A vulnerability affecting certain Balancer V2 pools has prompted Radiant to take precautionary measures.

Current Status:

- Issue limited to specific pool versions not used by Radiant

- Radiant deposits remain secure

- Base and BNB Chain markets operating normally

Temporary Restrictions:

- dLP interactions (Zapping) discouraged

- Balancer Pool usage on Arbitrum and Mainnet temporarily discouraged

Radiant is monitoring the situation with Balancer contributors and security partners. Updates will follow once the vulnerability is fully assessed.

A recent vulnerability has been reported affecting certain Balancer V2 pools. Radiant is actively monitoring the situation in coordination with Balancer contributors and security partners. Based on current information, the issue is limited to specific pool versions not utilized

Radiant Capital Adjusts RDNT Token Emissions to Optimize Market Efficiency

**Radiant Capital has fine-tuned its RDNT token emissions** to better distribute rewards across different markets. The protocol is **redistributing incentives** based on liquidity flow patterns: - Stronger rewards where liquidity is active - Reduced emissions in less active markets This adjustment is part of Radiant's ongoing effort to **maintain balance and enhance efficiency** in its incentive system. Users can track the updated emission rates in real-time at [radiant.capital](http://radiant.capital). The move follows Radiant's broader economic overhaul earlier this year, which introduced dynamic mechanisms to improve sustainability and competitiveness across the protocol.

Radiant Capital DAO Proposal: Accelerating RDNT Token Vesting

A new DAO proposal (RFP-46) aims to accelerate the vesting schedule for 200 million RDNT tokens in the Emissions Reserve. The proposal suggests: - Reducing vesting period from 3 to 2 years - Increasing token emissions to support higher APRs - Attracting more liquidity to Radiant Innovation Zone (RIZ) markets The goal is to expand liquidity and drive RIZ growth across multiple chains. Additionally, Super OETH, an innovative LST, is now available as a RIZ Market on Radiant: - Combines Ethereum staking rewards with Aerodrome incentives - Offers up to 4x leverage on Radiant - Currently earning up to 45% APY when maximally looped *Vote on the proposal:* [Snapshot link](https://snapshot.org/#/radiantcapital.eth/proposal/0xc9ded50bfb0aae1c957a94de44d65a2997694ac85703825f5ded16d43540bbb5)

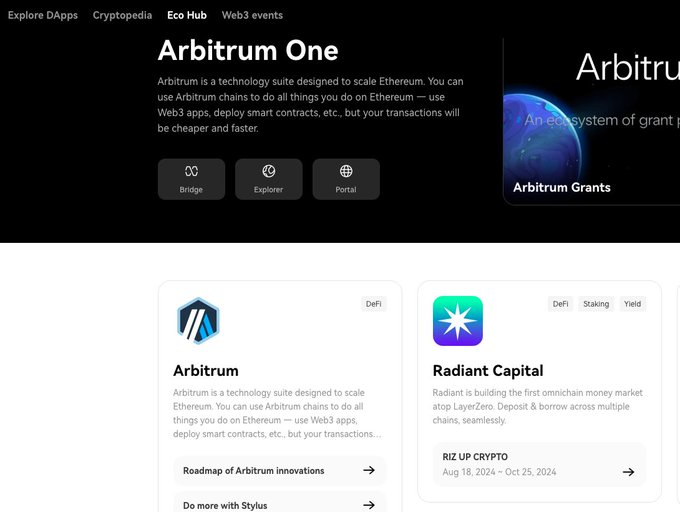

Radiant Featured in OKX Web3's New Eco Hub

Radiant, the omnichain money market built on LayerZero, has been featured in the newly launched Eco Hub by OKX Web3. This inclusion highlights Radiant's growing prominence in the decentralized finance space. - Radiant offers cross-chain deposit and borrowing capabilities - OKX Web3's Eco Hub showcases notable blockchain projects - This feature may increase visibility for Radiant's innovative platform The collaboration between Radiant and OKX Web3 demonstrates the increasing integration of multi-chain solutions in the DeFi ecosystem. Users interested in exploring Radiant's services can now find more information through the OKX Web3 Eco Hub.

Radiant Integrates Edge's Risk Oracle for Dynamic Fee Distribution

Radiant has become the first lending protocol to integrate Edge's Risk Oracle, powered by Chaos Labs. This technology: - Monitors and auto-updates risk-related parameters in real-time - Currently recommends updates for the reserve factor - Aims to balance deposit and borrowing rates The integration enables: - Dynamic fee distribution based on market needs - Smoother borrowing costs and optimal rates for lenders Implementation: - Initially rolled out for USDC on BNB - Approved for expansion to all BNB markets - Other chains to follow soon Long-term goals: - Full automation of risk parameters (e.g., supply and borrowing caps) - Gradual shift from manual oversight to auto mode Stay tuned for further updates on this developing system.