Beefy DeFi Hub Reports Growth in CLMs and Vaults

Beefy DeFi Hub Reports Growth in CLMs and Vaults

🐮 462 ways to moo-ve up

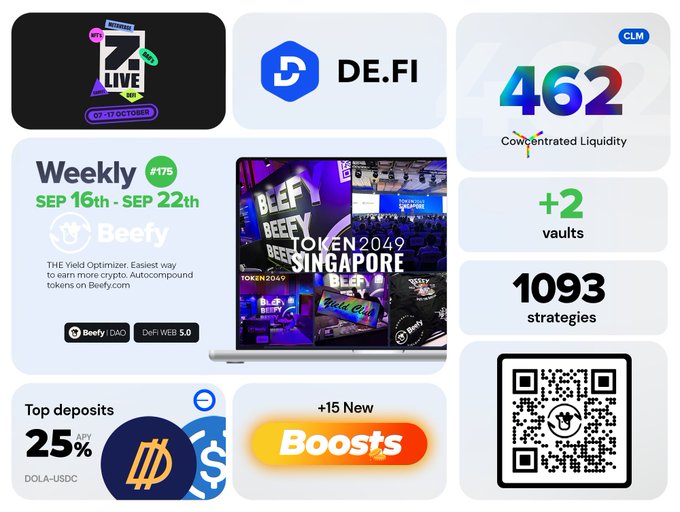

Beefy's Weekly Highlights #175 showcases significant growth in their DeFi offerings:n n- 462 Concentrated Liquidity Management (CLM) options available, with over $50M in Assets Under Management (AUM)n n- 663 vaults in operation, managing over $230M AUMn n- Announcement of attendance at #DeFiWorld2024n n- Introduction of 2 new yield strategiesn nThis update demonstrates Beefy's continued expansion in the DeFi space, offering users a wide range of yield optimization options. The growth in CLMs and vaults indicates increasing user adoption and trust in Beefy's platform.n nInterested in maximizing your crypto yields? Explore Beefy's diverse range of strategies and start earning more today.

Beefy Weekly Highlights #175 • 462 CLMs to choose from, over $50M AUM 🆑 • 663 vaults, over $230M AUM 🛡️ • We will be at #DeFiWorld2024 👀 • 2 new yield strategies! 🛠️

Beefy Launches on Monad with 5 New Vaults

**Beefy expands to Monad** with 5 fresh vaults as part of 10 new strategies launched this week. **Key metrics:** - $299K yield distributed to users - ~$218M total deposits - 6,111 autocompounds processed - 99.09 $BIFI tokens bought back The yield optimizer continues its multi-chain expansion, previously announcing plans to deploy on Monad from day one back in October.

🛡️ DeFi Insurance Works

**Nexus Mutual quickly processed nearly $100k in claims** following the Stream Finance exploit, protecting users across multiple protocols. **Key highlights:** - Claims paid out in **under a week** to affected Beefy, Euler, and Harvest Finance users - Coverage extended across Base, Arbitrum, Avalanche, and Sonic networks - Users were protected despite **not directly using Stream Finance** **The contagion effect:** Many users couldn't withdraw funds due to liquidity issues where xUSD was used as collateral, demonstrating how DeFi protocols' interconnected nature creates cascading risks. **Partners like OpenCover** facilitated the rapid payout process, showcasing how **multi-protocol coverage** can provide a safety net against second-order effects in DeFi. This incident highlights both the **real risks of protocol interdependence** and the **effectiveness of DeFi insurance** when properly implemented.

X Integrates Grok AI to Rank Following Timelines

**X (formerly Twitter) has launched a major update** that uses Grok AI to rank content in users' Following timelines. The update represents a significant shift in how social media feeds are organized, moving beyond chronological ordering to AI-driven content curation. **Key implications:** - Grok will determine which posts appear first in your Following feed - Content ranking may affect visibility for crypto projects and DeFi protocols - Users' engagement patterns will likely influence the AI's ranking decisions The change could impact how crypto communities and projects reach their audiences on the platform, as algorithmic ranking replaces the traditional chronological feed structure.

Beefy Partners with StakeDAO for Double-Digit Yield Opportunities

**Beefy Finance** has partnered with **StakeDAO** to offer competitive yield farming opportunities across multiple token pairs. **Current APY rates include:** - $msETH - $WETH: **13% APY** - $sUSD - $sUSDe: **11% APY** - $MIM / $DAI / $USDC / $USDT: **11% APY** These rates represent solid returns for DeFi users looking to maximize their crypto holdings through automated yield optimization strategies. The partnership combines Beefy's yield optimization platform with StakeDAO's liquid staking solutions.

🚀 Monad Yields Hit 370%

**Monad network** is offering **370% APY** on bluechip token pairs through concentrated liquidity management (CLM). The yield opportunity focuses on: - USDC-WETH trading pairs - Automated liquidity optimization - High returns on established tokens Access the vault: [Beefy Finance CLM](https://app.beefy.com/vault/uniswap-cow-monad-usdc-weth-rp) *Consider risks before investing in high-yield DeFi protocols.*