Balancer Protocol Facilitates Massive Liquidity Flow

Balancer Protocol Facilitates Massive Liquidity Flow

💰 Billion-Dollar Liquidity Breakthrough

The Balancer Protocol's $ezETH | $ETH composable stable pool routed liquidity worth half a billion dollars in a single day on April 25, 2024. This substantial liquidity flow enabled liquidations that would have been impossible otherwise due to the constraints imposed by Curve's price bounds on liquidity allocation. The Balancer community continues to promote the protocol's capabilities, encouraging users to 'Build Better. Build On Balancer.'

Half a billion dollars. That's how much liquidity was routed through the $ezETH | $ETH composable stable pool in just a single day. Without this pool, liquidations would not have been possible due to CL price bounds allocating liquidity out of range. x.com/0xmikko_eth/st…

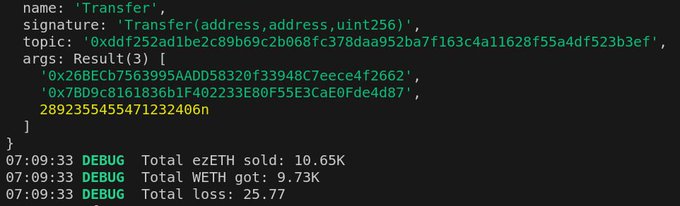

I just analyzed ezETH depeg consequences for Gearbox. All passive lenders funds are safe, no bad debt was incurred ✅ 115 Credit Accounts were liquidated, 10650 ezETH were sold on Balancer pool. Liquidation losses of 25.77 ETH were automatically covered by internal Gearbox

Balancer V3 Launches Three-Token Stablecoin Pool on Monad

Balancer V3 has deployed a three-token stablecoin pool on Monad, combining AUSD, USDC, and USDT0 in a single liquidity pool. **Key Features:** - First three-stablecoin pool enabled by Balancer V3 technology - Provides deep liquidity for AUSD stablecoin - Combines swap fees with lending yield for liquidity providers - Operates as both a stable and boosted pool The pool is now live and accessible at [balancer.fi](https://balancer.fi/pools/monad/v3/0x2daa146dfb7eaef0038f9f15b2ec1e4de003f72b). This deployment showcases V3's capability to handle multi-token stable pools, offering traders tighter spreads and liquidity providers additional yield opportunities beyond traditional two-token pairs.

Monad Enables Scalable Multi-Token Pools with Sub-Second Finality

**Monad's infrastructure breakthrough enables complex DeFi operations at scale.** The platform delivers: - **Sub-second finality** for near-instant transaction confirmation - **Parallel execution** allowing multiple operations simultaneously - **Cost-efficient multi-token pools** that remain practical at scale This technical foundation removes the latency and cost barriers that previously made complex pool operations inefficient on other chains. The infrastructure is purpose-built to support ambitious DeFi protocols requiring high throughput and low costs. Monad's approach addresses a core challenge in decentralized finance: maintaining performance as complexity increases.

Neverland Money Enables Dual-Yield Stablecoin Pool with Active Lending Deployment

A new liquidity pool integrates wrapped tokens from Neverland Money, allowing stablecoins to simultaneously generate lending yields while remaining available for trading. **How it works:** - Deposited stablecoins are actively deployed to lending protocols - Assets remain liquid and available for swaps at all times - When trades occur, the pool withdraws necessary amounts and redeploys excess capital **Yield sources:** - Swap fees from trading activity - Lending yields across all three pool assets This approach addresses a common DeFi tradeoff by enabling liquidity providers to earn from both trading fees and lending markets without sacrificing capital efficiency.

Stable Pools Optimize Trading for Assets Near Parity

**Stable Pools** are designed specifically for assets that trade close to equal value, like stablecoins pegged to the same dollar amount. **How it works:** - StableSwap math concentrates liquidity where trading actually occurs - Three stablecoins tracking the same value can trade with minimal slippage - Handles correlated assets (stablecoins and liquid staking tokens) with tight spreads **The advantage:** Assets that should trade near parity get the liquidity depth they need, without gas costs limiting activity. This represents genuine capital efficiency - liquidity is positioned exactly where it's most useful for traders. The approach benefits both liquidity providers and traders by reducing wasted capital on price ranges that rarely see activity.

🪙 Agora's AUSD Stablecoin Joins Major Stable Pool

**AUSD enters multi-stablecoin pool** Agora's AUSD stablecoin, with a $200M market cap and reserves managed by VanEck, has been combined into a stable pool alongside USDC and USDT. - AUSD: Fully-backed stablecoin by Agora - USDC: Backed by Circle - USDT: Backed by Tether The three major stablecoins are now pooled together, creating a unified liquidity solution. This follows AUSD's previous expansion across multiple blockchain networks including Plasma, Berachain, Citrea, Initia, and Sei Network.