Bitcoin Rebounds 6.67% to $85K After Trump's Tariff Pause

Bitcoin Rebounds 6.67% to $85K After Trump's Tariff Pause

🎢 Trump Hits Pause, BTC Soars

Bitcoin showed strong recovery last week, climbing 6.67% to reclaim $85K following Trump's announcement of a 90-day tariff pause. The rebound appears fundamentally sound, driven by spot buying rather than leverage, indicating genuine buyer interest.

Key points:

- Currently 83 days into a mid-cycle correction

- Down 31% from all-time highs

- Movement remains within normal bull market parameters

- Spot Cumulative Volume Delta shows consistent aggressive buying

- Price action contained between $75K-$85K range

While the correction has been significant, on-chain metrics suggest underlying strength in buyer activity.

#Bitcoin momentum surges! 🔹 @MicroStrategy adds 10,107 BTC, now holding 158,400 BTC 📈 🔹 @Metaplanet_JP raises $745M to expand its Bitcoin reserves ⚡ 🔹 @tether integrates $USDt into Bitcoin’s Lightning Network, boosting payment utility 💡 More info in Bitfinex Alpha!

Tweet not found

The embedded tweet could not be found…

Bitcoin remains range-bound, with volatility compressing and liquidity thinning - macro catalysts continue to drive price action. 📉📈 Will a breakout come soon? Watch our Bitfinex Alpha video for the full breakdown!

Markets have gone moribund according to Bitfinex Alpha 👀 Bitcoin has been range-bound between $91K and $102K for over 90 days. Volatility surged on Feb 21st after the @Bybit_Official hack and an S&P 500 options expiry sell-off, causing a 4.7% drop to ~$95K before it recovered 🚨

Bitfinex Alpha takes a look at the wild market swings, $3B in options expiring last week, and major market moves - get the full breakdown. 📉📈 🎥 Watch our review for full insights!

Access every week our comprehensive weekly reports on the Bitcoin market, emerging opportunities, and key industry developments. Enhance your investment strategies with in-depth analysis and stay informed every week with Bitfinex Alpha! Sign up here: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the evolving cryptocurrency market with Bitfinex Alpha! Gain access to comprehensive weekly reports packed with expert insights on market trends, opportunities, and shifts 📊 Empower your investment strategies with our in-depth analysis: go.bitfinex.com/AlphaSignUpPage

Uncertainty continues to overshadow the market. What the pros doing in these times of volatility? Find out in our latest Alpha Report: blog.bitfinex.com/bitfinex-alpha…

Bitcoin has pulled back nearly 30% from its recent all-time high. With ETF outflows piling up and short-term holders feeling the heat, is this just a pause or a deeper correction? Watch our Bitfinex Alpha video for a full breakdown on what’s next!

Institutional capital remains the key for Bitcoin to break its current trading range. Where are prices headed next? Our analysts reveal critical support and resistance levels in this week's Bitfinex Alpha! blog.bitfinex.com/bitfinex-alpha…

👀 Bitfinex Alpha: The UK Treasury exempts crypto staking from Collective Investment Scheme regulations, fuelling innovation and reinforcing a more crypto-friendly stance from the UK.

"We're seeing the possible commencement of a new type of market environment where altcoins are going through entire cycles while BTC continues to be macro-correlated and shows more maturity as a risk asset." - Bitfinex Alpha @Crypto_Potato @Mandy5Williams cryptopotato.com/bitfinex-warns…

Stay at the forefront of the crypto market with BITFINEX ALPHA! Unlock expert insights, available for free anytime. With detailed analysis, you'll have the tools you need to make more informed decisions and fine-tune your strategy for 2025. Sign up now: go.bitfinex.com/AlphaSignUpPage

Kickstart your week with Bitfinex Alpha ✅ Gain access to exclusive market insights, macro trends, and key predictions to guide your trading week. Sign up now: go.bitfinex.com/AlphaSignUpPage

This week we saw @MicroStrategy add 7,633 $BTC to its portfolio, pushing its total to 478,740 BTC! @saylor stays firm in his "buy and hold" strategy, reinforcing confidence in Bitcoin’s long-term value 🌟 More insights in Bitfinex Alpha 👀

From worst February since 2014 to a 20% rebound after Trump's Crypto Reserve announcement. This chart tells the story of Bitcoin's 28.3% correction and recovery. Get the full analysis here: blog.bitfinex.com/bitfinex-alpha…

As we start a new month, Bitcoin faces a volatile crossroads! Bitcoin closed February down 17.39%, its worst Feb since 2014. It plunged 18.4% to $78.6K amid record ETF outflows. However, March is kicking off with a bang 💥

81 days and counting... Bitfinex Alpha @pelimatos @cryptoslate cryptoslate.com/bitcoin-comple…

Bitfinex Alpha takes you through the mix of bullish momentum and risk in the crypto markets ✅ @MicroStrategy has launched another $2B convertible offering to fund Bitcoin acquisitions What's next?

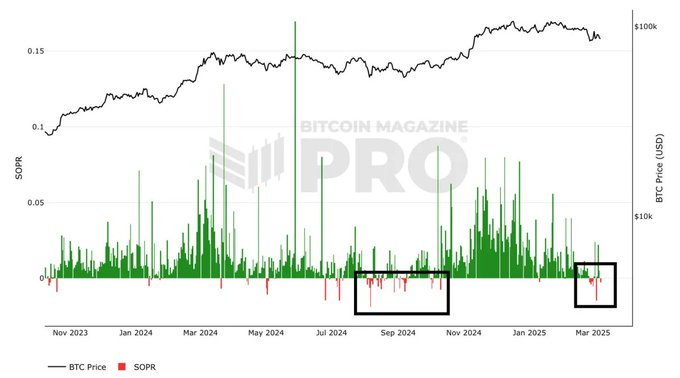

Onchain data reveals traders selling at a loss for the first time since Oct 2024. Is this a bottom or more pain ahead? Get the full analysis in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

$BTC dropped below $100K amid tariff hikes, mirroring broader market trends. Despite a 10% January gain, it's consolidating within a 15% range for the past 65 days. Volatility is cooling, but is a market-wide correction coming? 👀 More in Bitfinex Alpha!

Bitfinex Alpha takes a look at crypto moves in the past week 👀 🔥 @CBOE proposed staking for @Fidelity’s ETH ETF — a potential game-changer for ETH inflows if 3-4% yields are added. But will the SEC allow it? Dive in: blog.bitfinex.com/bitfinex-alpha…

Sign Up for Your Monday Market Edge: Bitfinex Alpha ✅ Get advanced market data, macro analysis & what to expect next. Sign up here: go.bitfinex.com/AlphaSignUpPage

After hitting an ATH of $109,590 on January 20, Bitcoin has since retraced to a low of $77,041 — a 29.7% pullback. While 30% dips have happened before in this cycle, but they are not common, and the overall outlook is uncertain. What's next? 👇 blog.bitfinex.com/bitfinex-alpha…

Make market analysis reports great again.

Get in-depth insights with Bitfinex Alpha! 🔹 Weekly Bitcoin Market Trends 🔹 Emerging Investment Opportunities 🔹 Key Industry Developments Enhance your investment strategies with expert analysis and stay informed every week. Sign up now: go.bitfinex.com/AlphaSignUpPage

After 90 days of $BTC consolidation, the market always moves decisively - one way or the other. Bitfinex Alpha @CryptoSlate @pelimatos cryptoslate.com/bitcoin-crash-…

Stay ahead of the curve with our weekly reports on the Bitcoin market, emerging trends, and key developments in the crypto space. Gain valuable insights to refine your investment strategies and stay updated every week with Bitfinex Alpha! Sign up now: go.bitfinex.com/AlphaSignUpPage

With volatility at historic lows, the market remains directionless as geopolitical tensions and macroeconomic uncertainty weigh on sentiment” - Bitfinex Alpha @FXstreetUpdate @cryptochhetri fxstreet.com/cryptocurrenci…

BTC closed Q1 2025 down nearly 11%, despite hitting an ATH of $109,590 in January. Hopes for pro-crypto policies under Trump have faded, and traders have been selling. We analyse what comes next in this week’s Bitfinex Alpha blog.bitfinex.com/bitfinex-alpha…

Bitcoin has been trading in a narrow range of $91,000 to $102,000 for 81 consecutive days, with historic lows in volatility. Geopolitical tensions & macroeconomic uncertainty continue to weigh on sentiment, leaving the market directionless. More in Bitfinex Alpha 👀

Don’t be phased by the volatility: “While BTC remains sensitive to macroeconomic factors, it is also exhibiting structural strength on higher timeframes… and remains in a robus trend” #Bitfinex Alpha @cointelegraph @sndr_krisztian coindesk.com/markets/2025/0…

Stay Ahead with Bitfinex Alpha! 🔹 Weekly Bitcoin Market insights 🔹 Key Industry Developments Enhance your investment strategies with expert analysis & stay informed every week! 📩 Sign up now: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the crypto world with Bitfinex Alpha! With in-depth analysis that helps drive smarter decisions, you’ll have the expert knowledge you need to refine your strategy. Sign up here: go.bitfinex.com/AlphaSignUpPage

Bitcoin’s price action remains range-bound, briefly dipping below the weekly open before closing 4.2% higher. As macro catalysts dominate, BTC lacks organic momentum. Volatility, liquidity, and investor sentiment are critical for the next move Bitcoin makes 🧵

Institutional investors are actively seeking ways to bring crypto-related assets into traditional finance 🌟 Read more in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Bitfinex Alpha analysis shows that the downturn has been exacerbated by macro-driven uncertainty, as well as Bitcoin’s increasing correlation with traditional markets. 📉 Watch our full review in the video! Read more in our full Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Bitcoin Faces Largest Cycle Pullback as $1.7B Liquidated in 24 Hours

Bitcoin has closed below its yearly open, approaching the $80,822 lows in what marks the **largest pullback of the current cycle**. **Key developments:** - Liquidations reached **$1.7 billion in 24 hours**, surpassing levels seen during the Covid crash and FTX collapse - Uncertainty-driven selling during US trading sessions continues to apply downward pressure - Price action reflects ongoing market stress as traders exit leveraged positions The scale of liquidations indicates significant deleveraging across the market, with forced selling creating cascading price pressure. US session volatility suggests macro uncertainty remains a primary driver of current weakness.

Tokenised Equities Transition from Concept to Market Reality

**Tokenised equities are making the leap from theoretical concept to practical implementation.** The digital asset market is witnessing a significant shift as tokenised equities begin to materialize in real-world applications. This development marks a notable evolution in how traditional securities can be represented and traded on blockchain infrastructure. **Key developments:** - Traditional equity instruments are being converted into digital tokens - The transition represents a practical application of blockchain technology in traditional finance - This shift could potentially reshape how securities are traded and settled The move toward tokenised equities suggests growing institutional acceptance of blockchain-based financial instruments. This development occurs as the broader digital asset market continues to mature and integrate with traditional financial systems. [Read the full analysis](https://blog.bitfinex.com/bitfinex-alpha/bitfinex-alpha-in-the-absence-of-spot-demand-btc-is-drifting/)

NYSE Launches 24/7 Blockchain Trading Venue for Tokenized Stocks

The New York Stock Exchange is launching a blockchain-enabled trading venue that will operate around the clock for tokenized equities. This marks a significant shift from traditional market hours. **Key developments:** - NYSE's new platform will enable 24/7 trading of tokenized stocks - Companies like Strategy and Bitmine Immersion are adding Bitcoin and Ethereum to their balance sheets as long-term reserves - This follows earlier moves by crypto exchanges to offer on-chain stock trading The initiative represents a practical step in bringing traditional finance infrastructure on-chain, moving beyond pilot programs to operational implementation.

🔴 Bitcoin Holds Ground After Fed Rate Decision Triggers $390M in Liquidations

The Federal Reserve maintained interest rates at 3.5-3.75% at its January 2026 meeting, signaling a cautious stance amid ongoing inflation concerns. **Market Impact:** - Bitcoin perpetual futures markets saw significant volatility - Over $250 million in long positions liquidated - Additional $140 million in liquidations recorded - BTC holding near recent lows despite pressure The Fed's decision to keep rates steady reflects limited appetite for monetary easing. For crypto markets, this translates to a measured near-term outlook with constrained upside potential absent new liquidity support. Traders remain cautious as Bitcoin tests key support levels in the wake of the announcement.

Dollar Down 11%, Gold Hits $5,580 ATH—Crypto Markets on Deck

**Market Shift Accelerates** The US Dollar has weakened approximately 11% over the past year, while gold has surged 29% in just 28 days, reaching all-time highs around $5,580 per ounce. **Capital Flight to Hard Assets** - Fear of fiat currency depreciation is driving investors toward tangible stores of value - Retail investors are expected to gradually redirect cash savings into more liquid assets - The crypto market appears positioned to benefit from this trend **Historical Context** The BTC/gold ratio previously dropped over 50% from its peak when gold hit $4,700/oz. Following that decline, Bitcoin significantly outperformed gold. Analysts suggest monitoring this relationship as liquidity conditions evolve through 2026.