Carbon Defi, a trading system by Bancor, integrates a trading platform with a trading bot using the Arb Fast Lane Protocol. This connects traders with different online markets for market arbitrage opportunities.

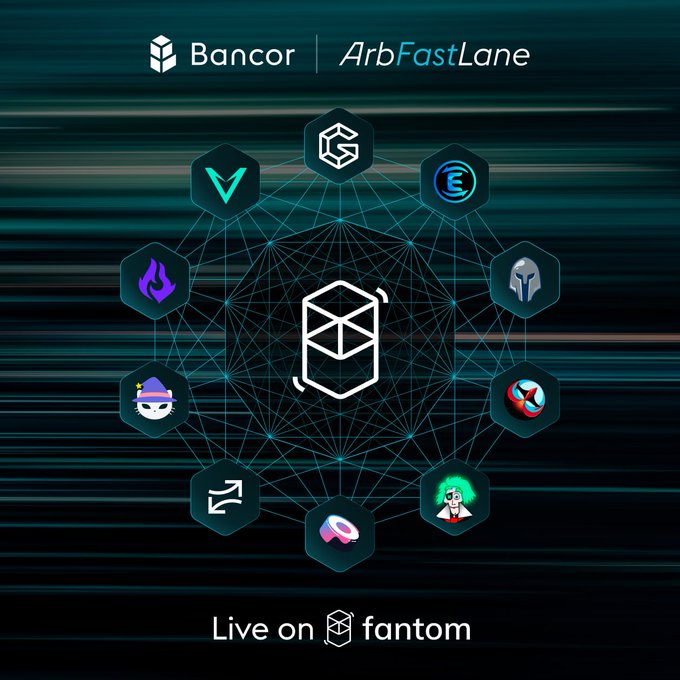

💪 @Bancor technology is now live on @FantomFDN 💪 #Bancor Protocols are managed by the #BancorDAO, a global community of $BNT token holders and delegates 🔽 VISIT bancor.network #Definews

❓ Why @FantomFDN? Its ability to process transactions rapidly and efficiently makes it an ideal ecosystem for DeFi innovations bringing a swift, streamlined experience for users. @Bancor’s integration taps into this potential seamlessly. The journey into Fantom’s dynamic

Carbon Defi is a trading system by @Bancor . It combines a trading platform with a trading bot. It does this by including another Bancor protocol called Arb Fast Lane. This connects traders with different online markets to help them perform market arbitrage. @CarbonDeFixyz

🌀 @Bancor Brings decentralized arbitrage and advanced trading capabilities to the @FantomFDN Ecosystem! 🌀 Alongside Graphene’s deployments on both Base and Fantom, Bancor launched the Arb Fast Lane Protocol, a first-of-its-kind framework that facilitates efficient order

Carbon DeFi Licenses Orderbook Technology to Multiple DeFi Projects

Carbon DeFi is licensing its smart contract technology to multiple DeFi projects, allowing them to deploy the platform's orderbook-style functionalities. **Key Features Being Licensed:** - One-directional trades and range orders for scaling - Linked orders for automated buy low, sell high strategies - MEV sandwich attack immunity - Arb Fast Lane solver system for liquidity aggregation The licensing represents a step toward long-term protocol sustainability as Carbon DeFi continues development. The Arb Fast Lane is expanding to Layer 2 networks, aiming to improve price alignment and liquidity efficiency across chains. Bancor representatives will discuss the technology at Consensus Hong Kong.

COTI Earn Expands: wADA and USDT Added to Strategy Options

COTI has expanded its Earn campaign on CarbonDeFi by adding two new tokens to eligible strategy options. **New Additions:** - $wADA (wrapped Cardano) - $USDT (Tether) Strategy makers can now create trading strategies using these tokens and earn Token Points (TPs), which are redeemable for $COTI when Season 3 ends. **Complete List of Eligible Tokens:** - $COTI - $gCOTI - $USDC - $wBTC - $wETH - $wADA - $USDT **Program Details:** - Minimum strategy value: $10 - Season 3 allocation: 15M $COTI total - Weekly distribution: 1,250,000 $COTI The expansion gives users more flexibility in building DeFi strategies while earning rewards on the COTI network. [Get started on CarbonDeFi](http://coti.CarbonDeFi.xyz)

Carbon DeFi Enables Token Projects to Become Onchain Market Makers

Carbon DeFi allows token projects to function as their own market makers through automated onchain strategies. **How it works:** - Projects create a **sell order** for their token at a specific price or range (e.g., $0.37-$0.50) - They set a **buy order** at a lower price to repurchase tokens using sale proceeds - Proceeds **automatically rotate** between orders, creating a continuous buy-low-sell-high cycle **Key advantages:** - Projects can fund just one side initially and let proceeds fund the other - Strategies are **fully transparent** and live onchain - Orders can be adjusted anytime without rebuilding - No expiry dates or third-party dependencies Unlike typical automated market makers, Carbon DeFi's linked orders aren't constrained to the same price level, giving projects precise control over their market-making strategy. The platform displays all fills, edits, and timestamps, with shareable strategy links for community transparency. [Read more](https://blog.bancor.network/should-token-projects-be-their-own-market-maker-3ddd6b98e83e)

Bancor's Arb Fast Lane Adds Privacy Layer with COTI Garbled Circuits

Bancor has integrated COTI's Garbled Circuits technology into its Arb Fast Lane to address a critical vulnerability in onchain arbitrage. **The Problem** - Arbitrage opportunities are extremely brief - Transactions become visible to all observers the moment they're broadcast - This transparency creates a competitive disadvantage **The Solution** - Garbled Circuits apply privacy at the execution moment - Protects traders when transparency becomes a liability - Maintains overall onchain transparency while securing critical execution windows The integration targets the specific moment where public visibility hurts arbitrage execution, rather than applying blanket privacy. This selective approach aims to balance the need for competitive protection with blockchain's transparency principles. [Read full details](https://blog.bancor.network/protecting-arbitrage-execution-with-privacy-without-sacrificing-onchain-transparency-661e5833aae1)

Bancor Launches Research Symposium on Incentive Design at EthCC

Bancor, in collaboration with Token Engineering and EthCC, is hosting **TERSE** (TE Research Symposium) at EthCC[9] in Cannes, France on March 31, 2026. The symposium focuses on rigorous analysis of **incentive alignment** in protocol design, treating it as an engineering problem rather than marketing. Researchers are invited to submit work that: - Models incentive effects with explicit assumptions - Quantifies trade-offs between decentralization and centralization - Examines protocol mechanisms and their embedded assumptions - Presents clear problem statements, methods, and limitations Both peer-reviewed papers and work-in-progress are welcome, provided submissions are research-driven and non-promotional. **Submission deadline:** February 20, 2026 [Submit your research](https://www.tokenengineering.net/)