💰 Balancer Proposes Framework for Redistributing $45.7M in Recovered Hack Funds

💰 Balancer Proposes Framework for Redistributing $45.7M in Recovered Hack Funds

💰 Recovery Framework Revealed

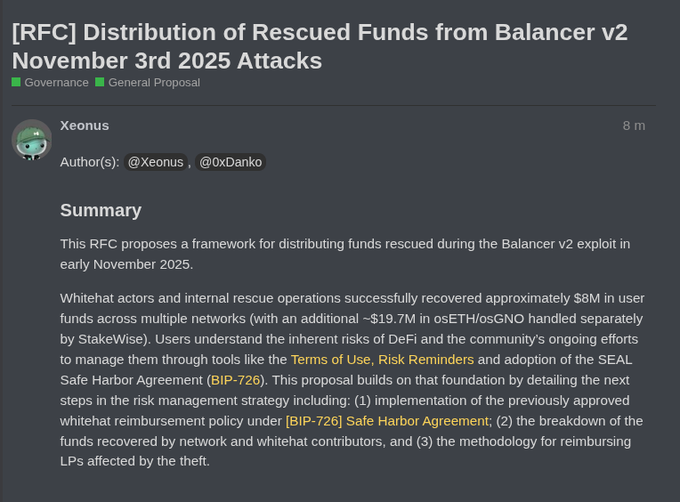

Balancer has opened community discussion on redistributing recovered funds from the November 3rd V2 exploit that initially stole $94.8M.

Key Recovery Details:

- $45.7M total protected/recovered through coordinated response

- $4.6M recovered by whitehat hackers under SEAL framework

- $19.3M protected through emergency pool pauses

- $21.8M recovered by StakeWise DAO emergency operation

Proposed Distribution Framework:

- Pool-by-pool reimbursement rather than socializing losses

- LPs must actively claim recovered funds (no airdrops)

- Proportional distribution based on positions at exploit time

- Only applies to pools where funds were actually recovered

Technical Background: The exploit targeted V2 Composable Stable Pools through rounding errors in exact-out swaps, affecting pools across Ethereum, Arbitrum, Base, Optimism, and Polygon. Balancer V3 remains completely unaffected due to its different architecture.

Next Steps:

- Community feedback period on forum proposal

- veBAL governance vote required for final approval

- Claiming process details to be announced

- Continued law enforcement coordination for remaining funds

Balancer emphasizes transparency and user-centric approach throughout the recovery process.

In connection with the recent Balancer V2 stable-pool incident, a new value-extraction path was identified in V2 meta-stable pools. In coordination with @certora and @_SEAL_Org , Balancer team initiated a whitehat recovery around 7PM UTC and has secured ~$4.1M to controlled

A new discussion is now live on the Balancer Forum for feedback, outlining a suggested framework for redistributing assets recovered during the recent attacks on v2, including both whitehat rescues and internal recovery efforts. It proposes a method for reimbursing LPs in pools

Balancer Investigation Continues with Law Enforcement on Fund Recovery

**Investigation Status** Balancer's recovery efforts for affected funds remain ongoing with law enforcement involvement. The team cannot share additional details at this time due to the active investigation. **Potential Future Distributions** - Any recovered funds may be distributed to affected users - Distributions would require approval through Balancer's governance process - Timeline remains uncertain as investigation continues The protocol maintains transparency about the situation while respecting law enforcement protocols.

Balancer Sets 180-Day Claim Window for Affected Users Under BIP-892

Balancer has established a **180-day claiming period** for affected users under BIP-892. **Key Details:** - Users must claim their assets within the specified 180-day window - After this deadline, unclaimed assets will be classified as dormant - The allocation of dormant assets will be determined through a separate governance proposal This policy follows similar precedents in DeFi governance, where unclaimed tokens are typically redirected to DAO treasuries after specified deadlines.

Gnosis Chain Develops Separate Recovery Mechanism for Lost Funds

**Gnosis Chain is working on its own claim mechanism for users who lost funds.** Following a hard fork that secured affected funds, the network is developing a separate recovery process. The mechanism is currently under development, with updates to be announced when available. **Key Points:** - Recovery handled independently by Gnosis Chain - Hard fork successfully secured the funds - Claim mechanism still in development - Official updates coming soon Users affected by fund losses should wait for official announcements from Gnosis Chain regarding the claim process.

Balancer Opens Claims for Whitehat-Rescued Funds from November Incident

Balancer has opened a 180-day claim window for users affected by the November 3rd V2 incident to recover whitehat-rescued funds. **Key Details:** - Claims process follows BIP-892 governance proposal - 180-day deadline for affected users to submit claims - Merkl waived campaign creation fees to support the recovery effort - Unclaimed assets after the window become dormant and subject to future governance decisions Affected users should act within the claim period to recover their funds.

Monad Ecosystem Hosts Multi-Protocol Livestream with Six Major Projects

The Monad ecosystem is organizing a livestream featuring representatives from six protocols: - **Fastlane** (Tom Fastlane) - **Magma** (Jerry PPB) - **Neverland** (Alice NVR) - **Curvance** (Crypto Tom) - **Kintsu** (Alexi0s) - **Balancer** (Marcus) The session aims to showcase developments within the Monad ecosystem. Previous community events have included discussions about the network's roadmap and featured projects like Curvance, Kizzy Mobile, and PingMe.