Bitcoin Faces 29.7% Pullback from ATH - Market Seeks Direction

Bitcoin Faces 29.7% Pullback from ATH - Market Seeks Direction

🎢 BTCs Wild Ride Continues

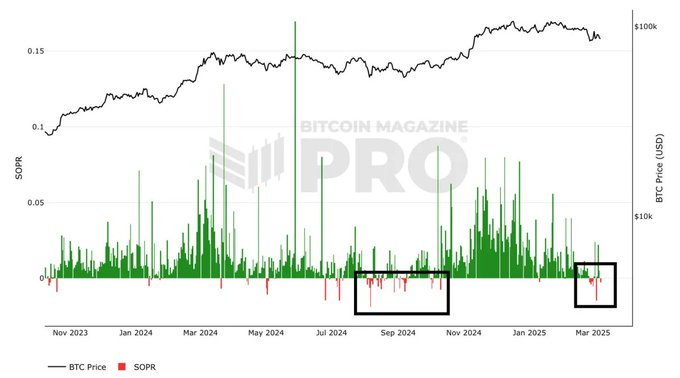

Bitcoin has dropped from its January 20 all-time high of $109,590 to a low of $77,041, marking a 29.7% decline. While such corrections have occurred before, they remain relatively uncommon in the current cycle.

Key points:

- Market stability depends on renewed interest from long-term holders and institutional investors

- Without fresh demand, extended consolidation or further downside possible

- Previous 90-day consolidation period between $91K-$102K recently broken

- Institutional flows remain weak amid broader macro uncertainty

The market outlook remains uncertain as traders await clear directional signals. Read full analysis

#Bitcoin momentum surges! 🔹 @MicroStrategy adds 10,107 BTC, now holding 158,400 BTC 📈 🔹 @Metaplanet_JP raises $745M to expand its Bitcoin reserves ⚡ 🔹 @Tether_to integrates $USDt into Bitcoin’s Lightning Network, boosting payment utility 💡 More info in Bitfinex Alpha!

Tweet not found

The embedded tweet could not be found…

Markets have gone moribund according to Bitfinex Alpha 👀 Bitcoin has been range-bound between $91K and $102K for over 90 days. Volatility surged on Feb 21st after the @Bybit_Official hack and an S&P 500 options expiry sell-off, causing a 4.7% drop to ~$95K before it recovered 🚨

Bitfinex Alpha takes a look at the wild market swings, $3B in options expiring last week, and major market moves - get the full breakdown. 📉📈 🎥 Watch our review for full insights!

Access every week our comprehensive weekly reports on the Bitcoin market, emerging opportunities, and key industry developments. Enhance your investment strategies with in-depth analysis and stay informed every week with Bitfinex Alpha! Sign up here: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the evolving cryptocurrency market with Bitfinex Alpha! Gain access to comprehensive weekly reports packed with expert insights on market trends, opportunities, and shifts 📊 Empower your investment strategies with our in-depth analysis: go.bitfinex.com/AlphaSignUpPage

Uncertainty continues to overshadow the market. What the pros doing in these times of volatility? Find out in our latest Alpha Report: blog.bitfinex.com/bitfinex-alpha…

👀 Bitfinex Alpha: The UK Treasury exempts crypto staking from Collective Investment Scheme regulations, fuelling innovation and reinforcing a more crypto-friendly stance from the UK.

"We're seeing the possible commencement of a new type of market environment where altcoins are going through entire cycles while BTC continues to be macro-correlated and shows more maturity as a risk asset." - Bitfinex Alpha @Crypto_Potato @Mandy5Williams cryptopotato.com/bitfinex-warns…

Stay at the forefront of the crypto market with BITFINEX ALPHA! Unlock expert insights, available for free anytime. With detailed analysis, you'll have the tools you need to make more informed decisions and fine-tune your strategy for 2025. Sign up now: go.bitfinex.com/AlphaSignUpPage

This week we saw @MicroStrategy add 7,633 $BTC to its portfolio, pushing its total to 478,740 BTC! @saylor stays firm in his "buy and hold" strategy, reinforcing confidence in Bitcoin’s long-term value 🌟 More insights in Bitfinex Alpha 👀

From worst February since 2014 to a 20% rebound after Trump's Crypto Reserve announcement. This chart tells the story of Bitcoin's 28.3% correction and recovery. Get the full analysis here: blog.bitfinex.com/bitfinex-alpha…

As we start a new month, Bitcoin faces a volatile crossroads! Bitcoin closed February down 17.39%, its worst Feb since 2014. It plunged 18.4% to $78.6K amid record ETF outflows. However, March is kicking off with a bang 💥

81 days and counting... Bitfinex Alpha @pelimatos @cryptoslate cryptoslate.com/bitcoin-comple…

Bitfinex Alpha takes you through the mix of bullish momentum and risk in the crypto markets ✅ @MicroStrategy has launched another $2B convertible offering to fund Bitcoin acquisitions What's next?

Onchain data reveals traders selling at a loss for the first time since Oct 2024. Is this a bottom or more pain ahead? Get the full analysis in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

$BTC dropped below $100K amid tariff hikes, mirroring broader market trends. Despite a 10% January gain, it's consolidating within a 15% range for the past 65 days. Volatility is cooling, but is a market-wide correction coming? 👀 More in Bitfinex Alpha!

Sign Up for Your Monday Market Edge: Bitfinex Alpha ✅ Get advanced market data, macro analysis & what to expect next. Sign up here: go.bitfinex.com/AlphaSignUpPage

After hitting an ATH of $109,590 on January 20, Bitcoin has since retraced to a low of $77,041 — a 29.7% pullback. While 30% dips have happened before in this cycle, but they are not common, and the overall outlook is uncertain. What's next? 👇 blog.bitfinex.com/bitfinex-alpha…

Get in-depth insights with Bitfinex Alpha! 🔹 Weekly Bitcoin Market Trends 🔹 Emerging Investment Opportunities 🔹 Key Industry Developments Enhance your investment strategies with expert analysis and stay informed every week. Sign up now: go.bitfinex.com/AlphaSignUpPage

After 90 days of $BTC consolidation, the market always moves decisively - one way or the other. Bitfinex Alpha @CryptoSlate @pelimatos cryptoslate.com/bitcoin-crash-…

Stay ahead of the curve with our weekly reports on the Bitcoin market, emerging trends, and key developments in the crypto space. Gain valuable insights to refine your investment strategies and stay updated every week with Bitfinex Alpha! Sign up now: go.bitfinex.com/AlphaSignUpPage

With volatility at historic lows, the market remains directionless as geopolitical tensions and macroeconomic uncertainty weigh on sentiment” - Bitfinex Alpha @FXstreetUpdate @cryptochhetri fxstreet.com/cryptocurrenci…

Bitcoin has been trading in a narrow range of $91,000 to $102,000 for 81 consecutive days, with historic lows in volatility. Geopolitical tensions & macroeconomic uncertainty continue to weigh on sentiment, leaving the market directionless. More in Bitfinex Alpha 👀

Don’t be phased by the volatility: “While BTC remains sensitive to macroeconomic factors, it is also exhibiting structural strength on higher timeframes… and remains in a robus trend” #Bitfinex Alpha @cointelegraph @sndr_krisztian coindesk.com/markets/2025/0…

Stay Ahead with Bitfinex Alpha! 🔹 Weekly Bitcoin Market insights 🔹 Key Industry Developments Enhance your investment strategies with expert analysis & stay informed every week! 📩 Sign up now: go.bitfinex.com/AlphaSignUpPage

Stay ahead in the crypto world with Bitfinex Alpha! With in-depth analysis that helps drive smarter decisions, you’ll have the expert knowledge you need to refine your strategy. Sign up here: go.bitfinex.com/AlphaSignUpPage

Institutional investors are actively seeking ways to bring crypto-related assets into traditional finance 🌟 Read more in Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Bitfinex Alpha analysis shows that the downturn has been exacerbated by macro-driven uncertainty, as well as Bitcoin’s increasing correlation with traditional markets. 📉 Watch our full review in the video! Read more in our full Bitfinex Alpha: blog.bitfinex.com/bitfinex-alpha…

Fantom Token Swap to Sonic Complete on Bitfinex

Bitfinex has successfully completed the Fantom (FTM) token swap to Sonic (S). Key updates: - Direct 1:1 conversion ratio (1 FTM = 1 S) - Trading, deposits, and withdrawals for Sonic tokens now fully operational - Upgrade includes new virtual machine for enhanced performance - Improved capabilities compared to previous Ethereum VM The migration marks a significant technical upgrade for the network while maintaining value continuity for token holders. [Learn more about the swap](https://www.bitfinex.com/posts/1098/)

Bitcoin Mining Investment Landscape Evolves with Hashrate Derivatives

Traditional Bitcoin mining stock investments face challenges as institutional investors seek alternative exposure methods. The market is responding with innovative solutions: - Hashrate derivatives emerge as a flexible alternative to mining stocks - Regulated futures products now available in US markets - Institutional players showing increased interest in mining exposure The shift marks a significant evolution in how investors can participate in Bitcoin mining without direct operational involvement. [Learn more about hashrate derivatives vs mining stocks](https://blog.bitfinex.com/education/how-do-hashrate-derivatives-compare-to-bitcoin-mining-stocks/)

Bitfinex Margin Longs Hit 4-Month High

Margin trading activity on Bitfinex shows significant bullish sentiment as long positions reach levels not seen since November 2024. Key points: - Traders added 13,787 BTC to long positions over 17 days - Current margin long levels mark highest point in 4 months - Movement indicates growing confidence in BTC price trajectory This surge in margin longs follows earlier data showing 83% of circulating Bitcoin being in profit, matching levels last seen during the 2021 all-time high.

SimpleBTC App Revolutionizes Bitcoin Education with Interactive Learning

Yannick Fraebel and the SimpleBTC team are developing educational apps that transform Bitcoin learning into an engaging, gamified experience. Key features: - Interactive lessons with real Bitcoin transactions - Lightning Network rewards for completing modules - Verifiable certificates for knowledge proof The platform aims to address the knowledge gap left by traditional finance education, making Bitcoin concepts accessible to newcomers. Similar to Duolingo's approach to language learning, users earn satoshis while progressing through lessons. Watch the full discussion: [Bitfinex Talks Episode](https://youtu.be/Qe387JdqDoQ)