Bitcoin Hits 2-Year Low Against Gold at 16 Ounces Per BTC

Bitcoin Hits 2-Year Low Against Gold at 16 Ounces Per BTC

🪙 Bitcoin's Gold Problem

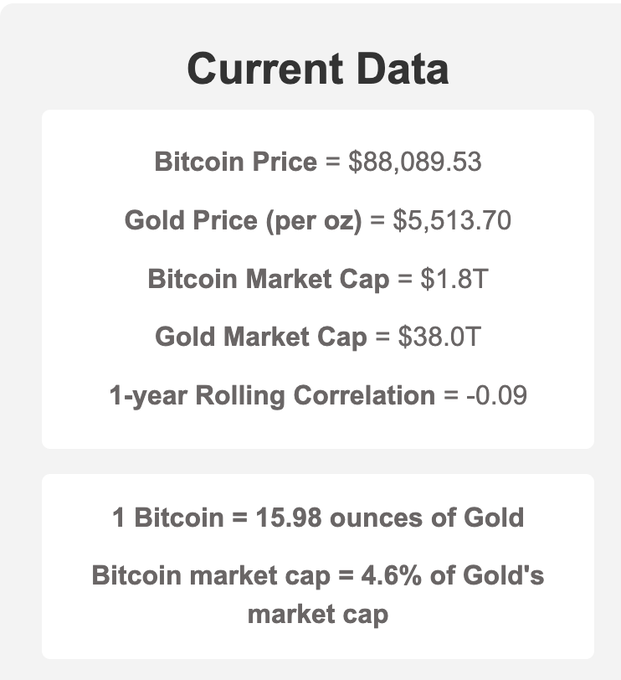

Bitcoin's value relative to gold has dropped to a 2-year low, with one BTC now worth approximately 16 ounces of gold.

Key Points:

- The BTC/gold ratio indicates crypto's weakening position compared to precious metals

- This metric provides an alternative view of Bitcoin's performance beyond dollar terms

- Gold has significantly outperformed Bitcoin in recent months, with a 53% gain versus BTC's 29%

Important Context:

A sharp reversal remains possible if macroeconomic conditions shift. The current low ratio could present either a warning signal or a potential opportunity, depending on how broader economic factors evolve.

The comparison highlights how traditional safe-haven assets like gold have attracted more capital during recent market uncertainty.

Dividing $BTC by gold price shows crypto at a 2-year low in gold terms (around 16 ounces of gold per Bitcoin). 🟠Remember: there may be a sharp reversal if the macroeconomic situation changes.

📅 February 2026 Crypto Calendar: Key Events and Token Unlocks

**Key Events This Week:** - **Feb 2**: Trump and Coinbase discuss crypto legislation in the US - **Feb 4**: EU-US trade agreement negotiations - **Feb 24**: Web Summit Qatar 2026 **Major Token Unlocks:** - **Feb 5**: XDC unlocks $30.61M (5% of float) - **Feb 6**: $HYPE releases $308.61M (2.79% of float) - **Feb 6**: $BERA unlocks $35.89M (41.70% of float) **Additional Developments:** - Berachain mainnet launch rumored for next week - Kentucky State Representative to file Bitcoin Strategic Reserve bill - MicroStrategy conference scheduled for Feb 24-25 - US economic data releases: ADP payrolls (Feb 4), NFP & unemployment (Feb 6), CPI data (Feb 11) The week ahead features significant regulatory discussions, substantial token unlocks, and potential network launches that could impact market dynamics.

🚨 Fed Decision Day

**FOMC meeting today** with 25 basis point rate cut nearly guaranteed (99% priced in). **Two scenarios ahead:** - Expected cut + dovish guidance → risk assets rally (crypto leads) - Unexpected pause or hawkish tone → sharp selloff in stocks & crypto **Key catalysts to watch:** - Balance sheet pause hints - 2025 rate cut signals - Forward guidance tone Crypto typically moves first and fastest on Fed decisions. Market positioning suggests most expect dovish outcome.

DWF Labs Acquires $25M in Trump-Backed WLFI Tokens

DWF Labs, a major Web3 market maker, has acquired $25 million in governance tokens from World Liberty Financial (WLFI), a Trump-backed project building a USD-pegged stablecoin on BNB Chain. Key developments: - USD1: New 1:1 USD-backed stablecoin launching on BNB Chain - Partnership aims to enhance liquidity and market adoption - Integration with BNB-based DeFi protocols planned The move is expected to boost BNB Chain's ecosystem through: - Increased on-chain volume - Cross-DeFi integrations - Enhanced stablecoin infrastructure Previously, WLFI adopted Chainlink's standard to help secure lending markets and enable cross-chain connectivity.

Ponder Launches Beta Version and Secures $1.5M Investment

Ponder, an AI-powered Web3 comparison engine, has launched its beta version with significant developments: - Beta release enables asset swapping and bridging across 20+ blockchain networks - Secured $1.5M funding from investors including Oblivion Labs, Normie Capital, and others - Planning Q4 2024 token generation event (TGE) with 20% initial release - Announcing 25,000 $PNDR token airdrop for WeWay community The platform focuses on comparing various Web3 services including: - EigenLayer re-staking - Runes/BRC-20/Ordinals - RWA/NFTs - DePIN protocols Visit wepad.io/project/ponder to check registration status.