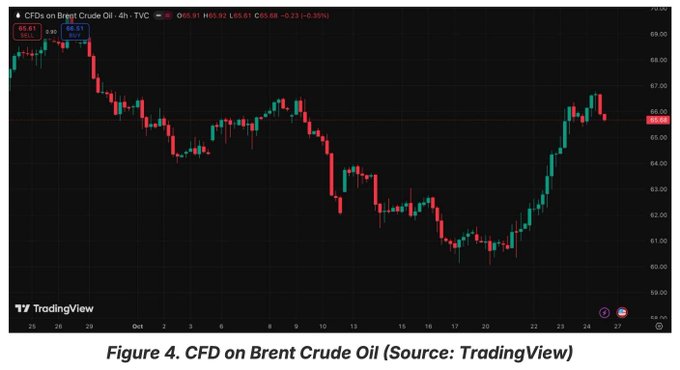

Crypto markets are benefitting from volatility in traditional assets. In what is usually the opposite case, surges in Brent crude to ~$65/barrel, is prompting institutional investors to reassess exposures across bonds, equities, and alternatives - including Bitcoin and Ether. ⬇️

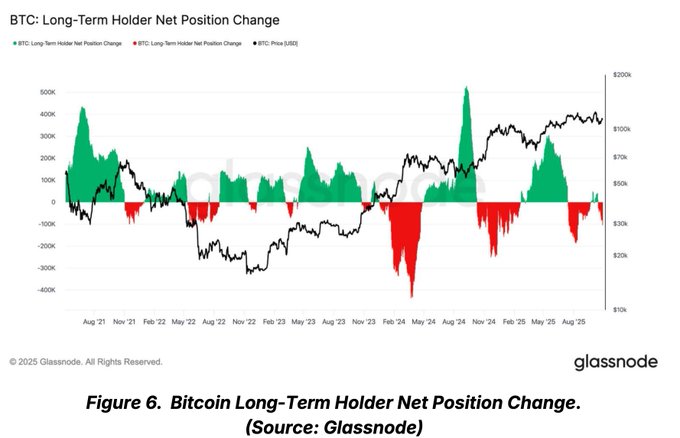

Market pressure on Bitcoin shows seasoned investors are cashing out, according to Bitfinex Alpha. Long-Term Holders are offloading ~104K BTC/month - the sharpest selling wave since July - adding structural pressure as they lock in gains. Read more ⬇️ issuu.com/docs/1ecc7cbae…

📉 #Bitcoin has now posted four straight weekly declines - something we haven’t seen in over 500 days. This time, the move is sharper: over the last month, BTC has fallen 30.6%, even deeper than the 24% drawdown during the 2024 consolidation phase.

BTC slips to 96k Why is the market retracing even after the US government re-opened following the longest shutdown in history? • Key economic data is still missing to guide the market & the Fed • It is not clear how much damage the shutdown has had on growth and productivity

Bitcoin’s 25% pullback may not be as consequential as it may seem. Despite trading below $94K, selling is slowing, hinting at early consolidation rather than full capitulation. Watch our video for details and read the full report: blog.bitfinex.com/bitfinex-alpha…

Bitcoin lost the $ 107,000 to $ 108,000 region last week and slipped under $ 100,000. That zone carried strong technical and on-chain weight, and the breakdown opened room for deeper price action. 📉

Good morning from Lugano 🇨🇭 Today @ThalexGlobal and Bitfinex Derivatives welcome leading investors, traders, and quantitative experts to the Gamma Summit. A private gathering exploring Bitcoin volatility, options, and liquidity.

“Bitcoin’s volatility is gradually coming down. New types of products are changing market structure and how options interact with perpetual markets.” A key takeaway from the Fireside Chat with @adam3us and @minus1_12 at Bitfinex Derivatives Gamma Summit.

The market’s pulse has slowed. Following last week’s rate cut - but no promise of more - traders are treading carefully. The aftermath of the historic 10.10 liquidation has left markets calmer, as directional flows subside and momentum resets. A thread 🧵

Holding 113k per BTC is critical. 🚨 “Trading above this level has historically marked the transition from corrective phases to accumulation phases.” Failing to do so poses the risk of a deeper retracement toward 97,500. - Bitfinex Alpha in @coindesk coindesk.com/markets/2025/1…

Bitcoin just triggered one of its strongest early-bottom signals of the cycle. After a sharp drawdown, BTC staged a notable rebound, aligning closely with the timing of previous local bottoms, even as volatility remains elevated… Could this be the start of a recovery?

Long-term holders are still taking profits and it’s weighing on the market. Since July, LTH supply has dropped by 0.3M BTC, signalling steady selling as new buyers struggle to match the pace. With inflows muted, the risk of demand exhaustion is rising. 👇

📉 Bitcoin’s momentum is fading & the market’s entering a “reset” phase. After a brief bounce on softer US inflation data, BTC slipped back below key support around $113K. Traders are watching $97.5K as the next line of defence. Here’s what else is shaping the month in crypto👇

At the inaugural Gamma Summit with @contrariangab of @herclegroup, Pierre-Antoine Mudry of @stsdigital_io, and Faiz Rasool say the 10.10 liquidation could have been eased if options markets were deeper, and that adoption will grow once education, liquidity, and better UX are met.

Bitcoin may have found its footing - but the foundation still looks shaky. After a steep $19B liquidation and an 18% drawdown, BTC is stabilising near $107K–$108K. The question now: is this consolidation or the calm before another move? 👇

Where the future of Bitcoin derivatives is defined. The Gamma Summit, hosted by @ThalexGlobal & Bitfinex Derivatives @bitfinex, brings together leading voices in Bitcoin options, futures, volatility & liquidity. Featuring @paoloardoino, @adam3us, @minus1_12 & @FedericoTenga 🧵

Crypto markets are delicately poised, but we have seen all this before: The current correction is similar to June 2024 and Feb 2025, both pivotal inflexion points balancing between recovery and deeper contraction. Bitfinex Alpha in @cointelegraph cointelegraph.com/news/bitcoin-e…

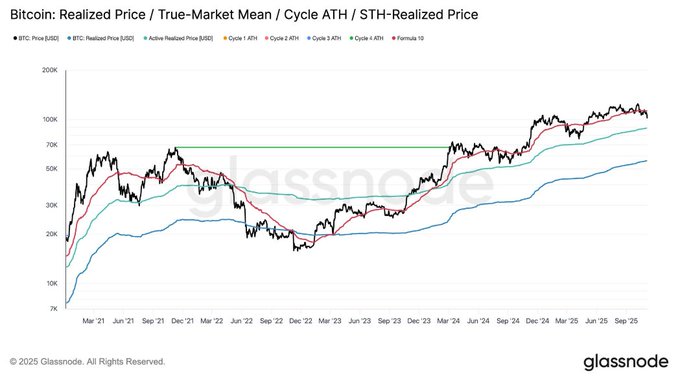

Our latest Alpha video breaks down last week’s market tone. BTC touched $99,045 in a move that fits earlier mid-cycle resets. We expect some short term rallies to the short-term holder level over $112k, but the lower bound is the Active Investors Realised Price around $88,500.

“The combination of extreme deleveraging, capitulation among short-term holders, and early signs of seller exhaustion has created the conditions for a stabilisation phase and a relief bounce,” - Bitfinex Alpha x.com/cryptonews/sta…

🚀 Bitcoin staged a sharp rebound this week, climbing nearly 8% in a single day as analysts pointed to signs that a local bottom may already be in. #Bitcoin #Crypto cryptonews.com/news/bitfinex-…

Unlock the next level of Bitcoin derivatives! The Gamma Summit, hosted by @ThalexGlobal & Bitfinex Derivatives (@bitfinex), is an invite-only forum for professionals to explore options, futures, volatility, hedging & liquidity.

🚨 Bitcoin just logged its third-largest drawdown of this cycle - down 25% from its ATH. Momentum still points downward on lower timeframes… but the pace of selling is finally stabilising. We see this as early signs of consolidation, not capitulation. ⬇️

Bitcoin Faces Largest Cycle Pullback as $1.7B Liquidated in 24 Hours

Bitcoin has closed below its yearly open, approaching the $80,822 lows in what marks the **largest pullback of the current cycle**. **Key developments:** - Liquidations reached **$1.7 billion in 24 hours**, surpassing levels seen during the Covid crash and FTX collapse - Uncertainty-driven selling during US trading sessions continues to apply downward pressure - Price action reflects ongoing market stress as traders exit leveraged positions The scale of liquidations indicates significant deleveraging across the market, with forced selling creating cascading price pressure. US session volatility suggests macro uncertainty remains a primary driver of current weakness.

Tokenised Equities Transition from Concept to Market Reality

**Tokenised equities are making the leap from theoretical concept to practical implementation.** The digital asset market is witnessing a significant shift as tokenised equities begin to materialize in real-world applications. This development marks a notable evolution in how traditional securities can be represented and traded on blockchain infrastructure. **Key developments:** - Traditional equity instruments are being converted into digital tokens - The transition represents a practical application of blockchain technology in traditional finance - This shift could potentially reshape how securities are traded and settled The move toward tokenised equities suggests growing institutional acceptance of blockchain-based financial instruments. This development occurs as the broader digital asset market continues to mature and integrate with traditional financial systems. [Read the full analysis](https://blog.bitfinex.com/bitfinex-alpha/bitfinex-alpha-in-the-absence-of-spot-demand-btc-is-drifting/)

NYSE Launches 24/7 Blockchain Trading Venue for Tokenized Stocks

The New York Stock Exchange is launching a blockchain-enabled trading venue that will operate around the clock for tokenized equities. This marks a significant shift from traditional market hours. **Key developments:** - NYSE's new platform will enable 24/7 trading of tokenized stocks - Companies like Strategy and Bitmine Immersion are adding Bitcoin and Ethereum to their balance sheets as long-term reserves - This follows earlier moves by crypto exchanges to offer on-chain stock trading The initiative represents a practical step in bringing traditional finance infrastructure on-chain, moving beyond pilot programs to operational implementation.

🔴 Bitcoin Holds Ground After Fed Rate Decision Triggers $390M in Liquidations

The Federal Reserve maintained interest rates at 3.5-3.75% at its January 2026 meeting, signaling a cautious stance amid ongoing inflation concerns. **Market Impact:** - Bitcoin perpetual futures markets saw significant volatility - Over $250 million in long positions liquidated - Additional $140 million in liquidations recorded - BTC holding near recent lows despite pressure The Fed's decision to keep rates steady reflects limited appetite for monetary easing. For crypto markets, this translates to a measured near-term outlook with constrained upside potential absent new liquidity support. Traders remain cautious as Bitcoin tests key support levels in the wake of the announcement.

Dollar Down 11%, Gold Hits $5,580 ATH—Crypto Markets on Deck

**Market Shift Accelerates** The US Dollar has weakened approximately 11% over the past year, while gold has surged 29% in just 28 days, reaching all-time highs around $5,580 per ounce. **Capital Flight to Hard Assets** - Fear of fiat currency depreciation is driving investors toward tangible stores of value - Retail investors are expected to gradually redirect cash savings into more liquid assets - The crypto market appears positioned to benefit from this trend **Historical Context** The BTC/gold ratio previously dropped over 50% from its peak when gold hit $4,700/oz. Following that decline, Bitcoin significantly outperformed gold. Analysts suggest monitoring this relationship as liquidity conditions evolve through 2026.