Bank of America Reports Banks Preparing to Launch Crypto Stablecoins

Bank of America Reports Banks Preparing to Launch Crypto Stablecoins

🏦 Banks Want In

Key updates from the latest Level Money report:

- slvlUSD delivered 7.99% weekly APY

- Total reserves at $74.5M across aUSDC and steakUSDC (Morpho)

- $68.98k in yield distributed this week

Market highlights:

- Stablecoins added $4.5B market cap post-GENIUS Act

- Lending overtakes stablecoin issuers as largest sector on Base by TVL

- MorphoLabs exceeds $1.6B in USDC supplied

- Bank of America reports banks preparing crypto stablecoin launches

Yield opportunities remain through Curve LP (60x XP), Pendle (40x XP), and Morpho vaults (40x XP).

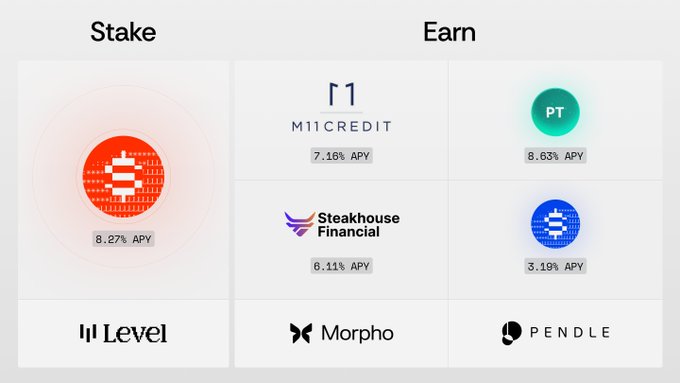

One token. Six strategies. lvlUSD: • Stake on Level ≈ 8 % APY • Lend on @M11Credit powered by @MorphoLabs • Secure fix yield or LP on @pendle_fi Hold USDC? Use @SteakhouseFi's vault powered by Morpho to earn and strengthen Level ecosystem! Composable money matters.

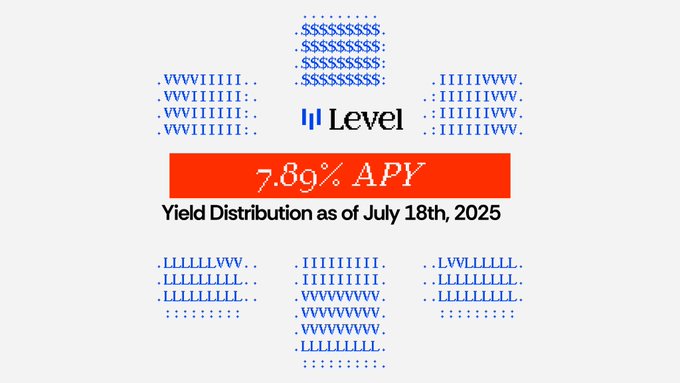

July 18th weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 7.89% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $47.6M in aUSDC → $33.2M in steakUSDC (Morpho) Total Reserves: $80.78M Check out our live Transparency Dashboard:

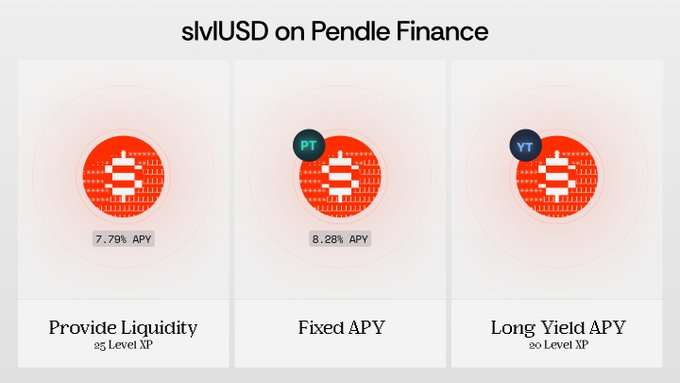

slvlUSD is your savings rate, powered by onchain composability. → Provide liquidity and stay flexible → Lock in fixed yield with PT positions → Capture longer-dated yield through YT Choose how you want your savings to behave. Level 🆙 x @pendle_fi 🧪

Your Dollars Are Sleeping 😴 Wake Them Up with lvlUSD Stablecoin supply has climbed almost nonstop since early 2023 and now approaches the $250 billion mark. Institutions and everyday users alike value the one crypto product that feels instantly familiar. But >90% of those

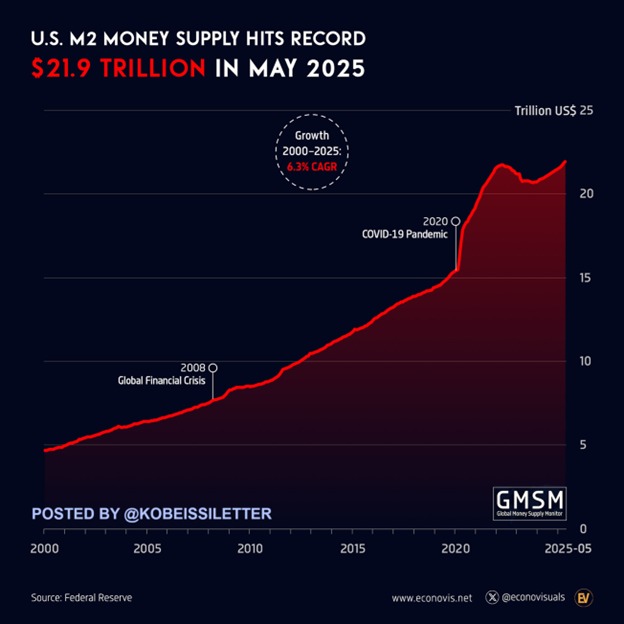

M2 hits $21.94T. Nineteen straight months of expansion. The money supply is growing. Your savings account probably isn’t. Let’s unpack what this means, and why DeFi-native savings layers like slvlUSD exist for a reason. 🧵

BREAKING: The US M2 money supply jumped +4.5% Y/Y in May, to a record $21.94 trillion. This marks the 19th consecutive monthly increase. It has now surpassed the previous all-time high of $21.86 trillion, posted in March 2022. Furthermore, inflation-adjusted M2 money supply

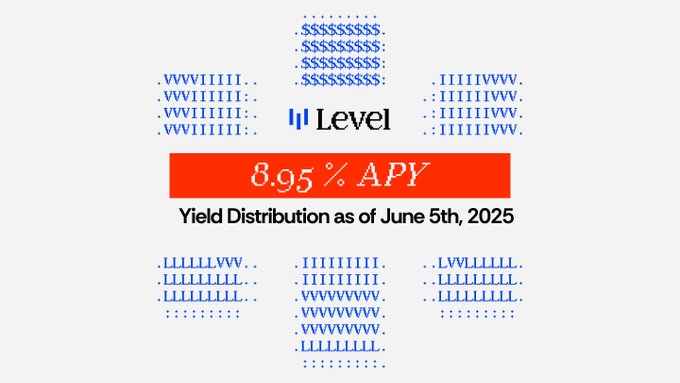

🚨 slvlUSD Weekly APY Update: 8.95% Level's latest distribution is here👇 How to earn: 1️⃣ Mint lvlUSD → level.money/dashboard/buy 2️⃣ Stake for yield → Convert to slvlUSD + track rewards level.money/dashboard/earn 3️⃣ Unstake anytime → Redeem after 7-day cooldown 🧬 Bonus XP

Weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 8.01% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $63.37M in aUSDC → $68k in aUSDT → $33.2M in steakUSDC (Morpho) Total Reserves: $96.64M Diversified, onchain and fully auditable

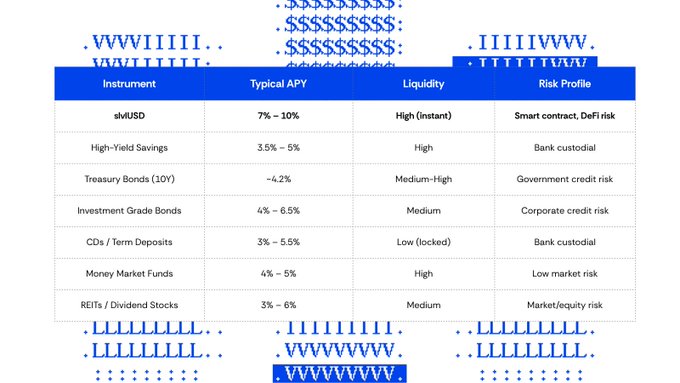

7–10% APY isn’t a promise. It’s already live, transparent, and built to scale. Level 🆙

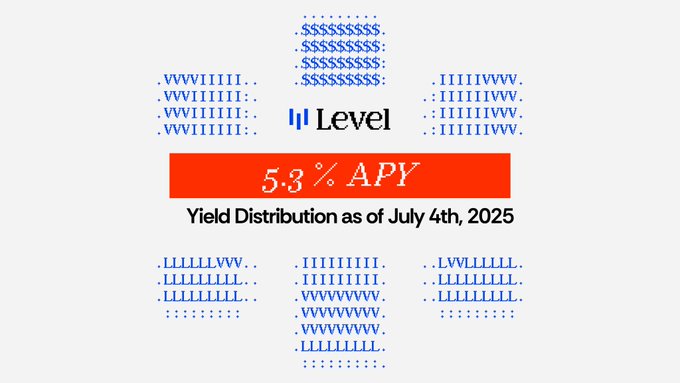

July 4th weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 5.3% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $79.1M in aUSDC → $63.8k in aUSDT → $33.18M in steakUSDC (Morpho) Total Reserves: $112.33M Check out our live

7/ While TradFi M2 hits ATHs, DeFi is building its own layered money system. Protocols like @levelusd let stablecoins evolve: → From idle (M0) → To productive (M1) → To programmable yield layers (M2) All onchain. All user-owned.

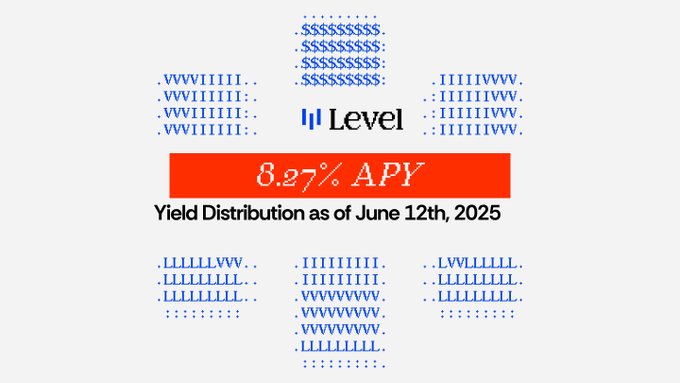

🚨 slvlUSD Weekly APY Update: 8.27% Level's latest distribution is here👇 How to earn: 1️⃣ Mint lvlUSD → level.money/dashboard/buy 2️⃣ Stake for yield → Convert to slvlUSD + track rewards level.money/dashboard/earn 3️⃣ Unstake anytime → Redeem after 7-day cooldown 🧬 Bonus XP

Weekly APY Update 🚨 1⃣ slvlUSD delivered a weekly APY of 8.38% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $93.86M in aUSDC → $8.96M in aUSDT → $28.1M in steakUSDC (Morpho) Total Reserves: $122.01M Diversified, onchain and fully

📈 Stablecoin Supply Keeps Climbing Stablecoin supply has risen steadily since early 2023 and now hovers near $250 B. Regulatory tailwinds in the US, Japan and elsewhere are turning stablecoins into crypto’s first clear product-market fit for institutions and mainstream users.

Weekly APY Update 🚨 1️⃣ slvlUSD delivered a weekly APY of 7.01% this week. 2️⃣ Reserve Composition Current allocation across lending strategies: → $91.9M in aUSDC → $61k in aUSDT → $33.18M in steakUSDC (Morpho) Total Reserves: $125.12M Diversified, onchain and fully

lvlUSD @lagoon_finance vault, curated by @Gami_Capital & @StakeCapital is Live 📥 Deposit once and earn lending yield from several protocols without having to be constantly monitoring your positions!

glevel for all @BinanceWallet users. Binance Web3 wallet users can now access the Level App directly. Real yield. Composable money. Onchain banking. Level 🆙

New integrations are now live on #BinanceWallet! Check out the newly added dApps: BgscLeaderboard, BugsNFT, Hitdex, Mind Network AgenticWorld, Spectra, Level, Vaultka, Definitive, GT APP, Orderly Omnivault Discover them now! ⤵️

Stablecoin access shouldn’t be gated by wallet choice. @levelusd now works with any wallet via @dynamic_xyz. More ways to access lvlUSD & slvlUSD. The same composable, yield-bearing core.

Why Composability Turns slvlUSD from a Yield Source into a Strategy Layer slvlUSD distributes real yield to holders, powered by Level’s reserve allocation across AAVE and Morpho Steakhouse USDC vault. With an average APY of 9.13% during Q2, it already stands out as one of the

How Yield-Bearing Stablecoins Became a Core Layer of DeFi’s Financial Stack As capital flows deepen onchain, expectations shift. It’s no longer enough for stablecoins to sit still. They need to earn: passively and reliably. Here’s where yield-bearing stablecoins fit 🧵

Stablecoin Yields Aren’t All Built the Same Yield-bearing stablecoins are becoming a core part of DeFi’s capital base. But not all yield is created equal and the mechanisms vary widely. At @levelusd, reserves are routed through onchain lending markets. Others deploy capital

slvlUSD Delivers 7.19% Average APY in Q3 Performance Report

**slvlUSD Q3 Performance Summary** Level's slvlUSD stablecoin delivered solid returns in Q3 2025: - **Average APY**: 7.19% - **Peak performance**: 8.65% - **Lowest rate**: 5.30% The yield remained within the **7-8% range** that has characterized slvlUSD performance, maintaining consistency for holders seeking reliable onchain income. **Key Features:** - Simple lending-based framework - Built for scalability - No added complexity This performance continues slvlUSD's track record of providing steady returns through its straightforward approach to decentralized yield generation.

**USDT Borrowing Costs Surge on Aave**

**Aave USDT utilization hits yearly highs** as borrowing demand tightens on-chain dollar liquidity. **Key developments:** - Borrowing APR jumped from ~3.43% to ~5.41% - Higher utilization typically boosts lender supply APY - Follows recent spikes that pushed rates above 10% **Market context:** While USDC gains market share for institutional use, USDT remains dominant by size. The utilization squeeze reflects broader DeFi liquidity dynamics. **Impact on strategies:** Looped positions and liquid leverage strategies may face negative yields during rate spikes. *DeFi markets operate 24/7 - rate changes can happen quickly.*

Level Protocol APY Drops to 8.27%

Level's latest slvlUSD yield distribution shows an **8.27% APY**, down from 8.95% last week. How to participate: - Mint lvlUSD through [Level's dashboard](https://level.money/dashboard/buy) - Convert to slvlUSD for yield - Unstake with 7-day cooldown Current XP farming opportunities: - Pendle: 40x XP (lvlUSD) / 20x XP (slvlUSD) - Curve Finance: 60x XP for LPs - Morpho: 40x XP using lvlUSD as collateral *Note: Distribution based on daily average market cap, with compounding. Past performance not indicative of future results. Not available for US persons.*