Markets are consolidating as optimism gradually returns following October's massive $19B liquidation event.

Key Support Holding

- BTC trading above 0.85 supply quantile cost basis

- Only 15% of circulating supply currently in loss

- $107K-$108K zone acting as gravitational support line

Market Dynamics

- Volatility remains compressed

- Bitcoin defending key technical levels

- Delicate balance between stability and next directional move

External Factors

- Rising energy prices creating market uncertainty

- FX volatility across global markets

- Potential catalyst: Additional liquidity could flow toward crypto

The market appears to be in a consolidation phase after the dramatic October selloff, with traders watching whether current support levels will hold or if another move is brewing.

What triggered the sharpest crypto sell-off in months last week? A sudden wave of spot selling as US–China tariff tensions spiked on Oct 10 - creating a 2.5x imbalance between sellers and buyers and fueling cascading liquidations across futures markets. Read more ⬇️

Despite uncertain markets, there’s still room for optimism. 🌤️ Historically, Bitcoin’s Q4 performance - especially in post-halving years - has shown strong recovery potential. Could we be on the brink of another turnaround? 🧵

As whales slow their selling and ETF inflows keep building, structural support for Bitcoin is strengthening. With benign inflation and a dovish Fed reviving risk appetite, the path toward new ATHs in Q4 looks increasingly clear.

With data releases on pause, markets are operating without key signals - setting up potential volatility once updates resume. Despite risks, traders are still eyeing BTC above $130K. Read what the Bitfinex analysts say in @YahooFinance @DLNewsInfo finance.yahoo.com/news/traders-s…

After one of the most dramatic days in crypto history, markets are showing both pain and potential. Bitcoin’s fall from above $126,000 last week to briefly below $103,310 marked an 18.1% drawdown - triggering the largest liquidation event ever recorded ⚠️ A closer look 👇

The Q4 outlook for Bitcoin looks strong. Supply is falling, whale selling is subsiding and demand from institutions continues to grow. - Bitfinex Alpha via @BTCTN news.bitcoin.com/bitfinex-analy…

As Bitcoin slips below $120,000, Bitfinex analysts share their perspective on the factors shaping today’s market. @Forbes’ @CharlesLBovaird includes our commentary in his latest analysis. forbes.com/sites/digital-…

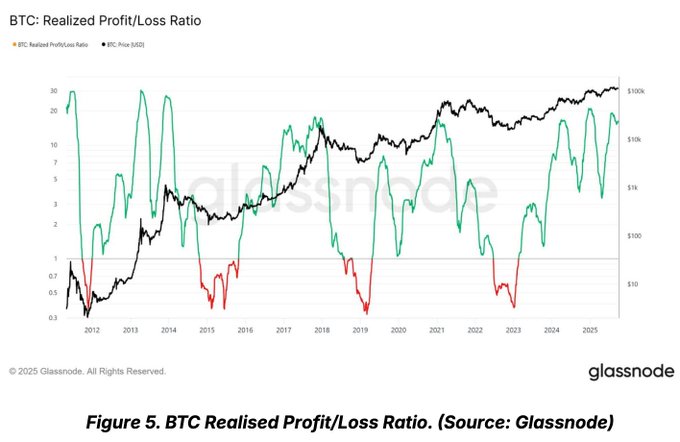

The defining feature of the current Bitcoin cycle? Its inflow structure. Unlike earlier cycles with a single prolonged wave, this cycle has seen three distinct multi-month surges - each punctuated by heavy profit-taking. Don’t miss the analysis ⬇️

Bitcoin Faces Largest Cycle Pullback as $1.7B Liquidated in 24 Hours

Bitcoin has closed below its yearly open, approaching the $80,822 lows in what marks the **largest pullback of the current cycle**. **Key developments:** - Liquidations reached **$1.7 billion in 24 hours**, surpassing levels seen during the Covid crash and FTX collapse - Uncertainty-driven selling during US trading sessions continues to apply downward pressure - Price action reflects ongoing market stress as traders exit leveraged positions The scale of liquidations indicates significant deleveraging across the market, with forced selling creating cascading price pressure. US session volatility suggests macro uncertainty remains a primary driver of current weakness.

Tokenised Equities Transition from Concept to Market Reality

**Tokenised equities are making the leap from theoretical concept to practical implementation.** The digital asset market is witnessing a significant shift as tokenised equities begin to materialize in real-world applications. This development marks a notable evolution in how traditional securities can be represented and traded on blockchain infrastructure. **Key developments:** - Traditional equity instruments are being converted into digital tokens - The transition represents a practical application of blockchain technology in traditional finance - This shift could potentially reshape how securities are traded and settled The move toward tokenised equities suggests growing institutional acceptance of blockchain-based financial instruments. This development occurs as the broader digital asset market continues to mature and integrate with traditional financial systems. [Read the full analysis](https://blog.bitfinex.com/bitfinex-alpha/bitfinex-alpha-in-the-absence-of-spot-demand-btc-is-drifting/)

NYSE Launches 24/7 Blockchain Trading Venue for Tokenized Stocks

The New York Stock Exchange is launching a blockchain-enabled trading venue that will operate around the clock for tokenized equities. This marks a significant shift from traditional market hours. **Key developments:** - NYSE's new platform will enable 24/7 trading of tokenized stocks - Companies like Strategy and Bitmine Immersion are adding Bitcoin and Ethereum to their balance sheets as long-term reserves - This follows earlier moves by crypto exchanges to offer on-chain stock trading The initiative represents a practical step in bringing traditional finance infrastructure on-chain, moving beyond pilot programs to operational implementation.

🔴 Bitcoin Holds Ground After Fed Rate Decision Triggers $390M in Liquidations

The Federal Reserve maintained interest rates at 3.5-3.75% at its January 2026 meeting, signaling a cautious stance amid ongoing inflation concerns. **Market Impact:** - Bitcoin perpetual futures markets saw significant volatility - Over $250 million in long positions liquidated - Additional $140 million in liquidations recorded - BTC holding near recent lows despite pressure The Fed's decision to keep rates steady reflects limited appetite for monetary easing. For crypto markets, this translates to a measured near-term outlook with constrained upside potential absent new liquidity support. Traders remain cautious as Bitcoin tests key support levels in the wake of the announcement.

Dollar Down 11%, Gold Hits $5,580 ATH—Crypto Markets on Deck

**Market Shift Accelerates** The US Dollar has weakened approximately 11% over the past year, while gold has surged 29% in just 28 days, reaching all-time highs around $5,580 per ounce. **Capital Flight to Hard Assets** - Fear of fiat currency depreciation is driving investors toward tangible stores of value - Retail investors are expected to gradually redirect cash savings into more liquid assets - The crypto market appears positioned to benefit from this trend **Historical Context** The BTC/gold ratio previously dropped over 50% from its peak when gold hit $4,700/oz. Following that decline, Bitcoin significantly outperformed gold. Analysts suggest monitoring this relationship as liquidity conditions evolve through 2026.